Our PDF editor that you can benefit from was designed by our leading web developers. It is easy to create the florida revenue com taxes registration form fast and conveniently with our software. Simply adhere to the following procedure to get going.

Step 1: The first task will be to click the orange "Get Form Now" button.

Step 2: Now you are on the document editing page. You can edit, add information, highlight certain words or phrases, put crosses or checks, and add images.

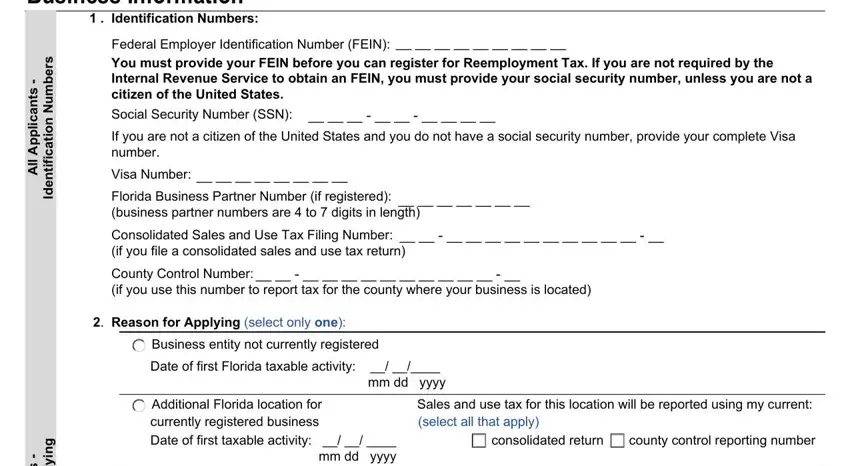

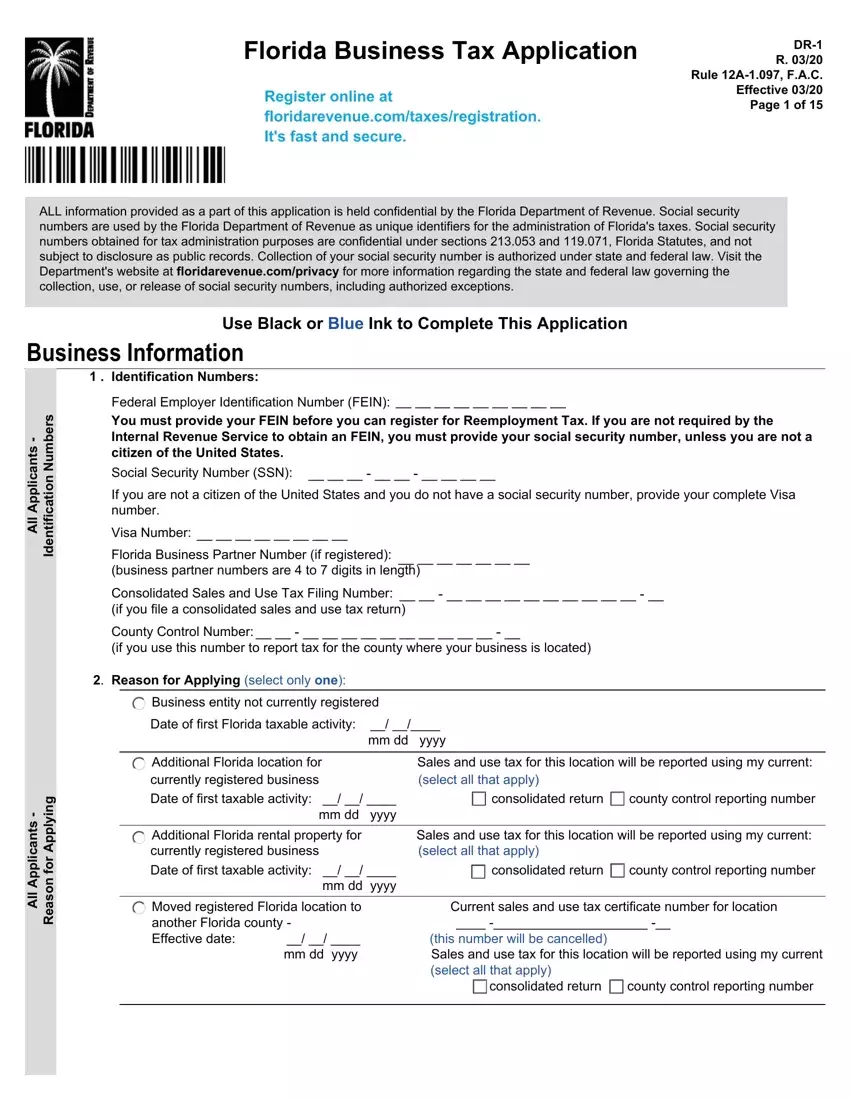

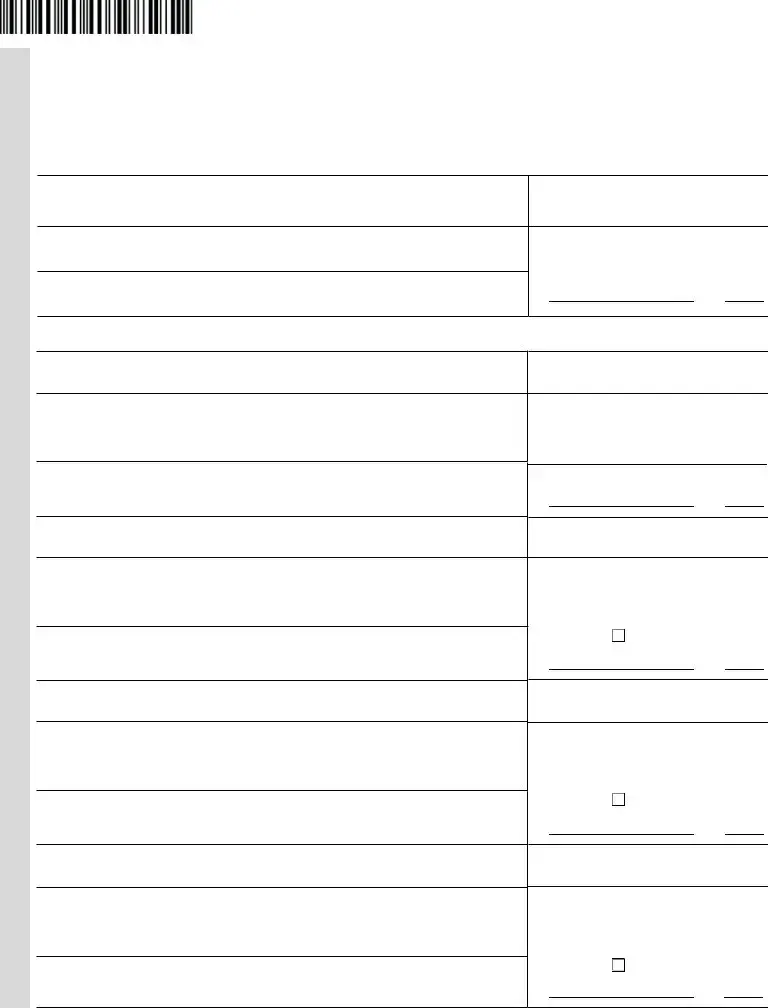

The following segments will help make up your PDF file:

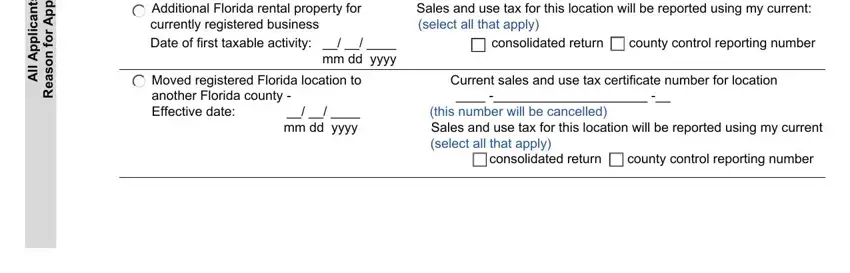

The system will demand you to fill in the s t n a c, i l, p p A, l l, g n y p p A r o f n o s a e R, Additional Florida rental property, currently registered business, mm dd yyyy, Moved registered Florida location, Current sales and use tax, and consolidated return county control field.

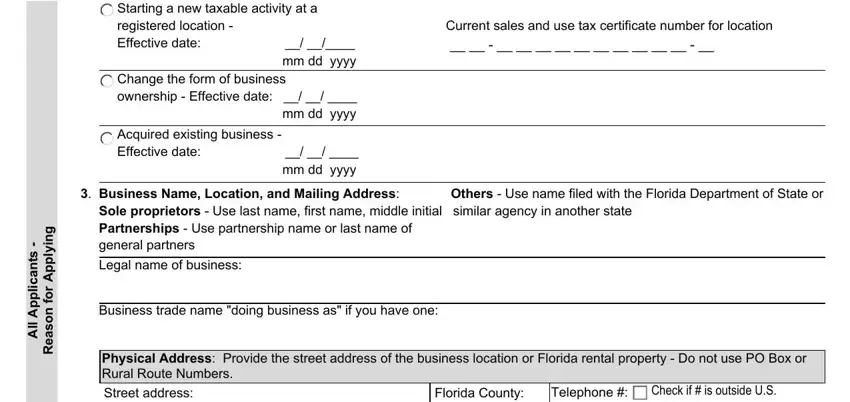

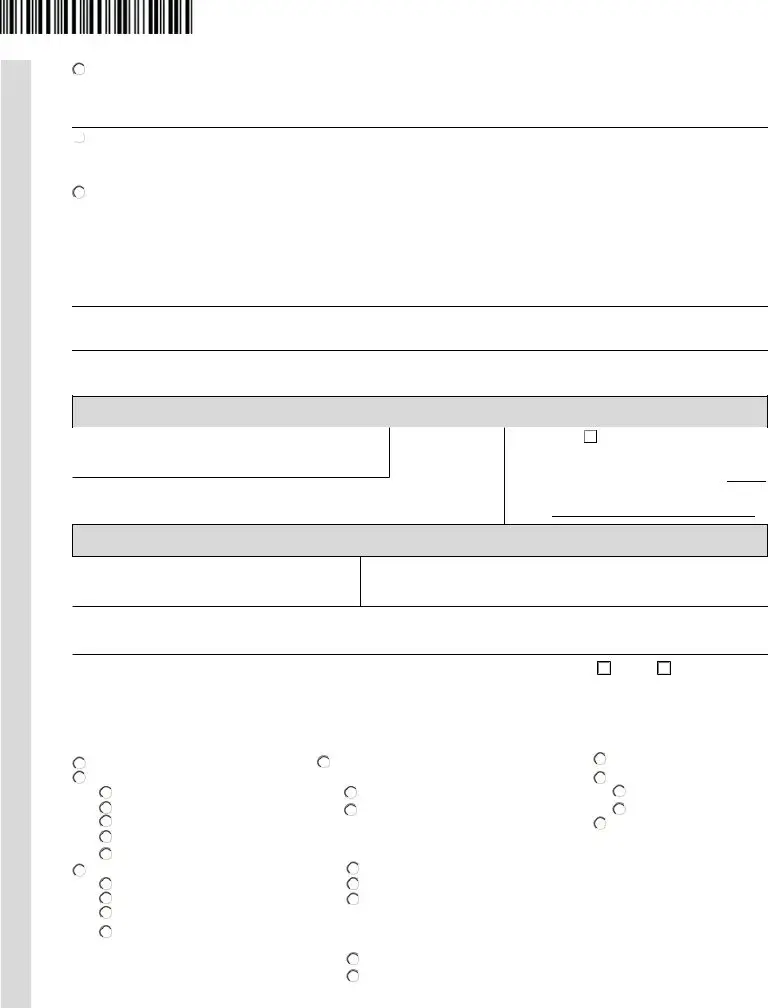

Highlight the most vital information on the Starting a new taxable activity at, Acquired existing business, Business Name Location and, Legal name of business, Business trade name doing business, Physical Address Provide the, Check if is outside US, Florida County, Telephone, s t n a c, i l, p p A, l l, and g n y p p A r o f n o s a e R part.

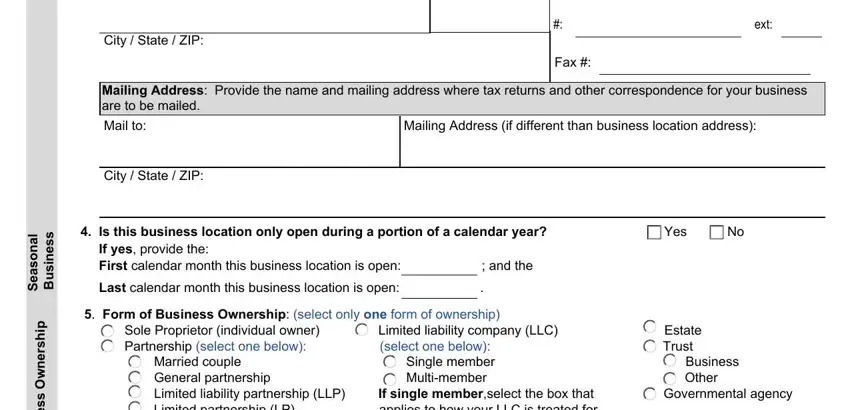

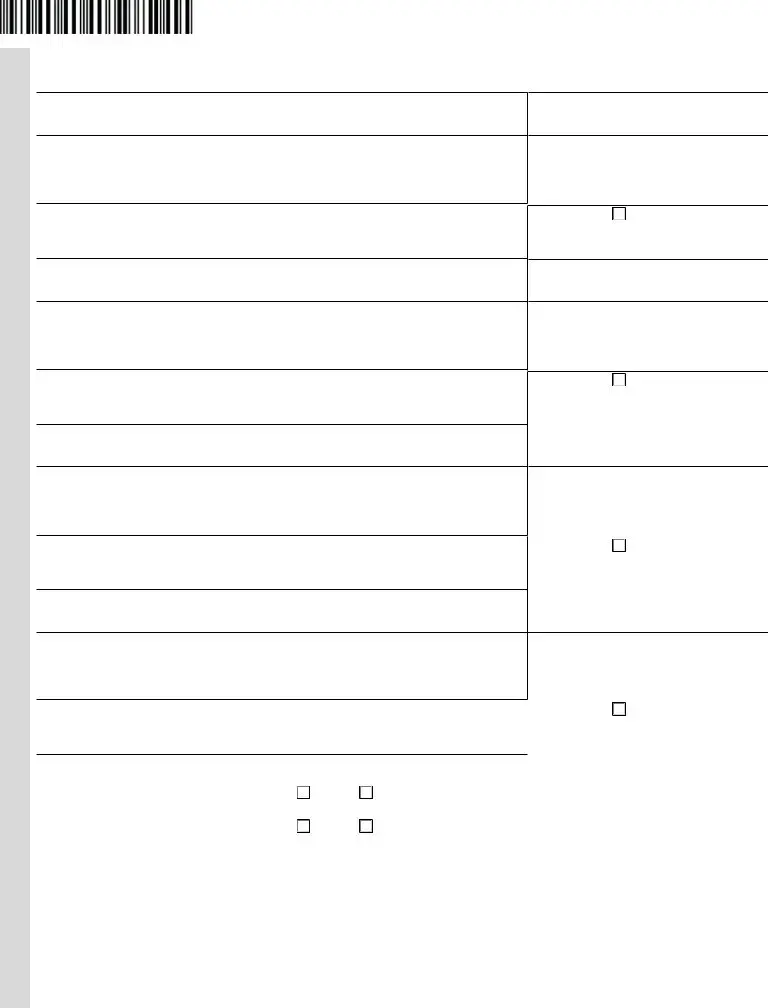

The Physical Address Provide the, City State ZIP, Fax, ext, Mailing Address Provide the name, Mailing Address if different than, City State ZIP, l a n o s a e S, s s e n s u B, Is this business location only, Last calendar month this business, p h s r e n w O s s e n s u B, and Form of Business Ownership select area will be used to put down the rights or responsibilities of each party.

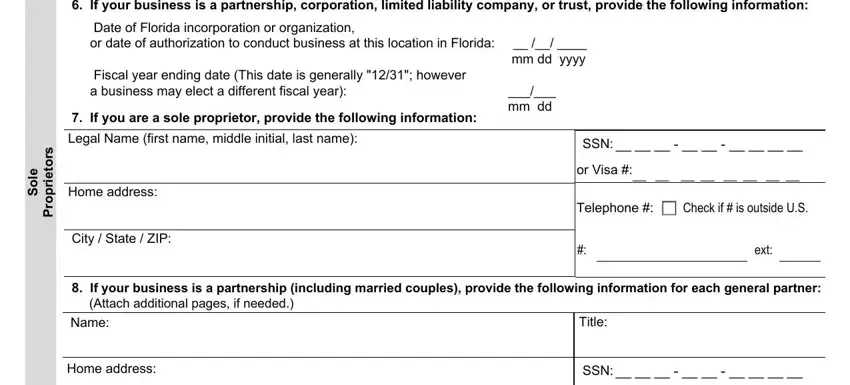

Check the areas e o S, s r o t e, i r p o r P, If your business is a partnership, Date of Florida incorporation or, Legal Name first name middle, Home address, City State ZIP, SSN, or Visa, Telephone, Check if is outside US, ext, If your business is a partnership, and Title and next fill them out.

Step 3: Press the Done button to make certain that your finalized document is available to be transferred to every device you prefer or sent to an email you specify.

Step 4: In order to avoid any kind of challenges in the long run, you will need to make a minimum of a couple of duplicates of the form.

Business entity not currently registered

Business entity not currently registered

Change the form of business ownership - Effective date: __/ __/ ____

Change the form of business ownership - Effective date: __/ __/ ____

Fax #:

Fax #: S Corporation

S Corporation

Check if # is outside U.S.

Check if # is outside U.S. Check if # is outside U.S.

Check if # is outside U.S.

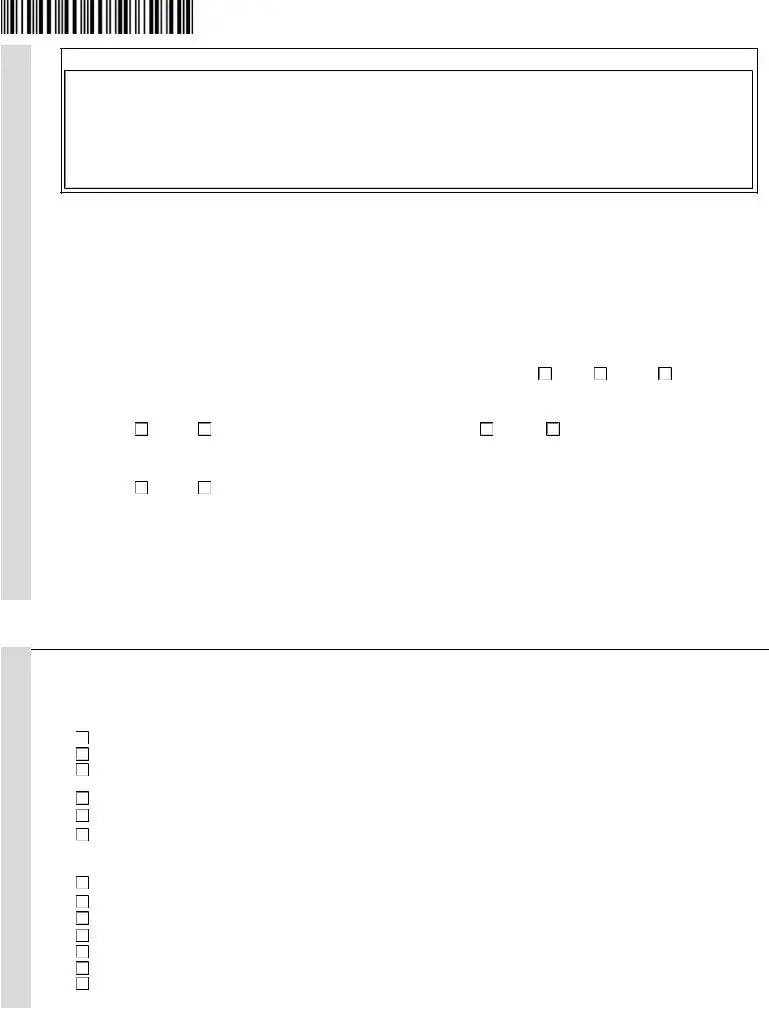

Sell products at retail (to consumers)

Sell products at retail (to consumers) Sell products at wholesale (to registered dealers who will sell to consumers)

Sell products at wholesale (to registered dealers who will sell to consumers) Sell products or goods from nonpermanent locations (such as flea markets or craft shows)

Sell products or goods from nonpermanent locations (such as flea markets or craft shows)