where tax forms 1040ez can be filled out online with ease. Simply try FormsPal PDF editor to finish the job in a timely fashion. FormsPal professional team is constantly working to develop the editor and enable it to be even easier for clients with its many functions. Take your experience to another level with constantly improving and interesting possibilities we provide! All it requires is a few easy steps:

Step 1: Firstly, open the tool by clicking the "Get Form Button" above on this webpage.

Step 2: With our online PDF editing tool, you can actually do more than merely fill out blanks. Express yourself and make your docs look perfect with customized text added in, or fine-tune the file's original content to excellence - all that comes with an ability to incorporate stunning photos and sign it off.

It is actually easy to fill out the document using out practical guide! Here's what you have to do:

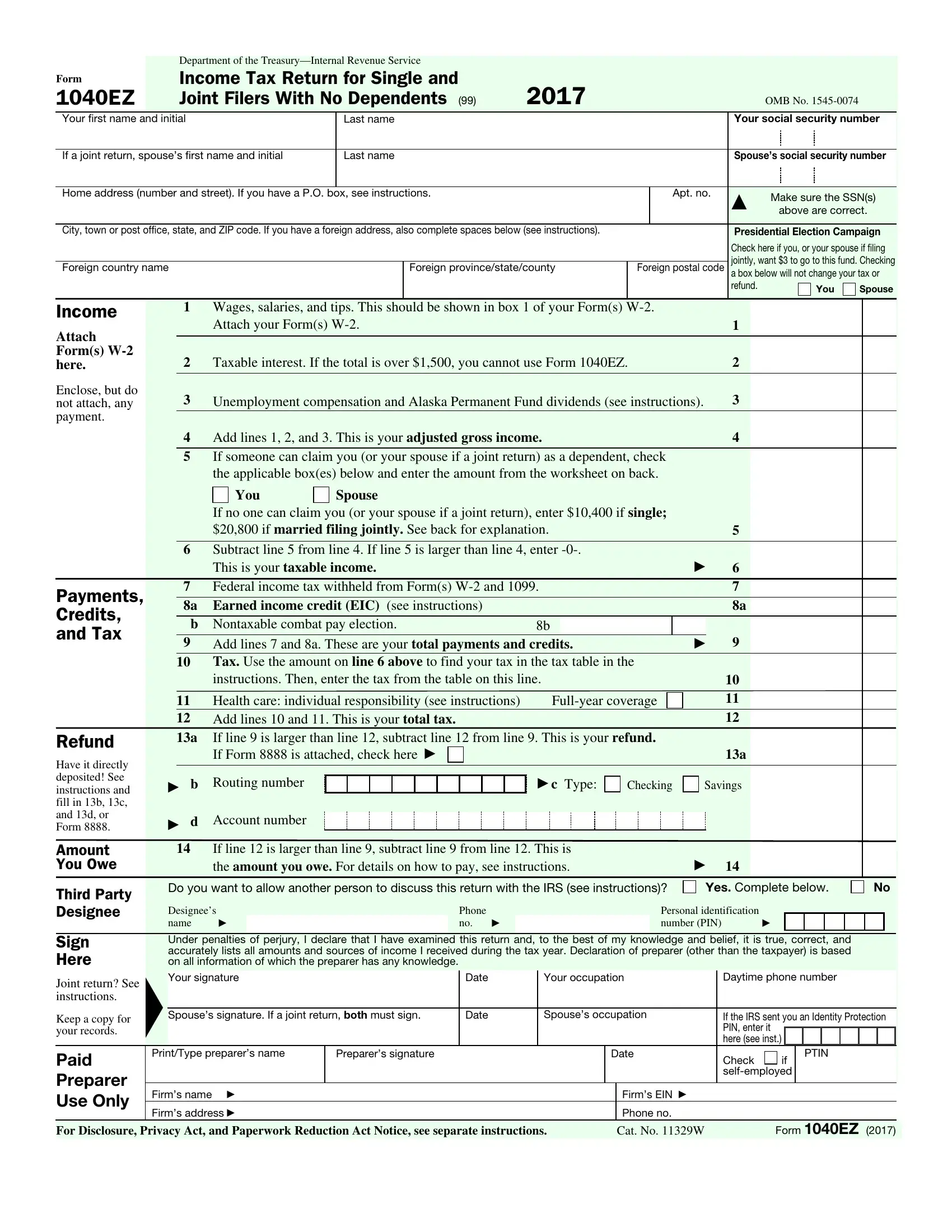

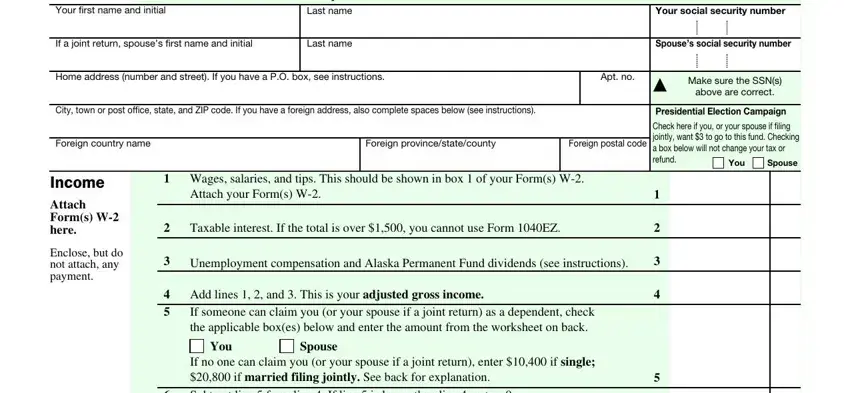

1. It is recommended to fill out the where tax forms 1040ez accurately, so be mindful while filling in the parts including all of these blanks:

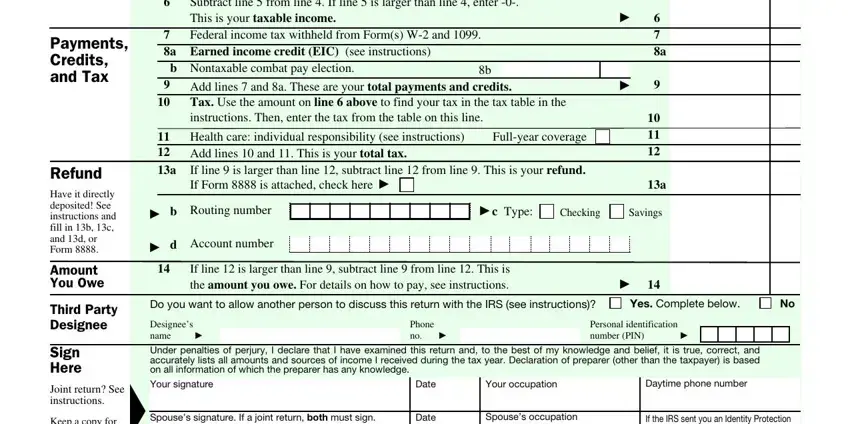

2. Just after this part is completed, proceed to enter the relevant information in all these: Payments Credits and Tax, Refund, Have it directly deposited See, Amount You Owe, Third Party Designee, Sign Here, Subtract line from line If line , a Earned income credit EIC see, a, b Nontaxable combat pay election, Add lines and a These are your, Health care individual, b Routing number, d Account number, and c Type.

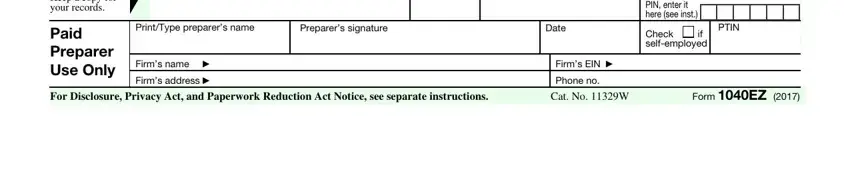

3. The next segment is fairly straightforward, If the IRS sent you an Identity, Check if selfemployed, PTIN, Your signature, Keep a copy for your records, Paid Preparer Use Only, PrintType preparers name, Preparers signature, Date, Firms name , Firms address , Firms EIN , Phone no, For Disclosure Privacy Act and, and Cat No W - all these blanks has to be filled out here.

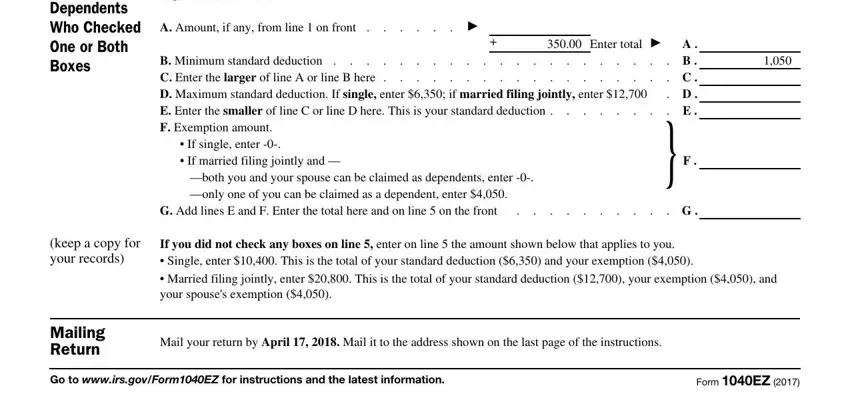

4. Filling out Worksheet for Line Dependents, Use this worksheet to figure the, A Amount if any from line on front, B Minimum standard deduction C, Enter total , If single enter If married, both you and your spouse can be, A B C D E , F , G Add lines E and F Enter the, G , keep a copy for your records, If you did not check any boxes on, Married filing jointly enter , and Mailing Return is paramount in this part - don't forget to be patient and fill in each and every empty field!

People frequently make errors while completing Married filing jointly enter in this area. Ensure you read again what you type in right here.

Step 3: Right after you've glanced through the details in the blanks, click on "Done" to complete your form at FormsPal. Sign up with us right now and instantly obtain where tax forms 1040ez, set for downloading. All alterations made by you are preserved , which means you can edit the file later as required. We do not share any details you enter while working with forms at FormsPal.