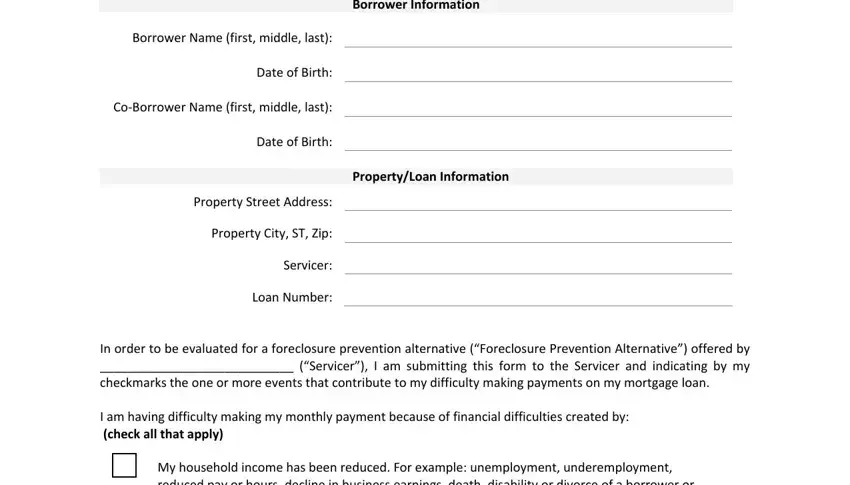

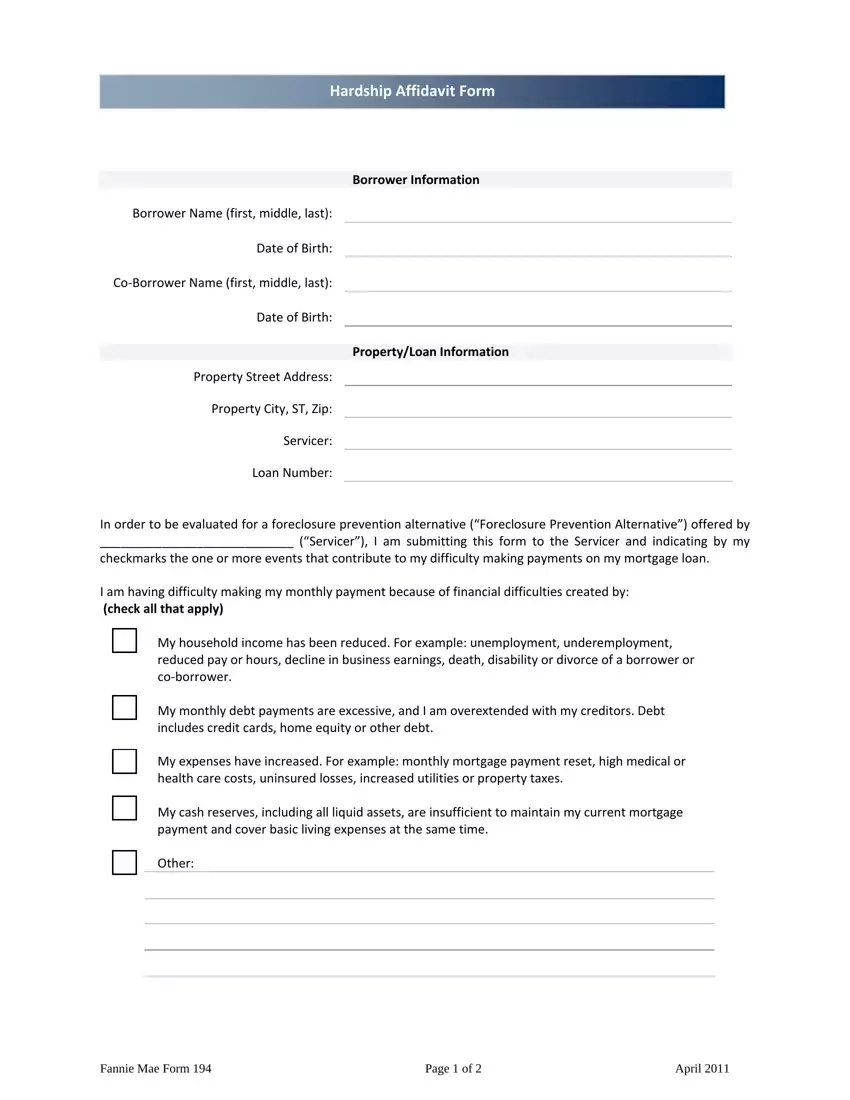

Hardship Affidavit Form

Borrower Information

Borrower Name (first, middle, last):

Date of Birth:

Co‐Borrower Name (first, middle, last):

Date of Birth:

Property/Loan Information

Property Street Address:

Property City, ST, Zip:

Servicer:

Loan Number:

In order to be evaluated for a foreclosure prevention alternative (“Foreclosure Prevention Alternative”) offered by

____________________________ (“Servicer”), I am submitting this form to the Servicer and indicating by my

checkmarks the one or more events that contribute to my difficulty making payments on my mortgage loan.

I am having difficulty making my monthly payment because of financial difficulties created by:

(check all that apply)

My household income has been reduced. For example: unemployment, underemployment, reduced pay or hours, decline in business earnings, death, disability or divorce of a borrower or co‐borrower.

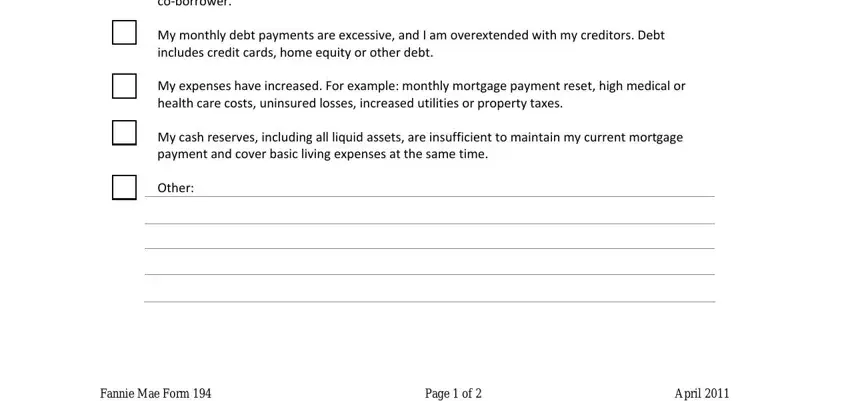

My monthly debt payments are excessive, and I am overextended with my creditors. Debt includes credit cards, home equity or other debt.

My expenses have increased. For example: monthly mortgage payment reset, high medical or health care costs, uninsured losses, increased utilities or property taxes.

My cash reserves, including all liquid assets, are insufficient to maintain my current mortgage payment and cover basic living expenses at the same time.

Other:

Fannie Mae Form 194 |

Page 1 of 2 |

April 2011 |

Hardship Affidavit Form

Borrower/Co‐Borrower Acknowledgement and Agreement

1.I certify that all of the information in this Hardship Affidavit is truthful and the event(s) identified above has/have contributed to my need for a Foreclosure Prevention Alternative relating to my mortgage loan.

2.I understand and acknowledge the Servicer may investigate the accuracy of my statements, may require me to provide supporting documentation, and that knowingly submitting false information may violate Federal law.

3.I understand the Servicer may pull a current credit report on all borrowers obligated on the note relating to my mortgage loan.

4.I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this Hardship Affidavit, or if I do not provide all of the required documentation, the Servicer may cancel a Foreclosure Prevention Alternative and may pursue foreclosure on my home.

5.I certify that I have not received a condemnation notice on my property.

6.I certify that I am willing to provide all requested documents and to respond to all Servicer communication in a timely manner. I understand that time is of the essence.

7.I understand that the Servicer may use this information to evaluate my eligibility for a Foreclosure Prevention Alternative, but the Servicer is not obligated to offer me assistance based solely on the representations in this Hardship Affidavit.

8.I understand that the Servicer may collect and record personal information, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, and information about account balances and activity. I understand and consent to the disclosure of my personal information and the terms of any Foreclosure Prevention Alternative offered by the Servicer to any investor, insurer, guarantor or servicer that owns, insures, guarantees or services my first lien or subordinate lien (if applicable) mortgage loan(s).

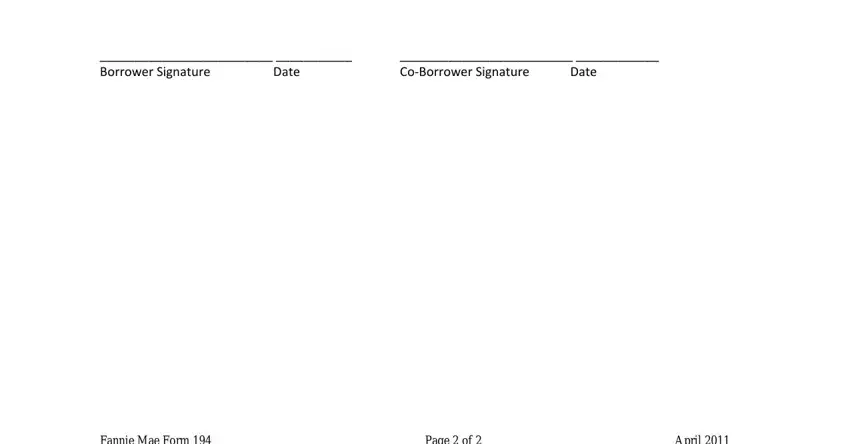

_________________________ ___________ |

_________________________ ____________ |

Borrower Signature |

Date |

Co‐Borrower Signature |

Date |

Fannie Mae Form 194 |

Page 2 of 2 |

April 2011 |