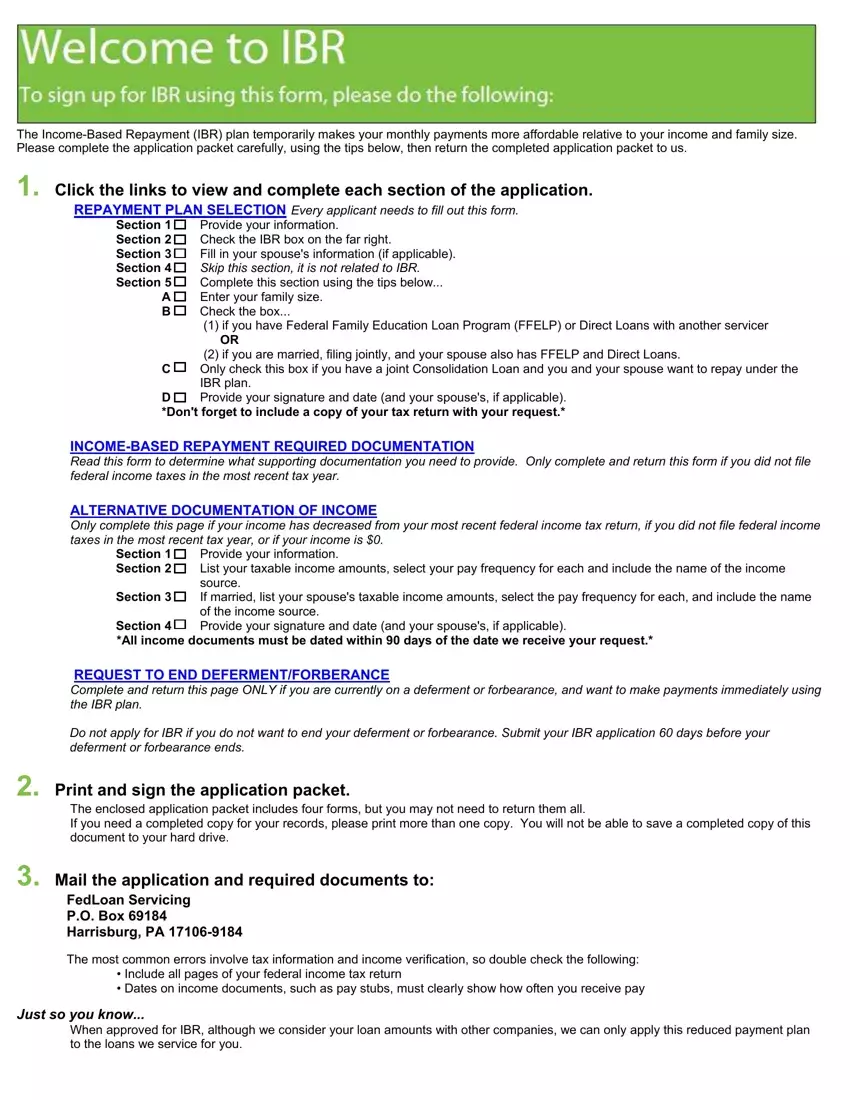

The Income-Based Repayment (IBR) plan temporarily makes your monthly payments more affordable relative to your income and family size. Please complete the application packet carefully, using the tips below, then return the completed application packet to us.

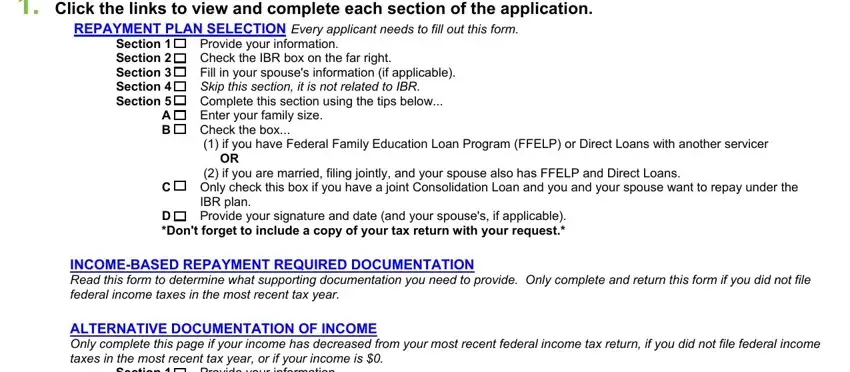

1. Click the links to view and complete each section of the application.

REPAYMENT PLAN SELECTION Every applicant needs to fill out this form.

Section 1 |

Provide your information. |

Section 2 |

Check the IBR box on the far right. |

Section 3 |

Fill in your spouse's information (if applicable). |

Section 4 |

Skip this section, it is not related to IBR. |

Section 5 |

Complete this section using the tips below... |

A |

Enter your family size. |

B |

Check the box... |

(1)if you have Federal Family Education Loan Program (FFELP) or Direct Loans with another servicer

OR

(2)if you are married, filing jointly, and your spouse also has FFELP and Direct Loans.

C |

Only check this box if you have a joint Consolidation Loan and you and your spouse want to repay under the |

|

IBR plan. |

D |

Provide your signature and date (and your spouse's, if applicable). |

*Don't forget to include a copy of your tax return with your request.*

INCOME-BASED REPAYMENT REQUIRED DOCUMENTATION

Read this form to determine what supporting documentation you need to provide. Only complete and return this form if you did not file federal income taxes in the most recent tax year.

ALTERNATIVE DOCUMENTATION OF INCOME

Only complete this page if your income has decreased from your most recent federal income tax return, if you did not file federal income taxes in the most recent tax year, or if your income is $0.

Section 1 |

Provide your information. |

Section 2 |

List your taxable income amounts, select your pay frequency for each and include the name of the income |

|

source. |

Section 3 |

If married, list your spouse's taxable income amounts, select the pay frequency for each, and include the name |

|

of the income source. |

Section 4 |

Provide your signature and date (and your spouse's, if applicable). |

*All income documents must be dated within 90 days of the date we receive your request.*

REQUEST TO END DEFERMENT/FORBERANCE

Complete and return this page ONLY if you are currently on a deferment or forbearance, and want to make payments immediately using the IBR plan.

Do not apply for IBR if you do not want to end your deferment or forbearance. Submit your IBR application 60 days before your deferment or forbearance ends.

2. Print and sign the application packet.

The enclosed application packet includes four forms, but you may not need to return them all.

If you need a completed copy for your records, please print more than one copy. You will not be able to save a completed copy of this document to your hard drive.

3. Mail the application and required documents to:

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

The most common errors involve tax information and income verification, so double check the following:

•Include all pages of your federal income tax return

•Dates on income documents, such as pay stubs, must clearly show how often you receive pay

Just so you know...

When approved for IBR, although we consider your loan amounts with other companies, we can only apply this reduced payment plan to the loans we service for you.

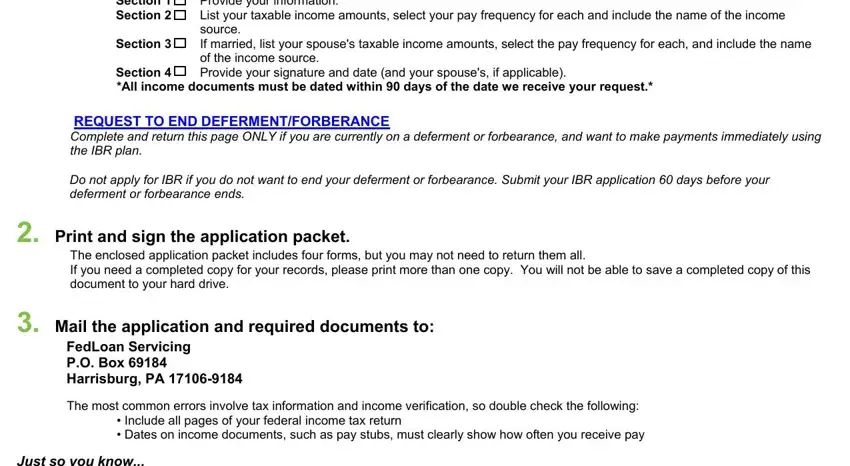

REPAYMENT PLAN SELECTION

William D. Ford Federal Direct Loan Program

Records Code: RPSFM-XBCR

OMB No. 1845-0014

Form Approved

Exp. Date 11/30/2013

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying documents is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

Instructions

To understand your repayment options, carefully read this entire form, including the important notices in Section 7, and the enclosed information that describes the available repayment plans. After reviewing this information, complete the applicable sections below to select a repayment plan or to change your current repayment plan. Please print clearly using blue or black ink. If you need help completing this form, contact your servicer through one of the methods provided in Section 6 of this form. Return the completed form to the address shown in Section 6.

Section 1: Borrower Information – to be completed by ALL BORROWERS |

|

|

Borrower’s Last Name |

First Name |

Middle Initial |

Borrower’s Social Security Number: |

____________________________________________ |

_________________________ |

_________ |

|____|____|____|-|____|____|-|____|____|____|____| |

|

Section 2: Repayment Plan Selection – to be completed by ALL BORROWERS

•Place an “X” in the box in the chart below under the repayment plan that you wish to select for the types of loans that you owe. The enclosed information describes each of the repayment plans.

•You must choose the same repayment plan for all of your Direct Loans, unless you want to repay under the Income Contingent Repayment (ICR) Plan or Income-Based Repayment (IBR) Plan and you have some loans that may not be repaid under those plans as indicated in the chart below. In this case, you may select the ICR Plan or IBR Plan for the loans that are eligible for repayment under those plans, and may select a different repayment plan for the loans that may not be repaid under ICR or IBR.

•In the chart below, the term “parent PLUS Loan” refers to a Direct PLUS Loan made under the William D. Ford Federal Direct Loan (Direct Loan) Program or a Federal PLUS Loan made under the Federal Family Education Loan (FFEL) Program that you borrowed to help pay for your dependent child’s undergraduate education. A “student PLUS Loan” is a Direct PLUS Loan or Federal PLUS Loan that you received to pay for your own graduate or professional education. A Direct PLUS Consolidation Loan is a Direct Consolidation Loan made before July 1, 2006 that repaid parent PLUS loans. No Direct PLUS Consolidation Loans have been made since July 1, 2006.

•To repay your loans under the IBR Plan, you must have a partial financial hardship (see Section 5).

•If you are beginning repayment of your loans for the first time and you do not select a repayment plan, or if you select the ICR Plan or IBR Plan but do not submit required additional forms and documentation, you will be placed on the Standard Repayment Plan.

•If you are requesting a change from another repayment plan to the ICR Plan or the IBR Plan and you do not submit required additional forms and documentation, you will remain on your current repayment plan.

•If you are requesting a change from your current repayment plan to a different plan, your servicer may grant you a forbearance for up to 60 days, if necessary, in order to collect and process documentation supporting your request (such as documentation required to process a request to repay under the ICR Plan or the IBR Plan). Unpaid interest that accrues during this maximum 60- day forbearance period will not be capitalized. (Capitalization is the addition of unpaid interest to the principal balance of your loan. This increases the principal balance and the total cost of your loan.)

•If you are delinquent in making payments under your current repayment plan at the time you request a change to a different plan, your servicer may grant you a forbearance to cover (1) any payments that are overdue at the time of your request, or (2) if you are requesting a change to the IBR Plan, any payments that would be overdue by the time your servicer determines whether you have a partial financial hardship (see Section 5), if it takes your servicer more than 60 days to make that determination. Unpaid interest that accrues during this forbearance period may be capitalized at the end of the forbearance period.

• |

Loan Types |

Standard |

Graduated |

Extended |

Income Contingent |

Income-Based |

Direct Subsidized Loans |

|

|

|

|

|

• |

Direct Unsubsidized Loans |

|

|

|

|

|

• |

Student Direct PLUS Loans |

|

Fixed Payments |

Graduated Payments |

|

|

•Direct Consolidation Loans that did not repay any parent PLUS loans

•Direct Consolidation Loans made on or after July

1, 2006 that repaid one or more parent PLUS loans |

Fixed Payments |

Graduated Payments |

|

Not Available |

|

|

|

• Parent Direct PLUS Loans |

|

|

|

|

• Direct PLUS Consolidation Loans |

Fixed Payments |

Graduated Payments |

Not Available |

Not Available |

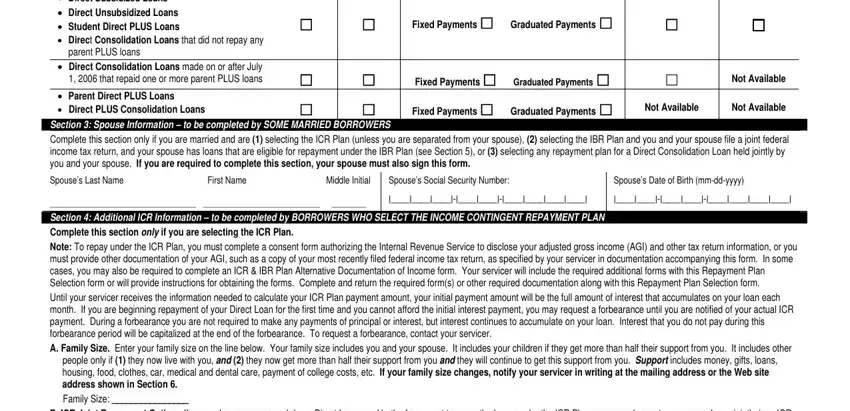

Section 3: Spouse Information – to be completed by SOME MARRIED BORROWERS

Complete this section only if you are married and are (1) selecting the ICR Plan (unless you are separated from your spouse), (2) selecting the IBR Plan and you and your spouse file a joint federal income tax return, and your spouse has loans that are eligible for repayment under the IBR Plan (see Section 5), or (3) selecting any repayment plan for a Direct Consolidation Loan held jointly by you and your spouse. If you are required to complete this section, your spouse must also sign this form.

Spouse’s Last Name |

First Name |

Middle Initial |

______________________________ |

________________________ |

_______ |

Spouse’s Social Security Number:

|____|____|____|-|____|____|-|____|____|____|____|

Spouse’s Date of Birth (mm-dd-yyyy)

|____|____|-|____|____|-|____|____|____|____|

Section 4: Additional ICR Information – to be completed by BORROWERS WHO SELECT THE INCOME CONTINGENT REPAYMENT PLAN

Complete this section only if you are selecting the ICR Plan.

Note: To repay under the ICR Plan, you must complete a consent form authorizing the Internal Revenue Service to disclose your adjusted gross income (AGI) and other tax return information, or you must provide other documentation of your AGI, such as a copy of your most recently filed federal income tax return, as specified by your servicer in documentation accompanying this form. In some cases, you may also be required to complete an ICR & IBR Plan Alternative Documentation of Income form. Your servicer will include the required additional forms with this Repayment Plan Selection form or will provide instructions for obtaining the forms. Complete and return the required form(s) or other required documentation along with this Repayment Plan Selection form.

Until your servicer receives the information needed to calculate your ICR Plan payment amount, your initial payment amount will be the full amount of interest that accumulates on your loan each month. If you are beginning repayment of your Direct Loan for the first time and you cannot afford the initial interest payment, you may request a forbearance until you are notified of your actual ICR payment. During a forbearance you are not required to make any payments of principal or interest, but interest continues to accumulate on your loan. Interest that you do not pay during this forbearance period will be capitalized at the end of the forbearance. To request a forbearance, contact your servicer.

A. Family Size. Enter your family size on the line below. Your family size includes you and your spouse. It includes your children if they get more than half their support from you. It includes other people only if (1) they now live with you, and (2) they now get more than half their support from you and they will continue to get this support from you. Support includes money, gifts, loans, housing, food, clothes, car, medical and dental care, payment of college costs, etc. If your family size changes, notify your servicer in writing at the mailing address or the Web site address shown in Section 6.

Family Size: ________________

B. ICR Joint Repayment Option. If you and your spouse each have Direct Loans and both of you want to repay the loans under the ICR Plan, you may choose to repay your loans jointly (see ICR Plan description in the enclosed Repayment Plan Choices sheet). If you choose to repay jointly, place an “X” in the box below and have your spouse sign and date this form.

I wish to repay my loan(s) jointly with my spouse under the ICR Plan.

C. Certification. Read the certification statement below, then sign and date this form.

All of the information I provided on this form is true and complete to the best of my knowledge. If asked by an authorized official, I agree to provide proof of the information that I have provided on this form.

|

|

|

|

Borrower’s Signature |

|

Date |

Spouse’s Signature (if required; see Section 3) |

|

Date |

REVISED 04/2011

•

•

Call us at 800-699-2908 or if you use a telecommunications device for the deaf (TDD) at 800-722-8189 E-mail us by going to www.MyFedLoan.org and signing in to Account Access.

Write to us at the mailing address provided above.

•

(Spouse’s signature is required if (1) you file a joint federal income tax return and your spouse also has loans that are eligible for the IBR Plan, or (2) you and your spouse want to repay a joint consolidation loan under the IBR Plan.)

Section 6: Where to Send the Completed Form Return this form to:

U.S. Department of Education

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

If you need help completing this form, or if you need to report a change in your address, contact: FedLoan Servicing.

Spouse’s Signature

Date

Borrower’s Signature

Date

Loans made under the FFEL Program are Federal Stafford Loans (subsidized and unsubsidized), Federal PLUS Loans, and Federal Consolidation Loans.

Federal Perkins Loans, HEAL loans or other health education loans, and private education loans are not eligible for the IBR plan. Your eligibility for the IBR Plan will be determined based on your total eligible loan debt and, if you are married and file a joint federal income tax return, your spouse’s total eligible loan debt. To access information on your eligible loans, check NSLDS at www.nslds.ed.gov.

Check this box if (1) you have eligible FFEL Program loans in addition to your eligible Direct Loan Program loans, or (2) you are married and file a joint federal income tax return, and your spouse has eligible Direct Loan or FFEL Program loans. NOTE: Including your spouse’s eligible loans will result in a lower monthly IBR Plan payment amount.

C. IBR Joint Consolidation Loan Repayment. If you and your spouse have an eligible joint consolidation loan that you and your spouse want to repay under the IBR Plan, place an “X” in the box below and have your spouse sign and date below in “D”. Both you and your spouse must have a partial financial hardship (see description above) to repay an eligible joint consolidation loan under IBR.

I wish to repay my joint consolidation loan(s) with my spouse under the IBR Plan.

D. Certification. Read the certification statement below, then sign and date this form. Your spouse must also sign and date this form if (1) you and your spouse file a joint federal income tax return and your spouse has loans that are eligible for IBR, or (2) you and your spouse want to repay a joint consolidation loan under the IBR Plan.

All of the information I provided on this form is true and complete to the best of my knowledge. If asked by an authorized official, I agree to provide proof of the information that I have provided on this form.

All FFEL Program loans are eligible except (1) a loan that is in default, (2) a Federal PLUS Loan made to a parent borrower, or (3) a Federal Consolidation Loan that repaid a Direct PLUS Loan or Federal PLUS Loan made to a parent borrower.

•

If you have any questions regarding the IBR Plan, partial financial hardship, or your family size determination, please contact your servicer.

B. Eligible Loans for the IBR Plan.

• All Direct Loan Program loans are eligible except (1) a loan that is in default, (2) a Direct PLUS Loan made to a parent borrower, (3) a Direct Consolidation Loan that repaid a Federal PLUS Loan or Direct PLUS Loan made to a parent borrower, or (4) a Direct PLUS Consolidation Loan.

Loans made under the Direct Loan Program are Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans

Family Size: ________________

If you do not provide your family size, your servicer will assume a family size of one.

NOTE:

An IBR Plan calculator is available at studentaid.ed.gov. The calculator evaluates your eligibility for the IBR Plan and estimates your initial IBR Plan payment amount. To use the calculator, you will need to enter your eligible loan debt, income, family size, and state of residence. The calculator is for informational purposes only; your servicer will make the official determination of your eligibility and payment amount based on the information you provide on this form and other required documentation.

To enroll in the IBR Plan, you must complete a consent form authorizing the Internal Revenue Service to disclose your AGI and other tax return information, or you must provide other documentation of your AGI, such as a copy of your most recently filed federal income tax return, as specified by your servicer in documentation accompanying this form. In some cases, you may also be required to complete an ICR & IBR Plan Alternative Documentation of Income form. Your servicer will include the required additional forms with this Repayment Plan Selection form or will provide instructions for obtaining the forms. Complete and return the required form(s) and/or other required documentation along with this Repayment Plan Selection form.

A. Family Size. Enter your family size on the line below. Your family size includes you, your spouse, and your children, including children who will be born during the year you certify your family size, if your children receive more than half their support from you. Your family size also includes other individuals if, at the time you certify your family size, these other individuals (1) live with you and (2) receive more than half of their support from you and will continue to receive this support for the year you certify your family size. Support includes money, gifts, loans, housing, food, clothes, car, medical and dental care, and payment of college costs. If you select IBR, you must notify us of your family size every year. Your servicer will contact you annually to confirm and update family size information.

Section 5: Additional IBR Information – to be completed by BORROWERS WHO SELECT THE INCOME-BASED REPAYMENT PLAN

Complete this section only if you are selecting the IBR Plan.

To initially qualify to repay your loans under the IBR Plan and to continue to make income-based payments, you must have a partial financial hardship. You are considered to have a partial financial hardship if the annual amount due on all of your eligible loans or, if you are married and file a joint federal income tax return, the annual amount due on all of your eligible loans and your spouse’s eligible loans, is more than 15% of the difference between your adjusted gross income (AGI), as shown on your most recently filed federal income tax return, and 150% of the poverty guideline amount for your family size and state of residence:

Annual amount of payments due > 15% [AGI – (150% x applicable poverty guideline amount)]

The annual amount of payments due is calculated based on the greater of (1) the total amount owed on eligible loans at the time those loans initially entered repayment or (2) the total amount owed on eligible loans at the time you or, if applicable, your spouse requested the IBR Plan. The annual amount of payments due is calculated using a Standard Repayment Plan with a10-year repayment period. The amount owed on eligible loans includes the amount owed on your eligible loans and, if you are married and file a joint federal income tax return, the amount owed on your spouse’s eligible loans. Eligible loans for the IBR Plan are listed in “B”, below. If you are married and file a joint federal income tax return, your AGI includes both your income and your spouse’s income. Your spouse must sign below if you file a joint federal income tax return and if your spouse also has loans that are eligible for repayment under the IBR Plan; by signing this form, your spouse is authorizing your servicer to access information about his or her federal student loans in the National Student Loan Data System (NSLDS).

Section 7: Important Notices

PRIVACY ACT NOTICE

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authority for collecting the requested information from and about you is §451 et seq. of the Higher Education Act (HEA) of 1965, as amended (20 U.S.C. 1087a et seq.) and the authorities for collecting and using your Social Security Number (SSN) are §484(a)(4) of the HEA (20 U.S.C. 1091(a)(4)) and 31 U.S.C. 7701(b). Participating in the William D. Ford Federal Direct Loan (Direct Loan) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the Direct Loan Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect and report on your loan(s) if your loan(s) become delinquent or in default. We also use your SSN as an account identifier and to permit you to access your account information electronically.

The information in your file may be disclosed, on a case-by-case basis or under a computer-matching program, to third parties as authorized under routine uses in the appropriate systems of records notices. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loan(s), to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default. To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions. To assist program administrators with tracking refunds and cancellations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal or state agencies. To provide a standardized method for educational institutions to efficiently submit student enrollment status, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation. If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualified researchers under Privacy Act safeguards.

PAPERWORK REDUCTION NOTICE

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a currently valid OMB control number. The valid OMB control number for this information collection is 1845-0014. The time required to complete this information collection is estimated to average .33 hours (20 minutes) per response, including the time to review instructions, search existing data resources, gather and maintain the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: U.S. Department of Education, Washington, DC 20210-4537. Do not send the completed form to this address.

If you have questions about the status of your individual submission of this form, contact your servicer (see Section 6).

|

|

INCOME-BASED REPAYMENT (IBR) |

|

|

REQUIRED DOCUMENTATION |

|

|

NOTE: The attached Repayment Plan Selection form can be |

|

IBRD |

|

used to request IBR for both Direct and FFELP loans. |

Records Code: IBRDF-XIBR

Version Date: 06/01/11

NAME: ____________________________________________ |

ACCOUNT NUMBER: ______________________________ |

|

|

ELIGIBLE LOAN TYPES

Review the eligibility information below to determine if your loan type(s) is eligible for the IBR plan.

Income-Based Repayment (IBR) Plan – Direct and FFELP Loans

Parent PLUS loans, including Direct or FFELP parent PLUS Loans, Direct PLUS Consolidation Loans or Direct or FFELP Consolidation Loans that repaid parent PLUS loans, are not eligible for this repayment plan.

REQUIRED DOCUMENTATION

You must provide a signed Repayment Plan Selection Form AND a copy of your most recently filed federal income tax return*. Select IBR on the Selection Form, complete the appropriate section, and include all additional documentation based on your situation described below. Failure to provide any of the required documentation may result in denial of your request.

|

IF YOU… |

THEN PROVIDE… |

|

|

|

|

are currently employed, but your income has recently changed |

a completed, signed Alternative Documentation of Income |

|

|

form, and |

|

|

proof of your current income, such as a pay stub |

|

|

|

|

currently receive only untaxed income (SSI/Child Support) |

a completed, signed Alternative Documentation of Income |

|

|

form with the appropriate box checked in Section 2 |

|

|

|

|

currently have no taxable or untaxed income |

a completed, signed Alternative Documentation of Income |

|

|

form |

|

|

|

|

are currently in a period of deferment or forbearance and are |

a completed Request to End Deferment/Forbearance form |

|

requesting to enter the IBR plan before the deferment or |

|

|

forbearance period ends |

|

|

|

|

|

|

|

* CERTIFICATION SECTION FOR NON-TAX FILERS

Complete the signature section below ONLY if you were not required to file a federal income tax return for the most recent tax year.

I certify that I was not required to file a federal income tax return for the most recent tax year because I did not meet the IRS filing requirements.

Borrower’s Signature: ______________________________________________________ |

Date: ______________________ |

Records Code: IBADI-XIBR |

Income Contingent Repayment Plan & Income-Based Repayment Plan |

|

|

|

OMB No. 1845-0016 |

Alternative Documentation of Income |

|

|

Form Approved |

William D. Ford Federal Direct Loan Program |

|

Exp. Date 06/30/2012 |

Federal Direct Stafford/Ford Loans, Federal Direct Unsubsidized Stafford/Ford Loans, |

|

Federal Direct Subsidized Consolidation Loans, Federal Direct Unsubsidized Consolidation Loans

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form shall be subject to penalties which may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

Section 1: Identifying Information

Before completing this form, carefully read the instructions in Section 5.

All borrowers must provide the Borrower Information below.

Borrower Information:

Borrower’s Name (please print clearly):

________________________________________________

Last Name First NameMiddle Initial

Borrower’s Social Security Number:

|__|__|__|-|__|__|-|__|__|__|__|

If you are married, you must also provide the Spouse Information below if

(1)you are repaying under the ICR Plan, or (2) you are repaying under the IBR Plan and you and your spouse file a joint federal tax return.

Spouse Information:

Your Spouse’s Name (please print clearly):

________________________________________________________

Last Name First NameMiddle Initial

Your Spouse’s Social Security Number:

|__|__|__|-|__|__|-|__|__|__|__|

Section 2: Borrower’s Income Information – to be completed by ALL BORROWERS

All borrowers must complete this section.

You must list all taxable income you are currently receiving (i.e., income from employment, unemployment income, dividend income, interest income, tips, alimony). Include the amount of money received, how often you receive this money, and your employer (if any) or the source of your income if you are not employed. You must attach supporting documentation for all income reported in this section (e.g., pay stubs, letters from your employer stating your income, interest or bank statements, dividend statements, canceled checks, or, when these forms of documentation are unavailable, a signed statement explaining your income source(s) and giving the addresses of these sources). Copies are acceptable, but all supporting documentation must be no more than 90 days old. If you have more than two sources of income, provide the information requested in this section on a separate piece of paper and mail it with this form. Do not report untaxed income such as Supplemental Security Income, child support, or federal or state public assistance. If your income or the income of your spouse changes significantly after your submission of this form, you must notify your servicer of this change (see contact information in Section 5).

|

Amount of |

|

Frequency of Payment (Please check the appropriate box.) |

|

Employer or Source of Income |

|

Income |

Weekly |

Bi-weekly |

Semi-monthly |

Monthly |

Yearly |

|

|

$

$

Check this box if you do not have any taxable income and receive only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

Section 3: Spouse’s Income Information – to be completed by SOME MARRIED BORROWERS

If you are married, you must provide your spouse’s income information if:

1.You are repaying under the ICR Plan, or

2.You are repaying under the IBR Plan and you and your spouse file a joint federal tax return.

If you are required to complete this section, you must provide the same information and supporting documentation for your spouse’s income that is required for your own income, as explained above in Section 2.

|

Amount of |

|

Frequency of Payment (Please check the appropriate box.) |

|

Employer or Source of Income |

|

Income |

Weekly |

Bi-weekly |

Semi-monthly |

Monthly |

Yearly |

|

|

$

$

Check this box if your spouse does not have any taxable income and receives only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

Check this box if your spouse does not have any taxable income and receives only untaxed income such as Supplemental Security Income, child support, or federal or state public assistance.

Section 4: Certification and Signature

All borrowers must complete this section. If you are married, your spouse must sign and date below only if (1) you are repaying under the ICR Plan, or (2) you are repaying under the IBR Plan and you and your spouse file a joint federal tax return.

Certification: I certify that all of the information reported in Section 2 and, if applicable, Section 3 is true and complete to the best of my knowledge. I agree to provide to the U.S. Department of Education (the Department) on an annual basis (or as required by the Department) alternative documentation of my income for the purpose of determining my appropriate repayment amount under the ICR Plan or IBR Plan. I understand that (1) if I do not provide this information the Department will base my ICR or IBR amount on my AGI, as reported by the IRS, or, in some instances, I will not be allowed to repay my loan(s) under the ICR or IBR Plan; (2) the Department may request my income information from the IRS even if alternative documentation of my income is accepted; and (3) if I am married, my spouse’s income information, documentation, and signature are also required if I am repaying under the ICR Plan, or if I am repaying under the IBR Plan and my spouse and I file a joint federal tax return.

Borrower’s Signature |

Date of Borrower’s Signature |

Spouse’s Signature |

Date of Spouse’s Signature |

Section 5: Instructions and Where to Send the Completed Form

INSTRUCTIONS:

YOU ARE REQUIRED to complete this form if you are repaying your Direct Loans under the Income Contingent Repayment (ICR) or the Income-Based Repayment (IBR) Plan and:

You are in your first year of repayment;

You are in your second year of repayment and have been notified that alternative documentation of your income is required; or

You have been notified that the Internal Revenue Service (IRS) is unable to provide the U.S. Department of Education (the Department) with your Adjusted Gross Income (AGI) or that of your spouse (if applicable).

YOU MAY complete this form if:

•You are repaying your Direct Loans under the ICR Plan and your AGI (and your spouse’s AGI, if you are married), as reported on your most recently filed federal tax return, does not reasonably reflect your current income (e.g., due to circumstances such as loss or change in employment by you or your spouse).

•You are repaying your Direct Loans under the IBR Plan and your AGI (and your spouse’s AGI, if you and your spouse file a joint federal tax return), as reported on your most recently filed federal tax return, does not reasonably reflect your current income (e.g., due to circumstances such as loss or change in employment by you or your spouse).

In cases where alternative documentation of your income is used, the amount of your monthly payment under the ICR or IBR Plan is based on the current income information you and your spouse (if applicable) provide and is reevaluated annually. Your monthly payment may be adjusted more frequently than annually if you notify your servicer that your AGI (or your spouse’s AGI, if you file a joint federal tax return) has changed significantly since your most recent submission of this form and you provide supporting documentation showing this change. To submit alternative documentation of your income, you must attach the required documentation, complete and sign this form, and return it to the address below. If you are married, your spouse must also complete and sign the applicable sections of this form and submit the required documentation if (1) you are repaying your loans under the ICR Plan, or (2) you are repaying your loans under the IBR Plan and you and your spouse file a joint federal tax return. If you need assistance, please call 800-699-2908, or TDD 800-722-8189.

.

Return this form to:

U.S. Department of Education

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

If you need assistance completing this form, call 800-699-2908. Individuals who use a telecommunications device for the deaf (TDD) may call

800-722-8189.

Section 6: Important Notices

PRIVACY ACT NOTICE

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authority for collecting the requested information from and about you is §451 et seq. of the Higher Education Act (HEA) of 1965, as amended (20 U.S.C. 1087a et seq.) and the authorities for collecting and using your Social Security Number (SSN) are §484(a)(4) of the HEA (20 U.S.C. 1091(a)(4)) and 31 U.S.C. 7701(b). Participating in the William D. Ford Federal Direct Loan (Direct Loan) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the Direct Loan Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect and report on your loan(s) if your loan(s) become delinquent or in default. We also use your SSN as an account identifier and to permit you to access your account information electronically.

The information in your file may be disclosed, on a case-by-case basis or under a computer-matching program, to third parties as authorized under routine uses in the appropriate systems of records notices. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loan(s), to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default. To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions. To assist program administrators with tracking refunds and cancellations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal or state agencies. To provide a standardized method for educational institutions to efficiently submit student enrollment status, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation. If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualified researchers under Privacy Act safeguards.

Paperwork Reduction Notice. According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a currently valid OMB control number. The valid OMB control number for this information collection is 1845-0016. The time required to complete this information collection is estimated to average 0.33 hours (20 minutes) per response, including the time to review instructions, search existing data resources, gather and maintain the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: U.S. Department of Education, Washington, DC 20202-4537. Do not send the completed form to this address.

If you have questions about the status of your application, contact us at the following address:

U.S. Department of Education

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

INCOME-BASED REPAYMENT (IBR) / INCOME CONTINGENT REPAYMENT (ICR) REQUEST TO END DEFERMENT/FORBEARANCE

Records Code: IBRDF-XIBR

Version Date: 06/01/10

RDF

BORROWER NAME: ____________________________________________

ACCOUNT NUMBER: ________________________________

_____________________________________________________________________________________________________________

I am requesting to have my deferment/forbearance terminated on my eligible loan(s) for the purpose of allowing FedLoan Servicing to process my request for IBR/ICR.

I understand that I am only requesting the termination of my current deferment/forbearance if I qualify for the requested repayment plan. I also understand that if my current deferment / forbearance is ended, any unpaid accrued interest will be capitalized (added to the balance) and my loan(s) will be placed into repayment.

__________________________________________ |

__________________ |

Borrower’s Signature |

Date |

Check this box if your spouse does not have any taxable income and receives only untaxed income such as Supplemental Security Income, child support,

Check this box if your spouse does not have any taxable income and receives only untaxed income such as Supplemental Security Income, child support,