Any time you would like to fill out Form 1040 V, there's no need to install any applications - simply make use of our online PDF editor. To retain our tool on the leading edge of efficiency, we aim to put into operation user-driven capabilities and enhancements on a regular basis. We are routinely looking for feedback - join us in remolding PDF editing. Starting is easy! Everything you need to do is follow these basic steps down below:

Step 1: First, access the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: With our online PDF editor, you could accomplish more than just fill in blanks. Express yourself and make your docs seem professional with customized textual content put in, or adjust the original content to excellence - all that comes along with the capability to insert almost any pictures and sign the document off.

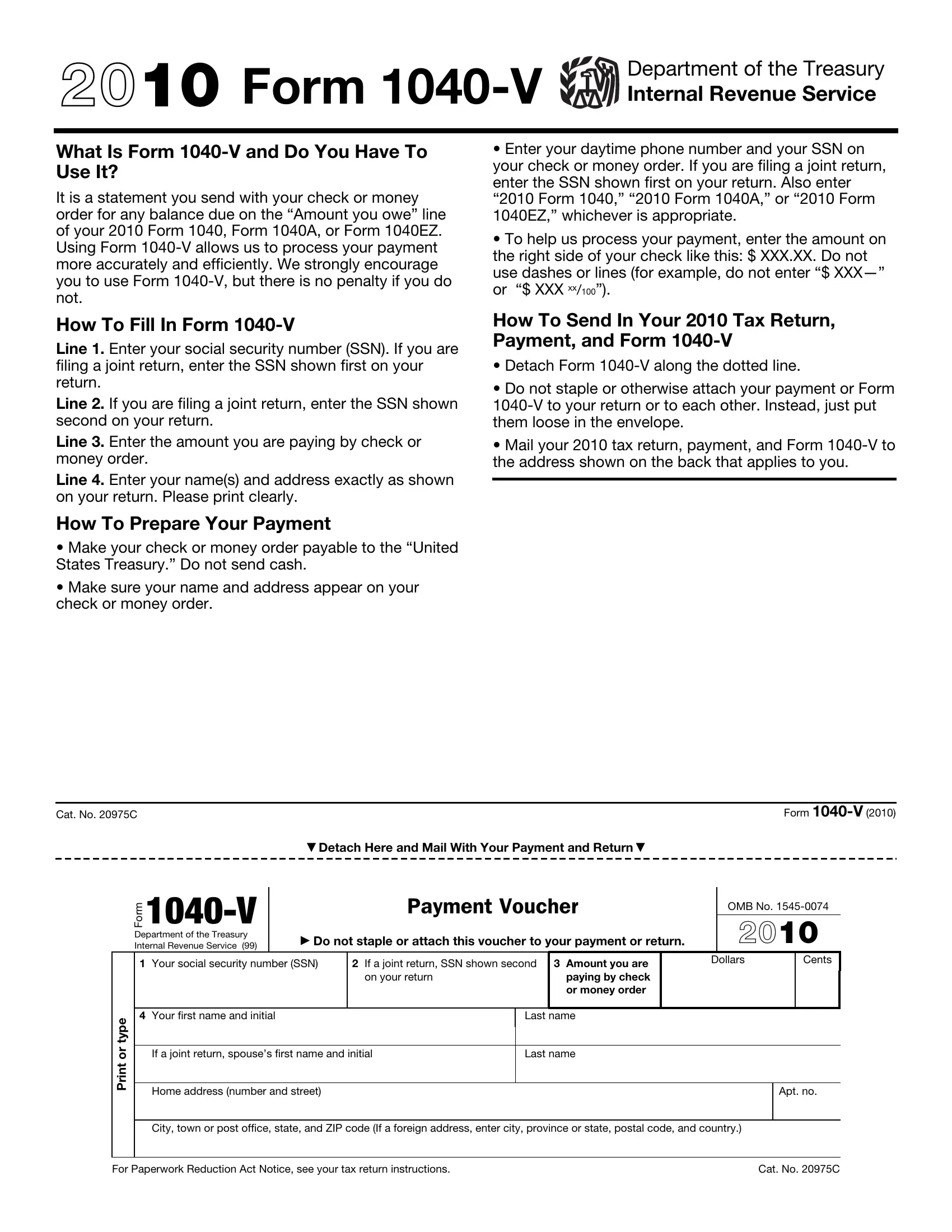

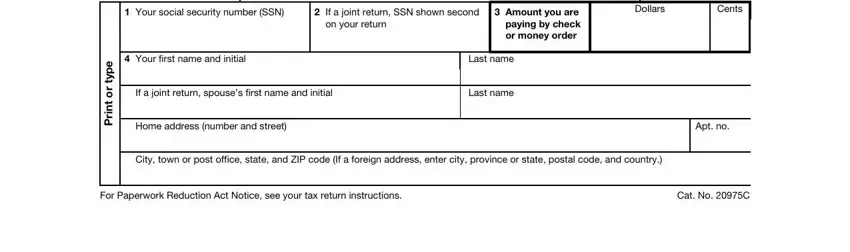

In order to finalize this PDF document, make sure that you type in the information you need in each and every field:

1. It's important to complete the Form 1040 V properly, thus be attentive when filling in the parts containing all of these blanks:

Step 3: Proofread everything you've typed into the blanks and click the "Done" button. After registering afree trial account at FormsPal, you will be able to download Form 1040 V or email it right off. The file will also be readily available via your personal account with your edits. We do not sell or share any information you enter whenever filling out documents at FormsPal.