General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Schedule B-1 (Form 1065) and its instructions, such as legislation enacted after the form and instructions were published, go to WWW.IRS.GOV/FORM1065.

Purpose of Form

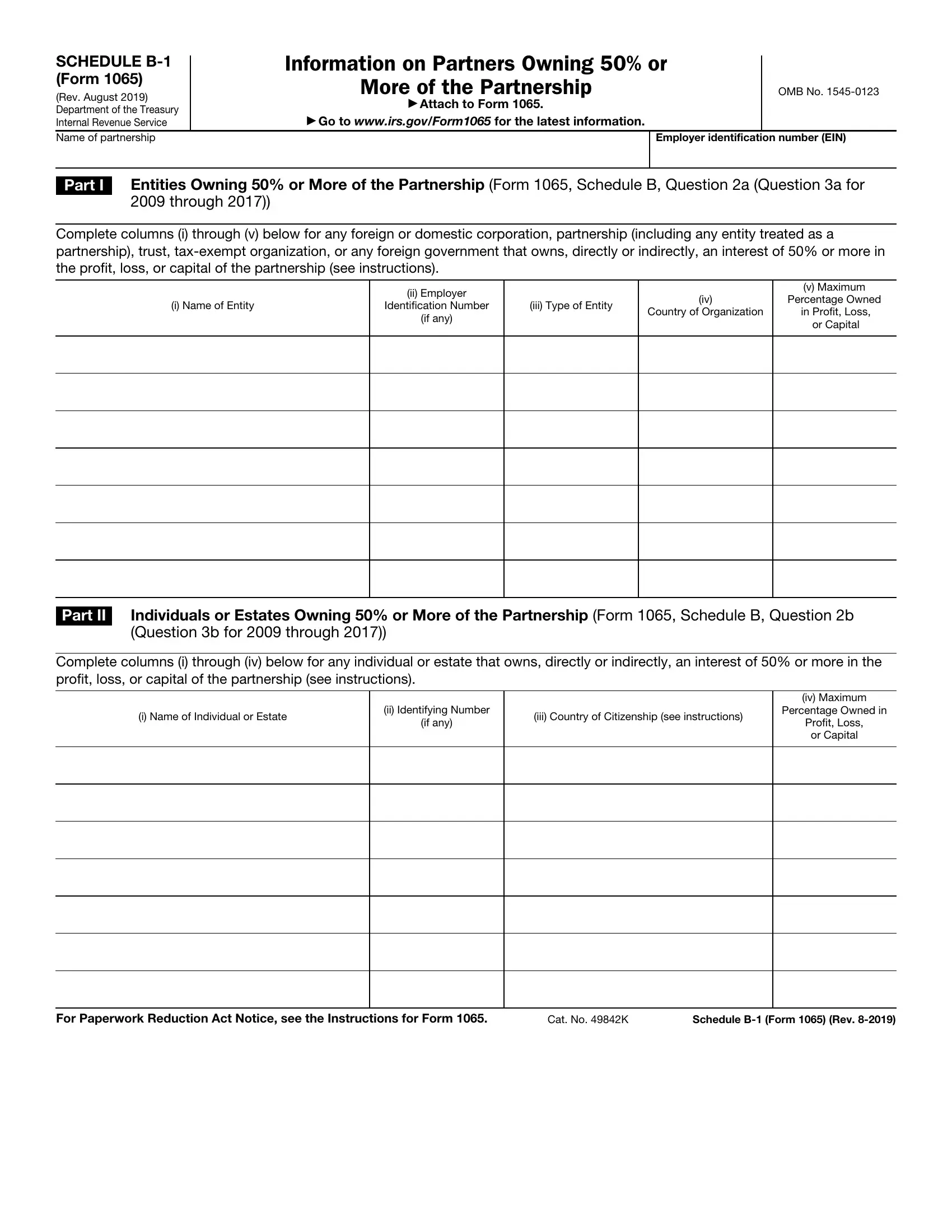

Use Schedule B-1 (Form 1065) to provide the information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

Who Must File

Schedule B-1 (Form 1065) must be filed by all partnerships that answer “Yes” to question 2a or question 2b (question 3a or question 3b for 2009 through 2017) on Form 1065, Schedule B. Attach Schedule B-1 to Form 1065.

Specific Instructions

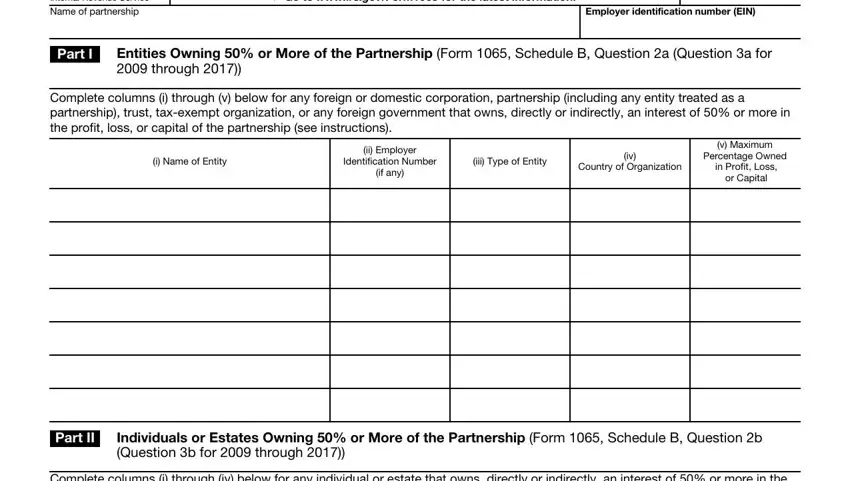

Part I

Complete Part I if the partnership answered “Yes” to Form 1065, Schedule B, question 2a (question 3a for 2009 through 2017). List each corporation, partnership, trust, tax-exempt organization, or foreign government owning, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership at the end of the tax year. Enter the name, EIN, type of entity (corporation, partnership, trust, tax- exempt organization, or foreign government), country of organization, and the maximum percentage interests owned, directly or indirectly, in the profit, loss, or capital of the partnership. For an affiliated group filing a consolidated tax return, list the parent corporation rather than the subsidiary members. List the entity owner of a disregarded entity rather than the disregarded entity. If the owner of a disregarded entity is an individual rather than an entity, list the individual in Part II. In the case of a tax-exempt organization, enter “tax-exempt organization” in column (iii).

Example 1. Corporation A owns, directly, an interest of 50% in the profit, loss, or capital of Partnership B. Corporation A also owns, directly, an interest of 15% in the profit, loss, or capital of Partnership C. Partnership B owns, directly, an interest of 70% in the profit, loss, or capital of Partnership C. Therefore, Corporation A owns, directly or indirectly, an interest of 50% in the profit, loss, or capital of Partnership C (15% directly and 35% indirectly through Partnership B). On Partnership C’s Form 1065, it must answer “Yes” to question 2a (question 3a for 2009 through 2017) of Schedule B. Partnership C must also complete Part I of Schedule B-1. In Part I, Partnership C must identify Corporation A, which includes entering “50%” in column (v) (its maximum percentage owned). It also must identify Partnership B, and enter “70%” in column

(v).

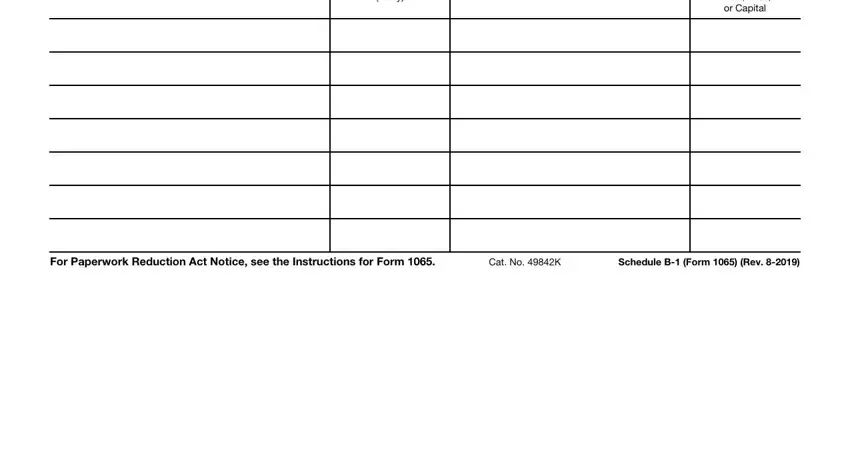

Part II

Complete Part II if the partnership answered “Yes” to Form 1065, Schedule B, question 2b (question 3b for 2009 through 2017). List each individual or estate owning, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership at the end of the tax year. Enter the name, social security or employer identification number, country of citizenship (for an estate, the citizenship of the decedent), and the maximum percentage interests owned, directly or indirectly, in the profit, loss, or capital of the partnership.

Example 2. A owns, directly, 50% of the profit, loss, or capital of Partnership X. B, the daughter of A, does not own, directly, any interest in X and does not own, indirectly, any interest in X through any entity (corporation, partnership, trust, or estate).

Because family attribution rules apply only when an individual (in this example, B) owns a direct interest in the partnership or an indirect interest through another entity, A’s interest in Partnership X is not attributable to B. On Partnership X’s Form 1065, it must answer “Yes” to question 2b (question 3b for 2009 through 2017) of Schedule B. Partnership X must also complete Part II of Schedule B-1. In Part II, Partnership X must identify A, which includes entering “50%” in column (iv). Partnership X will not identify B in Part II.