Submitting files along with our PDF editor is simpler compared to most things. To update uia 6347 form pdf the form, there isn't anything you have to do - just follow the steps down below:

Step 1: Press the orange "Get Form Now" button on the website page.

Step 2: You can find all the options that you may use on the template once you've got accessed the uia 6347 form pdf editing page.

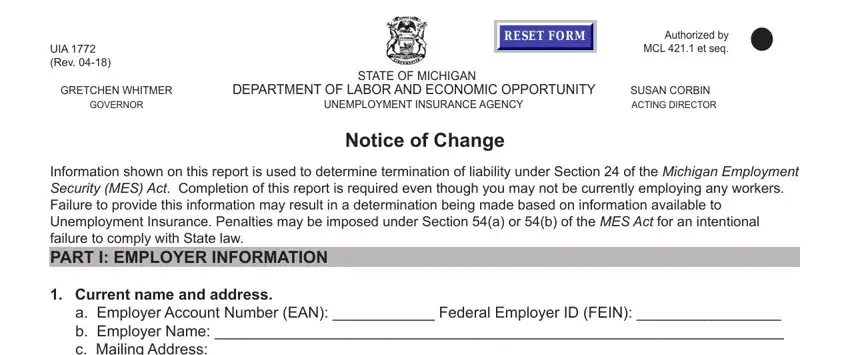

Type in the data demanded by the software to get the document.

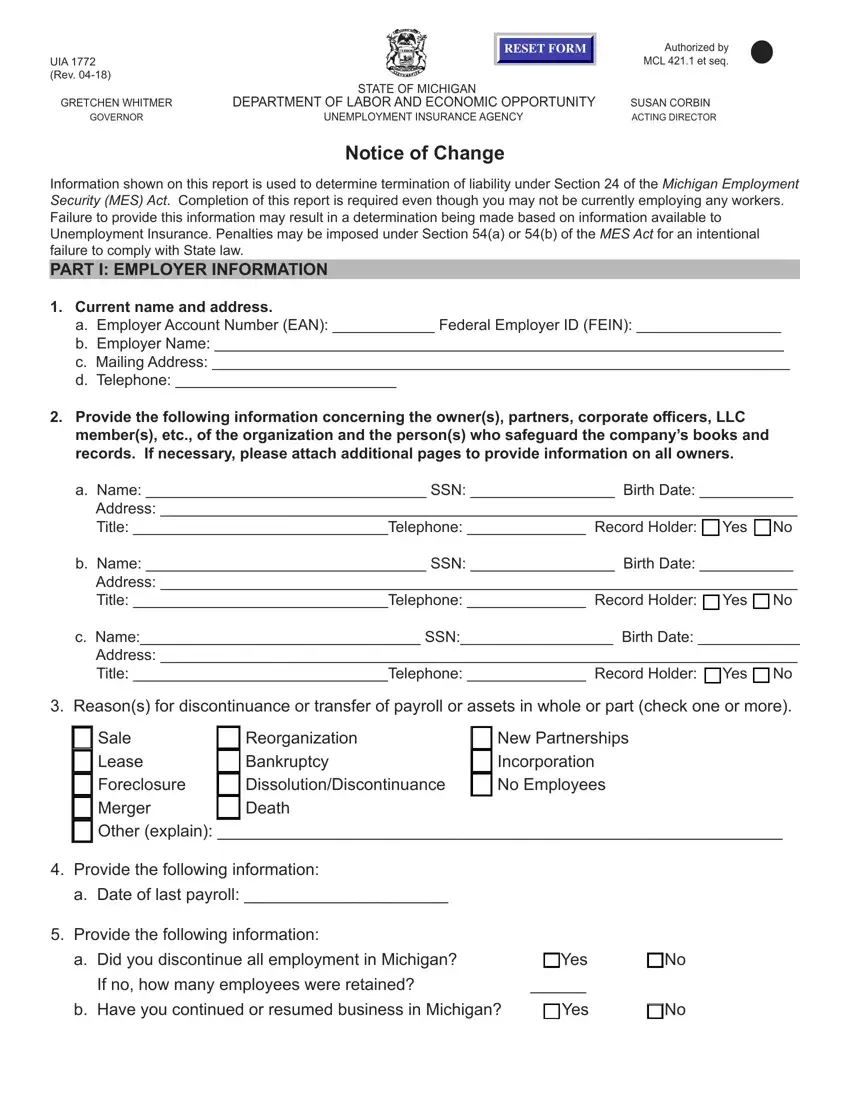

Type in the appropriate data in the a Employer Account Number EAN, Provide the following information, members etc of the organization, a Name SSN Birth Date Address, b Name SSN Birth Date Address, c Name SSN Birth Date Address, Reasons for discontinuance or, Sale Lease Foreclosure Merger, Reorganization Bankruptcy, and New Partnerships Incorporation No section.

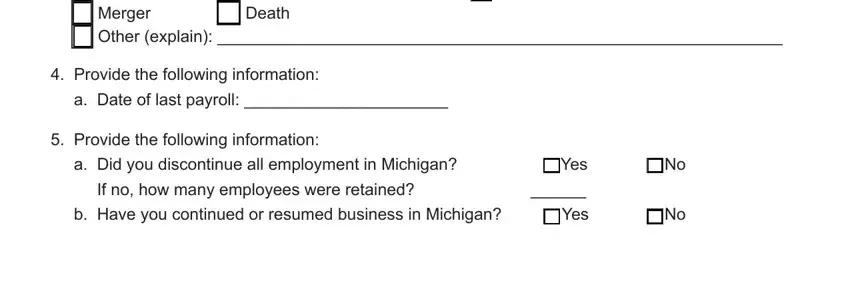

Note down the demanded data once you are within the Sale Lease Foreclosure Merger, Reorganization Bankruptcy, New Partnerships Incorporation No, Provide the following information, a Date of last payroll, Provide the following information, a Did you discontinue all, Yes, If no how many employees were, and b Have you continued or resumed box.

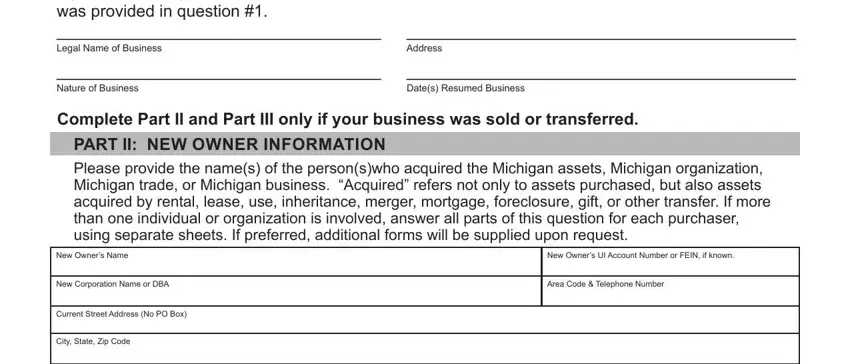

Describe the rights and responsibilities of the parties inside the box If you answered yes to question b, Address, Nature of Business, Dates Resumed Business, Complete Part II and Part III only, PART II NEW OWNER INFORMATION, New Owners Name, New Corporation Name or DBA, Current Street Address No PO Box, City State Zip Code, New Owners UI Account Number or, and Area Code Telephone Number.

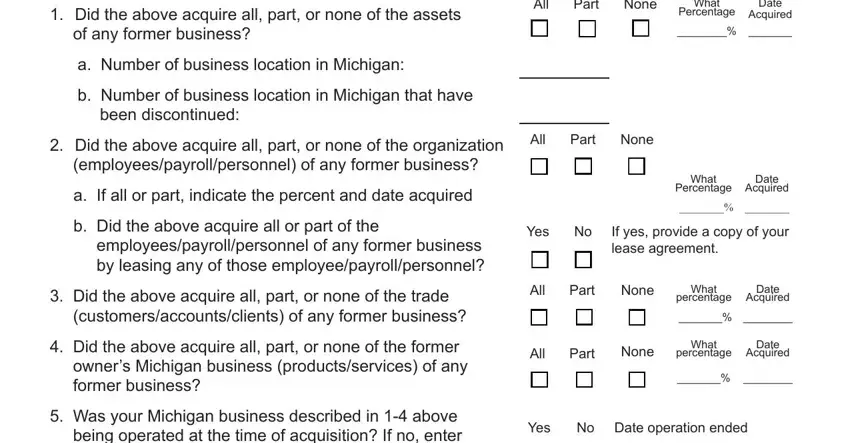

Fill in the form by taking a look at all of these fields: Did the above acquire all part or, of any former business, a Number of business location in, b Number of business location in, been discontinued, All, Part, None, What Percentage, Date Acquired, Did the above acquire all part or, All, Part, None, and If all or part indicate the.

Step 3: When you are done, select the "Done" button to upload the PDF form.

Step 4: You should create as many duplicates of the form as possible to avoid future issues.

Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No