nys et can be filled out online easily. Simply open FormsPal PDF tool to get the job done promptly. To retain our editor on the cutting edge of efficiency, we strive to implement user-oriented capabilities and enhancements on a regular basis. We're always glad to get suggestions - play a vital role in reshaping the way you work with PDF forms. In case you are seeking to start, here is what it will take:

Step 1: Simply press the "Get Form Button" above on this site to open our pdf form editing tool. This way, you'll find all that is necessary to work with your file.

Step 2: Using this handy PDF editor, you're able to accomplish more than simply fill out blanks. Express yourself and make your documents appear perfect with custom textual content put in, or modify the original input to perfection - all that backed up by the capability to insert stunning images and sign the document off.

It will be easy to complete the form following this practical tutorial! Here is what you want to do:

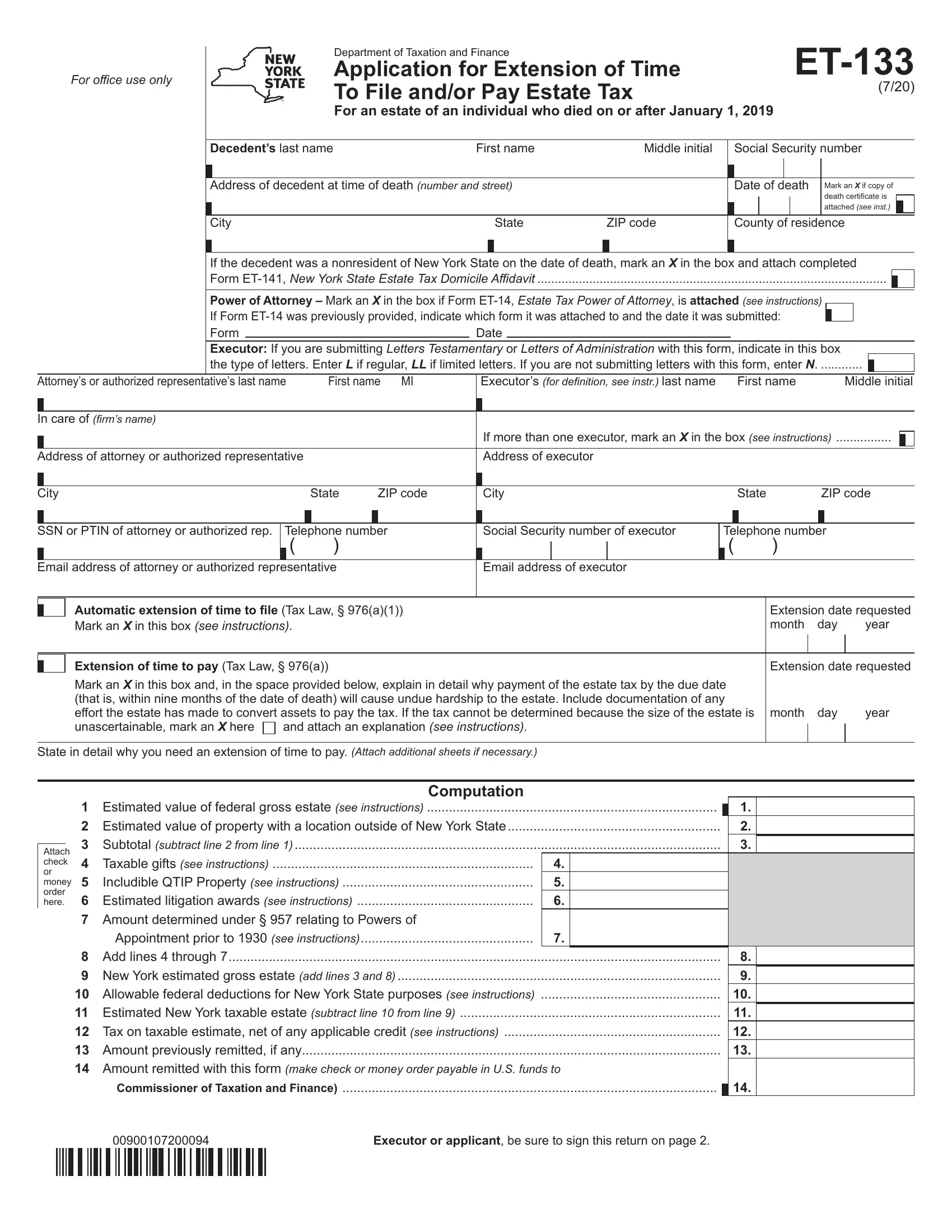

1. The nys et necessitates certain information to be inserted. Ensure that the subsequent fields are finalized:

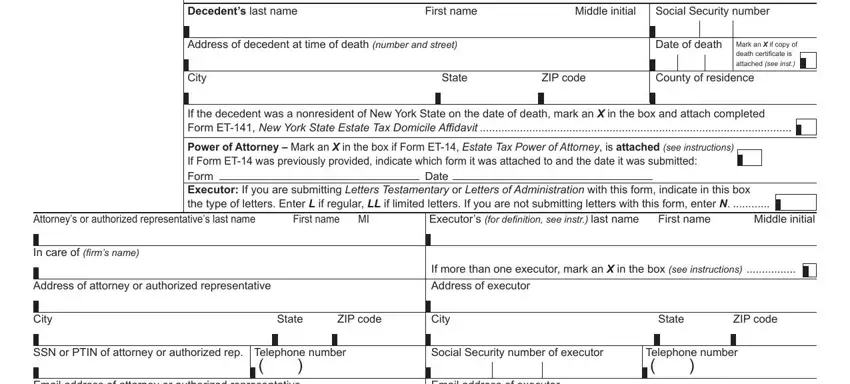

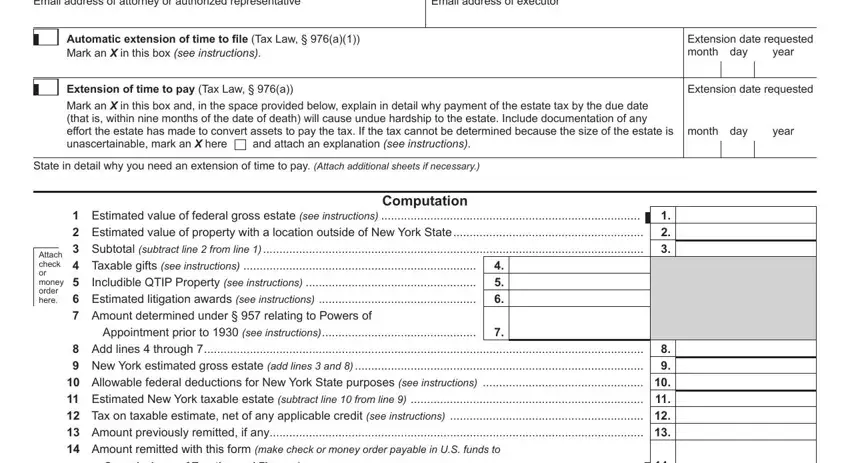

2. Right after filling in this section, go to the subsequent part and fill out the essential particulars in these fields - SSN or PTIN of attorney or, Email address of attorney or, Social Security number of executor, Extension date requested month day, year, Extension date requested, month day, year, Automatic extension of time to, Extension of time to pay Tax Law a, Mark an X in this box and in the, and attach an explanation see, State in detail why you need an, Computation, and Estimated value of federal gross.

Be really mindful while filling out Social Security number of executor and and attach an explanation see, because this is where most people make errors.

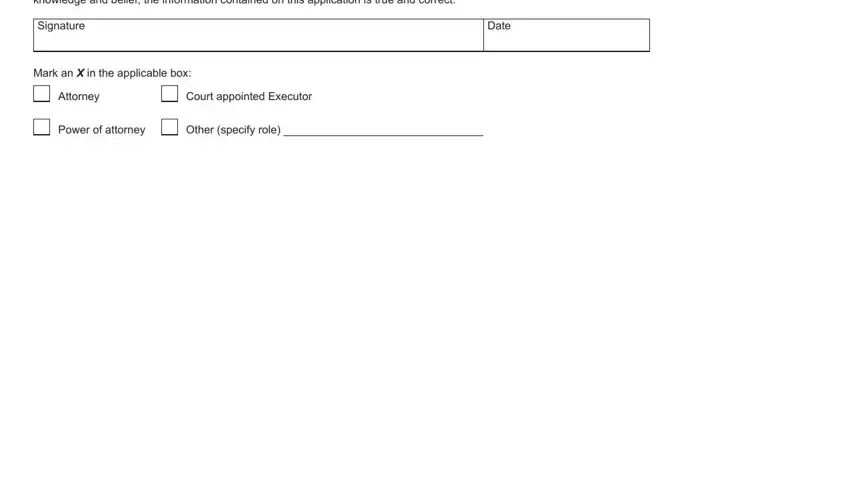

3. Through this part, review Certification Under penalties of, Signature, Date, Mark an X in the applicable box, Attorney, Court appointed Executor, Power of attorney, and Other specify role. Every one of these have to be completed with highest precision.

Step 3: Check the details you've entered into the blanks and then press the "Done" button. Try a 7-day free trial subscription with us and get immediate access to nys et - with all changes saved and accessible from your personal account. FormsPal provides risk-free document completion without personal information recording or any type of sharing. Feel comfortable knowing that your details are in good hands with us!