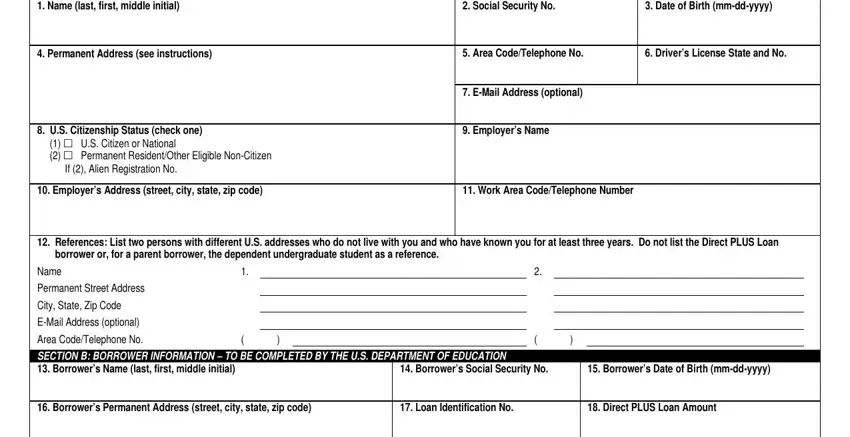

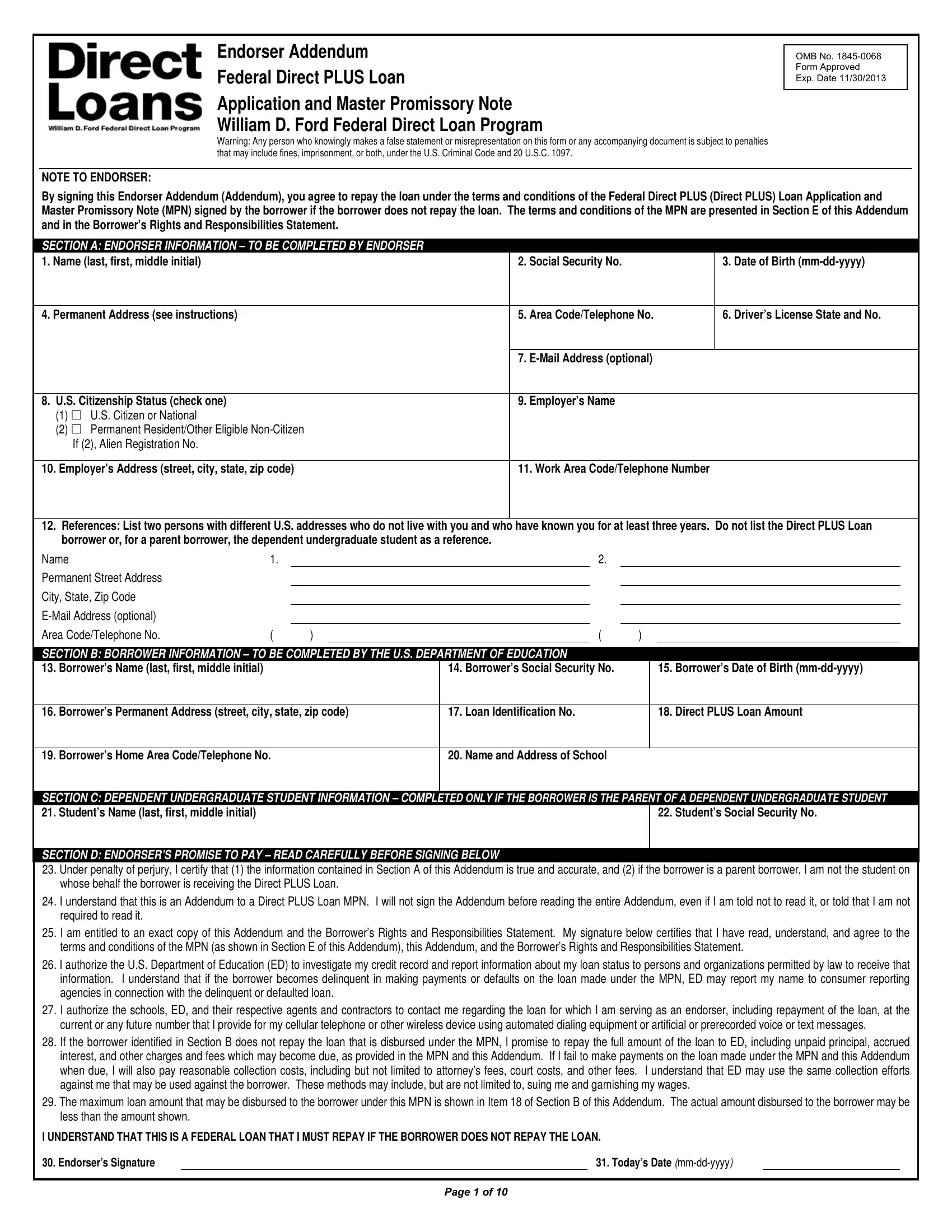

SECTION A: ENDORSER INFORMATION

Item 1. Enter your last name, then your first name and middle initial.

Item 2. Enter your nine-digit Social Security Number.

Item 3. Enter your date of birth.

Item 4. Enter your permanent address (number, street, apartment number, or rural route number and box number, then city, state, zip code). If your mailing address is a post office box or general delivery, you must list both your street address and your mailing address.

Item 5. Enter the area code and telephone number at which you can most easily be reached. (Do not list your work telephone number here.) If you do not have a telephone, enter N/A.

Item 6. Enter the two-letter state abbreviation for the state that issued your current driver’s license, followed by your driver’s license number. If you do not have a driver’s license, enter N/A.

Item 7. Enter your preferred e-mail address for receiving communications. You are not required to provide this information. If you do, we may use your e-mail address to communicate with you. If you do not have an e-mail address or do not wish to provide one, enter N/A.

Item 8. Place a check in the box that corresponds to your citizenship status. If you check box (2), enter your Alien Registration Number.

(1)“U.S. Citizen” includes citizens of the 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, and the Northern Mariana Islands. “National” includes not only all U.S. citizens, but also citizens of American Samoa and Swain’s Island.

(2)“Permanent Resident” means someone who can provide documentation of this status from the U.S. Citizenship and Immigration Services (USCIS). “Other Eligible Non-Citizen” includes individuals who can provide documentation from the USCIS that they are in the United States for a purpose that is not temporary, with the intention of becoming a citizen or permanent resident. This category includes refugees, persons granted asylum, Cuban-Haitian entrants, temporary residents under the Immigration Reform and Control Act of 1986, and others.

NOTE: If your citizenship status is not one of the categories described above, you are not eligible to be an endorser.

Item 9. Enter your employer’s name. If you are self-employed, enter the name of your business. If you are not employed, enter N/A.

Item 10. Enter your employer’s address (street, city, state, zip code) or, if you are self-employed, the address of your business.

Item 11. Enter your work area code and telephone number. If you are self- employed, enter the area code and telephone number of your business.

Item 12. Enter the requested information for two adults with different U.S. addresses who do not live with you and who have known you for at least three years. Do not list the Direct PLUS Loan borrower or the student as references. If a reference does not have a telephone number or e-mail address, or does not wish to provide an e-mail address, enter N/A. If you provide an e-mail address for a reference, ED may use it to communicate with the reference.

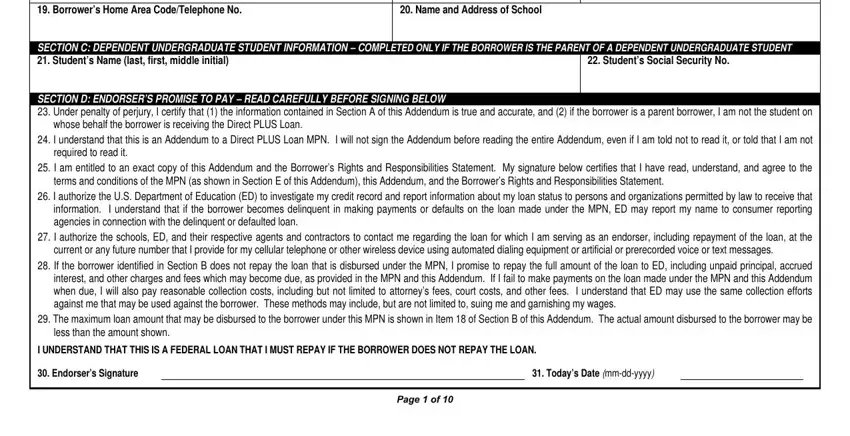

SECTION B: BORROWER INFORMATION

This section will be completed by the U.S. Department of Education.

SECTION C: DEPENDENT UNDERGRADUATE STUDENT INFORMATION

This section will be completed by the U.S. Department of Education if the Direct PLUS Loan borrower is the parent of a dependent undergraduate student. If the Direct PLUS Loan borrower is a graduate or professional student, this section will be blank.

SECTION G: IMPORTANT NOTICES

GRAMM-LEACH-BLILEY ACT NOTICE

In 1999, Congress enacted the Gramm-Leach-Bliley Act (Public Law 106-102). This Act requires that lenders provide certain information to their customers regarding the collection and use of nonpublic personal information.

We disclose nonpublic personal information to third parties only as necessary to process and service your loan and as permitted by the Privacy Act of 1974. See the Privacy Act Notice below. We do not sell or otherwise make available any information about you to any third parties for marketing purposes.

We protect the security and confidentiality of nonpublic personal information by implementing the following policies and practices. All physical access to the sites where nonpublic personal information is maintained is controlled and monitored by security personnel. Our computer systems offer a high degree of resistance to tampering and circumvention. These systems limit data access to our staff and contract staff on a “need-to-know” basis, and control individual users’ ability to access and alter records within the systems. All users of these systems are given a unique user ID with personal identifiers. All interactions by individual users with the systems are recorded.

PRIVACY ACT NOTICE

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authority for collecting the requested information from and about you is §451 et seq. of the Higher Education Act (HEA) of 1965, as amended (20 U.S.C. 1087a et seq.) and the authorities for collecting and using your Social Security Number (SSN) are §§428B(f) and 484(a)(4) of the HEA (20 U.S.C. 1078-2(f) and 1091(a)(4)) and 31 U.S.C. 7701(b). Participating in the William D. Ford Federal Direct Loan (Direct Loan) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the Direct Loan Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect and report on your loan(s) if your loan(s) become delinquent or in default. We also use your SSN as an account identifier and to permit you to access your account information electronically.

The information in your file may be disclosed, on a case by case basis or under a computer matching program, to third parties as authorized under routine uses in the appropriate systems of records notices. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loan(s), to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default. To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions. To assist program administrators with tracking refunds and cancellations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal or state agencies. To provide a standardized method for educational institutions to efficiently submit student enrollment status, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

(Privacy Act Notice continues on next page.)