County of Sacramento

Department of Finance Tax Collection and Business License Unit

700 H Street, Room 1710, Sacramento, CA 95814

Phone (916) 874-6644 fax (916) 874-8909 www.finance.saccounty.net

$44.00 For first business name and owner on statement $ 8.00 For each additional business name on this statement $ 8.00 For each additional business owner on this statement

Make checks or money orders payable to Sacramento County

FICTITIOUS BUSINESS NAME STATEMENT

THIS IS NOT A BUSINESS LICENSE

TYPE OR PRINT CLEARLY – MUST BE LEGIBLE

INSTRUCTIONS ON REVERSE

|

WHEN FILING BY MAIL, PROVIDE SELF ADDRESSED STAMPED ENVELOPE. |

ALL INFORMATION IS PUBLIC RECORD |

|

|

|

|

|

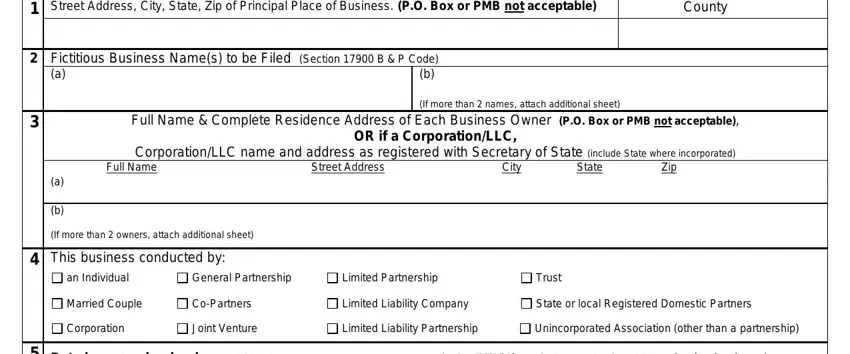

1 |

Street Address, City, State, Zip of Principal Place of Business. (P.O. Box or PMB not acceptable) |

|

County |

|

|

|

|

|

|

|

|

2 |

Fictitious Business Name(s) to be Filed |

(Section 17900 B & P Code) |

|

|

|

|

|

(a) |

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 names, attach additional sheet) |

|

3 |

Full Name & Complete Residence Address of Each Business Owner (P.O. Box or PMB not acceptable), |

|

|

|

OR if a Corporation/LLC, |

|

|

|

|

Corporation/LLC name and address as registered with Secretary of State (include State where incorporated) |

|

Full Name |

|

Street Address |

City |

State |

Zip |

|

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) |

|

|

|

|

|

|

|

|

(If more than 2 owners, attach additional sheet) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

This business conducted by: |

|

|

|

|

|

|

|

an Individual |

General Partnership |

Limited Partnership |

|

Trust |

|

|

Married Couple |

Co-Partners |

Limited Liability Company |

State or local Registered Domestic Partners |

|

Corporation |

Joint Venture |

Limited Liability Partnership |

Unincorporated Association (other than a partnership) |

|

|

|

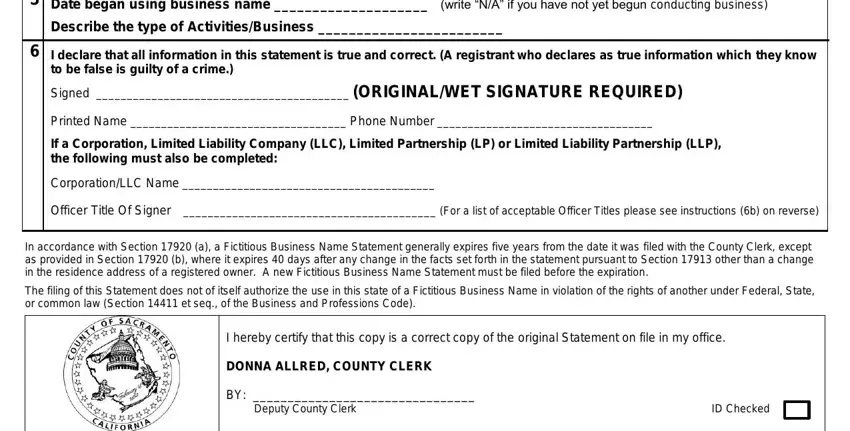

5 |

Date began using business name ____________________ |

(write “N/A” if you have not yet begun conducting business) |

|

Describe the type of Activities/Business ________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

6I declare that all information in this statement is true and correct. (A registrant who declares as true information which they know to be false is guilty of a crime.)

Signed _________________________________________ (ORIGINAL/WET SIGNATURE REQUIRED) Printed Name ___________________________________ Phone Number ___________________________________

If a Corporation, Limited Liability Company (LLC), Limited Partnership (LP) or Limited Liability Partnership (LLP), the following must also be completed:

Corporation/LLC Name _________________________________________

Officer Title Of Signer _________________________________________ (For a list of acceptable Officer Titles please see instructions (6b) on reverse)

In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, except as provided in Section 17920 (b), where it expires 40 days after any change in the facts set forth in the statement pursuant to Section 17913 other than a change in the residence address of a registered owner. A new Fictitious Business Name Statement must be filed before the expiration.

The filing of this Statement does not of itself authorize the use in this state of a Fictitious Business Name in violation of the rights of another under Federal, State, or common law (Section 14411 et seq., of the Business and Professions Code).

I hereby certify that this copy is a correct copy of the original Statement on file in my office.

DONNA ALLRED, COUNTY CLERK

BY: ________________________________

Deputy County Clerk |

ID Checked |

FBN Statement (11-2019)

NOTICE TO REGISTRANT PURSUANT TO SECTION 17924 BUSINESS & PROFESSIONS CODE (B & P Code)

Within 30 days after the fictitious business name statement has been filed with the County Clerk, the statement must be published in a newspaper of general circulation in the county where the fictitious business name was filed. The statement must be published once a week for four successive weeks with at least five days between each date of publication. An affidavit of publication must be filed with the county clerk within 30 days after the completion of the publication. If the registrant has no place of business in this state, the notice shall be published in a newspaper of general circulation in Sacramento County. (Section 17917 B & P Code, Section 6064 Government Code).

If refiling is required because the prior statement has expired, the refiling need not be published unless there has been a change in the information in the expired statement, provided the refiling is filed within 40 days of the date the statement expired. (Section 17917 B & P Code). Any person who executes, files, or publishes any fictitious business name statement, knowing that such statement is false, in whole or in part, is guilty of a misdemeanor and upon conviction thereof shall be fined not to exceed one thousand dollars ($1,000.00). (Section 17930 B & P Code).

According to Section 17900 B & P Code, “Fictitious Business Name” Means:

“(1) In the case of an individual, a name that does not include the surname of the individual”

INSTRUCTIONS FOR COMPLETION OF STATEMENT (Sec. 17913, 17914, 17915 B & P Code)

Type or print legibly. (P.O. Box, postal drop box, mailing suite and c/o addresses are not acceptable for either the business or residence address.)

1.Insert the street address and county of the principal place of business in California. The fictitious business name statement shall be filed with the clerk of the county in which the registrant has his principal place of business or if the registrant has no place of business in California, the Fictitious Business Name Statement shall be filed with the Clerk of Sacramento County.

2.Insert the fictitious business name or names if more than one name. Only those businesses operated at the same address may be listed on one statement.

3.Individual: insert full name and residence address of the individual.

Married Couple: insert full name and residence address of both spouses.

Partnership, co-partnership, joint venture, limited partnership, limited liability partnership, or other association of persons: insert the full name and residence address of each general partner.

Trust: insert the full name and residence address of each trustee.

Corporation: insert the name and address of the corporation as set out in its articles of incorporation, and the state of incorporation.

Limited Liability Company (LLC): insert the name and address of the LLC as set out in its articles of organization, and the state of organization.

State or local Registered Domestic Partnership: insert full name and residence address of each domestic partner.

4.Indicate which of the terms best describes the ownership of the business.

5.Insert the date on which the registrant first began using business name(s) or expected date to begin. If the registrant has not yet begun transacting business and the expected date is unknown, insert “N/A”.

Describe the type activities/business that is occurring at address in section 1

6a. If the registrant is an individual, the statement must be signed by the individual; if a partnership or other association of other persons, by a general partner; if a trust, by a trustee; if a corporation, by an officer (title must be indicated); if a limited liability company, by an officer or a manager (title must be indicated). (Signature of an agent is not acceptable)

6b. If the registrant is a Corporation, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO.

If the registrant is an LLC, acceptable officer titles include President, Vice President, Secretary, Treasurer, CEO, CFO, COO, Member, Managing Member, and Manager

IF YOU ARE FILING YOUR STATEMENT BY MAIL, PLEASE INCLUDE A SELF-ADDRESSED, STAMPED ENVELOPE FOR RETURN OF YOUR ENDORSED COPIES. IF FILING IN-PERSON OR BY AN AGENT, THE REGISTRANT OR AGENT MUST PRESENT PERSONAL IDENTIFICATION. ACCEPTED FORMS OF IDENTIFICATION ARE VALID CALIFORNIA DRIVERS LICENSE, CALIFORNIA ID, A PASSPORT, OR OTHER FORM DEEMED ACCEPTABLE TO THE COUNTY CLERK.

TRADE NAME REGISTRATION (Sec. 14411, 14412, 14415, 14416 B&P Code)

The filing of articles of incorporation with the state and/or a fictitious business name statement in the county establishes a rebuttable presumption within that county that the registrant or corporation has the exclusive right to use that business name, as well as any confusingly similar name, if the registrant or corporation is the first to register such name and is actively engaged in a business utilizing the name. The rebuttable presumption shall be applicable until the statement is abandoned or otherwise expires and no new statement has been filed by the registrant.

EXPIRATION OF FICTITIOUS BUSINESS NAME STATEMENT (Sec. 17920 B&P Code)

(a)In accordance with Section 17920 (a), a Fictitious Business Name Statement generally expires five years from the date it was filed with the County Clerk, unless the statement expires earlier under (b) or (c) below. A NEW FICTITIOUS BUSINESS NAME STATEMENT MUST BE FILED BEFORE THE EXPIRATION.

(b)A fictitious business name statement expires 40 days after any change in the facts as set forth in the statement, except (1) a change in the residence address of an individual, general partner, or trustee does not cause the statement to expire, and (2) the filing of a statement of withdrawal from partnership by a withdrawing partner does not cause the statement to expire. A NEW STATEMENT MUST BE FILED WITHIN 40 DAYS AFTER A CHANGE IN THE INFORMATION REQUIRED ON THIS STATEMENT.

(c)A fictitious business name statement expires when the registrant files a statement of abandonment of use of the fictitious business name statement.

ONCE FILED, ALL INFORMATION ON THE FICTITIOUS BUSINESS NAME STATEMENT IS PUBLIC RECORD

For additional information on fictitious business names, refer to our Website at www.finance.saccounty.net