|

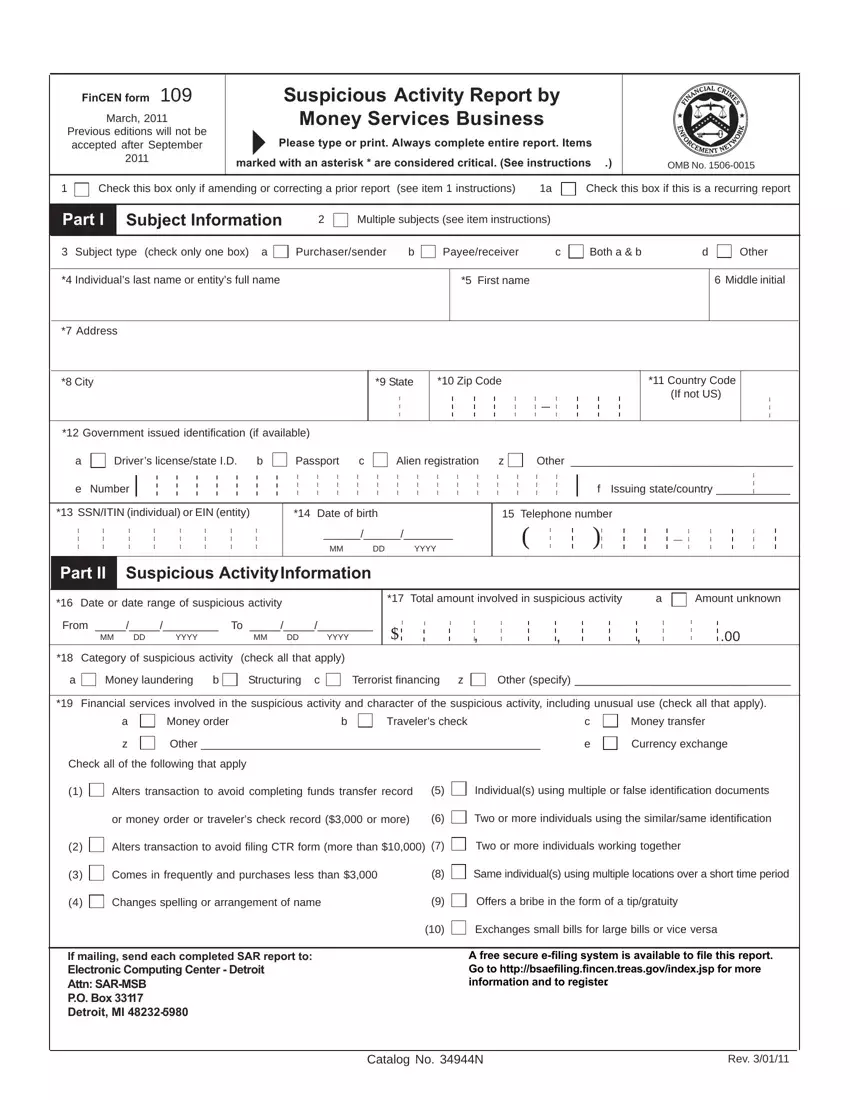

FinCEN Form 109a Suspicious Activity Report by Money Services Business -- Instructions |

1 |

|

|

Safe Harbor |

i. The transaction involves funds derived |

4. SSN -- Social Security Number |

|

|

|

|

|

from illegal activity or is intended or conducted |

5. Instruments -- includes Money order(s) |

|

Federal law (31 U.S.C. 5318(g)(3)) provides |

in order to hide or disguise funds or assets derived |

and/or Traveler’s Check(s) |

|

|

|

complete protection from civil liability for all |

from illegal activity (including, without limitation, |

6. Redeemer --A business that accepts |

|

reports of suspicious transactions made to |

the nature, source, location, ownership or control |

|

appropriate authorities, including supporting |

of such funds or assets) as part of a plan to violate |

instruments in exchange for currency or other |

|

documentation, regardless of whether such |

or evade any Federal law or regulation or to avoid |

instruments for which it is not the issuer is a |

|

reports are filed pursuant to this report’s |

any transaction reporting requirement under |

redeemer. The MSB definition in 31 CFR |

|

instructions or are filed on a voluntary basis. |

Federal law or regulation; |

1010.100(ff)(4) extends to “redeemers” of |

|

Specifically, the law provides that a financial |

|

money orders and traveler’s checks only insofar |

|

institution, and its directors, officers, employees |

ii. The transaction is designed, whether |

as the |

|

|

|

and agents, that make a disclosure of any possible |

through structuring or other means, to evade any |

instruments involved are redeemed for monetary |

|

violation of law or regulation, including in |

regulations promulgated under the Bank Secrecy |

value — that is, for currency or monetary or other |

|

connection with the preparation of suspicious |

Act; or |

negotiable or other instruments. The taking of the |

|

activity reports, “shall not be liable to any person |

|

instruments in exchange for goods or general ser- |

|

under any law or regulation of the United States, |

iii. The transaction has no business or |

vices is not redemption under BSA regulations. |

|

any constitution, law, or regulation of any State or |

apparent lawful purpose and the money services |

C. General Instructions |

|

|

|

political subdivision of any State, or under any |

business knows of no reasonable explanation for |

|

|

|

contract or other legally enforceable agreement |

the transaction after examining the available facts, |

|

|

|

|

(including any arbitration agreement), for such |

including the background and possible purpose |

1. This form should be e-filed through the |

|

disclosure or for any failure to provide notice of |

of the transaction. |

Bank Secrecy Act E-filing System. Go to |

|

such disclosure to the person who is the subject |

iv. The transaction involves the use of the |

http://bsaefiling.fincen.treas.gov/index.jsp |

|

of such disclosure or any other person identified |

to register. This form is also available for down- |

|

in the disclosure”. |

money services business to facilitate criminal |

load on the Financial Crimes Enforcement |

|

|

|

activity. |

Network’s Web site at www.fincen.gov, or may |

|

Notification Prohibited |

b. To the extent that the identification of |

be ordered by calling the IRS Forms Distribution |

|

Center at (800) 829-3676. |

|

|

|

|

|

transactions required to be reported is derived |

|

|

|

|

Federal law (31 U.S.C. 5318(g)(2)) provides that |

from a review of clearance records or other similar |

2. If not filed electronically or through magnetic |

|

a financial institution, and its directors, officers, |

records of money orders or traveler’s checks that |

media, send each completed suspicious activity |

|

employees, and agents, who report suspicious |

have been sold or processed, an issuer of money |

report to: |

|

|

|

transactions to the government voluntarily or as |

orders or traveler’s checks shall only be required |

|

|

|

|

required by 31 CFR 1022.320, may not notify |

to report a transaction or a pattern of transactions |

Electronic Computing Center-Detroit |

|

|

|

any person involved in the transaction that the |

that involves or aggregates funds or other assets of |

ATTN: SAR-MSB |

|

|

|

transaction has been reported. |

at least $5,000. |

P.O. Box 33117 |

|

|

|

|

|

2. File a SAR-MSB no later than 30 calendar |

Detroit, MI 48232-5980 |

|

|

|

|

|

|

|

|

|

Notification Required |

days after the date of initial detection of facts that |

3. While all items should be completed fully |

|

|

|

constitute a basis for filing the report. |

and accurately, items marked with an asterisk (*) |

|

In situations involving suspicious transactions |

3. The Bank Secrecy Act requires that each |

must be completed according to the provisions of |

|

requiring immediate attention, such as ongoing |

paragraph 4 below. |

|

|

|

money laundering schemes, a money transmitter; |

financial institution (including a money services |

|

|

|

|

a currency dealer or exchanger; or an issuer, seller, |

business) file currency transaction reports (CTRs) |

4. If the information for a item marked with a |

|

or redeemer of money orders and/or traveler’s |

in accordance with the Department of the Treasury |

asterisk (*) is not known or not applicable, enter |

|

checks shall immediately notify, by telephone, |

implementing regulations (31 CFR Chapter X). |

special response “XX” to complete the item. To |

|

an appropriate law enforcement authority. In |

These regulations require a financial institution |

indicate “Total amount” as unknown, check the |

|

addition, a timely SAR-MSB form shall be filed, |

to file a CTR (FinCEN Form 104) whenever a |

box provided. Non-asterisk fields should be left |

|

including recording any such notification in Part |

currency transaction exceeds $10,000. If a |

blank if the information is unknown or not |

|

|

|

VI on the form. |

currency transaction exceeds $10,000 and is |

applicable. |

|

|

|

|

|

suspicious, a money transmitter, or issuer, seller |

5. Complete each suspicious activity report by |

|

|

|

or redeemer of money orders and/or traveler’s |

|

A. When To FileA Report: |

checks or currency dealer or exchanger must |

providing as much information as possible on initial |

|

and amended or corrected reports. |

|

|

|

|

|

file two forms, a CTR to report the currency |

|

|

|

1. Money transmitters; currency dealers and |

transaction and a SAR-MSB to report the |

6. Do not include supporting documents when |

|

suspicious aspects of the transaction. If the |

|

exchangers; and issuers, sellers and redeemers |

|

suspicious activity involves a currency |

filing the suspicious activity report . Retain a copy |

|

of money orders and/or traveler’s checks that are |

|

transaction that is $10,000 or less, the institution |

of the suspicious activity report and all supporting |

|

subject to the requirements of the Bank Secrecy |

|

is only required to file a SAR-MSB. Appropriate |

documentation or business record equivalent in |

|

Act and its implementing regulations (31 CFR |

|

records must be maintained in each case. See |

your files for five (5) years from the date of the |

|

Chapter X are required to file a suspicious |

|

31 CFR Chapter X. |

report. All supporting documentation (such as |

|

activity report (SAR-MSB) with respect to: |

|

|

copies of instruments; receipts; sale, transaction |

|

|

|

|

|

a. Any transaction conducted or attempted |

B. Abbreviations and Definitions |

or clearing records; photographs, surveillance |

|

by, at, or through a money services business |

|

audio and/or video recording medium) must be |

|

1. EIN -- Employer Identification Number |

made available to appropriate authorities upon |

|

involving or aggregating funds or other assets of |

|

request. |

|

|

|

at least $2,000 (except as described in section |

2. IRS -- Internal Revenue Service |

|

|

|

|

|

|

|

“b” below) when the money services business |

3. ITIN -- Individual Taxpayer Identification |

|

|

|

|

knows, suspects, or has reason to suspect that: |

Number |

|

|

|

|

|

|

Catalog No. 35084Y |

Rev. 3/1/11 |

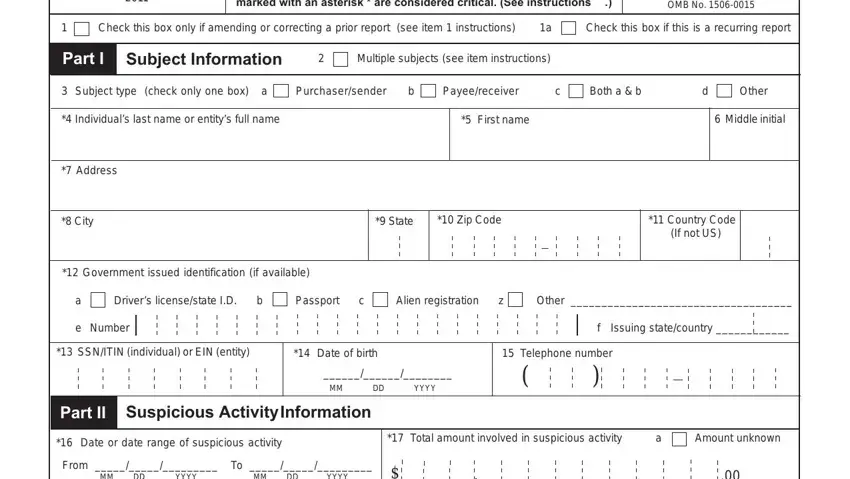

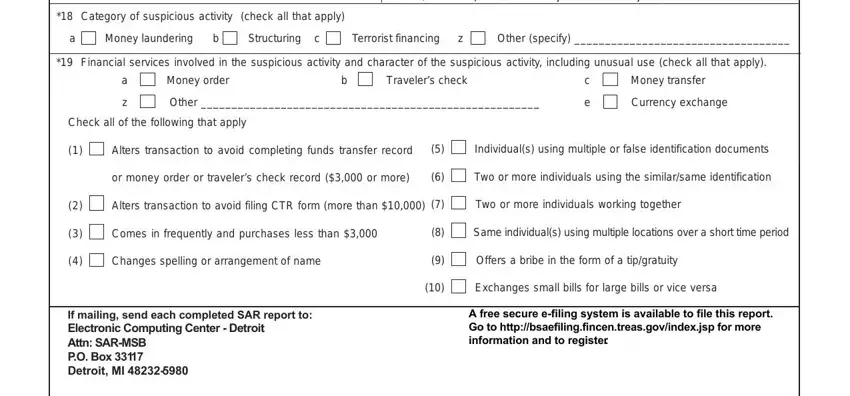

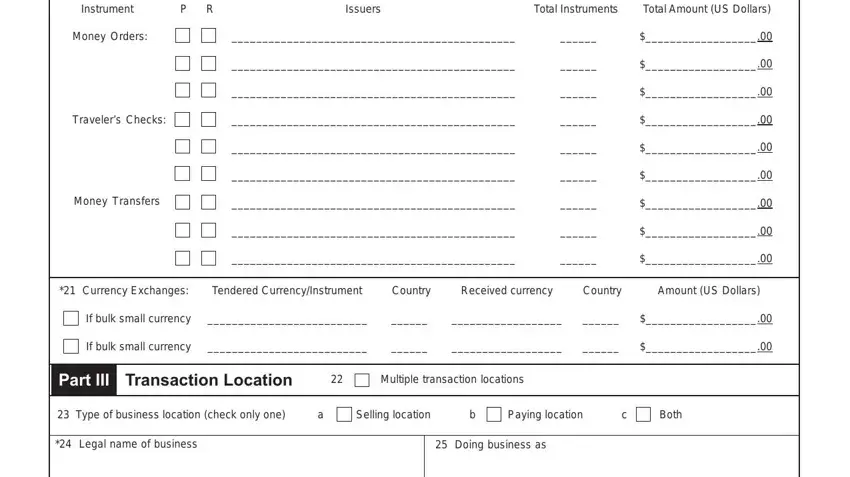

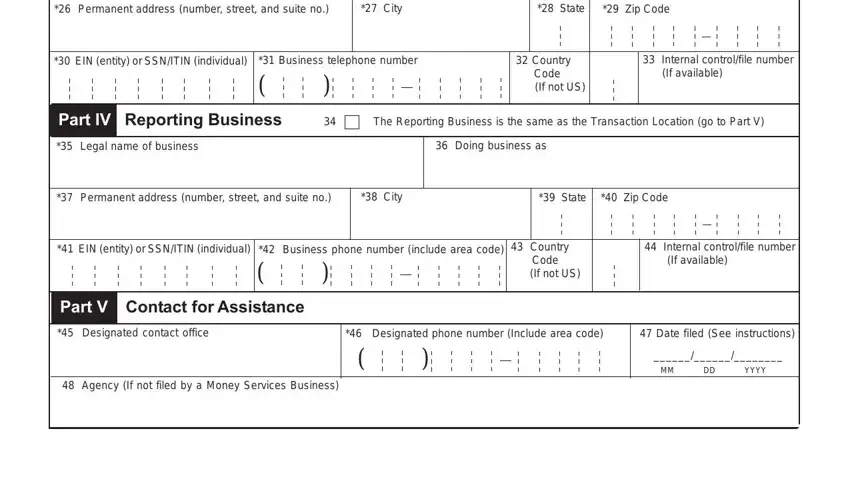

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .)

Please type or print. Always complete entire report. Items marked with an asterisk * are considered critical. (See instructions .) .00

.00

)

)