Only a few tasks can be simpler than completing files making use of this PDF editor. There is not much for you to do to modify the 15c2 11 document - simply abide by these steps in the next order:

Step 1: Select the button "Get Form Here" on the following website and click it.

Step 2: You are now on the form editing page. You can edit, add content, highlight selected words or phrases, put crosses or checks, and include images.

To complete the 15c2 11 PDF, enter the content for all of the sections:

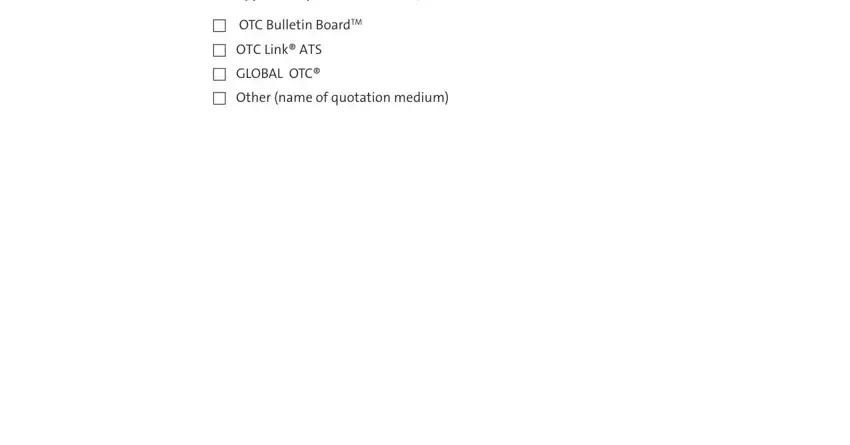

Fill out the Address of principal executive, Telephone number of principal, Type of security check one, Domestic Security, Foreign Security, DPP, Sponsored ADR, Unsponsored ADR, State of incorporation, Country of incorporation, Complete title and class of, Symbol of security if assigned, CUSIP, Par or stated value of security, and Total securities outstanding at area with the details requested by the software.

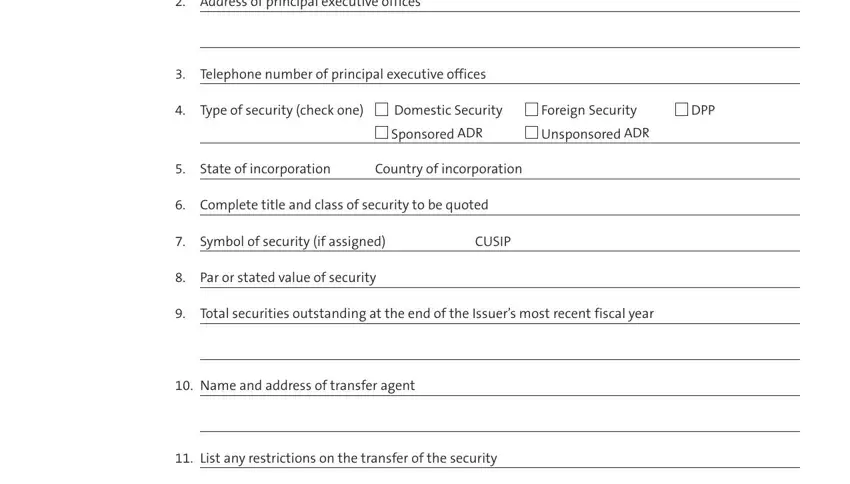

Describe the most essential information on the No price at this time, If you are requesting to enter a, The basis upon which the priced, and The factors considered in making part.

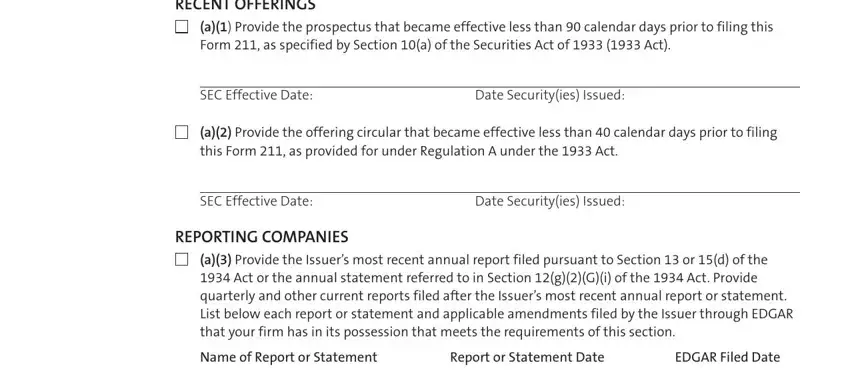

When it comes to space RECENT OFFERINGS, a Provide the prospectus that, SEC Effective Date, Date Securityies Issued, a Provide the offering circular, this Form as provided for under, SEC Effective Date, Date Securityies Issued, REPORTING COMPANIES, a Provide the Issuers most recent, Name of Report or Statement, Report or Statement Date, and EDGAR Filed Date, define the rights and obligations.

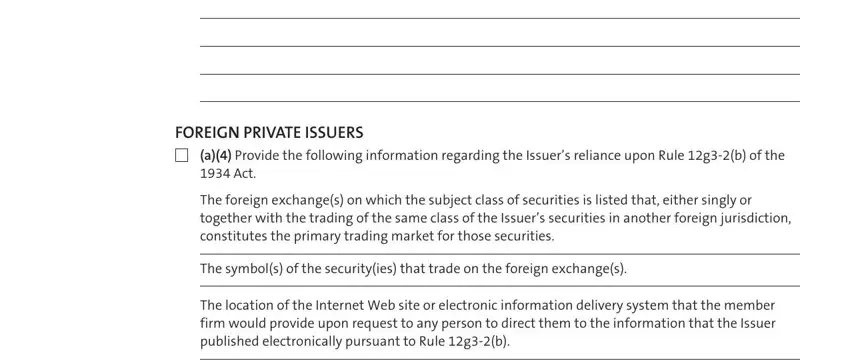

End up by reading these sections and filling them in as required: FOREIGN PRIVATE ISSUERS, a Provide the following, The foreign exchanges on which the, The symbols of the securityies, and The location of the Internet Web.

Step 3: As soon as you hit the Done button, your finalized form can be simply transferred to any kind of your devices or to email stated by you.

Step 4: You can generate copies of your document toavoid different possible challenges. Don't be concerned, we don't publish or record your information.

Trading suspension order or release enclosed.

Trading suspension order or release enclosed.

Not applicable.

Not applicable.