Navigating the complexities of importing merchandise into the United States requires a thorough understanding of various forms and regulations set by the Department of Homeland Security, especially those pertaining to U.S. Customs and Border Protection. Among these, the Entry Manifest form—formally recognized as CBP Form 7523—plays a crucial role for importers who seek duty-free entry for their goods. This document is essentially a carrier's certificate and release order, obligating the person importing the goods to declare their merchandise accurately under the applicable laws, notably under sections such as 19 U.S.C. 1433, 1484, and 1498 along with 19 CFR 123.4 and 143.23. It encompasses vital details starting from the port code, date, and mode of conveyance to the description, quantity, and value of the merchandise. Furthermore, it necessitates disclosures regarding the importer of record and consignee, if they differ, and captures signatures from the agent and inspector verifying the inspection and duty-free passage of the goods in question. This arrangement not only streamlines the release of merchandise upon arrival but also ensures adherence to the regulatory framework dictated by the Tariff Act of 1930, particularly sections 484(h) and 484(j), which specify the conditions under which goods may be released to the consignee. As the form carries an OMB control number, it signifies compliance with the Paperwork Reduction Act, suggesting its importance in maintaining efficient and law-adhered importation practices. Understanding the Entry Manifest form’s purpose, requirements, and the legal obligations it encapsulates can significantly aid importers in successfully navigating the importation process.

| Question | Answer |

|---|---|

| Form Name | Entry Manifest Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | entry manifest, 1930, Domingo, entry and manifest of merchandise of duty |

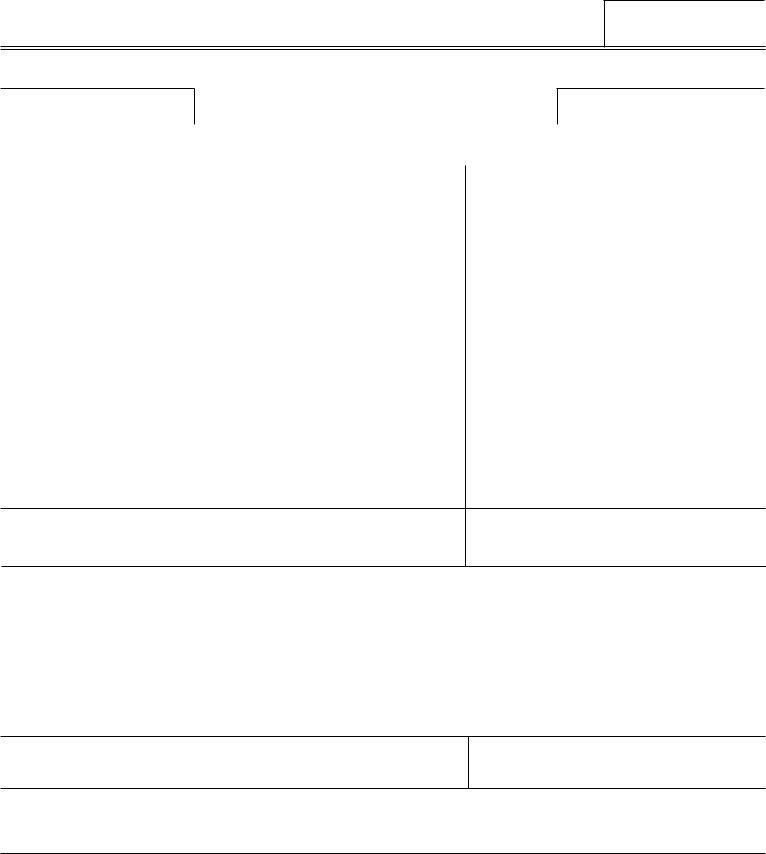

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

OMB No.

ENTRY AND MANIFEST OF MERCHANDISE FREE OF DUTY,

CARRIER'S CERTIFICATE AND RELEASE |

1. NO. |

|

19 U.S.C. 1433, 1484, 1498; 19 CFR 123.4, 143.23

The undersigned, as the importer of merchandise described below, which arrived at the port or station identified, hereby claims free entry therefore under the provisions of the applicable law indicated.

2. PORT CODE

3. DATE

4. VESSEL OR OTHER CONVEYANCE |

|

5. ARRIVAL DATE |

|

6. COUNTRY OF EXPORTATION |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

8. |

|

9. |

|

10. |

MARKS AND NUMBERS |

DESCRIPTION AND QUANTITY OF MERCHANDISE |

VALUE |

HTSUS HEADING NO. OR P.L. NO. |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. IMPORTER OF RECORD (Name and Address)

12. AGENT'S SIGNATURE

13. INSPECTED AND PASSED FREE OF DUTY BY: |

14. OWNER, PURCHASER, OR CONSIGNEE (If different from Importer of Record) |

|

|

|

|

15. SIGNATURE (Inspector) |

|

16. DATE |

|

|

|

|

|

|

CARRIER'S CERTIFICATE AND RELEASE ORDER

The undersigned carrier, to whom or upon whose order the articles described above must be released, hereby certifies that the person or firm named above as the importer is the owner purchaser, or consignee of such articles within the purview of section 484(h), Tariff Act of 1930. In accordance with the provisions of section 484(j), Tariff Act of 1930, authority is hereby given to release the articles to such consignee.

17. CARRIER

18. AGENT'S SIGNATURE

Paperwork Reduction Act Statement: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is

CBP Form 7523 (06/09)