Our PDF editor was built with the goal of allowing it to be as simple and easy-to-use as it can be. All of these steps are going to make creating the sfl tap financial worksheet quick and simple.

Step 1: Find the button "Get Form Here" on the following website and hit it.

Step 2: You can now manage the sfl tap financial worksheet. This multifunctional toolbar will let you insert, delete, transform, and highlight content material as well as undertake similar commands.

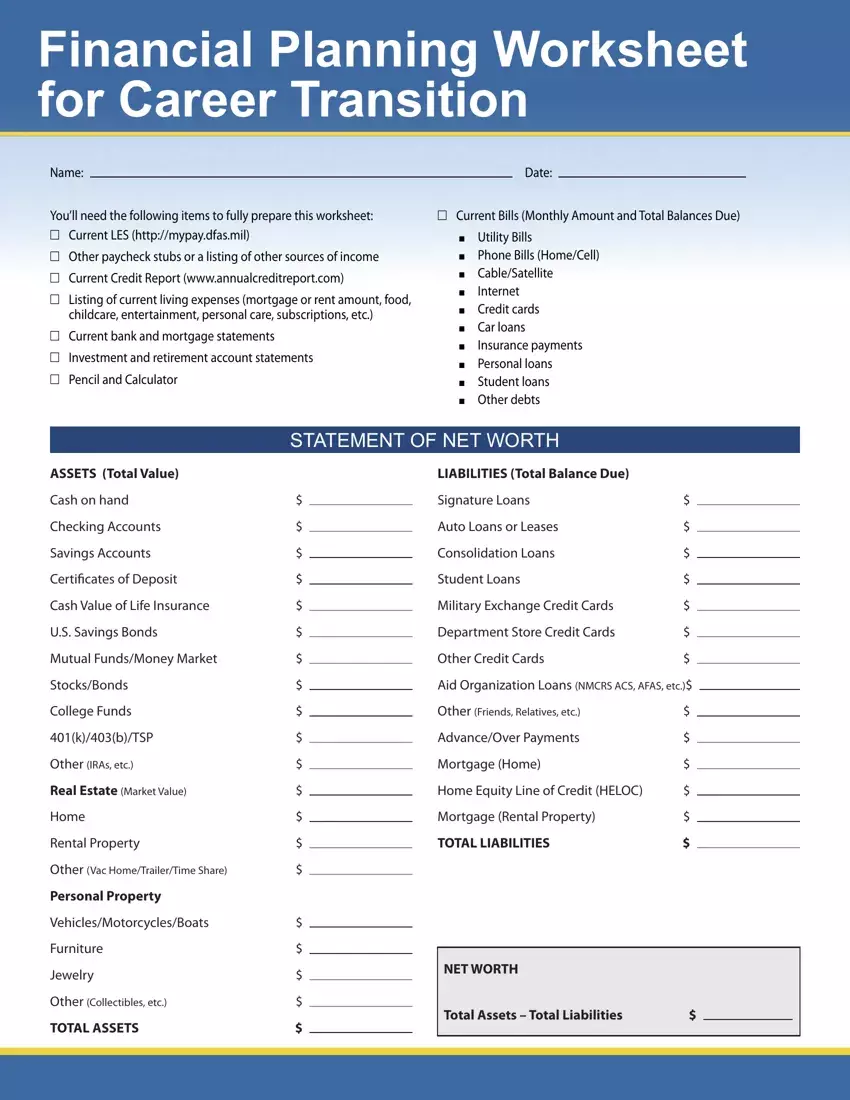

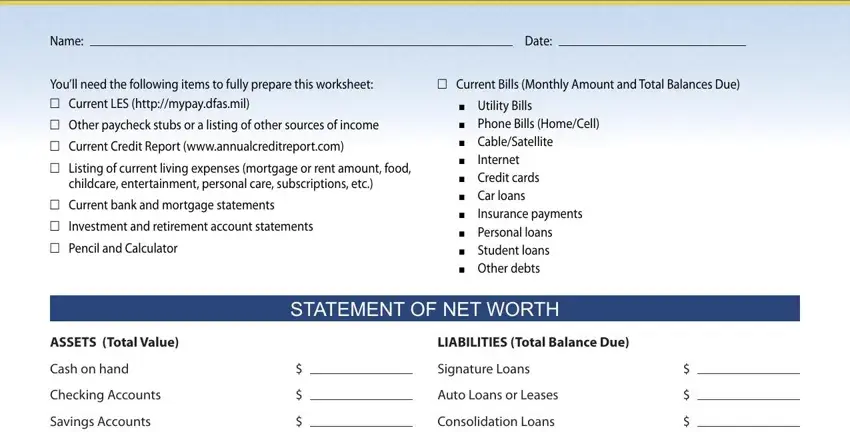

Type in the information required by the platform to create the form.

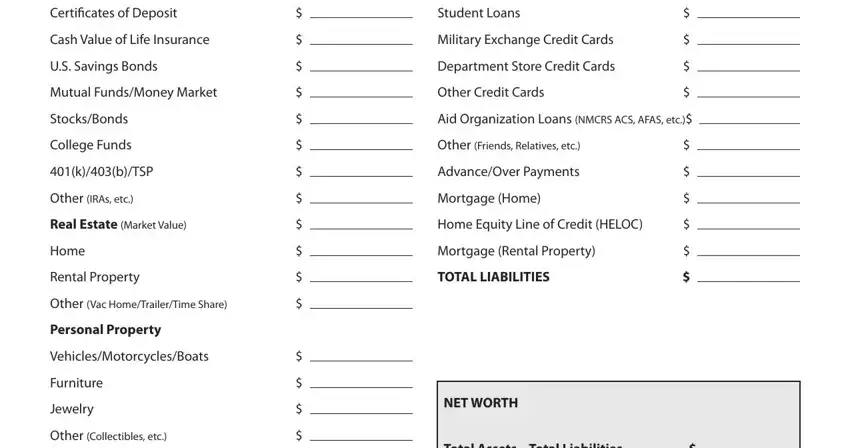

Write down the data in Certificates of Deposit, Cash Value of Life Insurance, US Savings Bonds, Mutual FundsMoney Market, StocksBonds, College Funds, kbTSP, Other IRAs etc, Real Estate Market Value, Home, Rental Property, Other Vac HomeTrailerTime Share, Personal Property, VehiclesMotorcyclesBoats, and Furniture.

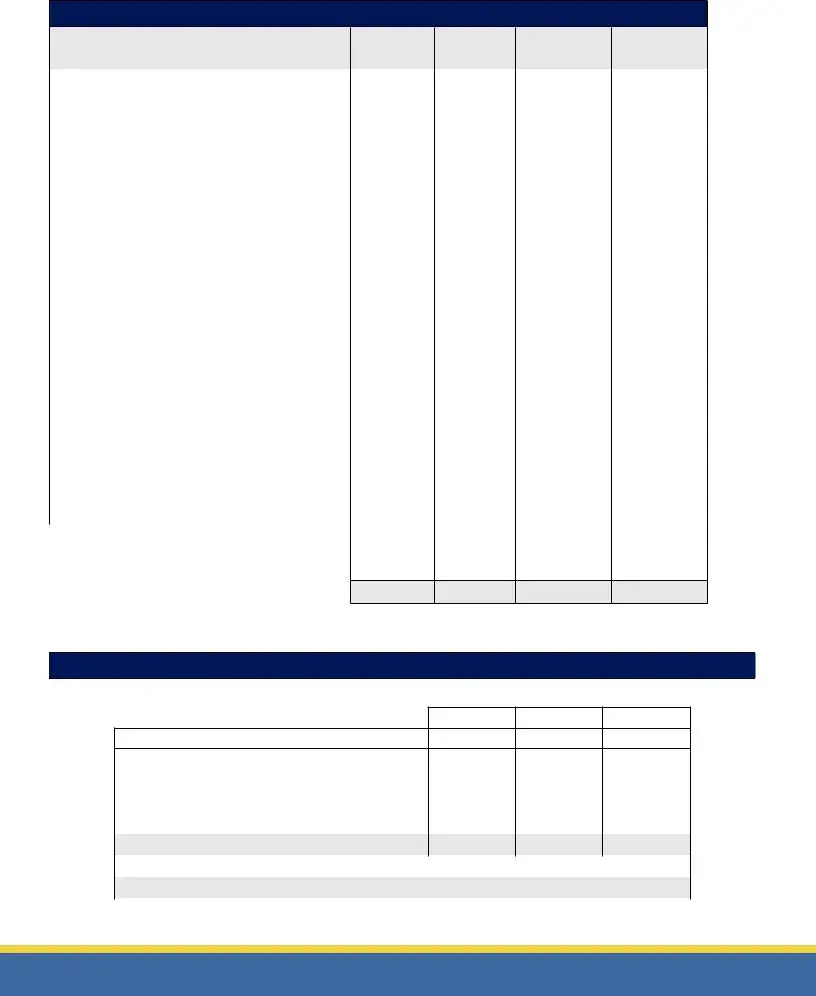

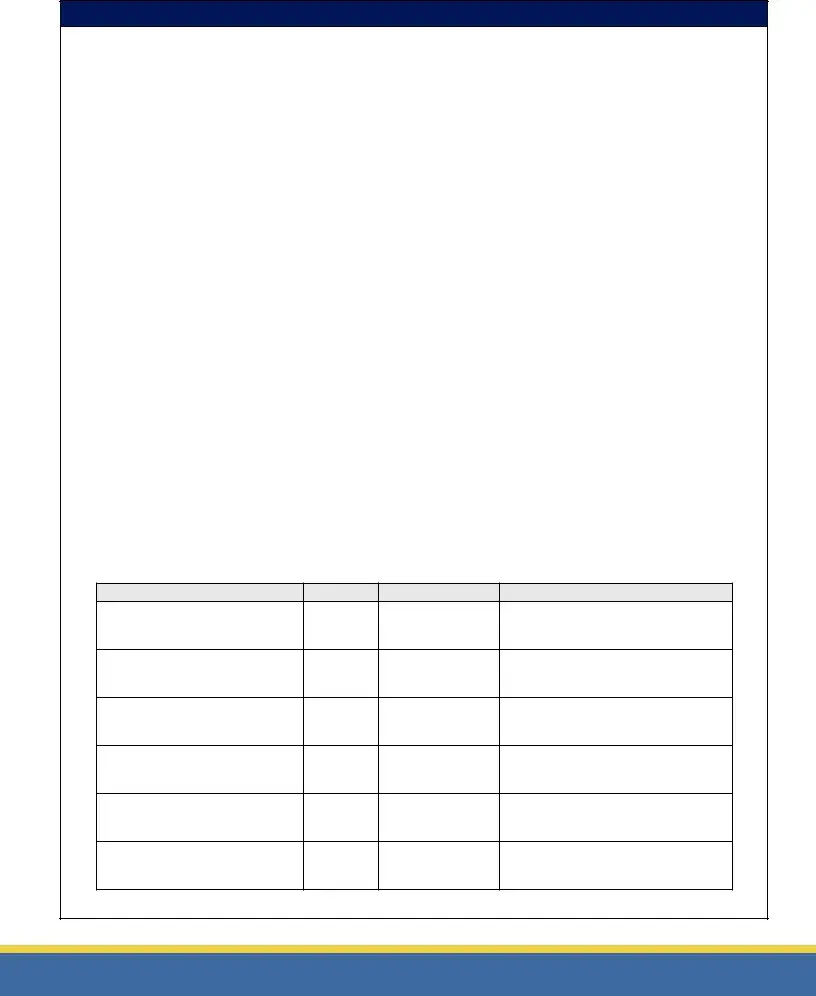

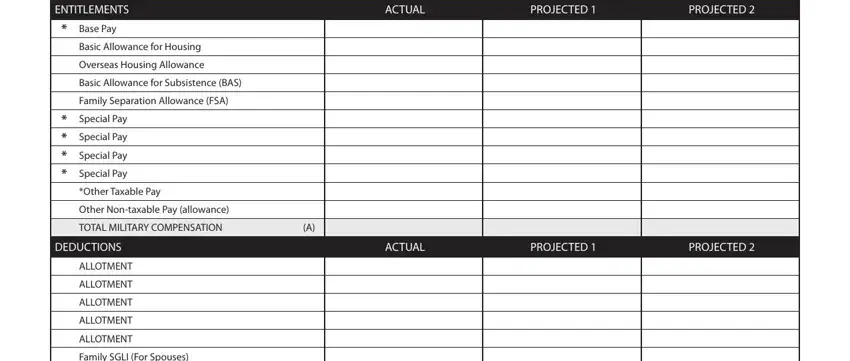

In the ACTUAL, PROJECTED, PROJECTED, ACTUAL, PROJECTED, PROJECTED, ENTITLEMENTS, Base Pay, Basic Allowance for Housing, Overseas Housing Allowance, Basic Allowance for Subsistence BAS, Family Separation Allowance FSA, Special Pay, Special Pay, and Special Pay area, identify the significant particulars.

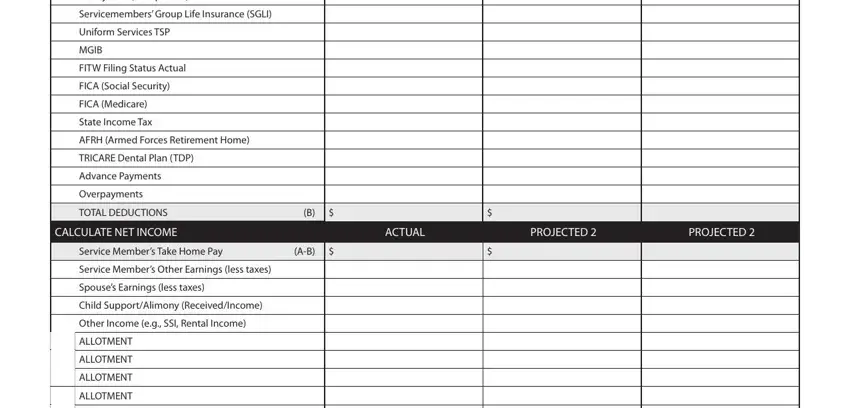

You will need to spell out the rights and responsibilities of both sides in section Family SGLI For Spouses, Servicemembers Group Life, Uniform Services TSP, MGIB, FITW Filing Status Actual, FICA Social Security, FICA Medicare, State Income Tax, AFRH Armed Forces Retirement Home, TRICARE Dental Plan TDP, Advance Payments, Overpayments, TOTAL DEDUCTIONS, CALCULATE NET INCOME, and ACTUAL.

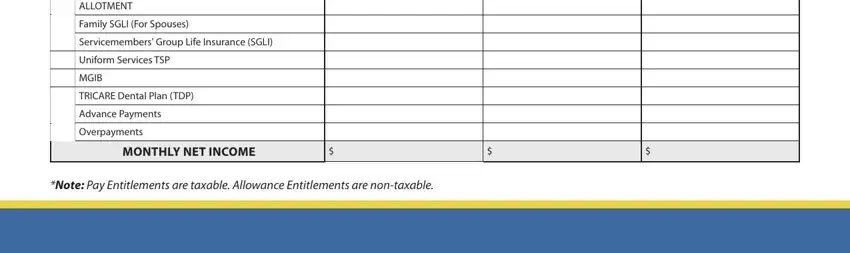

Check the areas ALLOTMENT, Family SGLI For Spouses, Servicemembers Group Life, Uniform Services TSP, MGIB, TRICARE Dental Plan TDP, Advance Payments, Overpayments, MONTHLY NET INCOME, and Note Pay Entitlements are taxable and next fill them in.

Step 3: As soon as you are done, choose the "Done" button to export your PDF form.

Step 4: Produce a minimum of several copies of the file to keep clear of all of the future challenges.