Navigating the complexities of workplace injuries and the associated compensations can be daunting for both employers and employees. Central to this process is the Employer Wage Verification form, a comprehensive document designed under the guidelines provided by the NRS 616C.045(2)(d). Required to be filled out by employers, the form plays a pivotal role in calculating the disability compensation owed to an injured worker. It prompts employers to detail the employee's wage information, hours worked, and any additional earnings such as overtime, bonuses, or commissions. Moreover, it asks for specifics pertaining to the employee's working hours, changes in job duties, or pay rates. Highlighting the significance of timeliness, the form emphasizes the importance of prompt submission to facilitate the timely payment of any due compensation. It encapsulates a range of employer obligations, from verifying the wages over a specified period to accounting for any absences, showcasing the intricate process involved in ensuring injured workers are fairly compensated. This thorough documentation process underscores the commitment to transparency and accuracy in the resolution of compensation claims, ultimately serving as a critical tool in the navigation of worker's compensation procedures.

| Question | Answer |

|---|---|

| Form Name | Employer Wage Verification Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | s pursuant 616c form, 616c employee compensation online, employer wage verification template, wage verification 616c form |

EMPLOYER'S WAGE VERIFICATION FORM

(Pursuant to NRS 616C.045(2)(d))

Please provide the following information for the employee named below by completing this form. The information is needed so that the amount of disability compensation to which your employee is entitled may be calculated. Prompt completion and return of this form will ensure the timely payment of any compensation due this injured worker. Please answer all questions and sign the form where indicated.

EMPLOYER: PLEASE PROVIDE THE FOLLOWING INFORMATION ANSWERING ALL QUESTIONS

Date: |

|

|

|

Injured Employee's Name (Last/First/M.I.): |

|

|

|

|

|

|

|

|

|

|

|

Social Security # |

|

|

|

|

|

|

||||||||||||||||||||||||

Claim No.: |

|

|

|

|

|

|

|

Date of Injury: |

|

|

|

|

|

|

|

|

|

|

|

|

Date of Hire: |

|

|

|

|

|

|

|

||||||||||||||||||

Was employee hired to work 40 hours per week: [ ] Yes |

[ ] No |

If no, # of hours per week: |

|

|

|

|

|

|

|

|

|

|

# of days per week: |

|

|

|||||||||||||||||||||||||||||||

On the date of injury, the employee's wage was: $ |

|

|

|

per [ ] Hour [ ] Day [ ] Week [ ] Month Date the wage became effective: |

|

|

||||||||||||||||||||||||||||||||||||||||

Was vacation paid during the applicable twelve week period? |

|

|

|

|

|

If so, during what pay period? |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Was sick leave paid during the applicable twelve week period? |

|

|

|

|

|

Was the injured employee paid for any holidays during the applicable twelve |

||||||||||||||||||||||||||||||||||||||||

week period? |

|

Did employee receive payment for overtime during the applicable twelve week period? |

|

|

Did employee receive |

|||||||||||||||||||||||||||||||||||||||||

termination pay during the applicable twelve week period? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Provide prior wage if current wage was in effect less than 12 weeks prior to date of injury: $ |

|

per [ ] Hour [ ] Day [ ] Week [ ] Month |

||||||||||||||||||||||||||||||||||||||||||||

During this |

[ ] Yes [ ] No |

|||||||||||||||||||||||||||||||||||||||||||||

If so, date: |

|

|

|

|

Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Does the employee receive commissions? [ ] Yes [ ] No |

|

|

Period of commission earned |

|

|

|

to |

|

|

. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Indicate the amount of commission received over the last 6 months, or since date of hire: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Does the employee receive bonuses/incentive pay? [ ] Yes [ ] No |

Period of bonuses/incentive pay earned |

|

|

|

|

|

|

|

to |

. |

|

|

||||||||||||||||||||||||||||||||||

Indicate the amount of bonuses received over last 12 months, or since date of hire: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Are the commission and bonus amounts included in GROSS EARNINGS below? |

[ ] Yes |

[ ] No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

Does the employee declare tips for the purpose of worker's compensation? [ ] Yes |

[ ] No See payroll declaration below. Attach declaration forms. |

|||||||||||||||||||||||||||||||||||||||||||||

Does the employee receive meals or lodging (excluding reimbursement for travel per diem)? |

[ ] Yes [ ] No |

(Do not include in gross earnings) |

||||||||||||||||||||||||||||||||||||||||||||

How many meals per day?______________ Monetary value of meals $____________________per [ ] Day [ ] Week [ ] Month

Lodging $_____________________per [ ] Day [ ] Week [ ] Month

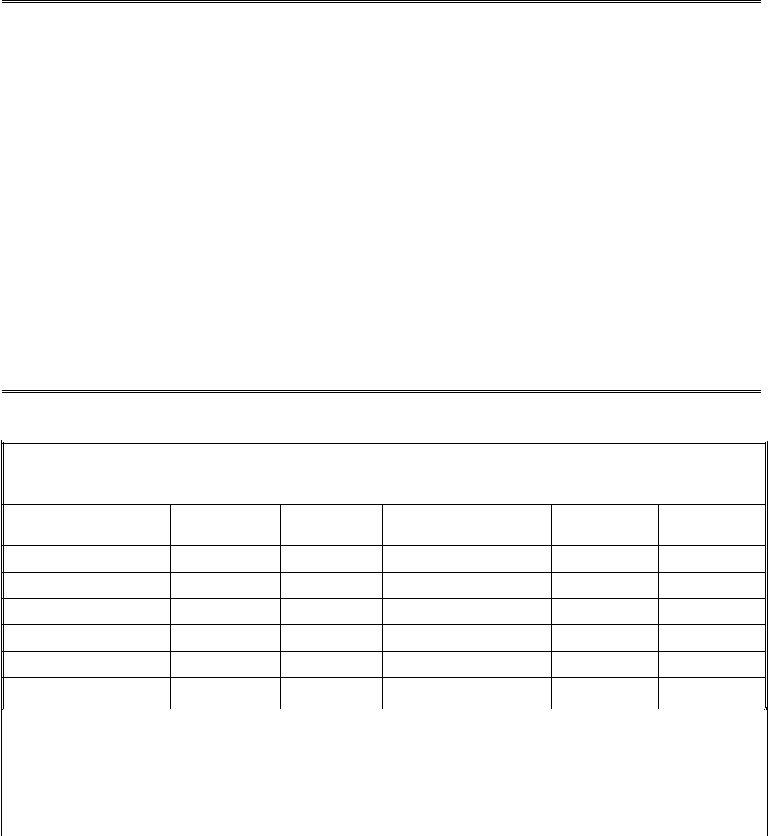

TWELVE WEEK VERIFICATION FROM PAYROLL RECORDS. Report GROSS EARNINGS, include overtime payment and any other remuneration (except reimbursement for expenses). (See NAC 616C.423)

Give payroll information from |

|

through |

|

. If employed less than twelve weeks, give gross earnings from date of hire to date of injury. |

|

|

|

|

|

If absent from work for the following reasons, please specify the date(s) absent and the number code for the reason of absence.

1.Certified illness or disability; 2. Institutionalized in a hospital, or other institution; 3. Enrolled as

Payroll Period

Beginning Ending

Gross Salary

(Excluding Tips)

Declared

Tips

Payroll Period

Beginning Ending

Gross Salary

(Excluding Tips)

Declared

Tips

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dates of Absence |

Reason |

|

Dates of Absence |

Reason |

|

Dates of Absence |

Reason |

|

|||||||||||||

|

Begin |

End |

|

Begin |

End |

|

|

|

|

Begin |

|

|

End |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Pay period ends on (check one) |

[ ] Sunday |

[ ] Monday [ ] Tuesday |

[ ] Wednesday |

[ ] Thursday |

[ ] Friday [ ] Saturday |

|

|||||||||||||||

|

Employee is paid: |

[ ] Weekly |

[ ] |

[ ] Monthly |

[ ] Other |

|

|

|

|

|||||||||||||

|

Employee scheduled day(s) off: [ ] Sunday [ ] Monday [ ] Tuesday [ ] Wednesday |

[ ] Thursday [ ] Friday [ ] Saturday [ ] Other |

|

|||||||||||||||||||

|

Explain "other": |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Date the employee last worked AFTER injury occurred: |

|

|

|

|

|

Date returned to work: |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

This information is true and correct as taken from the employee's payroll records. |

|

|

|

|

|

|

|

|

||||||||||||||

Print Name: |

|

|

|

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

|||||

Date: |

|

|

|

|

|

|

Employer: |

|

|

|

|

|

|

|

|

|

|

|

||||

Insurer: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||