If you wish to fill out ATEF, there's no need to download and install any software - just use our online PDF editor. To have our editor on the cutting edge of convenience, we strive to put into operation user-oriented capabilities and enhancements on a regular basis. We are routinely grateful for any suggestions - play a vital part in revolutionizing PDF editing. If you're seeking to get going, here's what it takes:

Step 1: First of all, open the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The editor offers you the capability to customize PDF forms in a variety of ways. Enhance it by including your own text, adjust existing content, and place in a signature - all doable in no time!

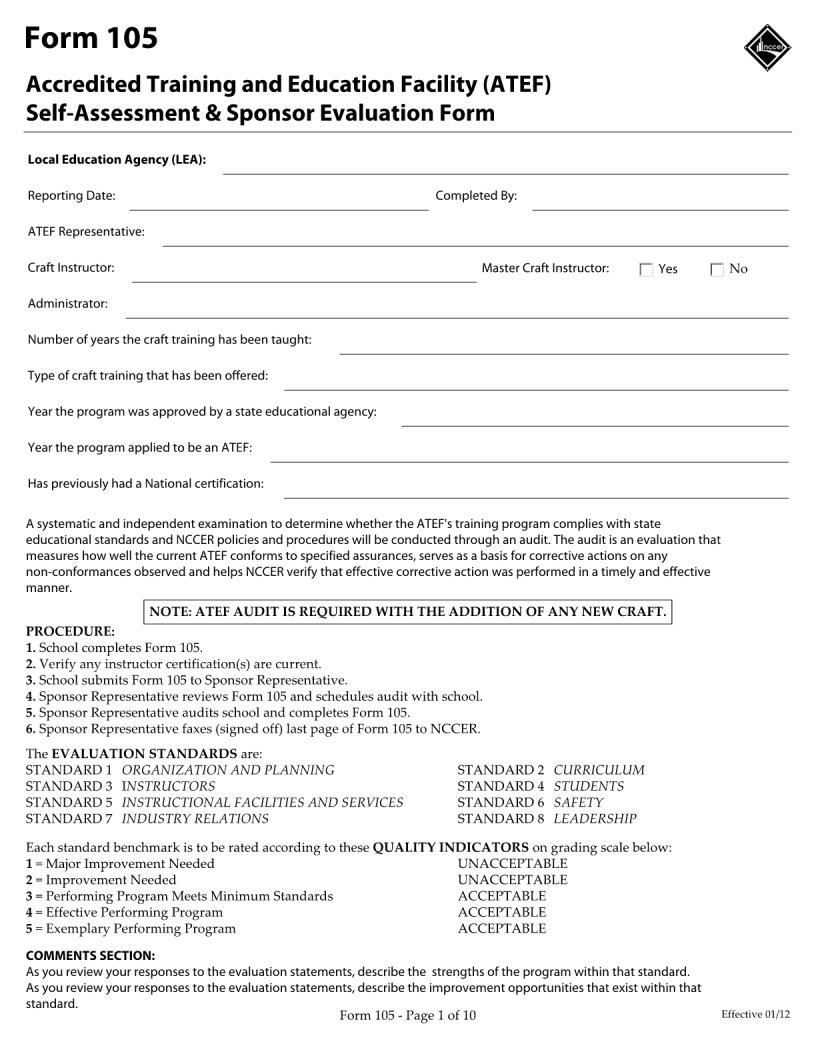

If you want to finalize this form, make sure you enter the necessary information in every blank field:

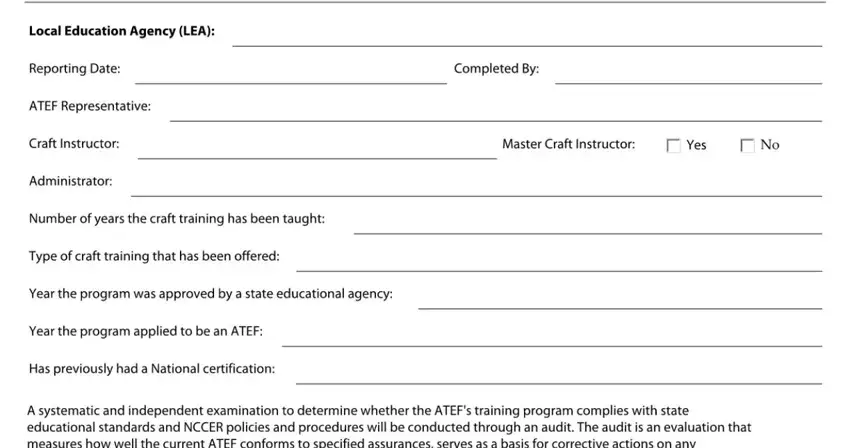

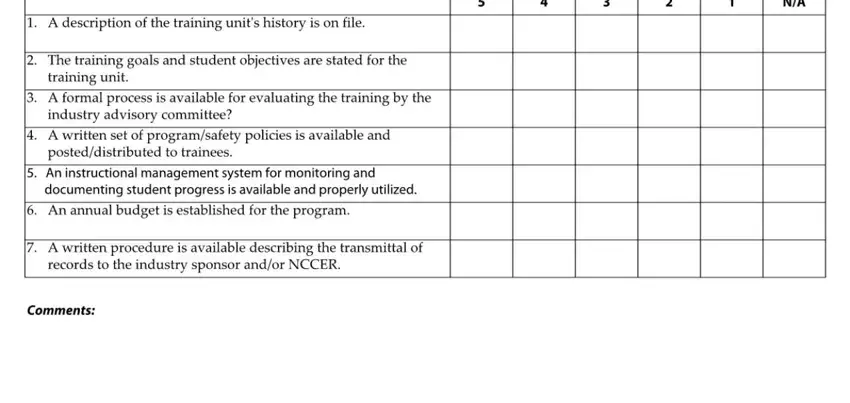

1. The ATEF necessitates specific details to be typed in. Ensure that the following blank fields are filled out:

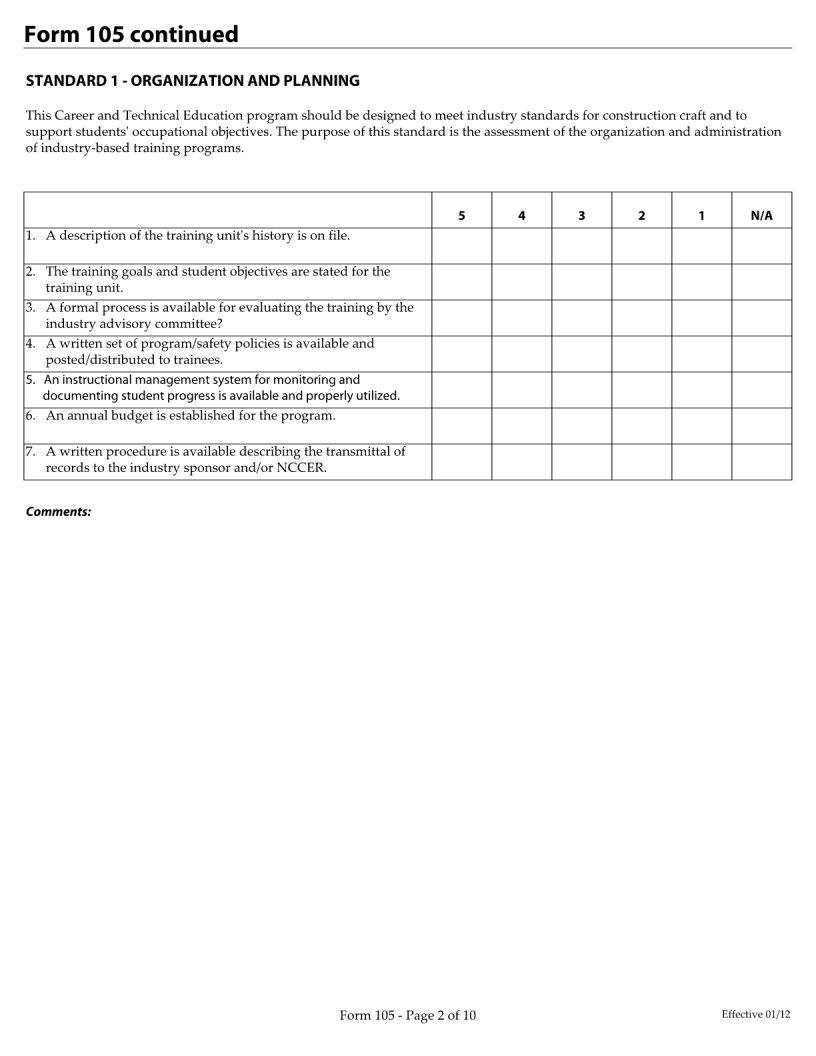

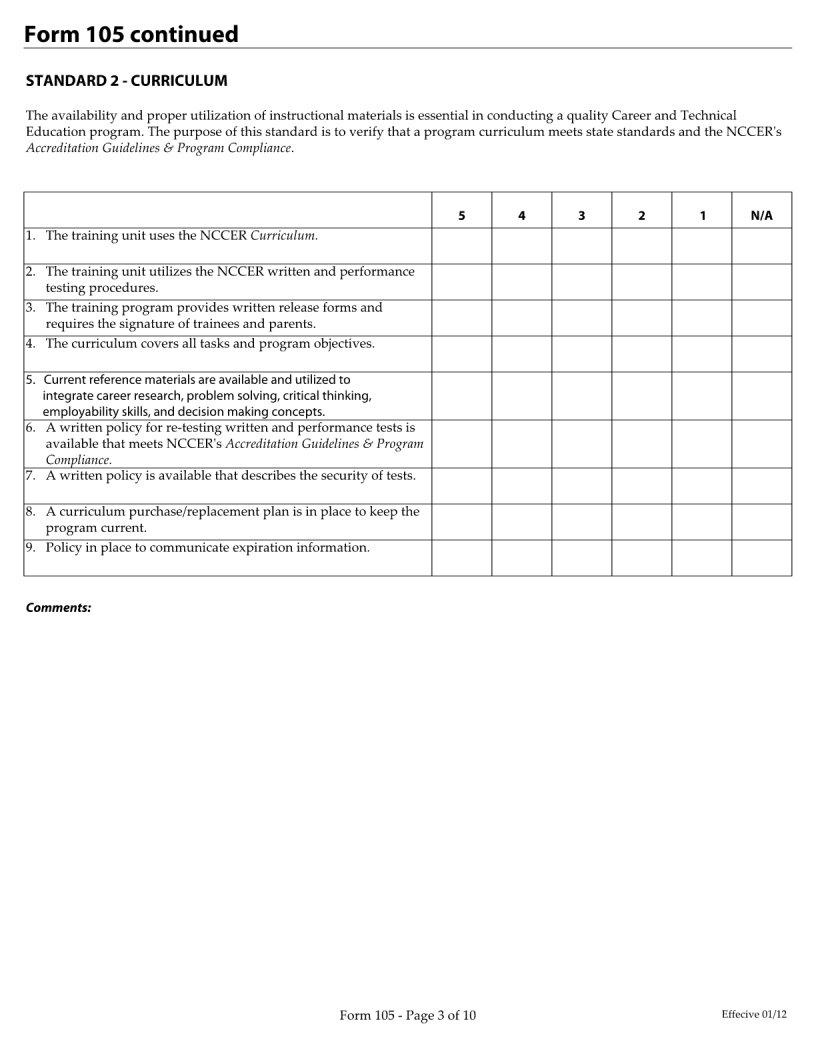

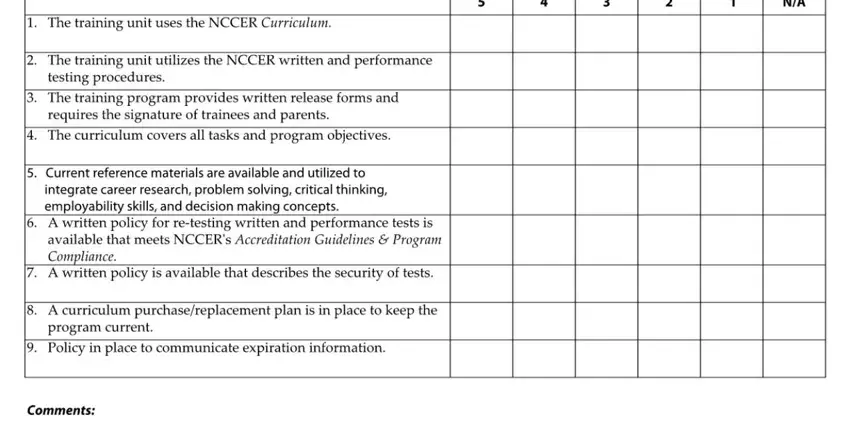

2. Immediately after this array of blanks is filled out, proceed to type in the relevant details in all these: .

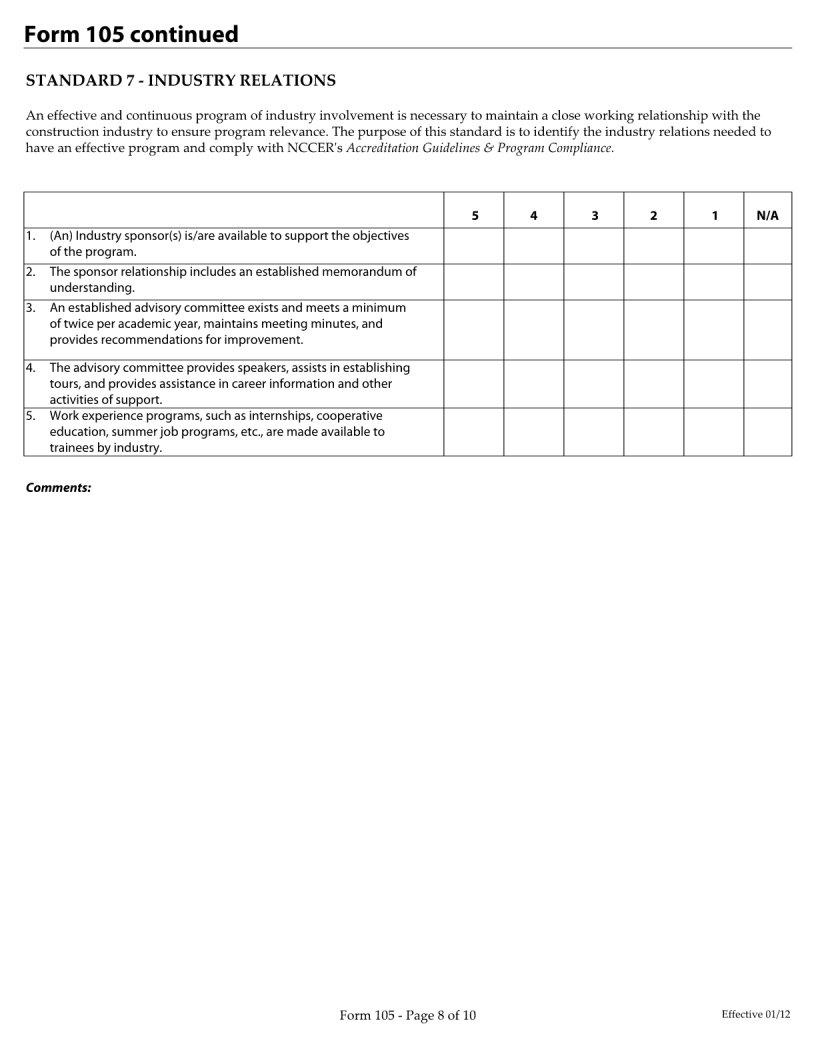

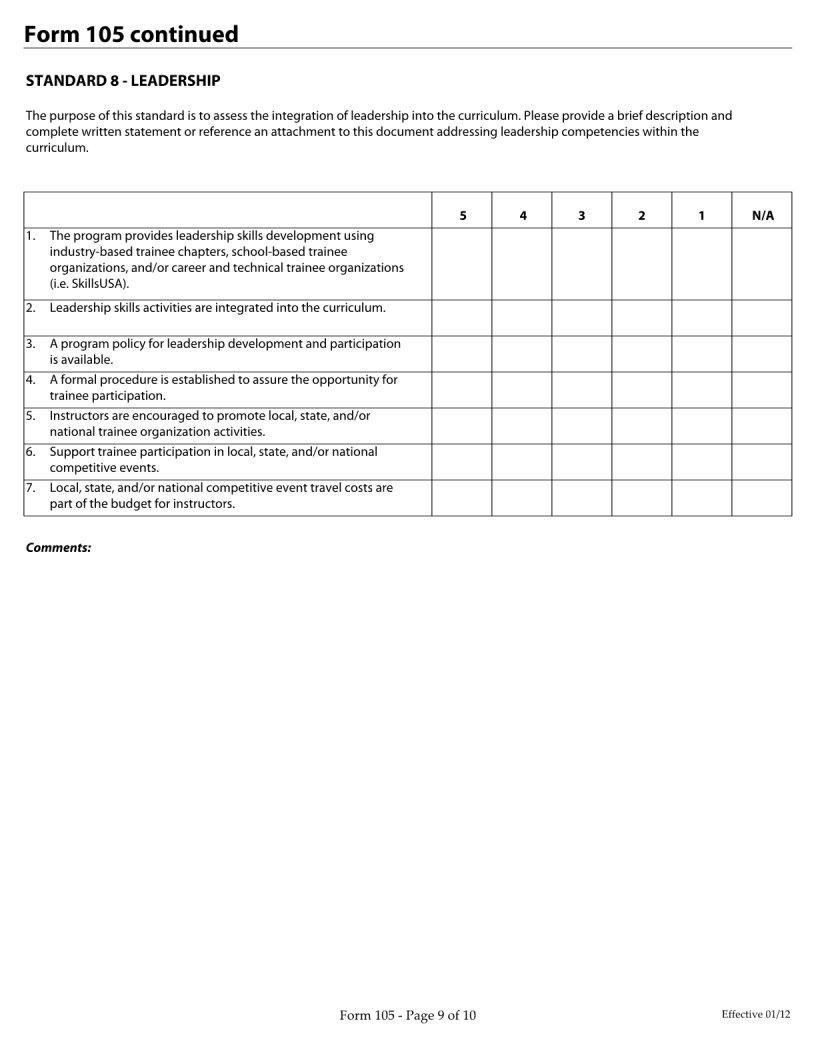

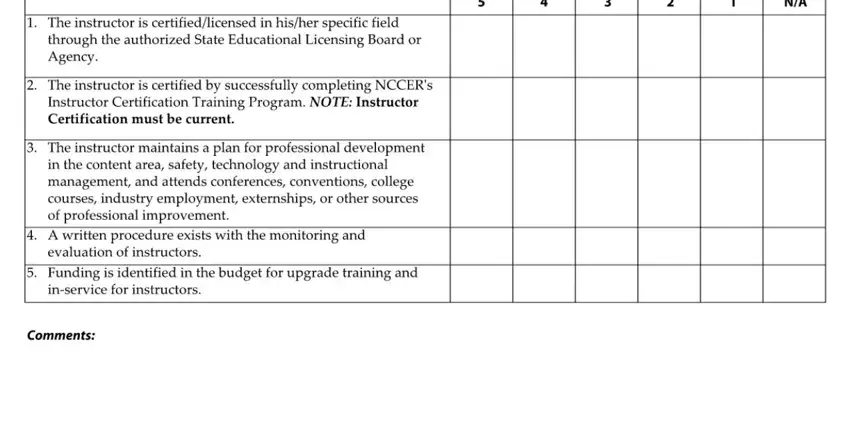

3. The following part is all about - type in every one of these blank fields.

People often make errors when filling out this field in this part. Be sure to go over whatever you enter right here.

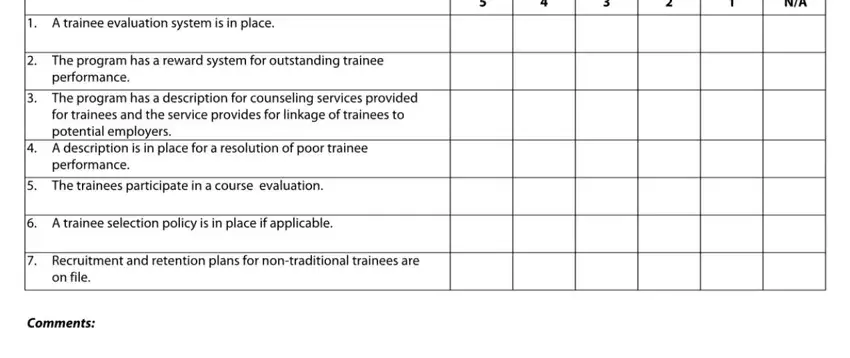

4. The following section will require your attention in the subsequent parts: . Just remember to enter all needed information to move further.

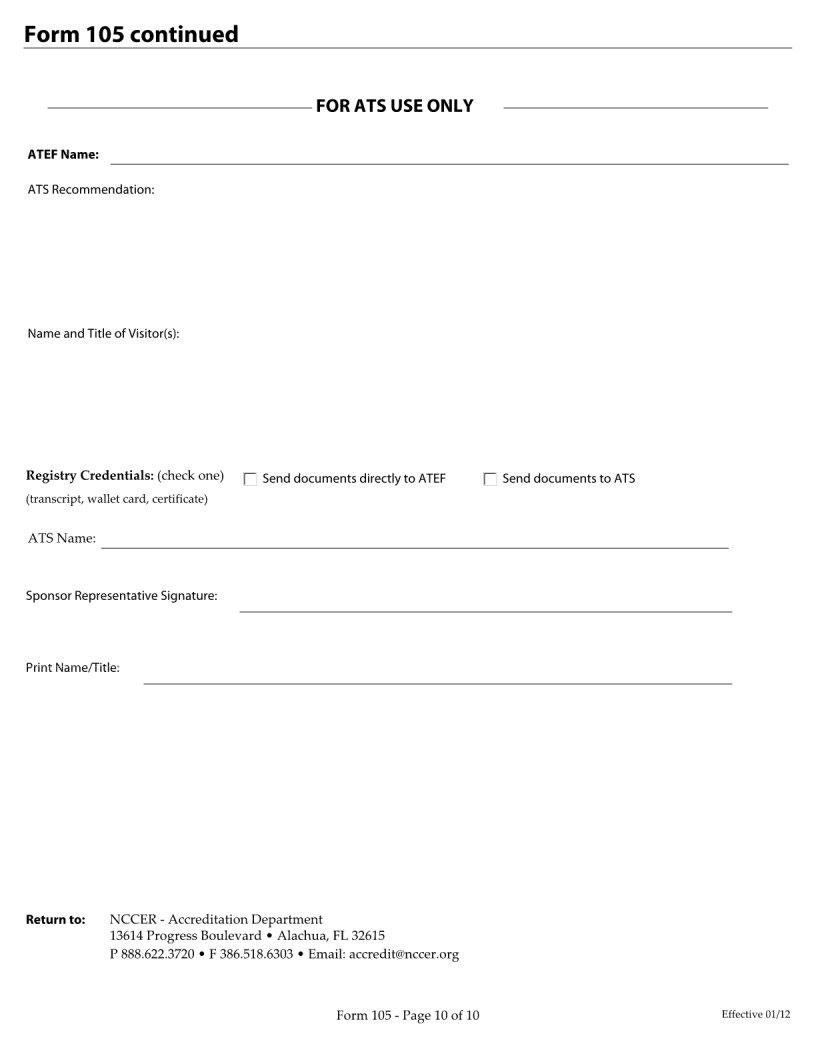

5. And finally, this final section is precisely what you will need to wrap up before submitting the PDF. The blank fields here include the following: .

Step 3: After proofreading your filled out blanks, hit "Done" and you are all set! Right after registering a7-day free trial account with us, you will be able to download ATEF or send it through email without delay. The file will also be at your disposal from your personal cabinet with all of your edits. At FormsPal, we do our utmost to make sure that your information is maintained private.