indiana estimated tax form 2021 can be filled in without any problem. Simply try FormsPal PDF editor to get the job done without delay. Our team is continuously endeavoring to develop the editor and help it become even better for people with its multiple functions. Benefit from the current modern prospects, and find a heap of unique experiences! To get started on your journey, go through these basic steps:

Step 1: Click on the orange "Get Form" button above. It'll open up our pdf editor so you could start filling out your form.

Step 2: The tool grants the capability to work with the majority of PDF forms in a variety of ways. Change it with any text, correct what's already in the file, and include a signature - all when it's needed!

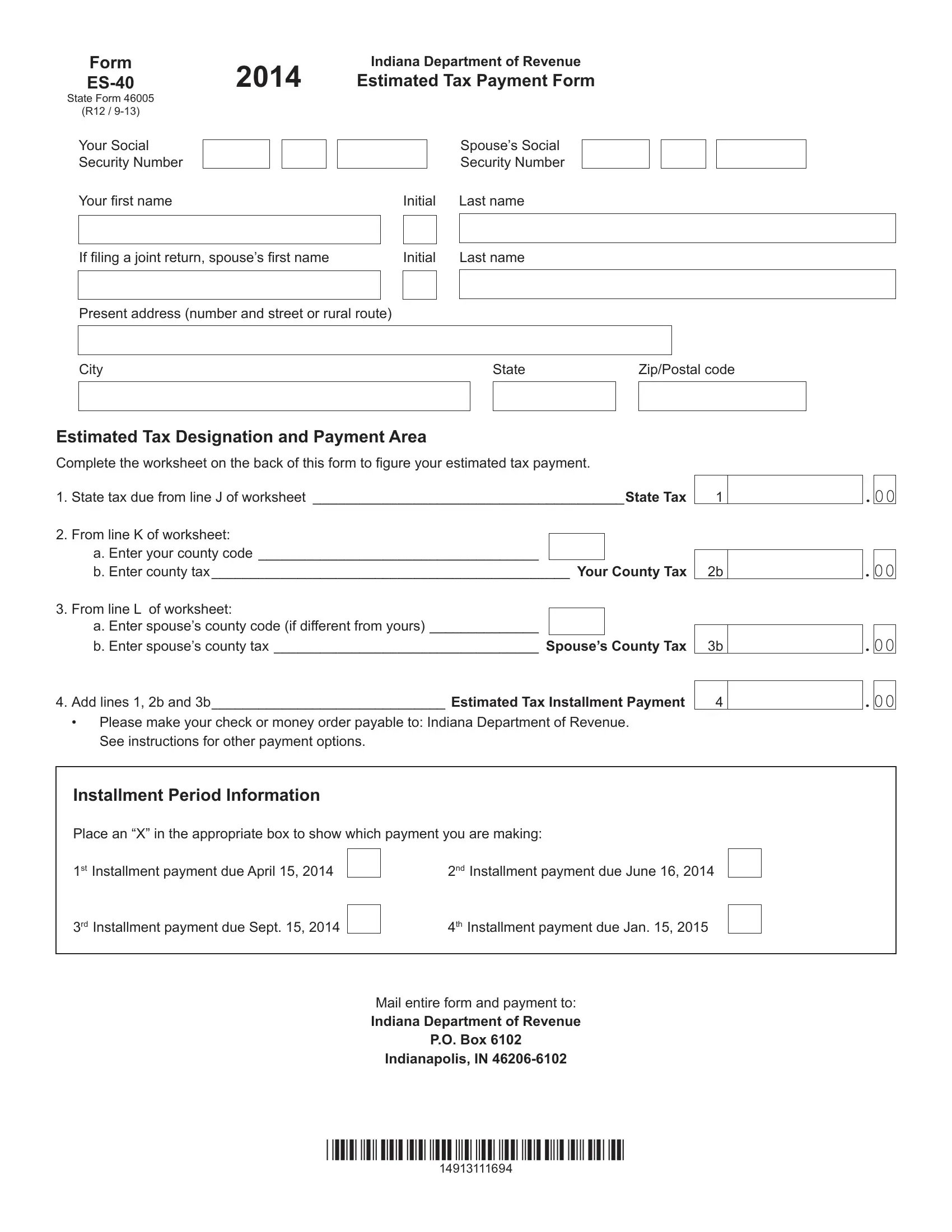

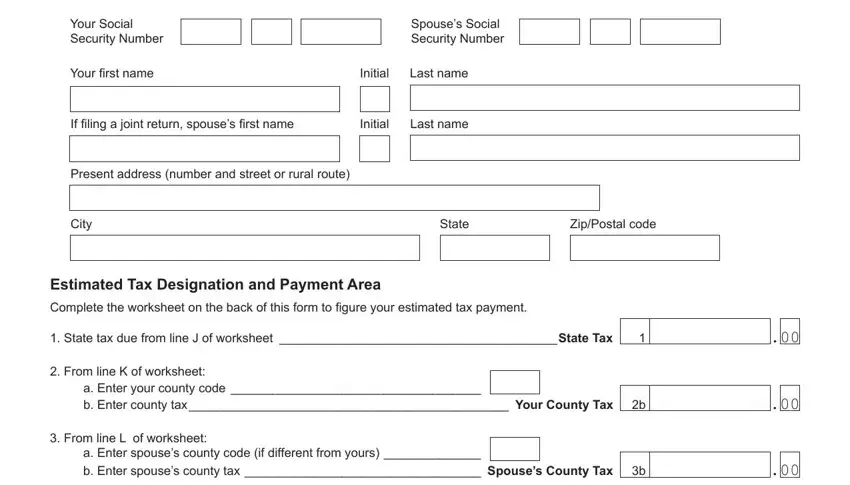

As for the fields of this specific PDF, here is what you should consider:

1. While filling in the indiana estimated tax form 2021, be certain to incorporate all of the necessary blank fields within its relevant area. It will help hasten the process, allowing your details to be processed promptly and appropriately.

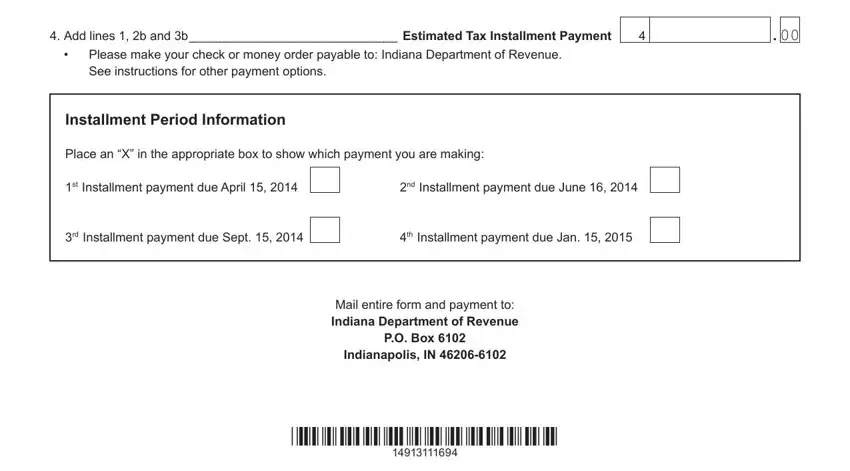

2. The subsequent part is to fill in the next few fields: Add lines b and b Estimated Tax, Please make your check or money, Installment Period Information, Place an X in the appropriate box, st Installment payment due April, nd Installment payment due June, rd Installment payment due Sept, th Installment payment due Jan, Mail entire form and payment to, PO Box, and Indianapolis IN.

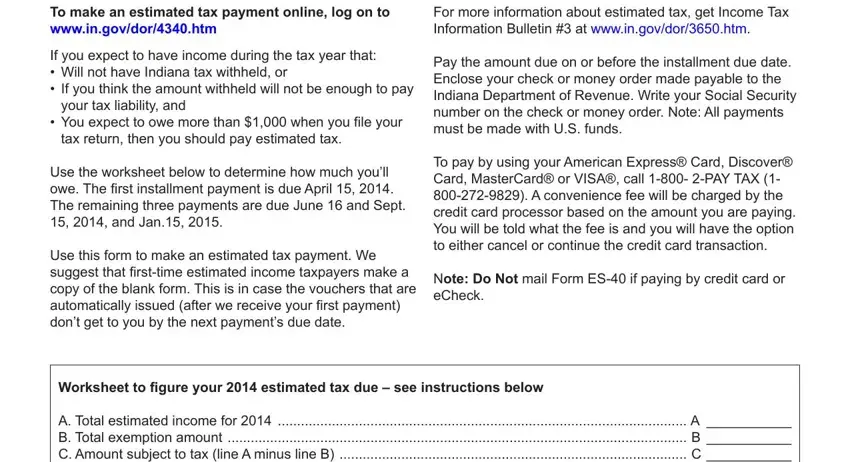

3. The following section should also be pretty straightforward, To make an estimated tax payment, For more information about, If you expect to have income, your tax liability and, You expect to owe more than when, tax return then you should pay, Use the worksheet below to, Use this form to make an estimated, Pay the amount due on or before, To pay by using your American, Note Do Not mail Form ES if paying, Worksheet to igure your estimated, and A Total estimated income for A - all these empty fields is required to be filled out here.

4. The following paragraph needs your information in the subsequent parts: Line E Multiply amount on line C, and Lines J K and L If you are paying. It is important to fill out all requested info to move onward.

Always be really careful when filling in Line E Multiply amount on line C and Line E Multiply amount on line C, because this is where a lot of people make some mistakes.

Step 3: Before finishing this file, check that blanks are filled in correctly. Once you are satisfied with it, click on “Done." Create a free trial option with us and obtain immediate access to indiana estimated tax form 2021 - which you are able to then use as you would like inside your FormsPal cabinet. FormsPal guarantees your information confidentiality by having a protected method that in no way saves or shares any sort of personal information involved. You can relax knowing your documents are kept confidential any time you use our service!