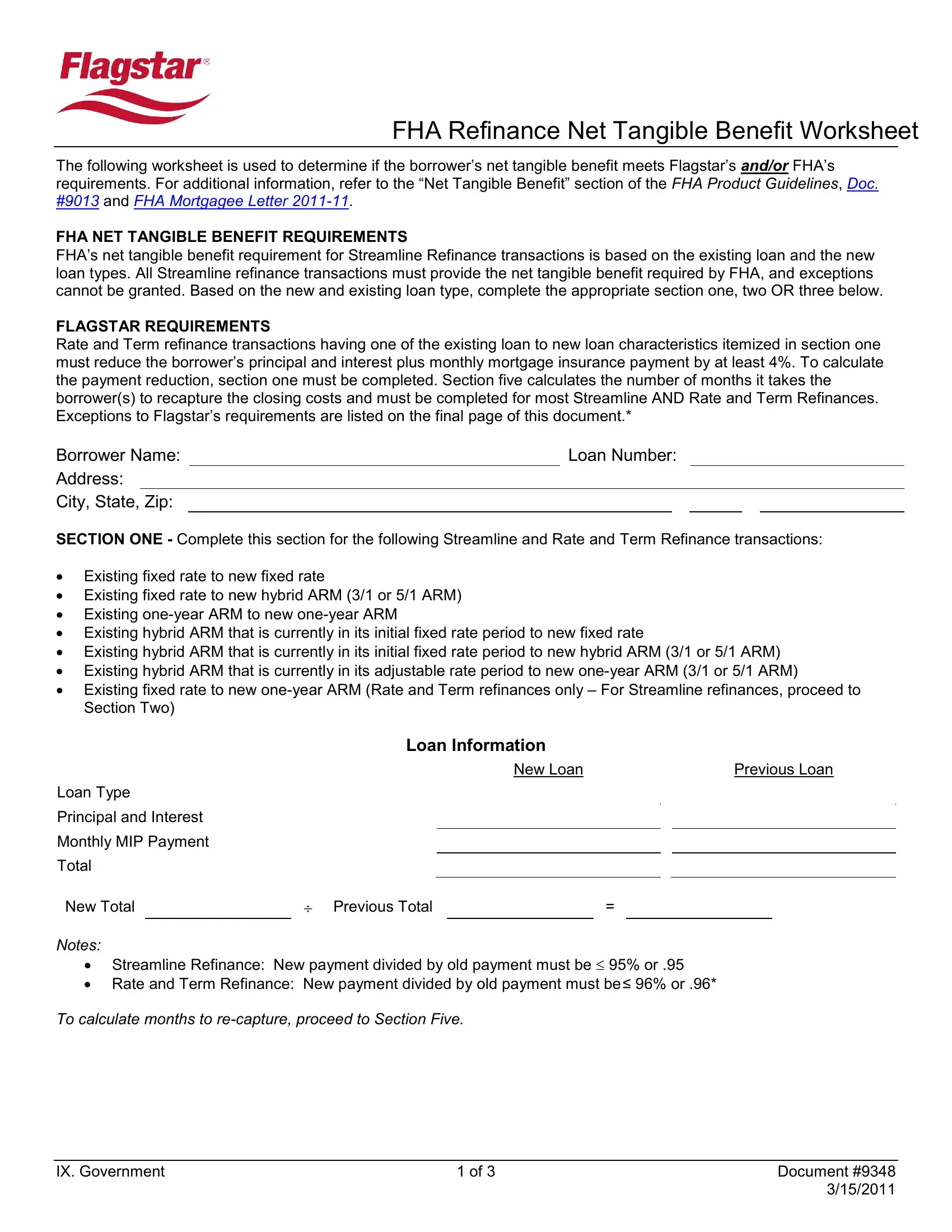

FHA Refinance Net Tangible Benefit Worksheet

The following worksheet is used to determine if the borrower’s net tangible benefit meets Flagstar’s AND/OR FHA’s requirements. For additional information, refer to the “Net Tangible Benefit” section of the FHA Product Guidelines, Doc. #9013 and FHA Mortgagee Letter 2011-11.

FHA NET TANGIBLE BENEFIT REQUIREMENTS

FHA’s net tangible benefit requirement for Streamline Refinance transactions is based on the existing loan and the new loan types. All Streamline refinance transactions must provide the net tangible benefit required by FHA, and exceptions cannot be granted. Based on the new and existing loan type, complete the appropriate section one, two OR three below.

FLAGSTAR REQUIREMENTS

Rate and Term refinance transactions having one of the existing loan to new loan characteristics itemized in section one must reduce the borrower’s principal and interest plus monthly mortgage insurance payment by at least 4%. To calculate the payment reduction, section one must be completed. Section five calculates the number of months it takes the borrower(s) to recapture the closing costs and must be completed for most Streamline AND Rate and Term Refinances. Exceptions to Flagstar’s requirements are listed on the final page of this document.*

|

|

|

|

|

|

|

|

|

|

Borrower Name: |

|

Loan Number: |

|

|

|

Address: |

|

|

|

|

|

|

|

|

City, State, Zip: |

|

|

|

|

|

|

|

|

SECTION ONE - Complete this section for the following Streamline and Rate and Term Refinance transactions:

•Existing fixed rate to new fixed rate

•Existing fixed rate to new hybrid ARM (3/1 or 5/1 ARM)

•Existing one-year ARM to new one-year ARM

•Existing hybrid ARM that is currently in its initial fixed rate period to new fixed rate

•Existing hybrid ARM that is currently in its initial fixed rate period to new hybrid ARM (3/1 or 5/1 ARM)

•Existing hybrid ARM that is currently in its adjustable rate period to new one-year ARM (3/1 or 5/1 ARM)

•Existing fixed rate to new one-year ARM (Rate and Term refinances only – For Streamline refinances, proceed to Section Two)

LOAN INFORMATION

Loan Type

Principal and Interest

Monthly MIP Payment

Total

New Total |

|

÷ Previous Total |

= |

|

|

|

|

|

Notes:

•Streamline Refinance: New payment divided by old payment must be ≤ 95% or .95

•Rate and Term Refinance: New payment divided by old payment must be≤ 96% or .96*

To calculate months to re-capture, proceed to Section Five.

IX. Government |

1 of 3 |

Document #9348 |

|

|

3/15/2011 |

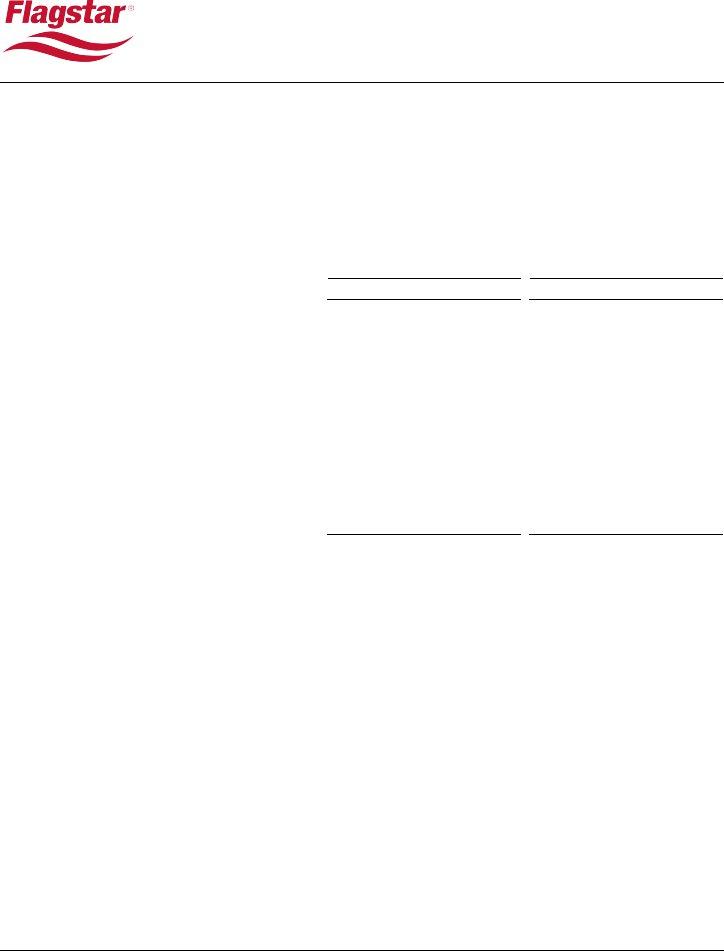

FHA Refinance Net Tangible Benefit Worksheet

SECTION TWO - Complete this section for the following Streamline Refinance transactions only (not required for rate and term refinance transactions):

•Existing fixed rate to new one-year ARM**

•Existing one-year ARM to new hybrid ARM (3/1 or 5/1 ARM)

•Existing hybrid ARM currently in its initial fixed rate period to new one-year ARM

•Existing hybrid ARM currently in its adjustable rate period to new hybrid ARM (3/1 or 5/1 ARM)

LOAN INFORMATION

Loan Type

Interest Rate

New interest rate must be at least 2% lower than the current rate in effect.

**To calculate months to re-capture, proceed to Section Five.

SECTION THREE - Complete this section for the following Streamline Refinance transactions only (not required for rate and term refinance transactions):

•Existing one-year ARM to new fixed rate

LOAN INFORMATION

Loan Type

Interest Rate

New interest rate may NOT exceed the current rate in effect by more than 2%

Section Five is not required.

SECTION FOUR - Complete this section for the following Streamline Refinance transaction only (not required for rate and term refinance transactions):

• Existing hybrid ARM currently in its adjustable period to new fixed rate

LOAN INFORMATION

|

|

|

|

New Loan |

|

|

|

Previous Loan |

Loan Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal and Interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly MIP Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Total |

|

÷ Previous Total |

|

= |

|

|

|

|

Notes:

•New payment divided by old payment must be ≤ 120% or 1.20; AND

•New interest rate may not exceed the current rate in effect by more than 2%

IX. Government |

2 of 3 |

Document #9348 |

|

|

3/15/2011 |

FHA Refinance Net Tangible Benefit Worksheet

Re-capture Calculation*

Total Closing Costs:

•Borrower items paid outside of closing

•All borrower paid costs in sections 800, 1100 and 1200 of the HUD-I Settlement Statement and/or the sum of the amounts in sections 1-4, 6, 7 and 8 on the Good Faith Estimate

÷ |

|

Monthly decrease in total mortgage payment (Current principal and interest plus monthly |

|

|

mortgage insurance minus new principal and interest plus monthly mortgage insurance |

|

|

|

|

from Section One) |

= |

|

Number of months to recapture closing costs (Divide total closing costs by monthly |

|

|

|

|

|

|

decrease in total mortgage payment) MUST BE ≤ 48 months |

*Not required if the new transaction:

Reduces the amortization of the existing mortgage (Streamline refis must meet the applicable FHA requirement in section one, two, or three but are not subject to the 48 months to re-capture. Rate and term refis are not subject to the payment reduction or 48 months to re-capture.)

Converts existing one-year ARM or hybrid ARM financing to a fixed rate loan (Streamline refis must meet the applicable FHA requirement in section one, two or three but are not subject to the 48 months closing cost recapture. Rate and Term refis are not subject to the payment reduction or 48 months to re-capture)

Converts interest only financing to fully amortized financing (Rate and Term refis only)

Rate and Term refinance is the result of a court-ordered divorce buyout – court documents, such as divorce decree required

Converts balloon loan to a fixed rate loan (Rate and Term refis only)

Consolidates a first mortgage with a purchase money second or seasoned second (Rate and Term refis only – Loan will be evaluated on a case-by-case basis. If payment is increasing but the note on the second is not due in the near future, exception will not be granted)

Flagstar Bank will not purchase or fund a loan that violates the U.S. Department of Housing and Urban Development Mortgagee Letter 2009-32, Section I, item C. If any loan purchased or funded by Flagstar Bank is subsequently determined to violate this FHA requirement, Flagstar Bank will require the loan to be repurchased. The information contained in this form is for informational purposes only and is not intended to constitute legal advice.

IX. Government |

3 of 3 |

Document #9348 |

|

|

3/15/2011 |