Any time you need to fill out emm submission form, there's no need to install any applications - simply give a try to our PDF tool. The tool is constantly improved by our staff, receiving handy functions and turning out to be greater. With a few easy steps, you'll be able to begin your PDF journey:

Step 1: Click on the "Get Form" button in the top part of this webpage to open our tool.

Step 2: After you open the file editor, you will find the form made ready to be filled in. In addition to filling out various fields, it's also possible to perform several other things with the file, such as writing any text, changing the initial textual content, adding illustrations or photos, affixing your signature to the document, and more.

It is actually simple to finish the pdf with this detailed guide! Here's what you want to do:

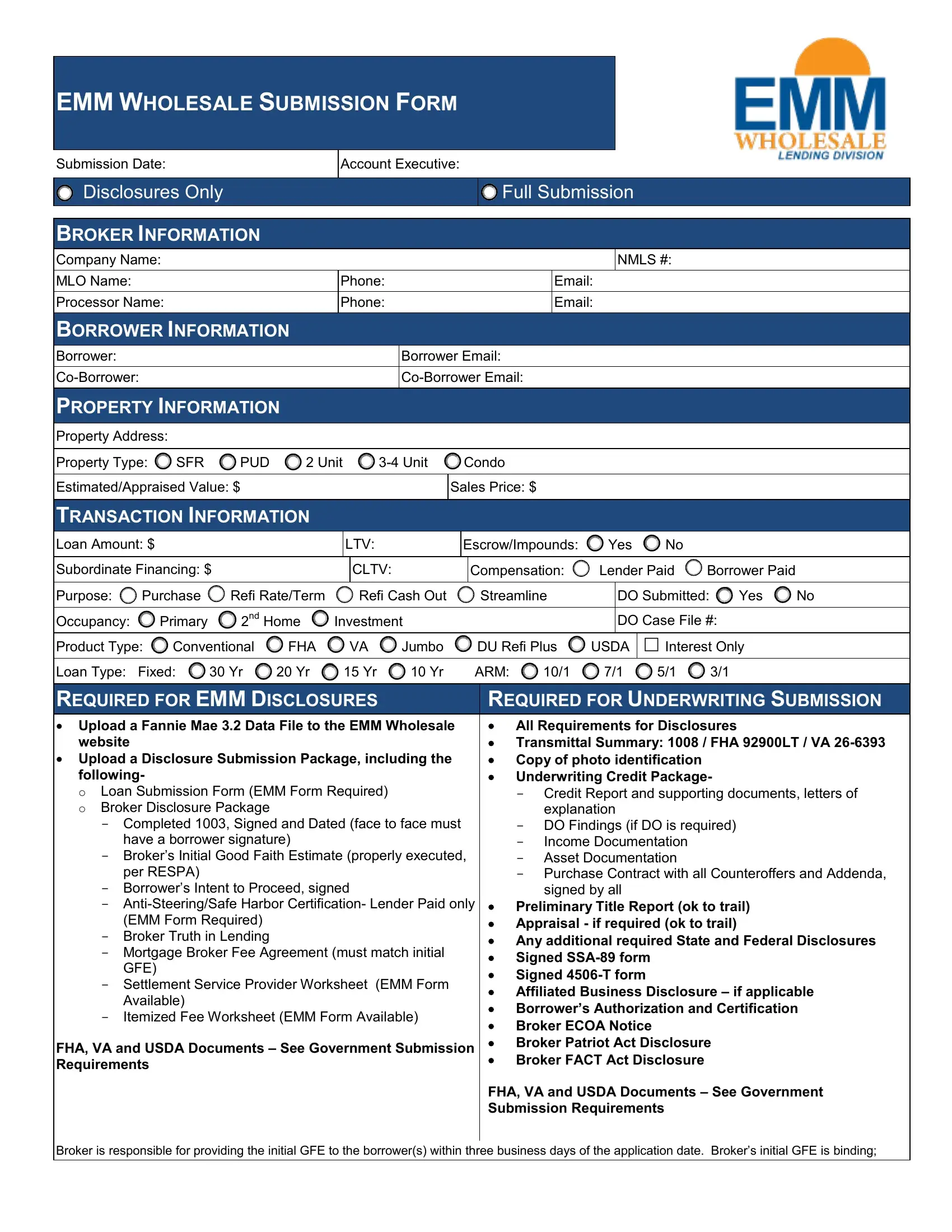

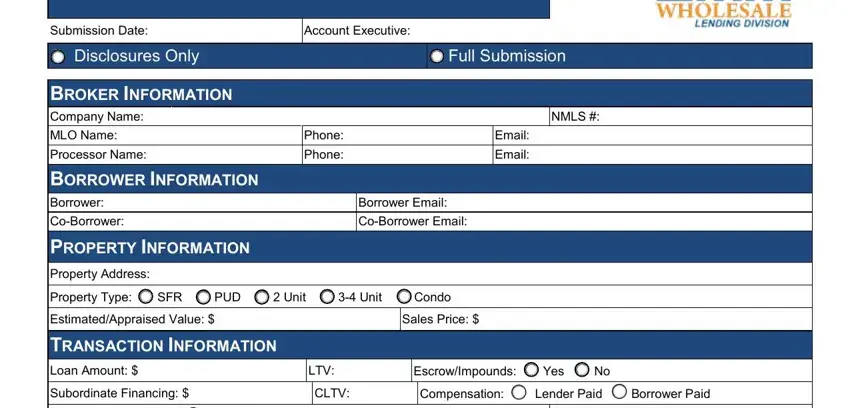

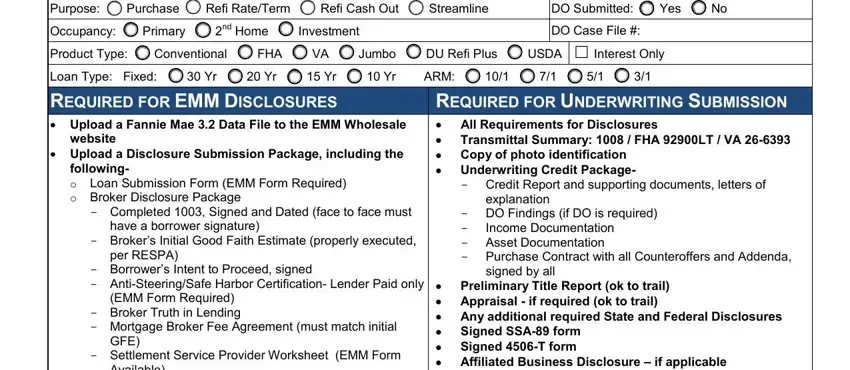

1. The emm submission form needs particular details to be inserted. Be sure that the following blanks are finalized:

2. When this selection of blanks is completed, proceed to type in the applicable information in all these - Subordinate Financing Purpose, DO Submitted Yes No DO Case File, website, Upload a Disclosure Submission, following o Loan Submission Form, Completed Signed and Dated face, have a borrower signature, Brokers Initial Good Faith, per RESPA, Borrowers Intent to Proceed, EMM Form Required Broker Truth in, GFE, Settlement Service Provider, Available Itemized Fee Worksheet, and REQUIRED FOR UNDERWRITING.

People often make mistakes while filling in website in this part. You should revise whatever you type in right here.

Step 3: When you've reread the information entered, press "Done" to finalize your document generation. Try a 7-day free trial subscription at FormsPal and obtain instant access to emm submission form - available from your FormsPal account. FormsPal is devoted to the privacy of our users; we always make sure that all information entered into our editor continues to be secure.