We found the finest website developers to make our PDF editor. The app will allow you to create the fl 155 form pdf file effortlessly and won't take too much of your time and effort. This easy-to-follow procedure will enable you to learn how to start.

Step 1: Click the orange "Get Form Now" button on this website page.

Step 2: Once you've entered the editing page fl 155 form pdf, you'll be able to notice all of the actions intended for your file within the upper menu.

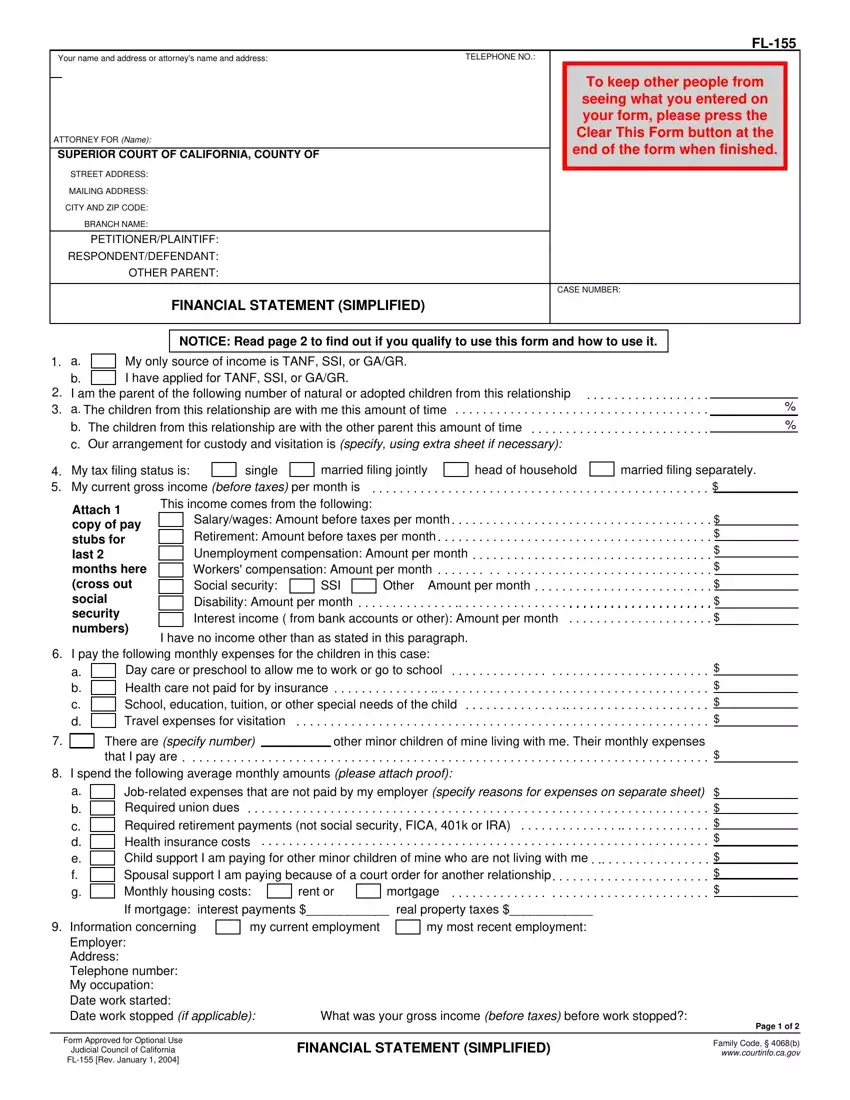

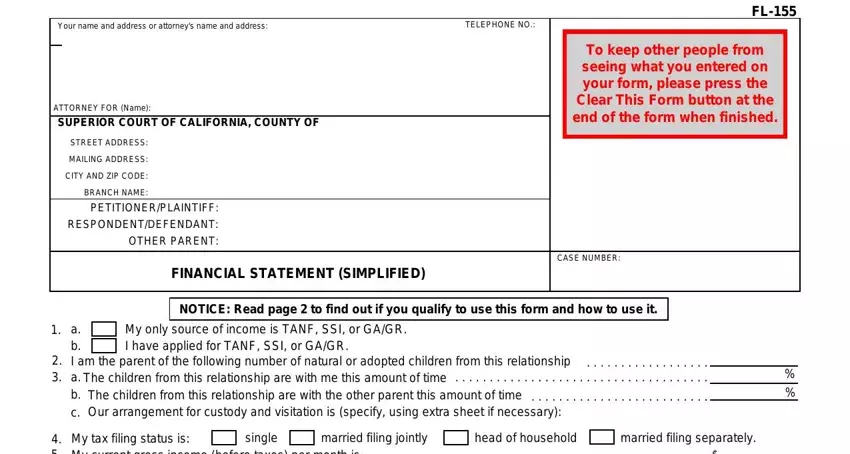

For each section, create the data asked by the platform.

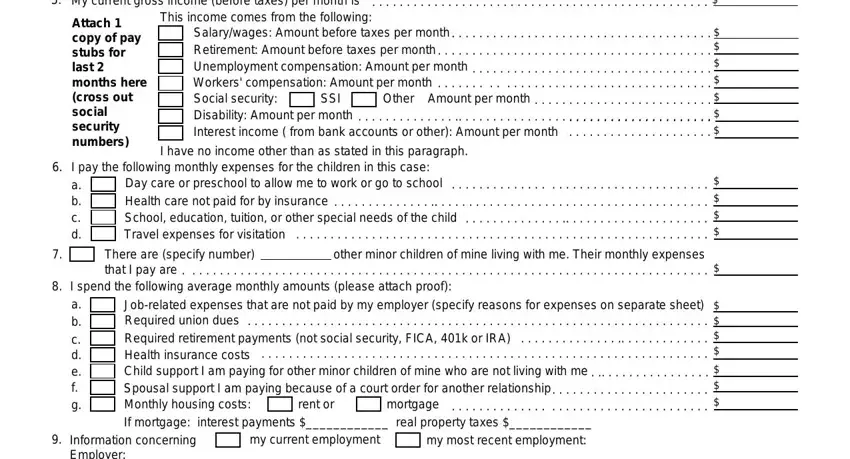

Provide the demanded details in the space This, income, comes, from, the, following Other, Amount, per, month SSI, There, are, specify, number, that, I, pay, are my, current, employment mortgage, and rent, or

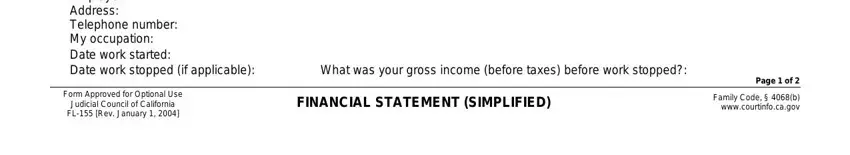

The application will request data to conveniently submit the box Form, Approved, for, Optional, Use FINANCIAL, STATEMENT, SIMPLIFIED Page, of and Family, Code, b, www, court, in, foca, gov

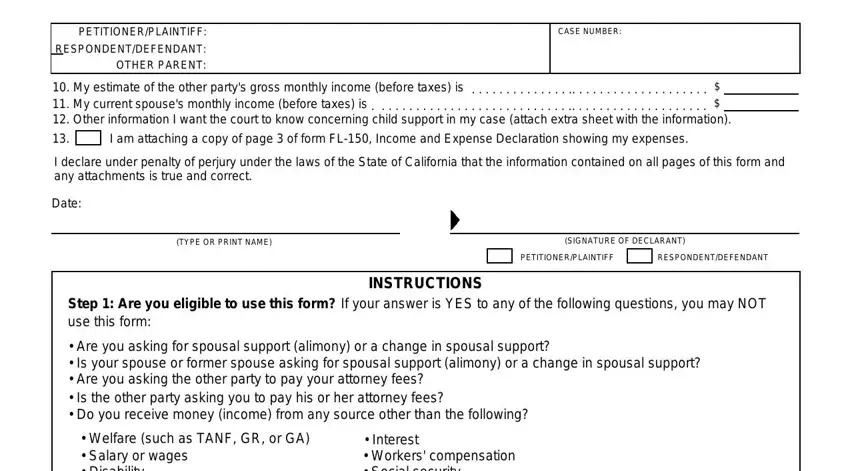

As part of box CASE, NUMBER Date, TYPE, OR, PRINT, NAME SIGNATURE, OF, DE, CLARA, NT PETITIONER, PLAINTIFF RESPONDENT, DEFENDANT and INSTRUCTIONS, identify the rights and obligations.

Fill out the document by reviewing these particular areas: FL, Rev, January FINANCIAL, STATEMENT, SIMPLIFIED and Page, of

Step 3: Choose the "Done" button. Then, you can export the PDF file - download it to your device or deliver it by using email.

Step 4: Ensure you keep away from upcoming challenges by producing minimally a pair of copies of your form.