If you need to fill out how do i get an exempt organization certificate, you won't have to download and install any kind of software - simply try our online PDF editor. To keep our editor on the cutting edge of efficiency, we aim to adopt user-oriented capabilities and improvements on a regular basis. We are always thankful for any feedback - play a pivotal role in remolding the way you work with PDF forms. It just takes a few basic steps:

Step 1: Hit the "Get Form" button in the top section of this page to access our PDF editor.

Step 2: As soon as you launch the online editor, you will notice the document all set to be completed. Aside from filling in different blank fields, you could also perform other sorts of things with the Document, that is putting on your own words, modifying the initial textual content, adding illustrations or photos, placing your signature to the form, and more.

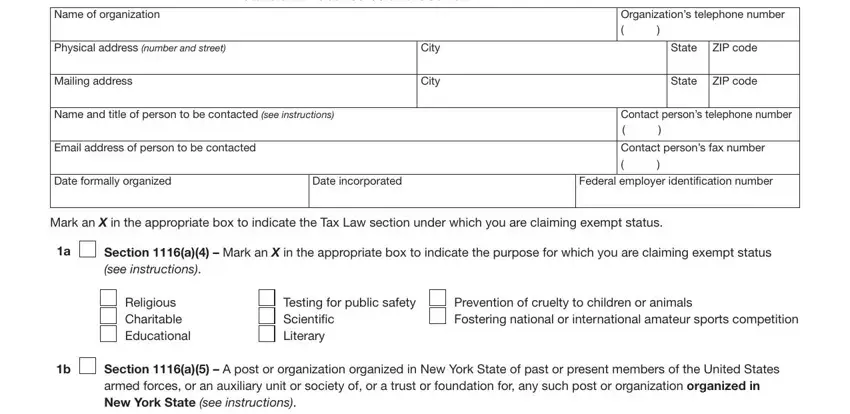

With regards to the blanks of this specific PDF, here's what you need to know:

1. To start off, while filling out the how do i get an exempt organization certificate, start with the form section that has the next fields:

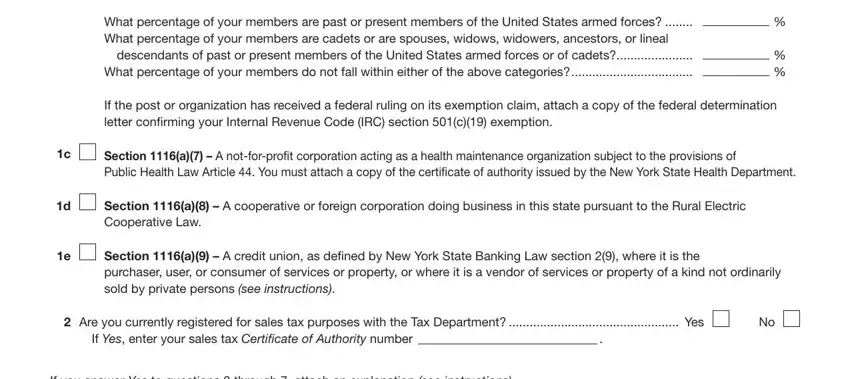

2. Once your current task is complete, take the next step – fill out all of these fields - What percentage of your members, If the post or organization has, Section a A notforproit, Section a A cooperative or, Section a A credit union as, Are you currently registered for, If Yes enter your sales tax, and If you answer Yes to questions with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

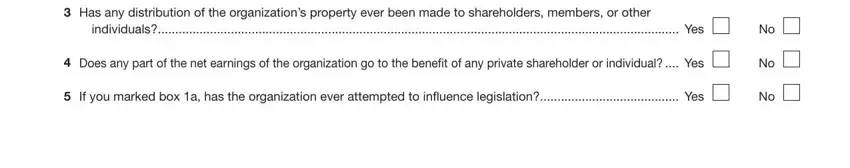

3. The following step is normally fairly easy, Has any distribution of the, individuals Yes, Does any part of the net earnings, and If you marked box a has the - every one of these empty fields will have to be filled out here.

Many people often make mistakes while filling out Does any part of the net earnings in this area. Remember to read twice whatever you type in here.

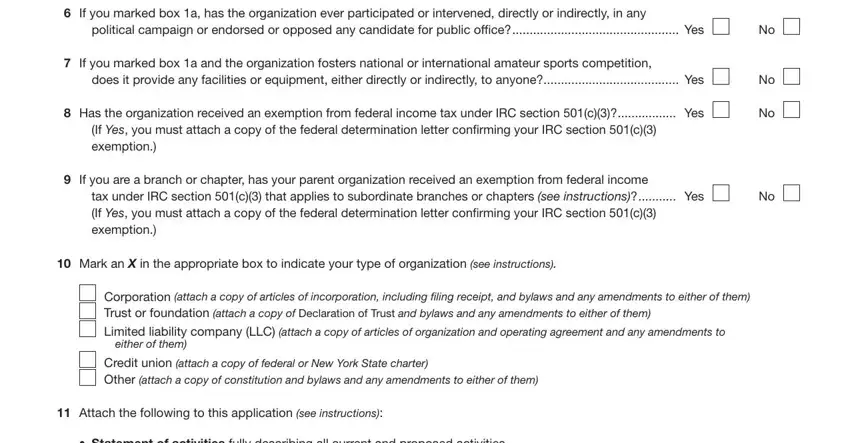

4. To move ahead, the following part requires filling in a couple of form blanks. Examples include If you marked box a has the, political campaign or endorsed or, If you marked box a and the, does it provide any facilities or, Has the organization received an, If Yes you must attach a copy of, exemption, If you are a branch or chapter, tax under IRC section c that, exemption, Mark an X in the appropriate box, Corporation attach a copy of, Limited liability company LLC, Attach the following to this, and Statement of activities fully, which you'll find essential to going forward with this form.

5. Since you come near to the final parts of the form, you will find a few extra requirements that need to be fulfilled. Particularly, Signature of oficer or trustee, Date, Name and title of oficer or, and Email address of oficer or trustee must all be filled in.

Step 3: After you've looked over the details provided, simply click "Done" to conclude your form. Sign up with us today and easily use how do i get an exempt organization certificate, prepared for download. Every last change you make is handily preserved , enabling you to edit the form later as required. When you work with FormsPal, you can fill out documents without having to get worried about information leaks or records being distributed. Our secure system makes sure that your personal information is kept safely.