You can fill out NJK-1 easily using our PDFinity® editor. To maintain our editor on the forefront of efficiency, we aim to implement user-driven capabilities and enhancements on a regular basis. We're always glad to get suggestions - play a vital part in revolutionizing PDF editing. It merely requires several easy steps:

Step 1: Click the orange "Get Form" button above. It will open our pdf editor so you could begin completing your form.

Step 2: This tool will give you the ability to customize your PDF document in a range of ways. Change it with personalized text, correct existing content, and put in a signature - all possible within a few minutes!

It is actually simple to complete the pdf using this detailed tutorial! Here's what you need to do:

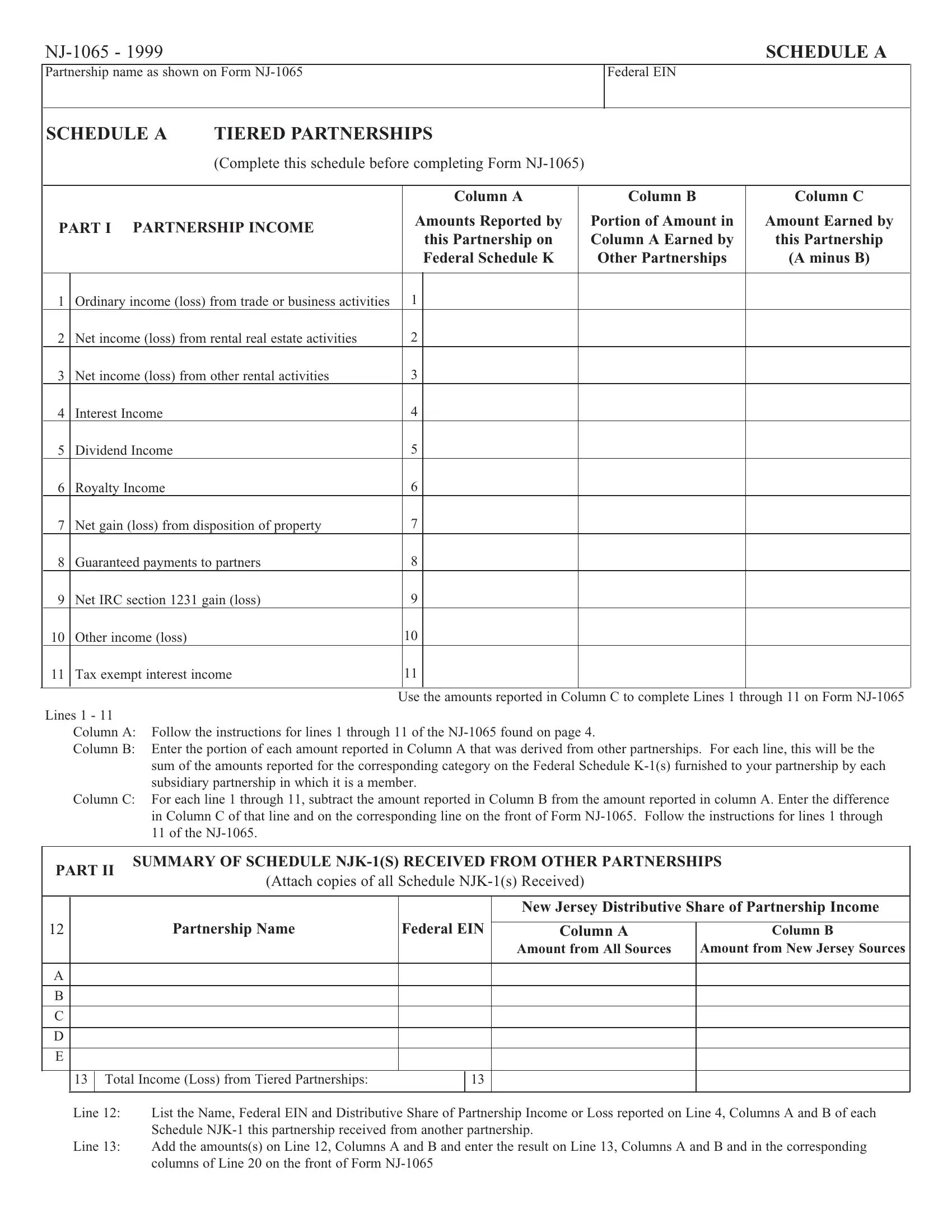

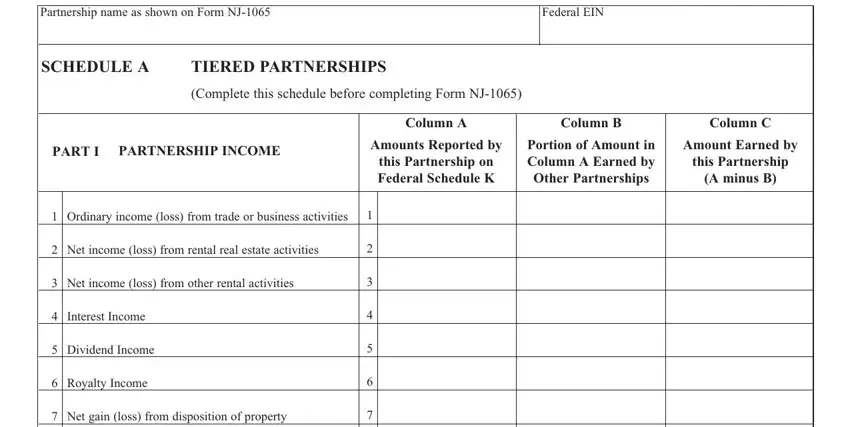

1. While completing the NJK-1, be sure to incorporate all essential blanks in their associated part. This will help to hasten the work, enabling your details to be handled without delay and correctly.

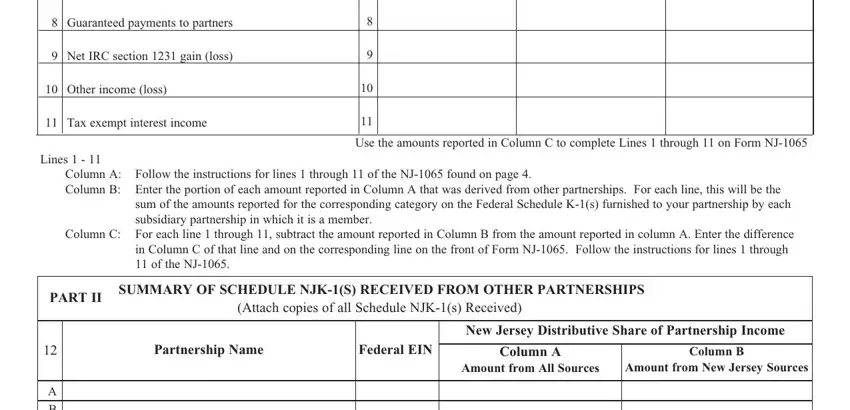

2. Once the previous part is done, go on to enter the suitable information in all these: Guaranteed payments to partners, Net IRC section gain loss, Other income loss, Tax exempt interest income, Lines, Use the amounts reported in Column, Column A Follow the instructions, Column C, sum of the amounts reported for, PART II, SUMMARY OF SCHEDULE NJKS RECEIVED, Attach copies of all Schedule NJKs, Partnership Name, Federal EIN, and Column A.

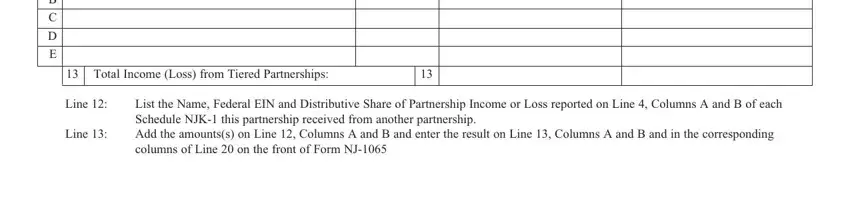

3. Completing Total Income Loss from Tiered, Line, Line, and List the Name Federal EIN and is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

People who work with this document generally get some things wrong when filling out Line in this section. You should read again what you enter here.

Step 3: Prior to moving on, double-check that all blanks were filled in correctly. As soon as you think it's all fine, click on “Done." Right after creating a7-day free trial account at FormsPal, you'll be able to download NJK-1 or email it directly. The PDF will also be readily accessible through your personal cabinet with your every single edit. FormsPal guarantees safe document editor with no personal information recording or any sort of sharing. Feel at ease knowing that your data is in good hands here!