edward jones beneficiary form can be filled out with ease. Just make use of FormsPal PDF tool to accomplish the job promptly. FormsPal is devoted to giving you the best possible experience with our editor by continuously adding new features and improvements. Our editor has become even more user-friendly with the latest updates! So now, filling out documents is easier and faster than before. With a few simple steps, it is possible to start your PDF editing:

Step 1: Open the PDF file inside our tool by pressing the "Get Form Button" above on this webpage.

Step 2: As soon as you access the PDF editor, you will find the form all set to be filled in. Apart from filling out various blanks, you could also do other things with the form, particularly adding your own textual content, modifying the original textual content, adding graphics, placing your signature to the document, and much more.

It is actually an easy task to complete the form using out detailed guide! This is what you want to do:

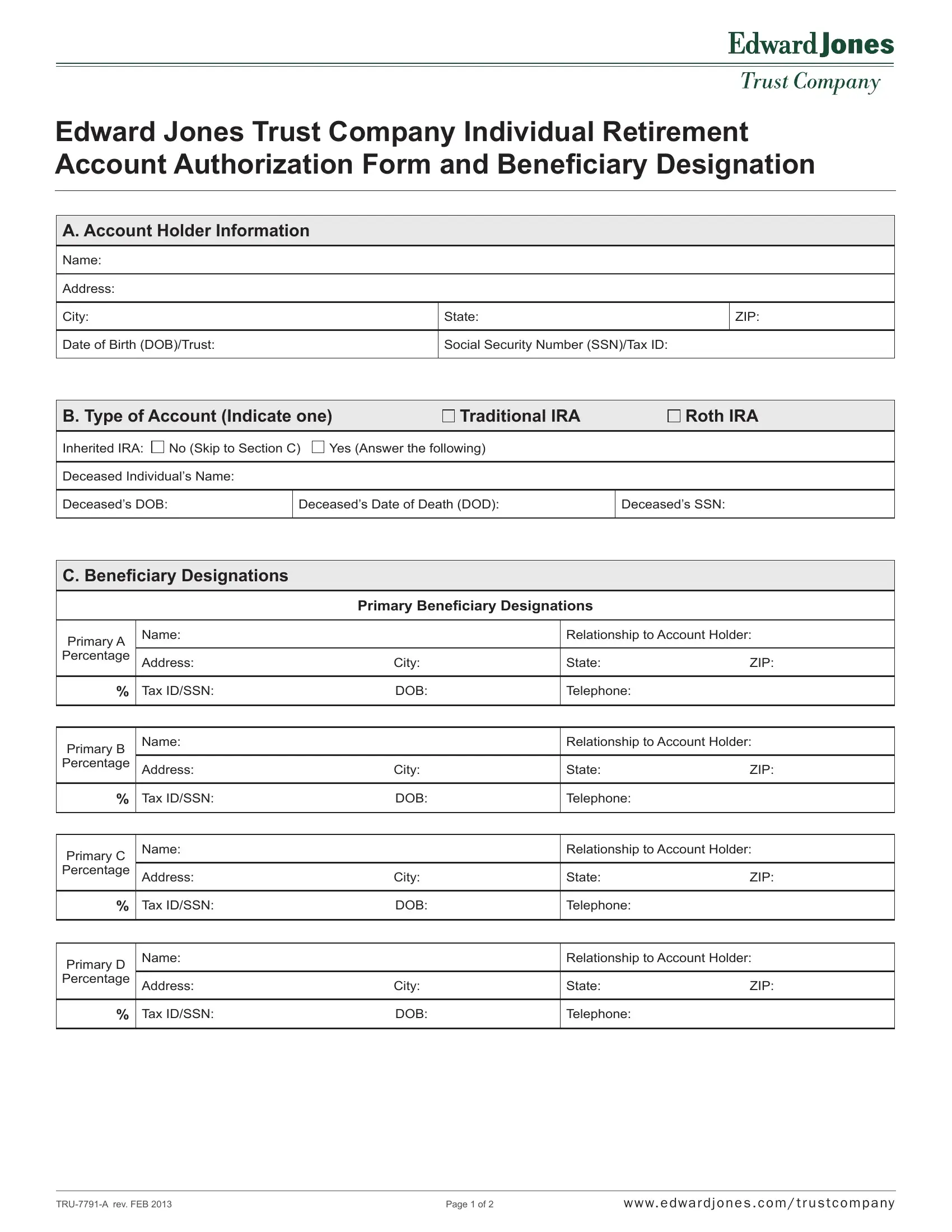

1. Begin completing your edward jones beneficiary form with a group of essential fields. Note all of the important information and make certain there's nothing missed!

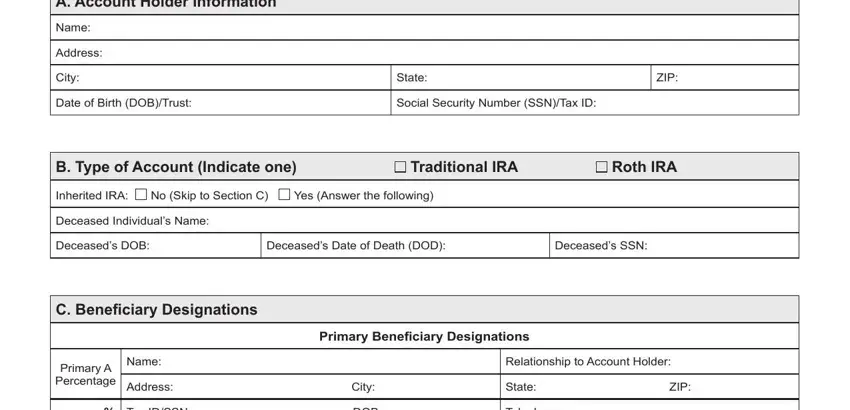

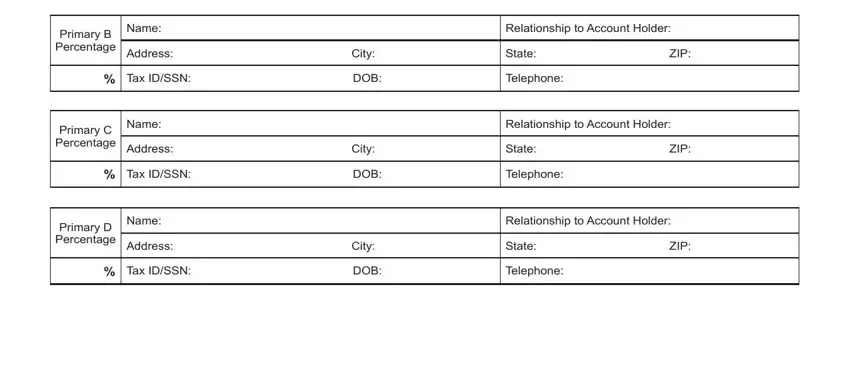

2. Once your current task is complete, take the next step – fill out all of these fields - Primary B Percentage, Name, Address, City, Tax IDSSN DOB, Primary C Percentage, Name, Address, City, Tax IDSSN DOB, Primary D Percentage, Name, Address, City, and Tax IDSSN DOB with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

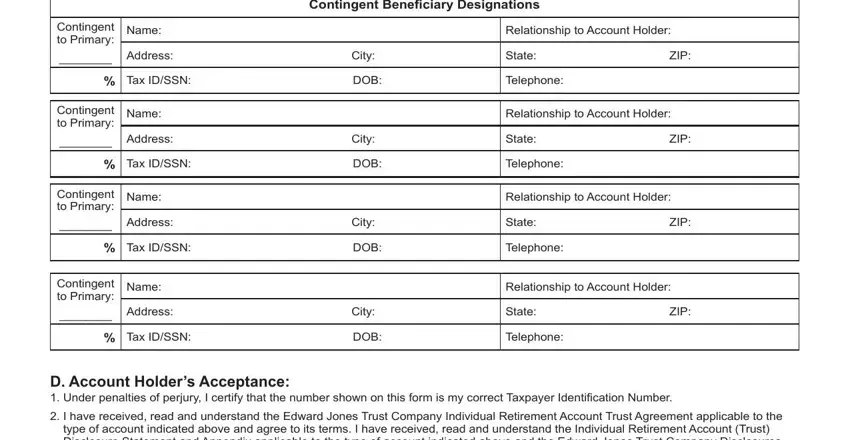

3. This subsequent segment is considered pretty uncomplicated, Contingent Beneiciary Designations, Contingent to Primary, Name, Address, City, Tax IDSSN DOB, Contingent to Primary, Name, Address, City, Tax IDSSN DOB, Contingent to Primary, Name, Address, and City - all these form fields has to be filled out here.

In terms of City and Contingent to Primary, be certain you get them right in this section. The two of these are thought to be the key fields in the form.

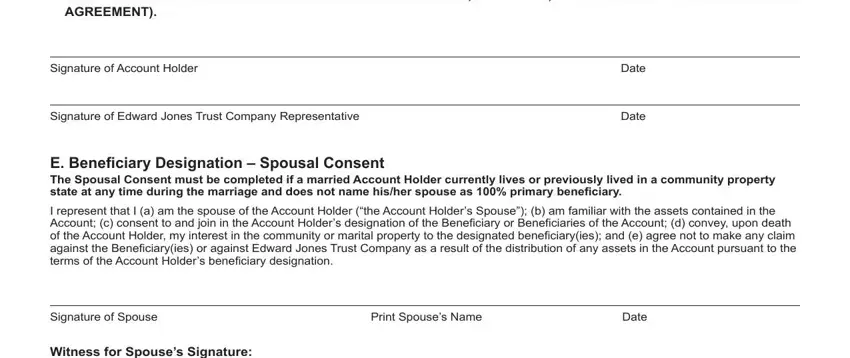

4. The following part requires your attention in the following places: BINDING ARBITRATION PROVISION, Signature of Account Holder, Signature of Edward Jones Trust, Date, Date, E Beneiciary Designation Spousal, Signature of Spouse, Print Spouses Name, Date, and Witness for Spouses Signature. Be sure that you fill in all of the requested information to move further.

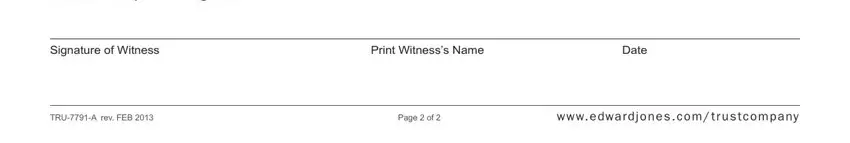

5. While you come near to the last sections of your form, you will find a few more requirements that must be met. Specifically, Witness for Spouses Signature, Signature of Witness, Print Witnesss Name, Date, TRUA rev FEB, Page of, and w w w e dwa r d j o n e s c o m must all be filled in.

Step 3: After going through the fields and details, hit "Done" and you are good to go! Right after getting a7-day free trial account with us, it will be possible to download edward jones beneficiary form or email it right away. The document will also be readily available via your personal account menu with all of your edits. When you use FormsPal, you can certainly fill out documents without stressing about personal data breaches or records being shared. Our protected platform ensures that your personal information is kept safely.