|

DEPARTMENT OF HOMELAND SECURITY |

|

See The Attached |

O.M.B. NO. 1660-0040 |

|

FEDERAL EMERGENCY MANAGEMENT AGENCY |

|

|

|

|

|

Instructions |

|

EXPIRES MAY 30, 2015 |

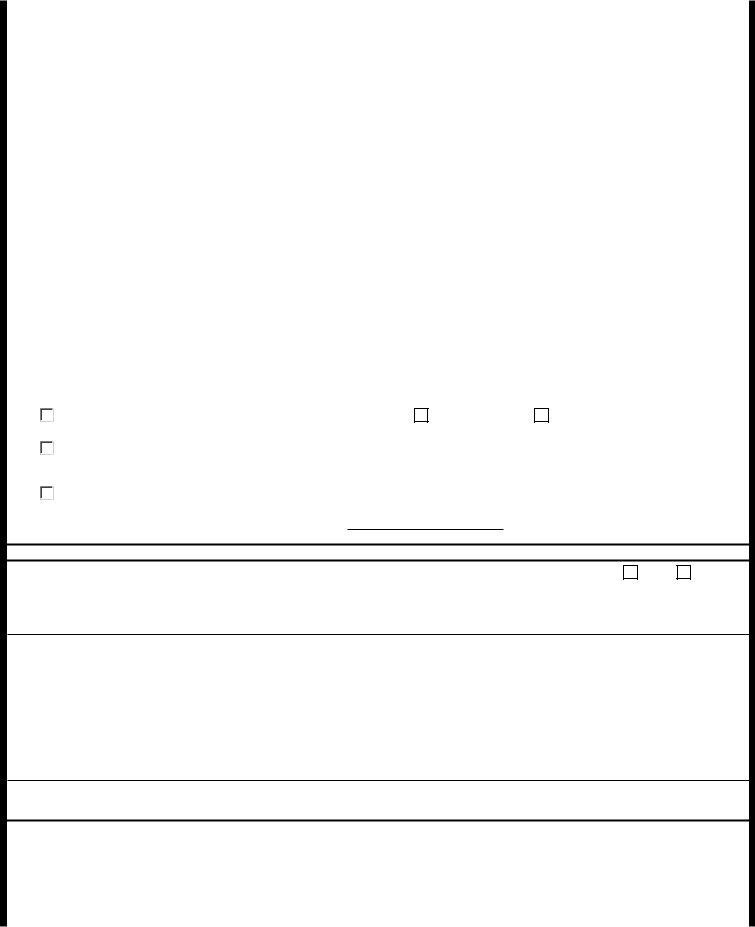

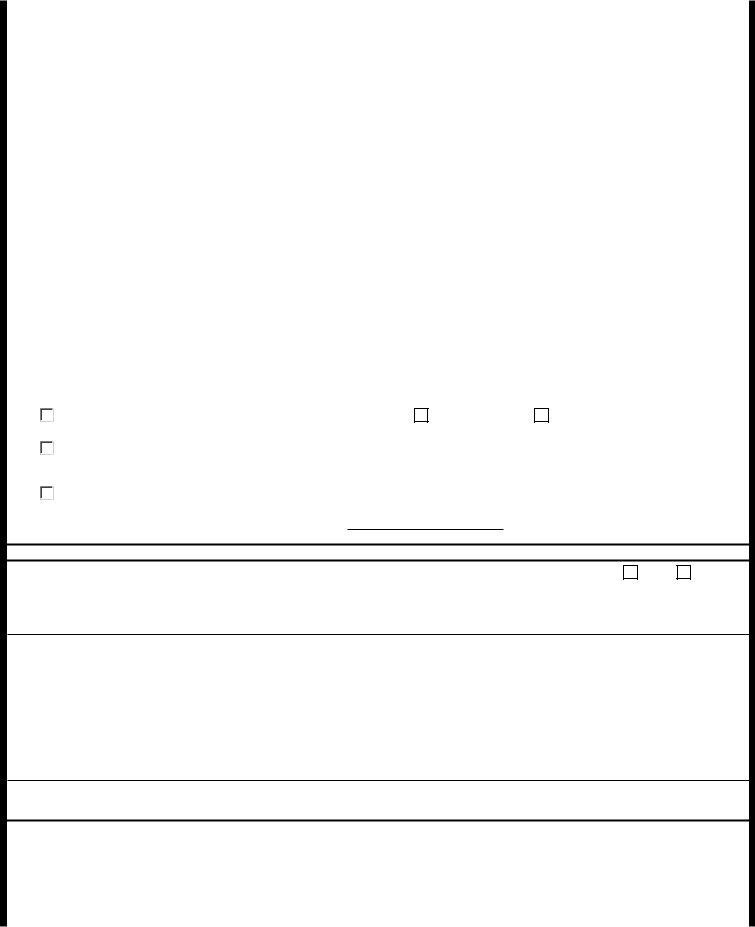

STANDARD FLOOD HAZARD DETERMINATION FORM (SFHDF) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

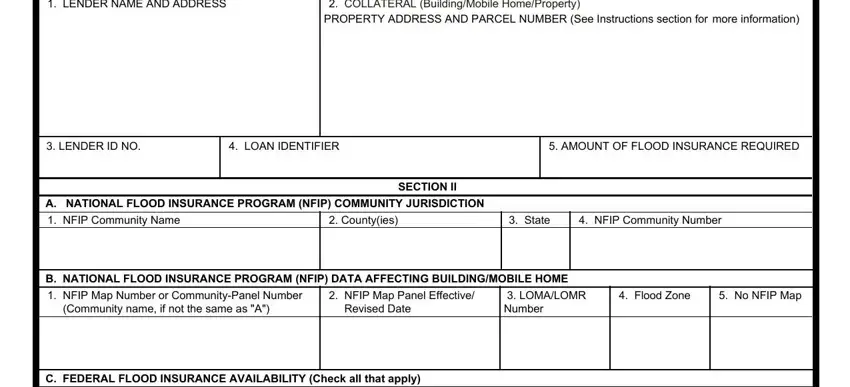

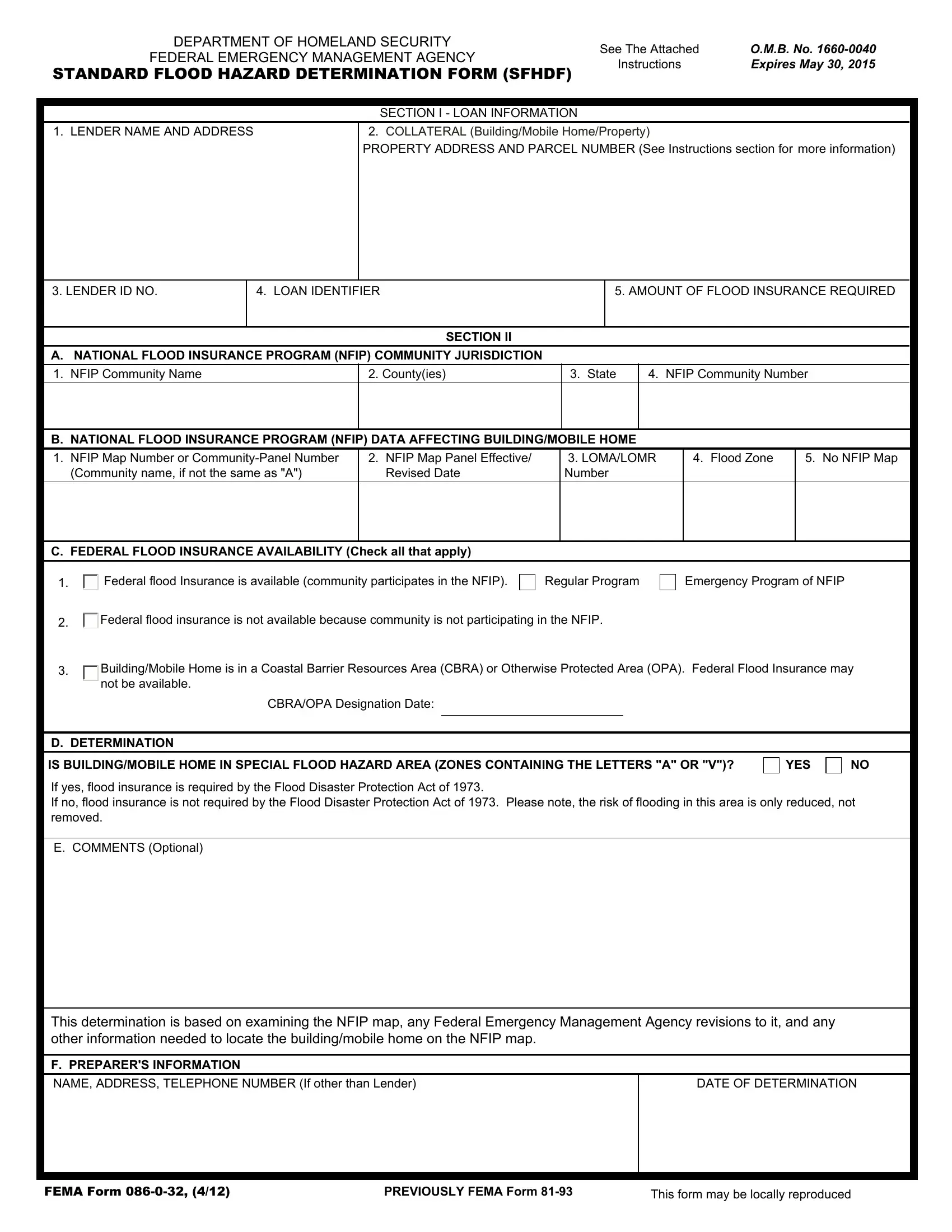

SECTION I - LOAN INFORMATION |

|

|

|

|

|

|

|

|

1. LENDER NAME AND ADDRESS |

|

2. COLLATERAL (Building/Mobile Home/Property) |

|

|

|

|

|

|

|

|

|

PROPERTY ADDRESS AND PARCEL NUMBER (See Instructions section for more information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. LENDER ID NO. |

|

4. LOAN IDENTIFIER |

|

|

|

5. AMOUNT OF FLOOD INSURANCE REQUIRED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION II |

|

|

|

|

|

|

|

|

|

|

|

A. NATIONAL FLOOD INSURANCE PROGRAM (NFIP) COMMUNITY JURISDICTION |

|

|

|

|

|

|

|

|

|

|

|

1. NFIP Community Name |

|

2. County(ies) |

|

3. State |

|

4. NFIP Community Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. NATIONAL FLOOD INSURANCE PROGRAM (NFIP) DATA AFFECTING BUILDING/MOBILE HOME |

|

|

|

|

|

|

1. NFIP Map Number or Community-Panel Number |

2. NFIP Map Panel Effective/ |

|

3. LOMA/LOMR |

4. Flood Zone |

5. No NFIP Map |

|

(Community name, if not the same as "A") |

Revised Date |

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

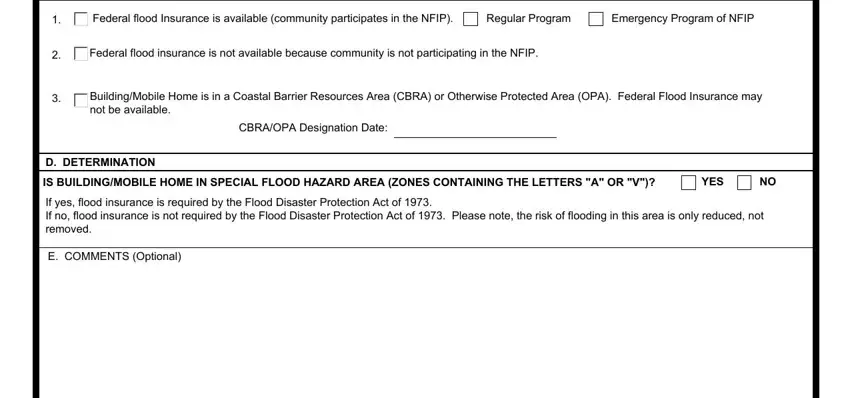

C. FEDERAL FLOOD INSURANCE AVAILABILITY (Check all that apply) |

|

|

|

|

|

|

|

|

|

|

|

1. |

Federal flood Insurance is available (community participates in the NFIP). |

Regular Program |

|

Emergency Program of NFIP |

2. |

Federal flood insurance is not available because community is not participating in the NFIP. |

|

|

|

|

|

|

|

|

3. |

Building/Mobile Home is in a Coastal Barrier Resources Area (CBRA) or Otherwise Protected Area (OPA). Federal Flood Insurance may |

|

not be available. |

|

|

|

|

|

|

|

|

|

|

|

|

|

CBRA/OPA Designation Date:

D. DETERMINATION

IS BUILDING/MOBILE HOME IN SPECIAL FLOOD HAZARD AREA (ZONES CONTAINING THE LETTERS "A" OR "V")? |

YES |

NO |

If yes, flood insurance is required by the Flood Disaster Protection Act of 1973.

If no, flood insurance is not required by the Flood Disaster Protection Act of 1973. Please note, the risk of flooding in this area is only reduced, not removed.

E. COMMENTS (Optional)

This determination is based on examining the NFIP map, any Federal Emergency Management Agency revisions to it, and any other information needed to locate the building/mobile home on the NFIP map.

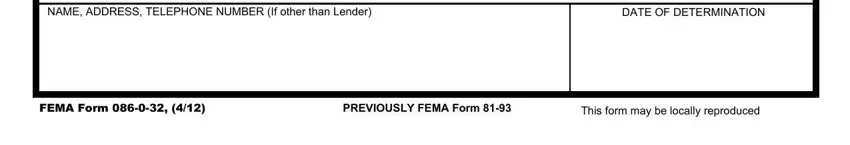

F. PREPARER'S INFORMATION

NAME, ADDRESS, TELEPHONE NUMBER (If other than Lender) |

DATE OF DETERMINATION |

|

|

|

|

FEMA FORM 086-0-32, (4/12) |

PREVIOUSLY FEMA Form 81-93 |

This form may be locally reproduced |

|

|

STANDARD FLOOD HAZARD DETERMINATION FORM INSTRUCTIONS

PAPERWORK BURDEN DISCLOSURE NOTICE

Public reporting burden for this form is estimated to average 20 minutes per response. The burden estimate includes the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and submitting the form.

This collection of information is mandatory. You are not required to respond to this collection of information unless a valid OMB control number is displayed in the upper right corner of this form. Send comments regarding the accuracy of the burden estimate and any suggestions for reducing the burden to: Information Collections Management, Department of Homeland Security, Federal Emergency Management Agency, 1800 South Bell Street, Arlington VA 20598-3005, Paperwork Reduction Project (1660-0040). NOTE: DO NOT

SEND YOUR COMPLETED FORM TO THIS ADDRESS.

SECTION 1

1.LENDER NAME: Enter lender name and address.

2.COLLATERAL (Building/Mobile Home/Personal Property) PROPERTY ADDRESS: Enter property address for the insurable collateral. In rural areas, a postal address may not be sufficient to locate the property. In these cases, legal property descriptions may be used and may be attached to the form if space provided is insufficient. If other identifiers are available, such as Longitude/Latitude, please use any that will help describe the collateral location properly. Additional information may be attached.

3.LENDER ID NO: The lender funding the loan should identify itself as follows: FDIC-insured lenders should indicate their FDIC Insurance Certificate Number; Federally-insured credit unions should indicate their charter/insurance number; Farm Credit institutions should indicate their UNINUM number. Other lenders who fund loans sold to or securitized by FNMA or FHLMC should enter FNMA or FHLMC seller/service number.

4.LOAN IDENTIFIER: Optional. May be used by lenders to conform with their individual method of identifying loans.

5.AMOUNT OF FLOOD INSURANCE REQUIRED: Optional. The minimum federal requirement for this amount is the lesser of: the outstanding principal loan balance; the value of the improved property, mobile home and/or personal property used to secure the loan; or the maximum statutory limit of flood insurance coverage. Lenders may exceed the minimum federal requirements. National Flood Insurance Program (NFIP) policies do not provide coverage in excess of the insured value of the building/mobile home/personal property.

SECTION 2

A.NATIONAL FLOOD INSURANCE PROGRAM (NFIP) COMMUNITY JURISDICTION

1. NFIP Community Name. Enter the complete name of the community (as indicated on the NFIP map) in which the building or mobile home is located. Under the NFIP, a community is the political unit that has authority to adopt and enforce floodplain management regulations for the areas within its jurisdiction. A community may be any State or area or political subdivision thereof, or any Indian tribe or authorized tribal organization, or Alaska Native village or authorized native organization. (Examples: Brewer, City of; Washington, Borough of; Worchester, Township of; Baldwin County; Jefferson Parish) For a building or mobile home that may have been annexed by one community but is shown on another community's NFIP map, enter the Community Name for the community with land-use jurisdiction over the building or mobile home.

2.County(ies). Enter the name of the county or counties in which the community is located. For unincorporated areas of a county, enter "unincorporated areas." For independent cities, enter "independent city."

3.State. Enter the two-digit state abbreviation. (Examples: VA, TX, CA)

4.NFIP Community Number. Enter the 6-digit NFIP community number. This number can be determined by consulting the NFIP Community Status Book or can be found on the NFIP map; copies of either can be obtained from FEMA's Website http://msc/fema.gov or by calling 1-800-358-9616. If no NFIP Community Number exists for the community, enter "none."

B.NFIP DATA AFFECTING BUILDING/MOBILE HOME

The information in this section (excluding the LOMA/LOMR information) is obtained by reviewing the NFIP map on which the building/mobile home is located. The current NFIP map may be obtained from FEMA by calling 1-800-358-9616. Scanned copies of the NFIP maps can be viewed on FEMA's website at http://msc.fema.gov. Note that even when an NFIP map panel is not printed, it may be reflected on a community's NFIP map index with its proper number, date, and flood zone indicated; enter these data accordingly.

1.NFIP Map Number or Community-Panel Number. Enter the 11-digit number shown on the NFIP map that covers the building or mobile home. (Examples: 480214 0022C; 58103C0075F). Some older maps will have a 9-digit number (Example: 12345601A). Note that the first six digits will not match the NFIP Community Number when the sixth digit is a "C" or when one community has annexed land from another but the NFIP map has not yet been updated to reflect this annexation. When the sixth digit is a "C", the NFIP map is in countywide format and shows the flood hazards for the geographic areas of the county on one map, including flood hazards for incorporated communities and for any unincorporated county contained within the county's geographic limits. Such countywide maps will list an NFIP Map Number. For maps not in such countywide format, the NFIP will list a Community-Panel Number on each panel.

If no NFIP map is in effect for the location of the building or mobile home, enter "none."

2.NFIP Map Panel Effective/Revised Date. Enter the map effective date or the map revised date shown on the NFIP map. (Example: 6/15/93) This will be the latest of all dates shown on the map.

3.LOMA/LOMR. If a Letter of Map Amendment (LOMA) or Letter of Map Revision (LOMR) has been issued by FEMA since the

current Map Panel Effective/Revised Date that revises the flood hazards affecting the building or mobile home, check "yes" and specify the date of the letter; otherwise, no entry is required. Information on LOMAs and LOMRs is available from the following sources:

*The community's official copy of its NFIP map should have a copy of all subsequently-issued LOMAs and LOMRs attached to it.

*For LOMAs and LOMRs issued on or after October 1, 1994, FEMA publishes a list of these letters twice a year as a compendium in the Federal Register. This information is also available on FEMA's website at http://msc.fema.gov.

*A subscription service providing digitized copies of these letters on CD-ROM is also available by calling 1-800-358-9616.

4.Flood Zone. Enter the flood zone(s) covering the building or mobile home. (Examples: A, AE, A4, AR, AR/A, AR/AE, AR/AO, V, VE, V12, AH, AO, B, C, X, D) If any part of the building or mobile home is within the Special Flood Hazard Area (SFHA), the entire building or mobile home is considered to be in the SFHA. All flood zones beginning with the letter "A" or "V" are considered Special Flood Hazard Areas (SFHAs). Each flood zone is defined in the legend of the NFIP map on which it appears. If there is no NFIP map for the subject area, enter "none."

5.No NFIP Map. If no NFIP map covers the area where the building or mobile home is located, check this box.

C. FEDERAL FLOOD INSURANCE AVAILABILITY. Check all boxes that apply; however, note that boxes 1 (Federal Flood Insurance is available ...) and 2 (Federal Flood Insurance is not available ...) are mutually exclusive. Federal flood insurance is available to all residents of a community that participates in the NFIP. Community participation status can be determined by consulting the NFIP Community Status Book, which is available from FEMA and at http://www.fema.gov/fema/csb.shtm . The NFIP Community Status Book will indicate whether or not the community is participating in the NFIP and whether participation is in the Emergency or Regular Program. If the community participates in the NFIP, check either Regular Program or Emergency Program. To obtain Federal flood insurance, a copy of this completed form may be provided to an insurance agent.

Federal flood insurance is prohibited in designated Coastal Barrier Resources Areas (CBRA) and Otherwise Protected Areas (OPAs) for buildings or mobile homes built or substantially improved after the date of the CBRA or OPA designation. Information about the Coastal Barrier Resources System may be obtained on FEMA's website at http://www.fema.gov/plan/prevent/floodplain/nfipkeywords/cbrs. shtm

D. DETERMINATION. If any portion of the building/mobile home is in an identified Special Flood Hazard Area (SFHA), check yes (flood insurance is required). If no portion of the building/mobile home is in an identified SFHA, check no. If no NFIP map exists for the community, check no. If no NFILP map exists, Section B5 should also be checked.

E.COMMENTS. Optional.

F.PREPARER'S INFORMATION. If other than the lender, enter the name, address, and telephone number of the company or organization performing the flood hazard determination. An individual's name may be included, but is not required.

Date of Determination. Enter date on which flood hazard determination was completed.

MULTIPLE BUILDINGS: If the loan collateral includes more than one building, a schedule for the additional buildings/mobile homes indicating the determination for each may be attached. Otherwise, a separate form must be completed for each building or mobile home. Any attachments should be noted in the comment section. A separate flood insurance policy is required for each building or mobile home.

GUARANTEES REGARDING INFORMATION: Determinations on this form made by persons other than the lender are acceptable only to the extent that the accuracy of the information is guaranteed.

FORM AVAILABILITY: Copies of this form are available from the FEMA fax-on-demand line by calling (202) 646-FEMA and requesting form #23103. Guidance on using the form in a printed, computerized, or electronic format is contained in form #23110. This information is also available on FEMA's website http://www.fema.gov/plan/prevent/fhm/frm_form.shtm).

PURPOSE OF FORM: In accordance with P.L. 103-325, Sec. 1365, (b) (1), this form has been designated to facilitate compliance with the flood insurance purchase requirements of the National Flood Insurance Reform Act of 1994.