Iowa Sales/Use/Excise Tax Exemption Certificate, page 2

Instructions

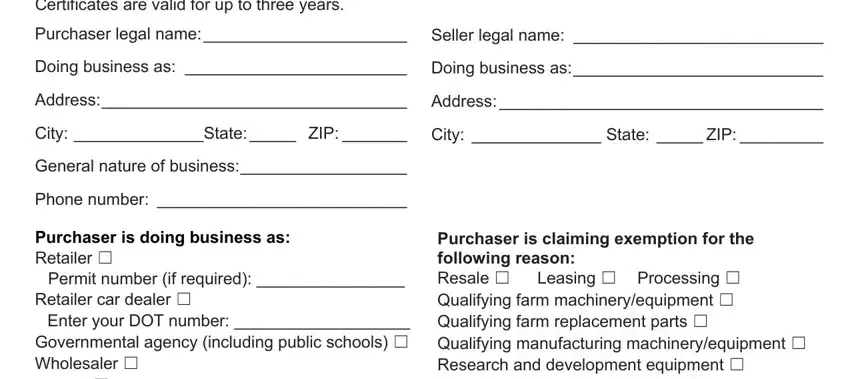

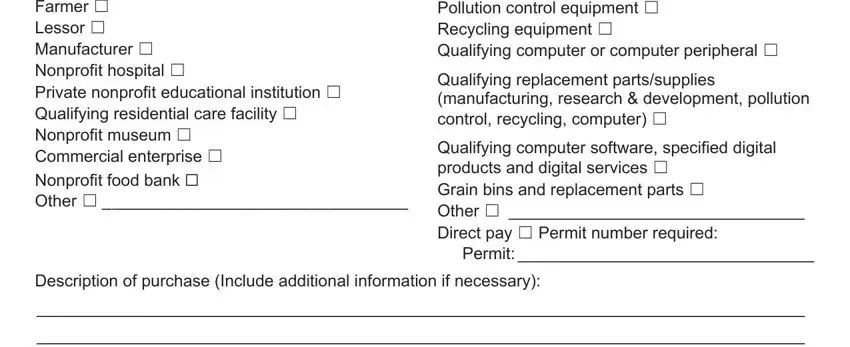

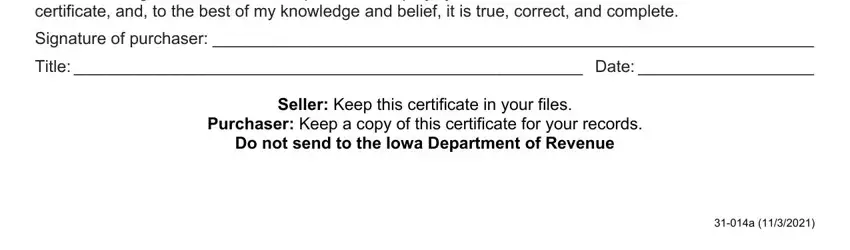

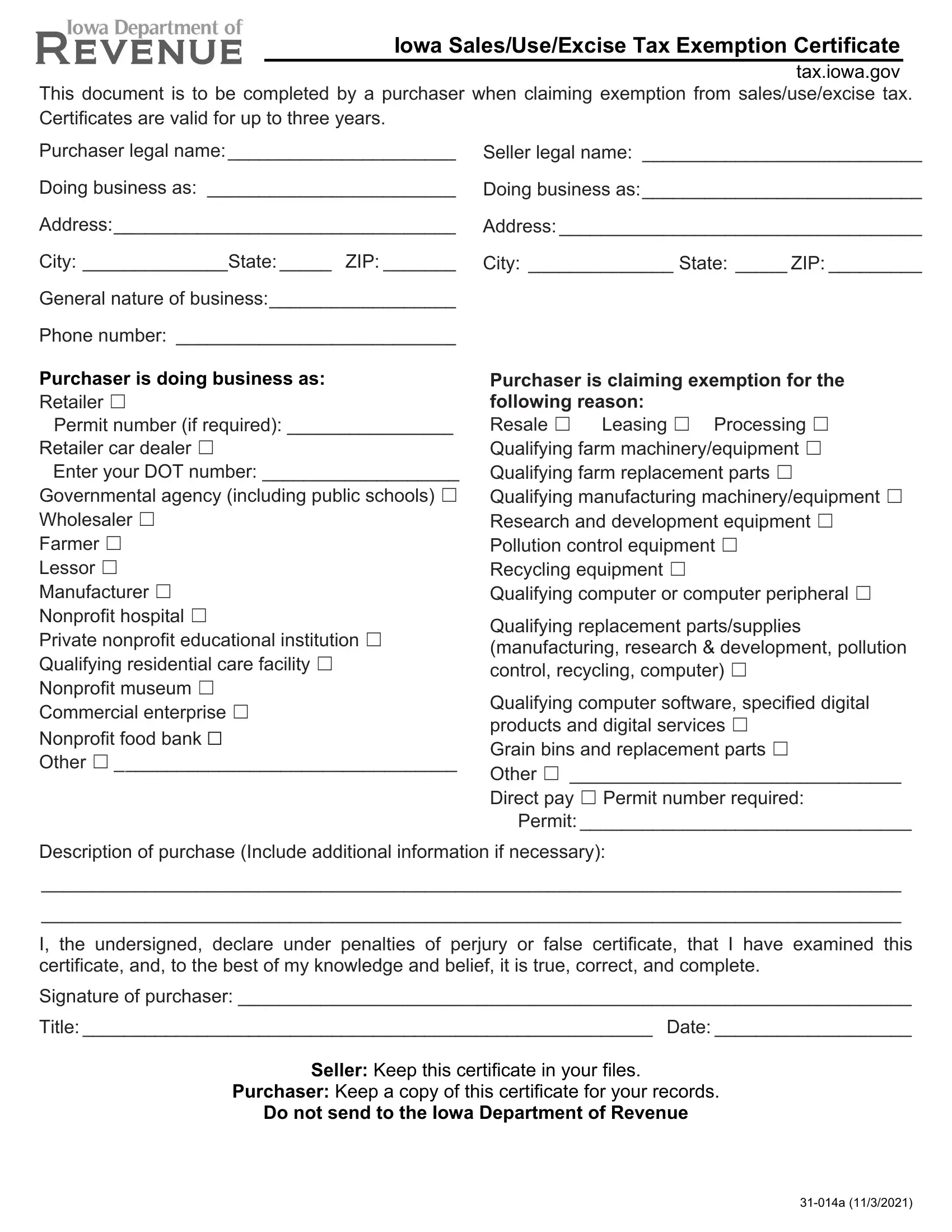

This exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. The seller must retain this certificate as proof that exemption has been properly claimed. The certificate must be complete to be accepted by the seller. The seller can accept an exemption certificate only on property that is qualified (see the exemptions below) or based on the nature of the buyer. If property or services purchased for resale or processing are used or disposed of by the purchaser in a nonexempt manner, the purchaser is then responsible for the tax.

General Information about Exemptions

Resale: Any person in the business of selling who is purchasing items to resell may claim this exemption. The purchaser can be acting as either a retailer or wholesaler and may not be required to have a sales/use/excise tax permit. Retailers with a sales/use/excise tax permit number must enter it in the space provided.

Processing: Exempt purchases for processing include tangible personal property which by means of fabrication, compounding, manufacturing, or germination becomes an integral part of other tangible personal property ultimately sold at retail; chemicals, solvents, sorbents, or reagents used, consumed, dissipated, or depleted in processing personal property intended to be sold ultimately at retail, and chemicals used in the production of free newspapers and shoppers’ guides. Note: To claim an exemption for fuel used to create heat, power, or steam for processing or for fuel used to generate electric current, use Iowa Sales Tax Exemption Certificate, Energy used in Processing or Agriculture.

Qualifying farm machinery/equipment: The item must be one of the following:

1.A self-propelled implement directly and primarily used in agricultural production, such as a tractor.

2.An implement directly and primarily used in agricultural production that is customarily drawn or attached to a self-propelled implement in the performance of its function, such as a plow.

3.A grain dryer (heater and blower only) directly and primarily used in agricultural production.

4.A snow blower, rear-mounted or front-mounted blade, or rotary cutter used in agricultural production, if attached to or towed by a self-propelled implement.

5.A diesel fuel trailer, seed tender, all-terrain vehicle, or off-road utility vehicle primarily used in agricultural production.

6.Tangible personal property that does not become a part of real property and is directly and primarily used in livestock or dairy production, aquaculture production, or the production of flowering, ornamental, or vegetable plants.

7.Auger systems, curtains, curtain systems, drip systems, fans and fan systems, shutters, inlets, shutter or inlet systems, and refrigerators used in livestock or dairy production, aquaculture production, or the production of flowering, ornamental, or vegetable plants.

8.An auxiliary attachment improving safety, performance, operation, or efficiency for items 1 through 7.

9.A replacement part for items 1 through 8.

10.A container, label, carton, pallet, packing case, wrapping, baling wire, twine, bag, bottle, shipping case, or other similar item used in agricultural, livestock, or dairy production.

Qualifying manufacturing machinery/equipment: The item must be computers, machinery, equipment, replacement parts, supplies, or material used to construct or self-construct computers, machinery, equipment, replacement parts, or supplies used for one of the following purposes:

1.Directly and primarily used in processing by a manufacturer.

2.Directly and primarily used to maintain integrity or unique environmental conditions for the product.

3.Directly and primarily used in research and development of new products or processes.

4.Directly and primarily used in recycling or reprocessing of waste products.

Pollution control equipment: The equipment must be used by a manufacturer primarily to reduce, control, or eliminate air or water pollution.