Understanding the complexities of Form FinCEN 8300 is crucial for businesses and individuals who handle large cash transactions. Instituted by the Department of the Treasury, this form serves as a means to report cash payments exceeding $10,000 received in a single transaction or series of related transactions. Its dual reporting to the Internal Revenue Service and the Financial Crimes Enforcement Network underscores its importance in the government's efforts to combat money laundering and other financial crimes. The form requires detailed information about the identity of the payer, the recipient, and specifics of the transaction, including the method of payment and a description of the transaction's nature. Significantly, Form FinCEN 8300 is not just for traditional businesses; it also applies to individuals engaged in trade or business who might receive large cash payments, including court clerks receiving bail in cash exceeding the reporting threshold. Furthermore, the form plays a crucial role in identifying suspicious transactions, allowing filers to mark if a transaction seems dubious, thus serving as a tool for both regulatory compliance and the promotion of legal and ethical business practices. There's a mandate for filers to provide a written statement to the person involved in the transaction, enhancing transparency and accountability. Given the potential legal repercussions and hefty penalties for failure to correctly file or intentionally disregarding filing requirements, understanding and compliance with FinCEN 8300 are non-negotiable for entities operating within its scope.

| Question | Answer |

|---|---|

| Form Name | Fincen Form 8300 |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | FinCEN, department of the treasury internal revenue service, reportable, Issuer |

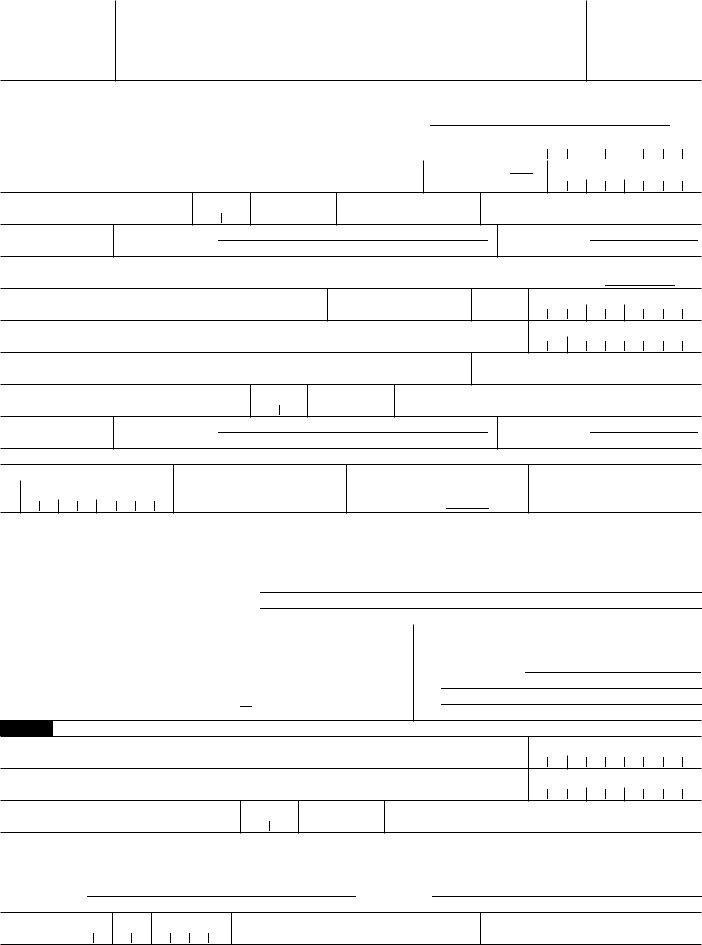

Form

IRS 8300

(Rev. December 2004)

OMB No.

Department of the Treasury Internal Revenue Service

Report of Cash Payments Over $10,000

Received in a Trade or Business

�See instructions for definition of cash.

�Use this form for transactions occurring after December 31, 2004. Do not use prior versions after this date.

For Privacy Act and Paperwork Reduction Act Notice, see page 5.

FinCEN 8300 Form

(Rev. December 2004) OMB No.

Department of the Treasury

Financial Crimes

Enforcement Network

1 |

Check appropriate box(es) if: |

a |

Amends prior report; |

b |

Suspicious transaction. |

|||||

Part I |

Identity of Individual From Whom the Cash Was Received |

|

|

|

|

|

||||

2 |

If more than one individual is involved, check here and see instructions |

|

|

|

|

� |

||||

3 |

Last name |

|

|

4 First name |

|

5 M.I. |

6 Taxpayer identification number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7Address (number, street, and apt. or suite no.)

8 Date of birth |

� |

(see instructions) |

|

M M D D Y Y Y Y

9City

10State

11ZIP code

12Country (if not U.S.)

13Occupation, profession, or business

14Identifying document (ID)

aDescribe ID � c Number �

b Issued by �

Part II |

Person on Whose Behalf This Transaction Was Conducted |

|

15 If this transaction was conducted on behalf of more than one person, check here and see instructions |

� |

|

16Individual’s last name or Organization’s name

17First name

18M.I.

19Taxpayer identification number

20Doing business as (DBA) name (see instructions)

Employer identification number

21Address (number, street, and apt. or suite no.)

22Occupation, profession, or business

23City

24State

25ZIP code

26Country (if not U.S.)

27Alien identifi- cation (ID)

aDescribe ID � c Number �

b Issued by �

Part III Description of Transaction and Method of Payment

28Date cash received

M M D D Y Y Y Y

29Total cash received

$ |

.00 |

30If cash was received in

more than one payment,

check here |

� |

31Total price if different from item 29

$ |

.00 |

32Amount of cash received (in U.S. dollar equivalent) (must equal item 29) (see instructions):

a |

U.S. currency |

$ |

|

.00 |

|

(Amount in $100 bills or higher |

$ |

.00 |

) |

|||

b |

Foreign currency |

$ |

|

.00 |

|

(Country � |

|

|

|

) |

|

|

c |

Cashier’s check(s) $ |

|

.00 |

|

� |

Issuer’s name(s) and serial number(s) of the monetary instrument(s) � |

||||||

d Money order(s) |

$ |

|

.00 |

|

|

|

|

|

|

|

||

e |

Bank draft(s) |

$ |

|

.00 |

|

|

|

|

|

|

|

|

f |

Traveler’s check(s) $ |

.00 |

|

|

|

|

|

|

|

|

||

33 Type of transaction |

|

|

|

|

|

|

|

34 Specific description of property or service shown in |

||||

a |

Personal property purchased |

f |

|

Debt obligations paid |

|

33. Give serial or registration number, address, docket |

||||||

b |

Real property purchased |

g |

|

Exchange of cash |

|

number, etc. � |

||||||

c |

Personal services provided |

h |

|

Escrow or trust funds |

|

|

|

|

||||

d |

Business services provided |

i |

|

Bail received by court clerks |

|

|

|

|

||||

eIntangible property purchased j Other (specify in item 34) �

Part IV Business That Received Cash

35Name of business that received cash

36Employer identification number

37Address (number, street, and apt. or suite no.)

Social security number

38City

39State

40ZIP code

41Nature of your business

42Under penalties of perjury, I declare that to the best of my knowledge the information I have furnished above is true, correct, and complete.

Signature �Title �

Authorized official

43 |

Date |

M M |

|

of |

|

signature

D D Y Y Y Y

44Type or print name of contact person

45Contact telephone number

( )

IRS Form 8300 (Rev. |

Cat. No. 62133S |

FinCEN Form 8300 (Rev. |

IRS Form 8300 (Rev. |

Page 2 |

FinCEN Form 8300 (Rev. |

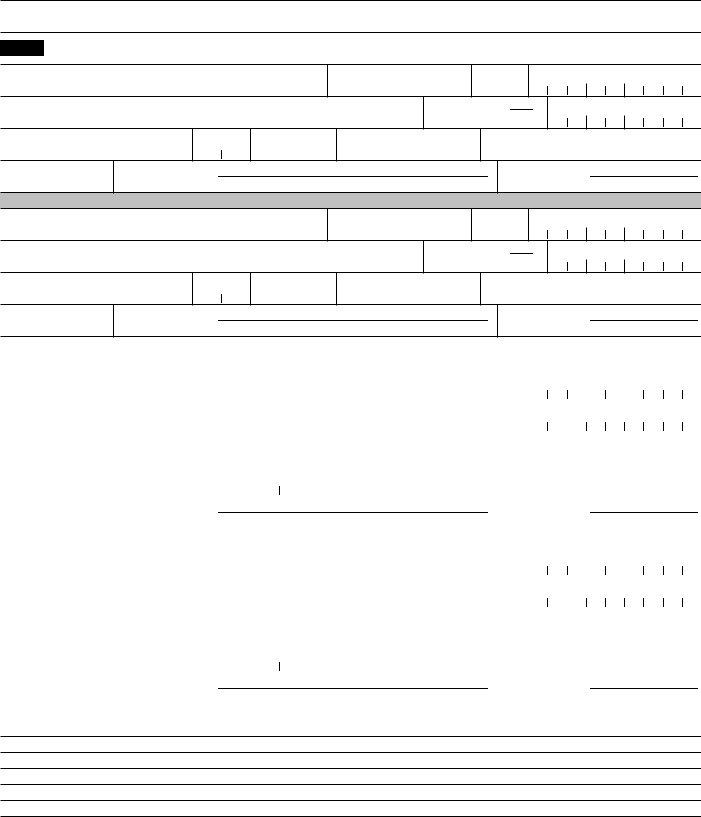

Multiple Parties

(Complete applicable parts below if box 2 or 15 on page 1 is checked)

Part I

3Last name

4First name

5M.I.

6Taxpayer identification number

7Address (number, street, and apt. or suite no.)

8 Date of birth |

� |

(see instructions) |

|

M M D D Y Y Y Y

9City

10State

11ZIP code

12Country (if not U.S.)

13Occupation, profession, or business

14Identifying document (ID)

aDescribe ID � c Number �

b Issued by �

3Last name

4First name

5M.I.

6Taxpayer identification number

7Address (number, street, and apt. or suite no.)

8 Date of birth |

� |

(see instructions) |

|

M M D D Y Y Y Y

9City

10State

11ZIP code

12Country (if not U.S.)

13Occupation, profession, or business

14Identifying document (ID)

aDescribe ID � c Number �

b Issued by �

Part II |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

16 |

Individual’s last name or Organization’s name |

|

17 First name |

|

18 |

M.I. |

19 Taxpayer identification number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20 |

Doing business as (DBA) name (see instructions) |

|

|

|

|

|

|

|

Employer identification number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Address (number, street, and apt. or suite no.) |

|

|

|

|

22 |

Occupation, profession, or business |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23 |

City |

|

|

24 State |

25 |

ZIP code |

26 |

Country (if not U.S.) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

27 |

Alien identifi- |

a Describe ID � |

|

|

|

|

|

|

b Issued by � |

|||||||

|

cation (ID) |

c Number � |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Individual’s last name or Organization’s name |

|

17 First name |

|

18 |

M.I. |

19 Taxpayer identification number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

20 |

Doing business as (DBA) name (see instructions) |

|

|

|

|

|

|

|

Employer identification number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Address (number, street, and apt. or suite no.) |

|

|

|

|

22 |

Occupation, profession, or business |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23 |

City |

|

|

24 State |

25 |

ZIP code |

26 |

Country (if not U.S.) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

27 |

Alien identifi- |

a Describe ID � |

|

|

|

|

|

|

b Issued by � |

|||||||

|

cation (ID) |

c Number � |

|

|

|

|

|

|

|

|

|

|

|

|||

Comments – Please use the lines provided below to comment on or clarify any information you entered on any line in Parts I, II, III, and IV

IRS Form 8300 (Rev. |

FinCEN Form 8300 (Rev. |

IRS Form 8300 (Rev. |

Page 3 |

FinCEN Form 8300 (Rev. |

|

|

|

Section references are to the Inter nal Revenue Code unless otherwise noted.

Important Reminders

●Section 6050I (26 United States Code (U.S.C.) 6050I) and 31 U.S.C. 5331 require that certain information be reported to the IRS and the Financial Crimes Enforcement Network (FinCEN). This information must be reported on IRS/FinCEN Form 8300.

●Item 33 box i is to be checked only by clerks of the court; box d is to be checked by bail bondsmen. See the instructions on page 5.

●For purposes of section 6050I and 31 U.S.C. 5331, the word “cash” and “currency” have the same meaning. See Cash under Definitions on page 4.

General Instructions

Who must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related transactions, must file Form 8300. Any transactions conducted between a payer (or its agent) and the recipient in a

Keep a copy of each Form 8300 for 5 years from the date you file it.

Clerks of Federal or State courts must file Form 8300 if more than $10,000 in cash is received as bail for an individual(s) charged with certain criminal offenses. For these purposes, a clerk includes the clerk’s office or any other office, department, division, branch, or unit of the court that is authorized to receive bail. If a person receives bail on behalf of a clerk, the clerk is treated as receiving the bail. See the instructions for Item 33 on page 5.

If multiple payments are made in cash to satisfy bail and the initial payment does not exceed $10,000, the initial payment and subsequent payments must be aggregated and the information return must be filed by the 15th day after receipt of the payment that causes the aggregate amount to exceed $10,000 in cash. In such cases, the reporting requirement can be satisfied either by sending a single written statement with an aggregate amount listed or by furnishing a copy of each Form 8300 relating to that payer. Payments made to satisfy separate bail requirements are not required to be aggregated. See Treasury Regulations section

Casinos must file Form 8300 for nongaming activities (restaurants, shops, etc.).

Voluntary use of Form 8300. Form

8300 may be filed voluntarily for any suspicious transaction (see Definitions) for use by the IRS, even if the total amount does not exceed $10,000.

Exceptions. Cash is not required to be reported if it is received:

●By a financial institution required to file Form 104, Currency Transaction Report.

●By a casino required to file (or exempt from filing) Form 103, Currency Transaction Report by Casinos, if the cash is received as part of its gaming business.

●By an agent who receives the cash from a principal, if the agent uses all of the cash within 15 days in a second transaction that is reportable on Form 8300 or on Form 104, and discloses all the information necessary to complete Part II of Form 8300 or Form 104 to the recipient of the cash in the second transaction.

●In a transaction occurring entirely outside the United States. See Publication 1544, Reporting Cash Payments Over $10,000 (Received in a Trade or Business), regarding transactions occurring in Puerto Rico, the Virgin Islands, and territories and possessions of the United States.

●In a transaction that is not in the course of a person’s trade or business.

When to file. File Form 8300 by the 15th day after the date the cash was received. If that date falls on a Saturday, Sunday, or legal holiday, file the form on the next business day.

Where to file. File the form with the Internal Revenue Service, Detroit Computing Center, P.O. Box 32621, Detroit, Ml 48232.

Statement to be provided. You must give a written or electronic statement to each person named on a required Form 8300 on or before January 31 of the year following the calendar year in which the cash is received. The statement must show the name, telephone number, and address of the information contact for the business, the aggregate amount of reportable cash received, and that the information was furnished to the IRS. Keep a copy of the statement for your records.

Multiple payments. If you receive more than one cash payment for a single transaction or for related transactions, you must report the multiple payments any time you receive a total amount that exceeds $10,000 within any

causes the total amount to exceed $10,000. If more than one report is required within 15 days, you may file a combined report. File the combined report no later than the date the earliest report, if filed separately, would have to be filed.

Taxpayer identification number (TIN). You must furnish the correct TIN of the person or persons from whom you receive the cash and, if applicable, the person or persons on whose behalf the transaction is being conducted. You may be subject to penalties for an incorrect or missing TIN.

The TIN for an individual (including a sole proprietorship) is the individual’s social security number (SSN). For certain resident aliens who are not eligible to get an SSN and nonresident aliens who are required to file tax returns, it is an IRS Individual Taxpayer Identification Number (ITIN). For other persons, including corporations, partnerships, and estates, it is the employer identification number (EIN).

If you have requested but are not able to get a TIN for one or more of the parties to a transaction within 15 days following the transaction, file the report and attach a statement explaining why the TIN is not included.

Exception: You are not required to provide the TIN of a person who is a nonresident alien individual or a foreign organization if that person does not have income effectively connected with the conduct of a U.S. trade or business and does not have an office or place of business, or fiscal or paying agent, in the United States. See Publication 1544 for more information.

Penalties. You may be subject to penalties if you fail to file a correct and complete Form 8300 on time and you cannot show that the failure was due to reasonable cause. You may also be subject to penalties if you fail to furnish timely a correct and complete statement to each person named in a required report. A minimum penalty of $25,000 may be imposed if the failure is due to an intentional or willful disregard of the cash reporting requirements.

Penalties may also be imposed for causing, or attempting to cause, a trade or business to fail to file a required report; for causing, or attempting to cause, a trade or business to file a required report containing a material omission or misstatement of fact; or for structuring, or attempting to structure, transactions to avoid the reporting requirements. These violations may also be subject to criminal prosecution which, upon conviction, may result in imprisonment of up to 5 years or fines of up to $250,000 for individuals and $500,000 for corporations or both.

IRS Form 8300 (Rev. |

Page 4 |

FinCEN Form 8300 (Rev. |

|

|

|

Definitions

Cash. The term “cash” means the following:

●U.S. and foreign coin and currency received in any transaction.

●A cashier’s check, money order, bank draft, or traveler’s check having a face amount of $10,000 or less that is received in a designated reporting transaction (defined below), or that is received in any transaction in which the recipient knows that the instrument is being used in an attempt to avoid the reporting of the transaction under either section 6050I or 31 U.S.C. 5331.

Note. Cash does not include a check drawn on the payer’s own account, such as a personal check, regardless of the amount.

Designated reporting transaction. A retail sale (or the receipt of funds by a broker or other intermediary in connection with a retail sale) of a consumer durable, a collectible, or a travel or entertainment activity.

Retail sale. Any sale (whether or not the sale is for resale or for any other purpose) made in the course of a trade or business if that trade or business principally consists of making sales to ultimate consumers.

Consumer durable. An item of tangible personal property of a type that, under ordinary usage, can reasonably be expected to remain useful for at least 1 year, and that has a sales price of more than $10,000.

Collectible. Any work of art, rug, antique, metal, gem, stamp, coin, etc.

Travel or entertainment activity. An item of travel or entertainment that pertains to a single trip or event if the combined sales price of the item and all other items relating to the same trip or event that are sold in the same transaction (or related transactions) exceeds $10,000.

Exceptions. A cashier’s check, money order, bank draft, or traveler’s check is not considered received in a designated reporting transaction if it constitutes the proceeds of a bank loan or if it is received as a payment on certain promissory notes, installment sales contracts, or down payment plans. See Publication 1544 for more information.

Person. An individual, corporation, partnership, trust, estate, association, or company.

Recipient. The person receiving the cash. Each branch or other unit of a person’s trade or business is considered a separate recipient unless the branch receiving the cash (or a central office linking the branches), knows or has reason to know the identity of payers making cash payments to other branches.

Transaction. Includes the purchase of property or services, the payment of debt, the exchange of a negotiable instrument for cash, and the receipt of cash to be held in escrow or trust. A single transaction may not be broken into multiple transactions to avoid reporting.

Suspicious transaction. A transaction in which it appears that a person is attempting to cause Form 8300 not to be filed, or to file a false or incomplete form. The term also includes any transaction in which there is an indication of possible illegal activity.

Specific Instructions

You must complete all parts. However, you may skip Part II if the individual named in Part I is conducting the transaction on his or her behalf only. For voluntary reporting of suspicious transactions, see Item 1 below.

Item 1. If you are amending a prior report, check box 1a. Complete the appropriate items with the correct or amended information only. Complete all of Part IV. Staple a copy of the original report to the amended report.

To voluntarily report a suspicious transaction (see Definitions), check box 1b. You may also telephone your local IRS Criminal Investigation Division or call

Part I

Item 2. If two or more individuals conducted the transaction you are reporting, check the box and complete Part I for any one of the individuals. Provide the same information for the other individual(s) on the back of the form. If more than three individuals are involved, provide the same information on additional sheets of paper and attach them to this form.

Item 6. Enter the taxpayer identification number (TIN) of the individual named. See Taxpayer identification number (TIN) on page 3 for more information.

Item 8. Enter eight numerals for the date of birth of the individual named. For example, if the individual’s birth date is July 6, 1960, enter 07 06 1960.

Item 13. Fully describe the nature of the occupation, profession, or business (for example, “plumber,” “attorney,” or “automobile dealer”). Do not use general or nondescriptive terms such as “businessman” or

Item 14. You must verify the name and address of the named individual(s). Verification must be made by examination of a document normally accepted as a means of identification when cashing checks (for example, a driver’s license, passport, alien registration card, or other official

document). In item 14a, enter the type of document examined. In item 14b, identify the issuer of the document. In item 14c, enter the document’s number. For example, if the individual has a Utah driver’s license, enter “driver’s license” in item 14a, “Utah” in item 14b, and the number appearing on the license in item 14c.

Note. You must complete all three items (a, b, and c) in this line to make sure that Form 8300 will be processed correctly.

Part II

Item 15. If the transaction is being conducted on behalf of more than one person (including husband and wife or parent and child), check the box and complete Part II for any one of the persons. Provide the same information for the other person(s) on the back of the form. If more than three persons are involved, provide the same information on additional sheets of paper and attach them to this form.

Items 16 through 19. If the person on whose behalf the transaction is being conducted is an individual, complete items 16, 17, and 18. Enter his or her TIN in item 19. If the individual is a sole proprietor and has an employer identification number (EIN), you must enter both the SSN and EIN in item 19. If the person is an organization, put its name as shown on required tax filings in item 16 and its EIN in item 19.

Item 20. If a sole proprietor or organization named in items 16 through 18 is doing business under a name other than that entered in item 16 (e.g., a “trade” or “doing business as (DBA)” name), enter it here.

Item 27. If the person is not required to furnish a TIN, complete this item. See Taxpayer Identification Number (TIN) on page 3. Enter a description of the type of official document issued to that person in item 27a (for example, “passport”), the country that issued the document in item 27b, and the document’s number in item 27c.

Note. You must complete all three items (a, b, and c) in this line to make sure that Form 8300 will be processed correctly.

Part III

Item 28. Enter the date you received the cash. If you received the cash in more than one payment, enter the date you received the payment that caused the combined amount to exceed $10,000. See Multiple payments under General Instructions for more information.

Item 30. Check this box if the amount shown in item 29 was received in more than one payment (for example, as installment payments or payments on related transactions).

IRS Form 8300 (Rev. |

Page 5 |

FinCEN Form 8300 (Rev. |

|

|

|

Item 31. Enter the total price of the property, services, amount of cash exchanged, etc. (for example, the total cost of a vehicle purchased, cost of catering service, exchange of currency) if different from the amount shown in item 29.

Item 32. Enter the dollar amount of each form of cash received. Show foreign currency amounts in U.S. dollar equivalent at a fair market rate of exchange available to the public. The sum of the amounts must equal item 29. For cashier’s check, money order, bank draft, or traveler’s check, provide the name of the issuer and the serial number of each instrument. Names of all issuers and all serial numbers involved must be provided. If necessary, provide this information on additional sheets of paper and attach them to this form.

Item 33. Check the appropriate box(es) that describe the transaction. If the transaction is not specified in boxes

Part IV

Item 36. If you are a sole proprietorship, you must enter your SSN. If your business also has an EIN, you must provide the EIN as well. All other business entities must enter an EIN.

Item 41. Fully describe the nature of your business, for example, “attorney” or “jewelry dealer.” Do not use general or nondescriptive terms such as “business” or “store.”

Item 42. This form must be signed by an individual who has been authorized to do so for the business that received the cash.

Comments

Use this section to comment on or clarify anything you may have entered on any line in Parts I, II, III, and IV. For example, if you checked box b (Suspicious transaction) in line 1 above Part I, you may want to explain why you think that the cash transaction you are reporting on Form 8300 may be suspicious.

Privacy Act and Paperwork Reduction Act Notice. Except as otherwise noted, the information solicited on this form is required by the Internal Revenue Service (IRS) and the Financial Crimes Enforcement Network (FinCEN) in order to carry out the laws and regulations of the United States Department of the Treasury. Trades or businesses, except for clerks of criminal courts, are required to provide the information to the IRS and FinCEN under both section 6050I and 31 U.S.C. 5331. Clerks of criminal courts are required to provide the information to the IRS under section 6050I. Section 6109 and 31 U.S.C. 5331 require that you provide your social security number in order to adequately identify you and process your return and other papers. The principal purpose for collecting the information on this form is to maintain reports or records which have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, by directing the Federal Government’s attention to unusual or questionable transactions.

You are not required to provide information as to whether the reported transaction is deemed suspicious. Failure to provide all other requested information, or providing fraudulent information, may result in criminal prosecution and other penalties under Title 26 and Title 31 of the United States Code.

Generally, tax returns and return information are confidential, as stated in section 6103. However, section 6103 allows or requires the IRS to disclose or give the information requested on this form to others as described in the Code. For example, we may disclose your tax information to the Department of Justice, to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, to carry out their tax laws. We may disclose this information to other persons as necessary to obtain information which we cannot get in any other way. We may disclose this information to Federal, state, and local child support agencies; and to other Federal agencies for the purposes of determining entitlement for benefits or the eligibility for and the repayment of loans. We may also provide the records to appropriate state, local, and foreign criminal law enforcement and regulatory personnel in the performance of their official duties. We may also disclose this information to other countries under a tax treaty, or to Federal and state agencies to enforce Federal nontax criminal laws and to combat terrorism.

The IRS authority to disclose information to combat terrorism expired on December 31, 2003. Legislation is pending that would reinstate this authority. “In addition, FinCEN may provide the information to those officials if they are conducting intelligence or

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any law under Title 26 or Title 31.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is 21 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, you can write to the Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova, CA