If you desire to fill out 1041 a charitable, it's not necessary to install any kind of applications - simply try our PDF editor. We at FormsPal are aimed at giving you the perfect experience with our editor by consistently releasing new functions and upgrades. With all of these updates, working with our editor becomes easier than ever before! Here is what you would want to do to begin:

Step 1: Hit the orange "Get Form" button above. It'll open our editor so that you could begin filling out your form.

Step 2: Using this state-of-the-art PDF tool, you'll be able to accomplish more than just complete blank fields. Express yourself and make your forms seem sublime with customized text added in, or adjust the file's original content to perfection - all that accompanied by the capability to add your personal pictures and sign the document off.

Be mindful while completing this pdf. Make sure that all necessary blanks are filled out properly.

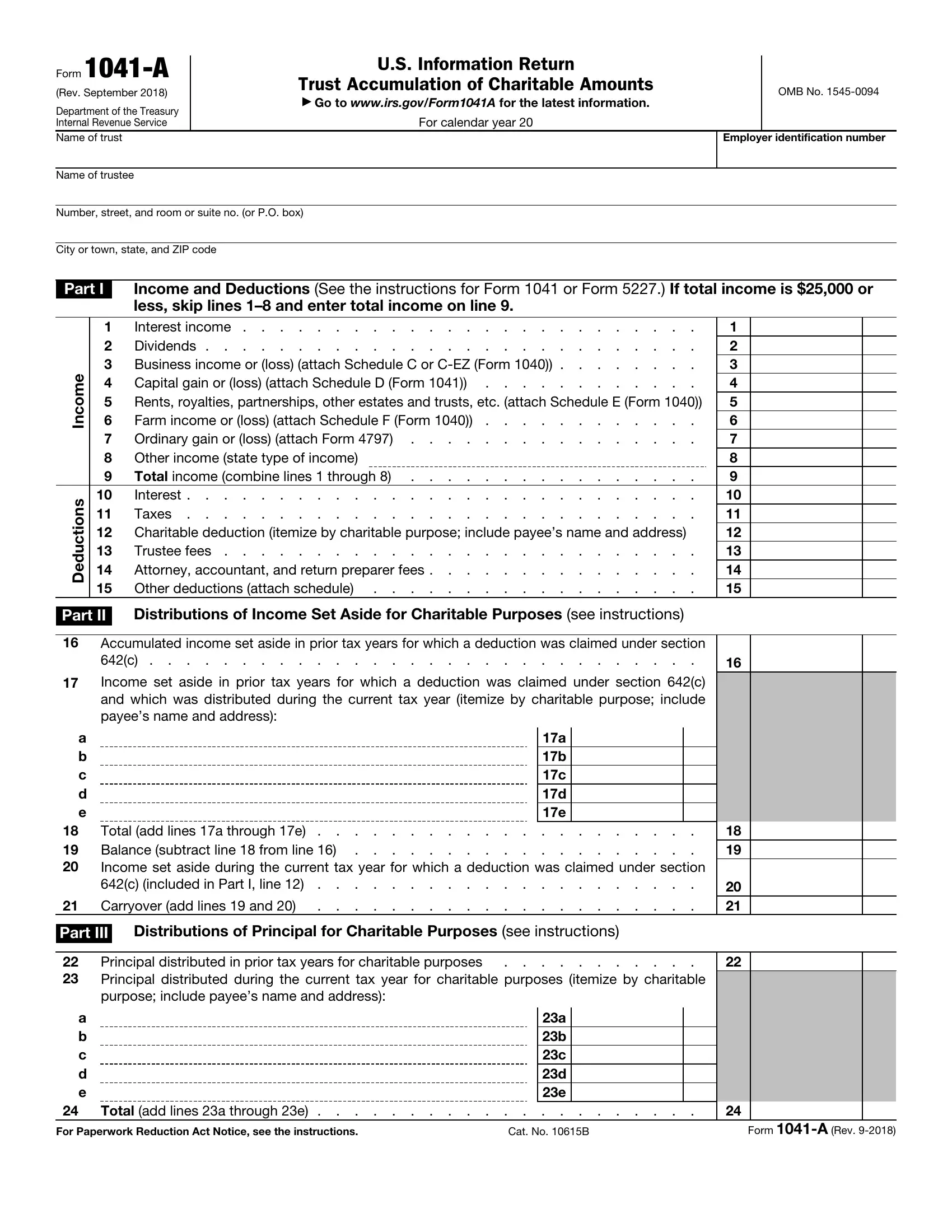

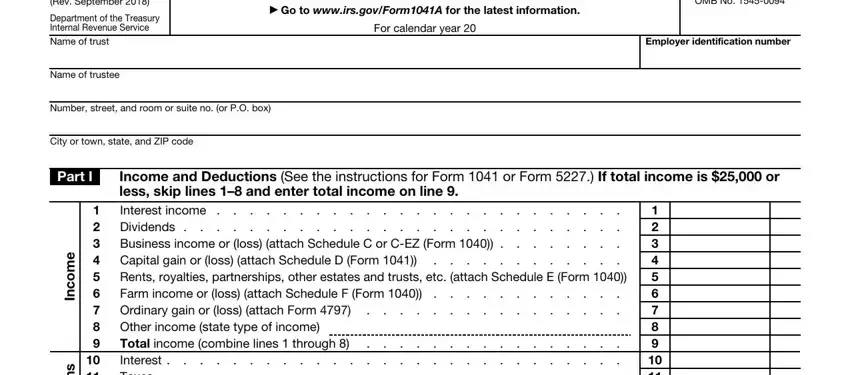

1. Fill out your 1041 a charitable with a group of essential blank fields. Gather all the necessary information and be sure there is nothing omitted!

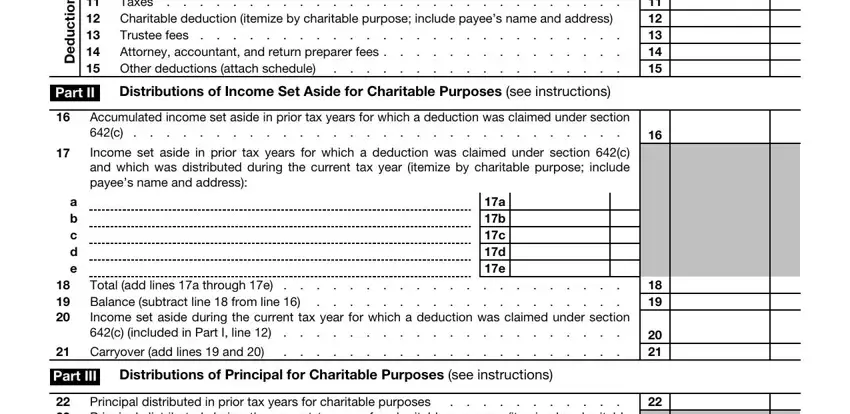

2. After the previous segment is complete, you should put in the required specifics in Dividends Business income or, Trustee fees Attorney accountant, Total income combine lines, Part II, Distributions of Income Set Aside, Accumulated income set aside in, Income set aside in prior tax, a b c d e, Total add lines a through e, Balance subtract line from, Income set aside during the, Carryover add lines and, Part III Distributions of, Principal distributed in prior tax, and a b c d e so that you can move on further.

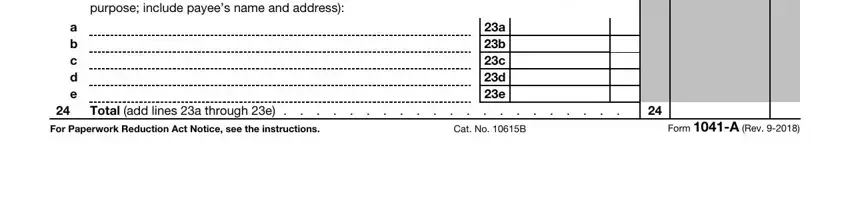

3. The following part is all about Principal distributed in prior tax, a b c d e, Total add lines a through e, For Paperwork Reduction Act Notice, Cat No B, Form A Rev, and a b c d e - complete all of these fields.

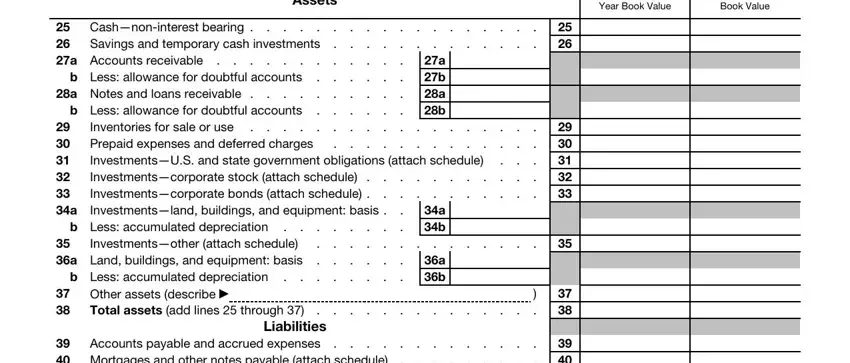

4. The form's fourth subsection arrives with the following blank fields to look at: Assets, a Beginningof Year Book Value, b EndofYear, Book Value, a b a b, a Notes and loans receivable, Cashnoninterest bearing a, b Less allowance for doubtful, Savings and temporary cash, Investmentsother attach schedule, b Less accumulated depreciation, b Less accumulated depreciation, a b, a b, and Other assets describe.

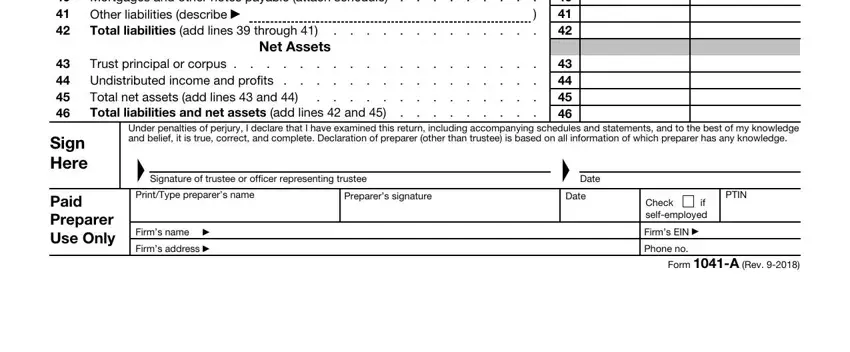

5. To conclude your document, the particular segment requires a couple of extra fields. Filling out Mortgages and other notes, Total liabilities add lines, Trust principal or corpus, Undistributed income and, Total net assets add lines, Net Assets, Sign Here, Paid Preparer Use Only, Under penalties of perjury I, Signature of trustee or officer, PrintType preparers name, Preparers signature, Date, Date, and Firms name is going to wrap up the process and you can be done in a flash!

Always be really careful when completing Total liabilities add lines and PrintType preparers name, since this is the section in which most users make some mistakes.

Step 3: Revise all the information you have inserted in the blank fields and then click the "Done" button. Acquire your 1041 a charitable the instant you sign up for a 7-day free trial. Instantly access the pdf document within your FormsPal cabinet, with any edits and adjustments automatically saved! FormsPal offers risk-free form tools devoid of personal data record-keeping or distributing. Feel comfortable knowing that your data is secure here!