It is possible to prepare fincen forms instantly using our online editor for PDFs. In order to make our tool better and simpler to utilize, we consistently develop new features, with our users' suggestions in mind. If you are looking to start, here is what you will need to do:

Step 1: Simply press the "Get Form Button" above on this page to open our pdf editor. This way, you will find everything that is necessary to fill out your file.

Step 2: The tool provides the ability to work with most PDF documents in many different ways. Enhance it with your own text, correct what's originally in the PDF, and place in a signature - all possible within a few minutes!

Pay close attention while filling out this document. Ensure that each and every field is done accurately.

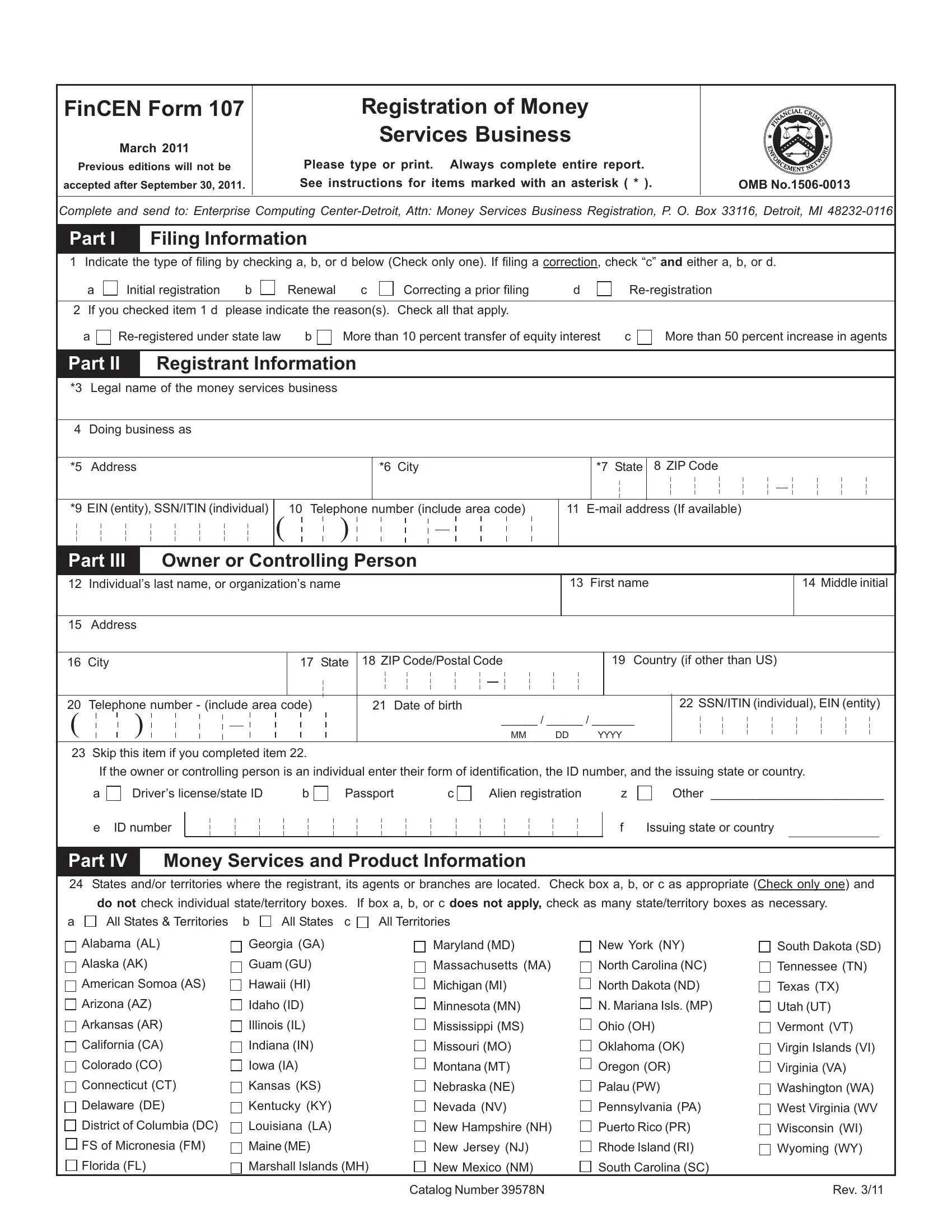

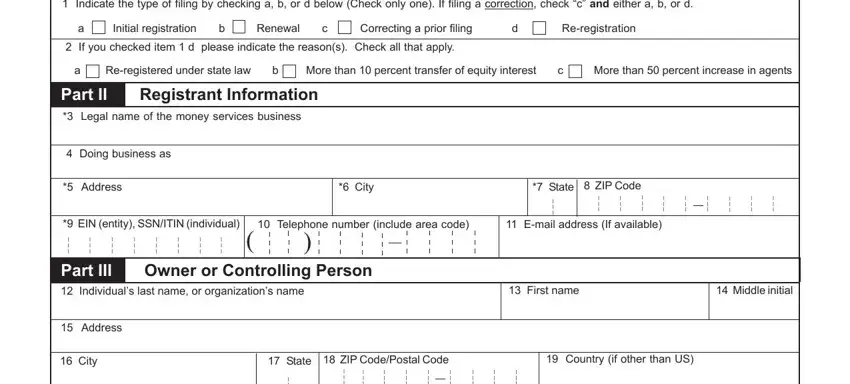

1. You will need to fill out the fincen forms correctly, hence be attentive when working with the sections that contain all these fields:

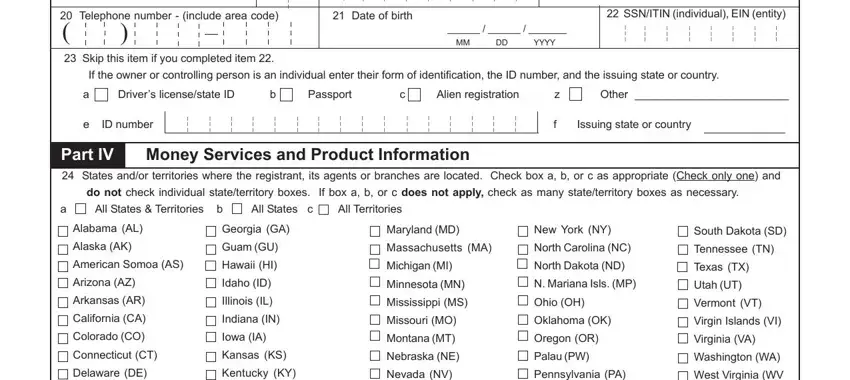

2. Just after finishing this section, go to the subsequent part and complete all required particulars in these blank fields - Telephone number include area, Date of birth, SSNITIN individual EIN entity, Skip this item if you completed, MM DD YYYY, If the owner or controlling person, a Drivers licensestate ID b, e ID number f, Issuing state or country, Part IV Money Services and Product, do not check individual, a All States Territories b All, Alabama AL, Alaska AK, and American Somoa AS.

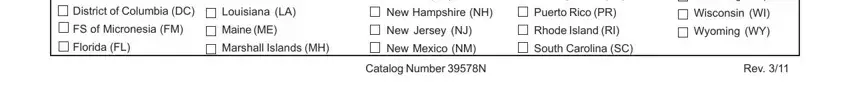

3. Within this stage, check out Kentucky KY, Nevada NV, Pennsylvania PA, District of Columbia DC, Louisiana LA, New Hampshire NH, Puerto Rico PR, FS of Micronesia FM, Maine ME, New Jersey NJ, Rhode Island RI, Florida FL, Marshall Islands MH, New Mexico NM, and South Carolina SC. All these have to be completed with greatest precision.

As for FS of Micronesia FM and New Jersey NJ, make sure that you review things in this current part. Those two are surely the most important fields in this PDF.

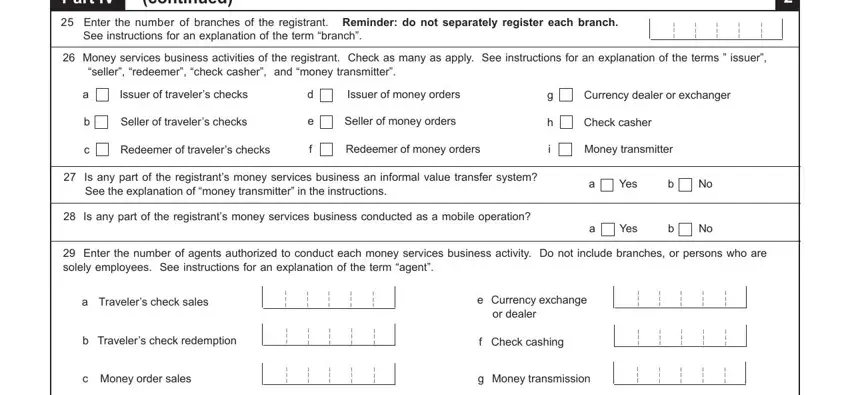

4. This fourth subsection comes with all of the following blank fields to type in your particulars in: Part IV continued, Enter the number of branches of, Money services business, a Issuer of travelers checks, d Issuer of money orders, g Currency dealer or exchanger, b Seller of travelers checks, e Seller of money orders, h Check casher, c Redeemer of travelers checks, f Redeemer of money orders, i Money transmitter, Is any part of the registrants, a Yes b No, and Is any part of the registrants.

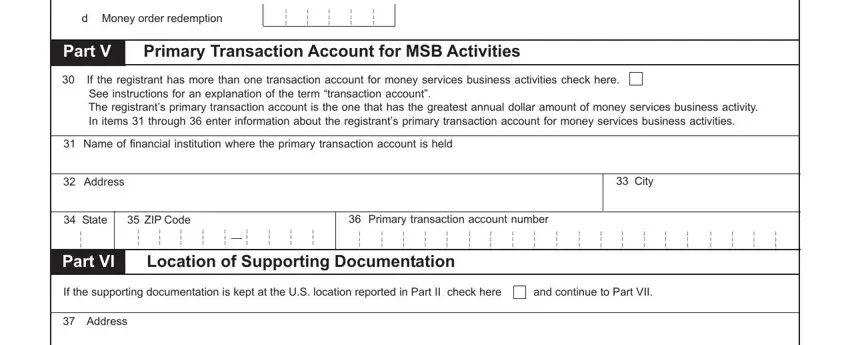

5. The pdf has to be concluded by going through this area. Below you will see an extensive list of fields that have to be filled out with appropriate information in order for your document submission to be faultless: d Money order redemption, Part V Primary Transaction Account, If the registrant has more than, Name of financial institution, Address, City, State, ZIP Code, Primary transaction account number, Part VI Location of Supporting, If the supporting documentation is, and Address.

Step 3: Always make sure that your details are correct and then simply click "Done" to complete the task. Go for a 7-day free trial account with us and get instant access to fincen forms - which you are able to then work with as you wish from your personal account page. If you use FormsPal, you can easily fill out forms without being concerned about database leaks or data entries being shared. Our secure software ensures that your personal details are stored safe.