You may work with simplified method worksheet instantly with the help of our online editor for PDFs. In order to make our tool better and simpler to utilize, we consistently implement new features, with our users' suggestions in mind. It merely requires a few easy steps:

Step 1: Open the PDF file in our editor by hitting the "Get Form Button" in the top part of this webpage.

Step 2: As soon as you launch the PDF editor, you will see the document ready to be filled in. Apart from filling out different blank fields, you might also do several other things with the Document, namely writing any textual content, editing the original textual content, adding images, signing the form, and a lot more.

Completing this form will require attentiveness. Make sure all required fields are filled in properly.

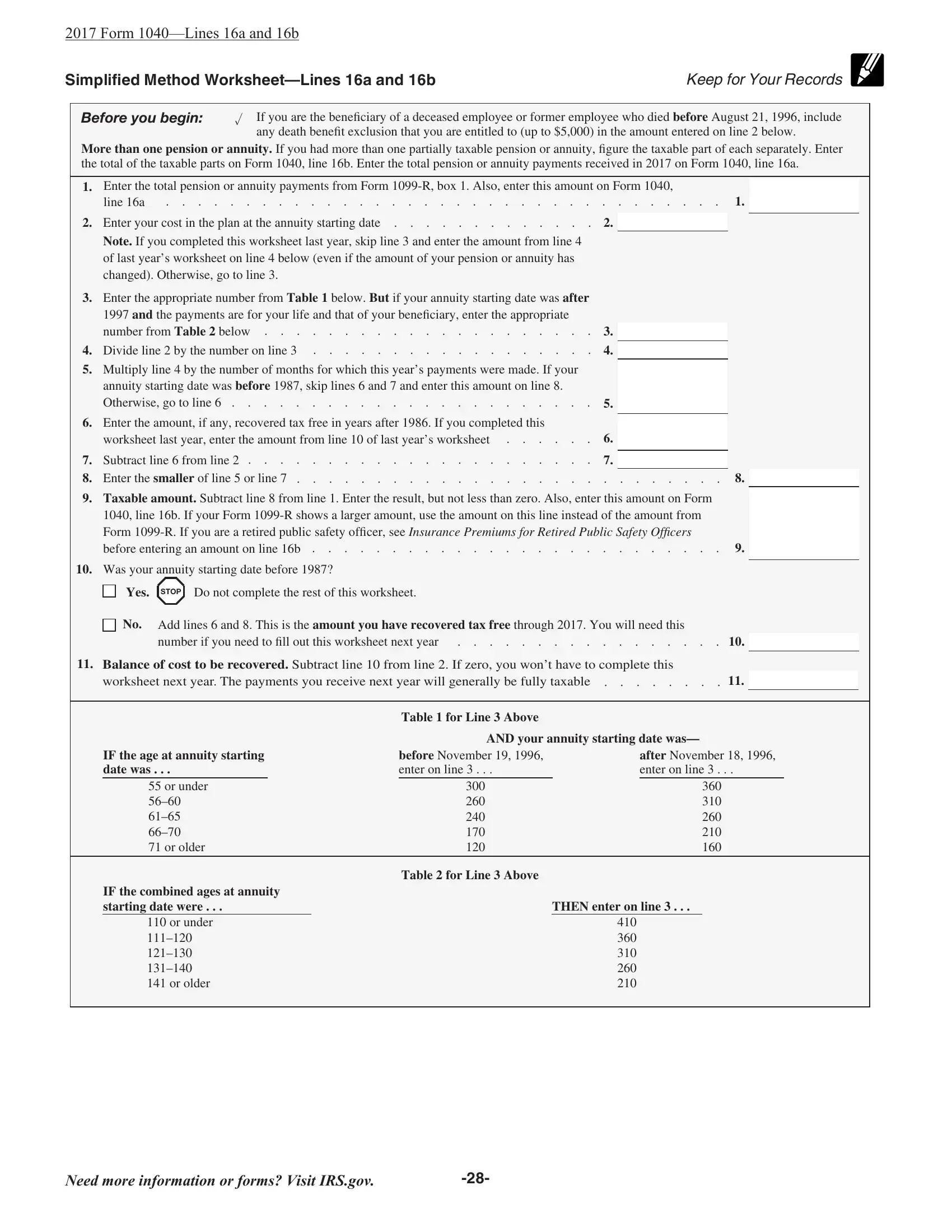

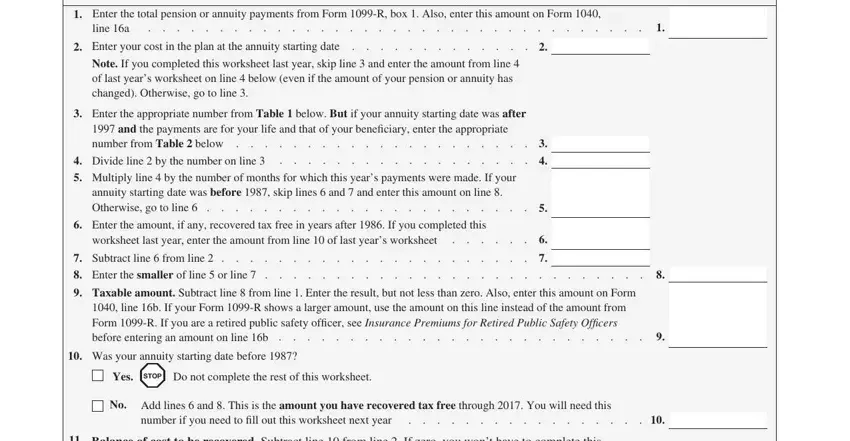

1. It is crucial to complete the simplified method worksheet properly, hence be attentive while filling out the parts including these fields:

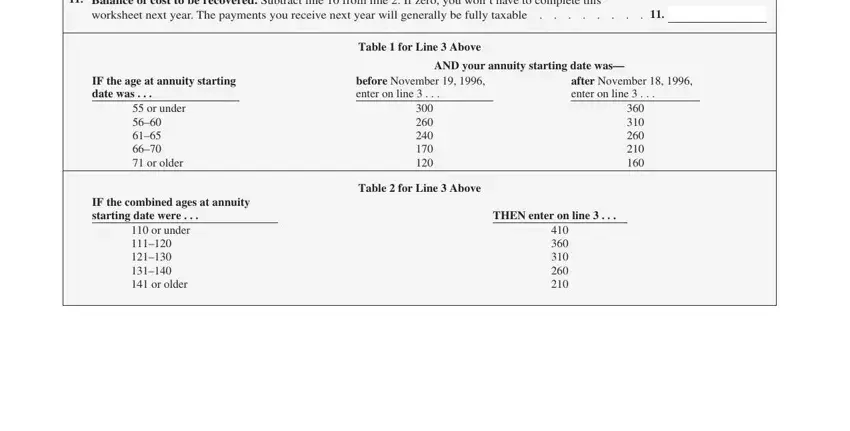

2. Now that the last array of fields is done, you're ready include the essential particulars in Balance of cost to be recovered, IF the age at annuity starting, or under or older, IF the combined ages at annuity, or under or older, Table for Line Above, AND your annuity starting date was, before November enter on line, Table for Line Above, after November enter on line, and THEN enter on line allowing you to move on further.

It is easy to get it wrong while filling in your Balance of cost to be recovered, so make sure that you take another look prior to deciding to submit it.

Step 3: Before finalizing the form, ensure that blanks were filled in properly. As soon as you determine that it is good, click on “Done." Try a free trial option with us and acquire direct access to simplified method worksheet - which you can then use as you wish inside your FormsPal account. FormsPal guarantees your data confidentiality by having a secure method that in no way saves or distributes any type of personal information used. Rest assured knowing your docs are kept safe whenever you work with our tools!