Suspicious Transactions

This Currency Transaction Report (CTR) should NOT be filed for suspicious transactions involving $10,000 or less in currency OR to note that a transaction of more than $10,000 is suspicious. Any suspicious or unusual activity should be reported by a financial institution in the manner prescribed by its appropriate federal regulator or BSA examiner. (See the instructions for Item 37). If a transaction is suspicious and in excess of $10,000 in currency, then both a CTR and the appropriate Suspicious Activity Report form must be filed.

In situations involving suspicious transactions requiring immediate attention, such as when a reportable transaction is ongoing, the fianacial institution shall immediately notify, by telephone, appropriate law enforcement and regulatory authorities in addition to filing a timely suspicious activity report.

General Instructions

Who Must File. Each financial institution (other than a casino, which instead must file FinCEN Form 103, and the U.S. Postal Service for which there are separate rules) must file FinCEN Form 104 (CTR) for each deposit, withdrawal, exchange of currency, or other payment or transfer, by, through, or to the financial institution which involves a transaction in currency of more than $10,000. Multiple transactions must be treated as a single transaction if the financial institution has knowledge that (1) they are by or on behalf of the same person, and (2) they result in either currency received (Cash In) or currency disbursed (Cash Out) by the financial institution totaling more than $10,000 during any one business day. For a bank, a business day is the day on which transactions are routinely posted to customers’ accounts, as normally communicated to depository customers. For all other financial institutions, a business day is a calendar day.

Generally, financial institutions are defined as banks, other types of depository institutions, brokers or dealers in securities, money transmitters, currency exchangers, check cashers, and issuers and sellers of money orders and traveler’s checks. Should you have questions, see the definitions in 31 CFR Chapter X.

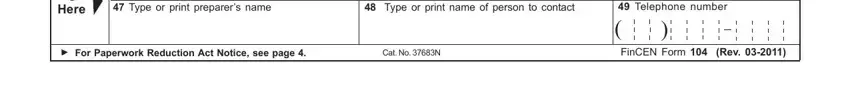

When and Where To File. This form should be e-filed through the Bank Secrecy Act E-filing System. Go to http: //bsaefiling.fincen.treas.gov/index.jsp to register. This form is also available for download on the Financial Crimes Enforcement Network’s Web site at www.fincen.gov, or may be ordered by calling the IRS Forms Distribution Center at (800) 829-3676. File this CTR by the 15th calendar day after the day of the transaction with the:

Enterprise Computing Center - Detroit

ATTN: CTR

P.O. Box 33604

Detroit, MI 48232-5604

Keep a copy of each CTR for five years from the date filed.

A financial institution may apply to file the CTRs electronically. To obtain an application to file electronically, contact the Bank Secrecy Act E-filing System. Go to http: //bsaefiling.fincen.treas.govindex.jsp to register or contact the BSA E-Filing Help Desk at 1- 888-827-2778 (select option # 6) or via email at

BSAEFilingHelp@notes.tcs.treas.gov.

Identification Requirements. All individuals (except a employees of armored car services) conducting a reportable transaction(s) for themselves or for another person, must be identified by means of an official

document(s). Acceptable forms of identification include driver’s license, military and military/dependent identification cards, passport, state issued identification card, cedular card (foreign), non-resident alien identification cards, or any other identification document

or documents, which contain name and preferably address and a photograph and are normally acceptable by financial institutions as a means of identification when cashing checks for persons other than established customers.

Acceptable identification information obtained previously and maintained in the financial institution’s records may be used. For example, if documents verifying an individual’s identity were examined and recorded on a signature card when an account was opened, the financial institution may rely on that information. In completing the CTR, the financial institution must indicate on the form the method, type, and number of the identification. Statements such as “known customer” or “signature card on file” are not sufficient for form completion.

Penalties. Civil and criminal penalties are provided for failure to file a CTR or to supply information or for filing a false or fraudulent CTR. See 31 U.S.C. 5321, 5322 and 5324.

For purposes of this CTR, the terms below have the following meanings:

Currency. The coin and paper money of the United States or any other country, which is circulated and customarily used and accepted as money.

Person. An individual, corporation, partnership, trust or estate, joint stock company, association, syndicate, joint venture or other unincorporated organization or group.

Organization. Entity other than an individual.

Transaction in Currency. The physical transfer of currency from one person to another. This does not include a transfer of funds by means of bank check, bank draft, wire transfer or other written order that does not involve the physical transfer of currency.

Negotiable Instruments. All checks and drafts (including business, personal, bank, cashier’s and third-party), money orders, and promissory notes. For purposes of this CTR, all traveler’s checks shall also be considered negotiable instruments whether or not they are in bearer form.

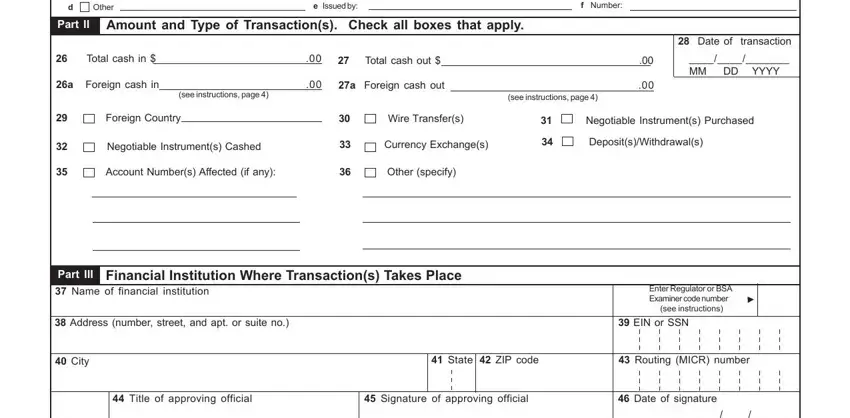

Foreign exchange rate. If foreign currency is a part of a currency transaction that requires the completion of a CTR, use the exchange rate in effect for the business day of the transaction to compute the amount, in US dollars, to enter in item 26/27. The source of the exchange rate that is used will be determined by the reporting institution.

Specific Instructions

Because of the limited space on the front and back of the CTR, it may be necessary to submit additional information on attached sheets. Submit this additional information on plain paper attached to the CTR. Be sure to put the individual’s or entity’s name and identifying number (items 2, 3, 4, and 6 of the CTR) on any additional sheets so that if it becomes separated, it may be associated with the CTR.

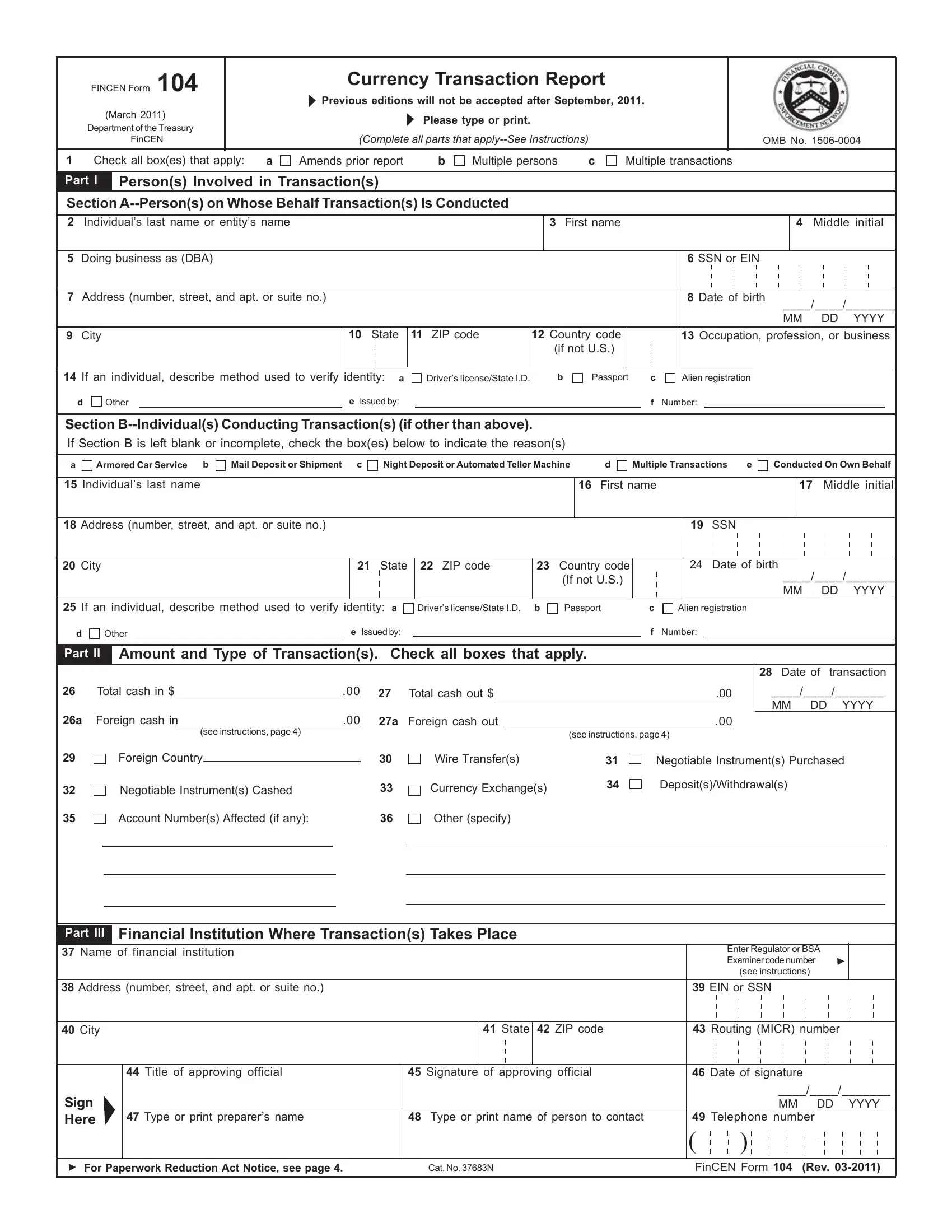

Item 1a. Amends Prior Report. If this CTR is being filed because it amends a report filed previously, check Item 1a. Staple a copy of the original CTR to the amended one, complete Part III fully and only those other entries which are being amended.

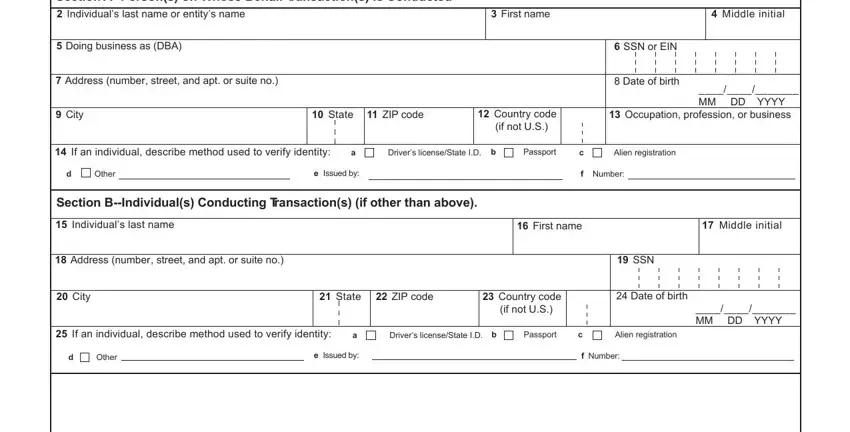

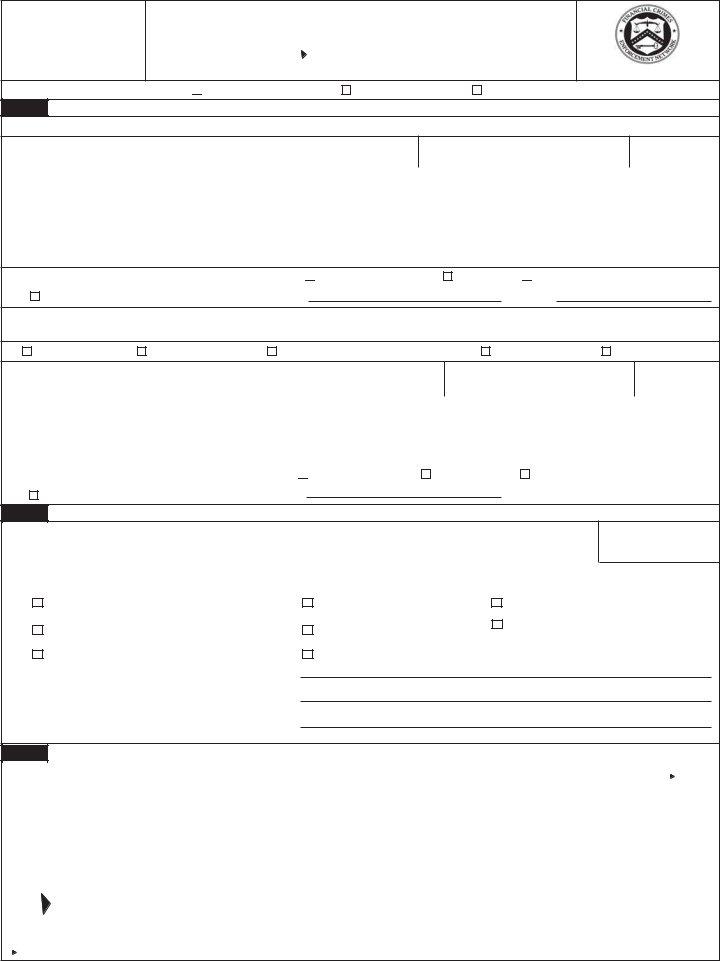

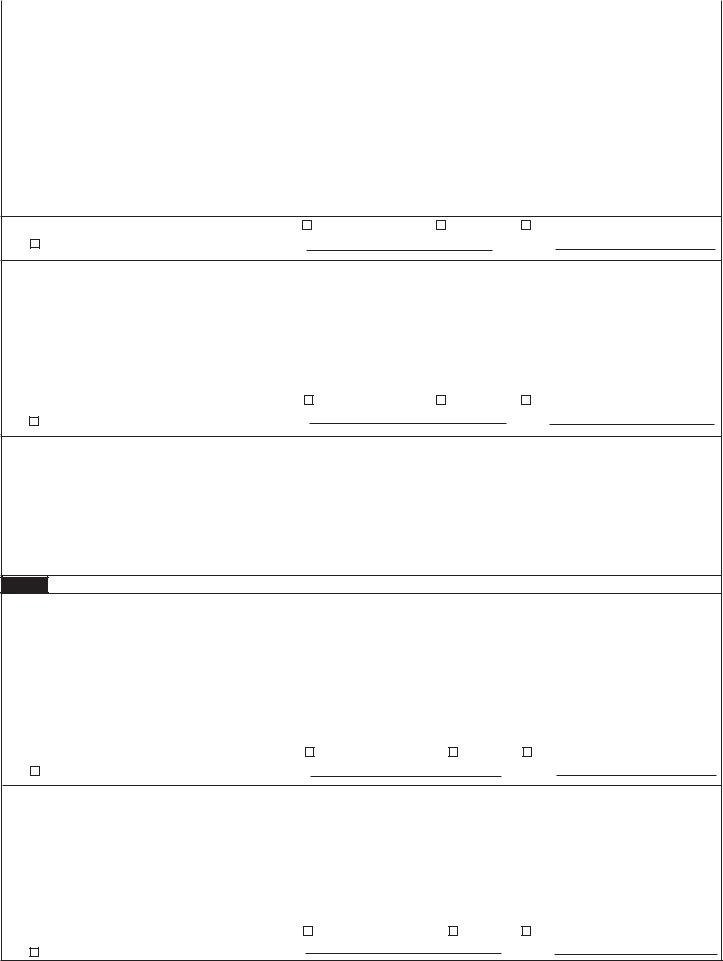

Item 1b. Multiple Persons. If this transaction is being conducted by more than one person or on behalf of more than one person, check Item 1b. Enter information in Part I for one of the persons and provide information on any other persons on the back of the CTR.

Item 1c. Multiple Transactions. If the financial institution has knowledge that there are multiple transactions, check Item 1c.

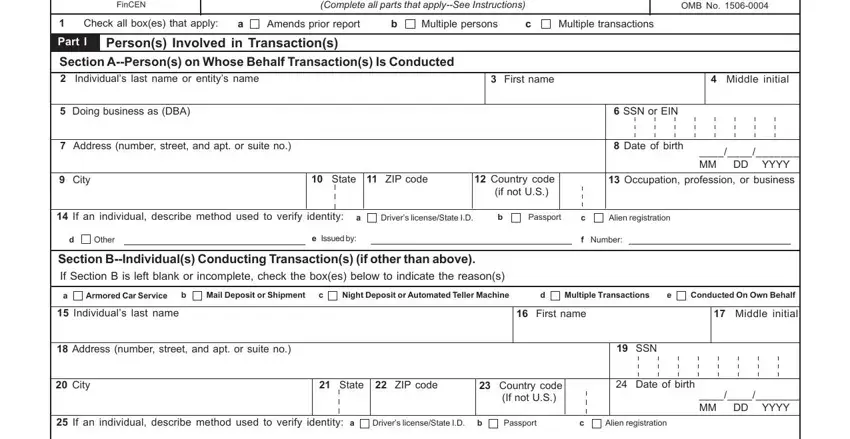

PART I - Person(s) Involved in Transaction(s)

Section A must be completed. If an individual conducts a transaction on his own behalf, complete Section A and leave Section “B” BLANK. If an individual conducts a transaction on his own behalf and on behalf of another person(s), complete Section “A” for each person and leave Section “B” BLANK. If an individual conducts a transaction on behalf of another person(s), complete Section “B” for the individual conducting the transaction, and complete Section “A” for each person on whose behalf the transaction is conducted of whom the financial institution has knowledge.

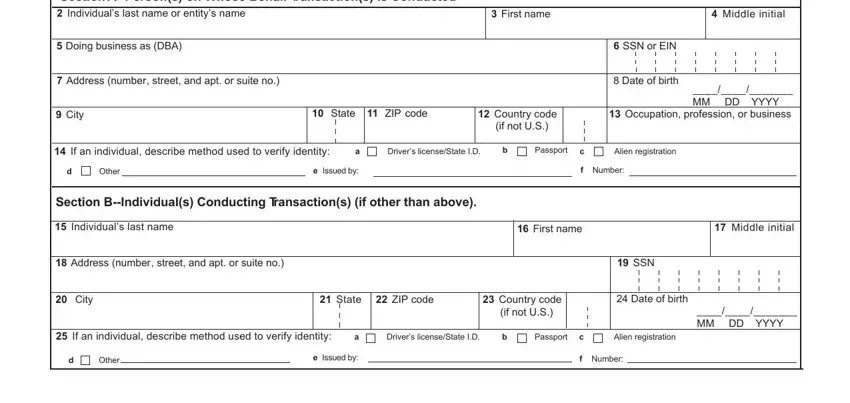

Section A. Person(s) on Whose Behalf Transaction(s) Is Conducted. See instructions above.

Items 2, 3, and 4. Individual/Organization Name. If

the person on whose behalf the transaction(s) is conducted is an individual, put his/her last name in Item 2, first name in Item 3, and middle initial in Item 4. If there is no middle initial, leave item 4 BLANK. If the transaction is conducted on behalf of an entity, enter the name in Item 2 and leave Items 3 and 4 BLANK.

Item 5. Doing Business As (DBA). If the financial institution has knowledge of a separate “doing business as” name, enter it in Item 5. For example, if Smith Enterprise is doing business as MJ’s Pizza, enter “MJ’s Pizza” in item 5.

Item 6. SSN or EIN. Enter the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) or Employer Identification Number (EIN) of the person or entity identified in Item 2. If none, leave blank.

Items 7, 9, 10, 11, and 12. Address. Enter the permanent address including ZIP Code of the person identified in Item

2.Use the U.S. Postal Service’s two letter state abbreviation code. A P. O. Box should not be used by itself, and may only be used if there is no street address. If a P. O. Box is used, the name of the apartment or suite number, road or route number where the person resides must also be provided. If the address is outside the U.S., provide the street address, city, province or state, postal code (if known), and the two letter country code. For country code list go to www.fincen.gov/reg_bsaforms.html or telephone 800-949- 2732 and select option number 5. If U.S., leave item 12 blank.

Item 8. Date of Birth. Enter the date of birth. Eight numerals must be inserted for each date. The first two will reflect the month, the second two the day, and the last four the year. Azero (0) should precede any single digit number. For example, if an individual’s birth date is April 3 1948, Item 8 should read 04 03 1948.

Item 13. Occupation, profession, or business. If known, identify the occupation, profession or business that best describes the individual or entity in Part I (E.G., attorney, car dealer, carpenter, doctor, farmer, plumber, truck driver, etc.). Do not use nondescript terms such as businessman, merchant, store owner (unless store’s name is provided), or self employed. If unemployed, or retired are used enter the regular or former occupation if known.

Item 14. If an Individual, Describe Method Used To

Verify Identity. If an individual conducts the transaction(s) on his/her own behalf, his/her identity must be verified by examination of an acceptable document (see General Instructions). For example, check box a if a driver’s license is used to verify an individual’s identity, and enter the state that issued the license and the number in items E and f. If the transaction is conducted by an individual on behalf of another individual not present, or on behalf of an entity, check box “14d” “Other” and enter “NA” on the line provided.