If you desire to fill out wages earnings claim, you won't have to install any sort of programs - simply use our PDF tool. The tool is continually upgraded by our team, acquiring awesome features and turning out to be a lot more versatile. All it takes is a few easy steps:

Step 1: Hit the "Get Form" button at the top of this page to open our tool.

Step 2: As you open the online editor, you will notice the form prepared to be filled in. Apart from filling out various fields, you may as well do other sorts of actions with the Document, specifically writing any words, editing the original textual content, inserting images, affixing your signature to the form, and much more.

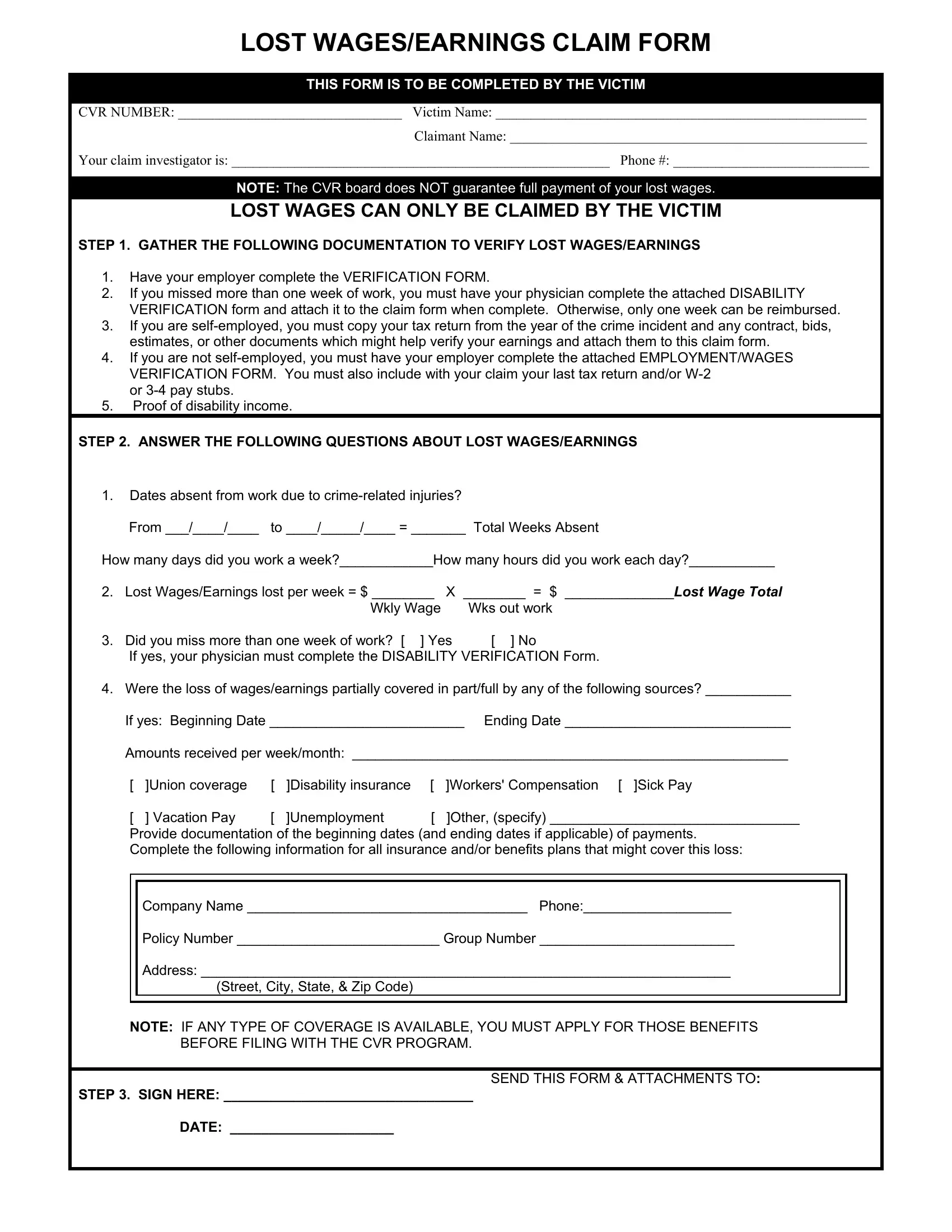

In order to complete this PDF form, be certain to enter the necessary details in each and every blank field:

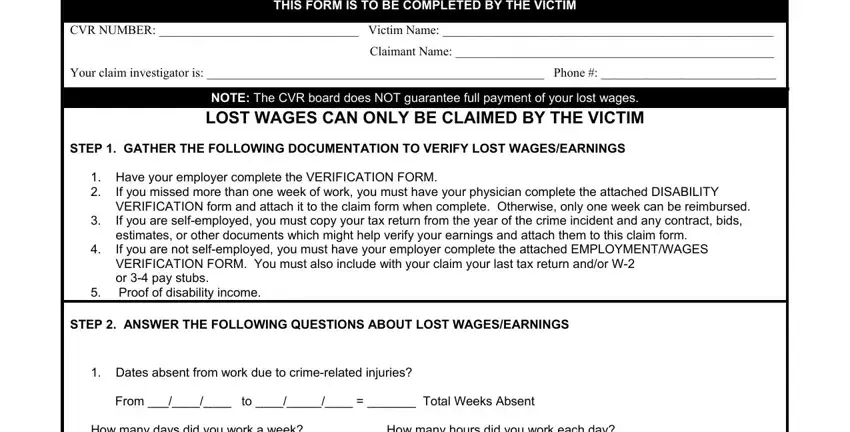

1. It's very important to complete the wages earnings claim properly, therefore be careful when working with the sections containing these fields:

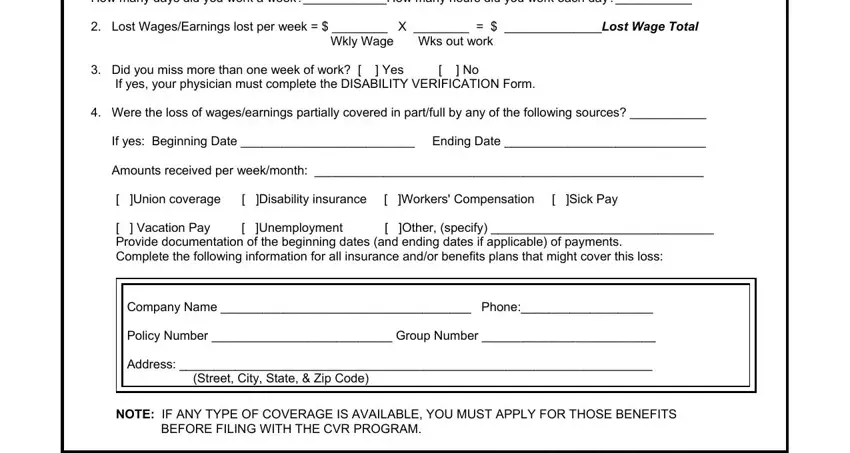

2. The next part is to submit the following blank fields: Dates absent from work due to, If yes your physician must, Were the loss of wagesearnings, Union coverage Disability, Company Name Phone Policy Number, NOTE IF ANY TYPE OF COVERAGE IS, and SEND THIS FORM ATTACHMENTS TO.

Always be extremely attentive while filling out SEND THIS FORM ATTACHMENTS TO and Dates absent from work due to, because this is the section where many people make a few mistakes.

3. The next step is fairly uncomplicated, SEND THIS FORM ATTACHMENTS TO - these fields will need to be completed here.

Step 3: Right after double-checking your fields, click "Done" and you're done and dusted! Try a free trial option at FormsPal and acquire instant access to wages earnings claim - accessible in your personal account. If you use FormsPal, you can easily fill out documents without stressing about information breaches or entries getting distributed. Our protected software makes sure that your private details are maintained safely.