With the help of the online editor for PDFs by FormsPal, you are able to fill in or alter irs form 1065 schedule c here and now. FormsPal development team is constantly endeavoring to improve the editor and make it much easier for clients with its extensive functions. Discover an endlessly progressive experience now - take a look at and find out new opportunities along the way! Getting underway is easy! Everything you should do is adhere to these basic steps down below:

Step 1: Press the "Get Form" button above. It is going to open up our pdf editor so that you can begin completing your form.

Step 2: As you launch the editor, you will find the form prepared to be filled out. Besides filling out different fields, you can also do other sorts of actions with the Document, specifically writing any words, modifying the original textual content, adding images, affixing your signature to the document, and a lot more.

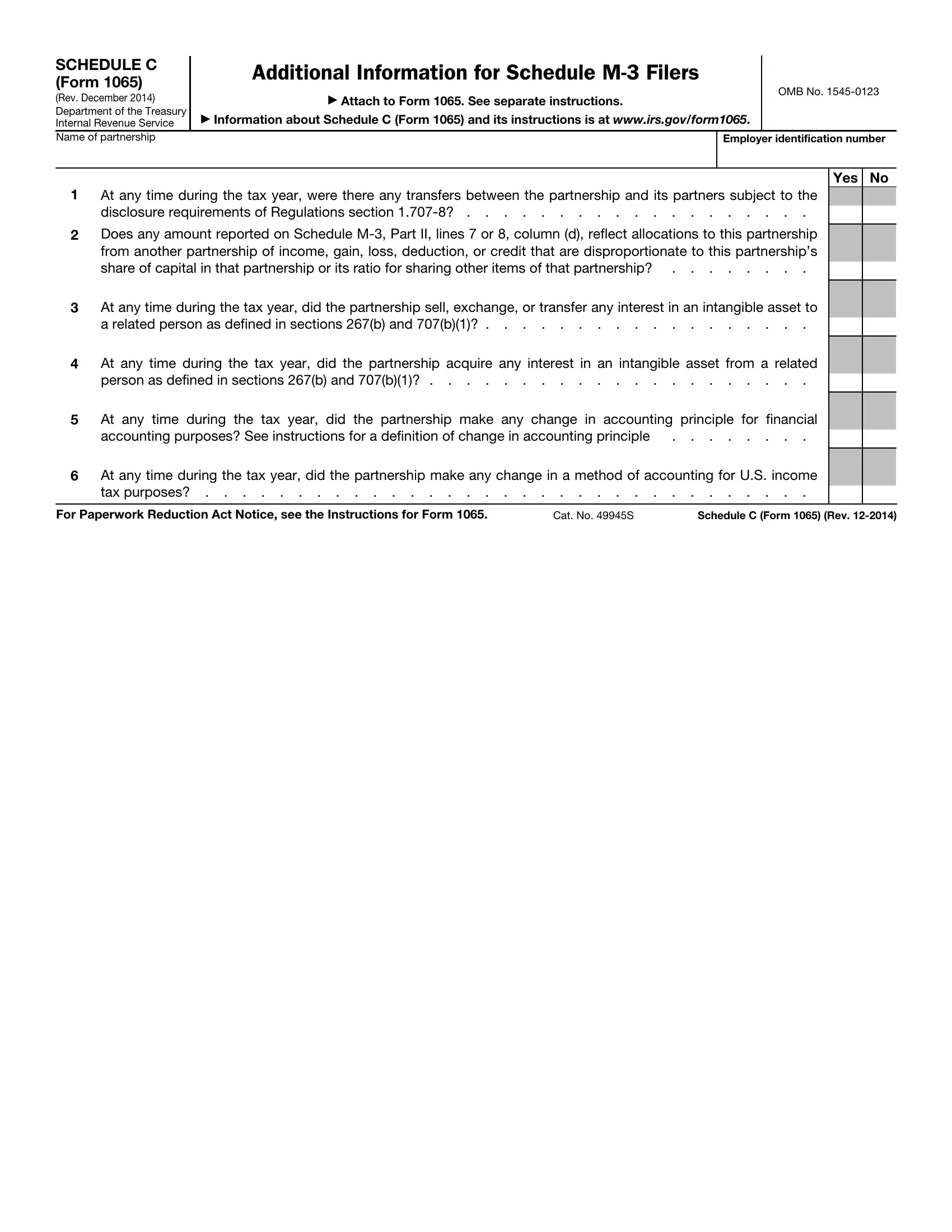

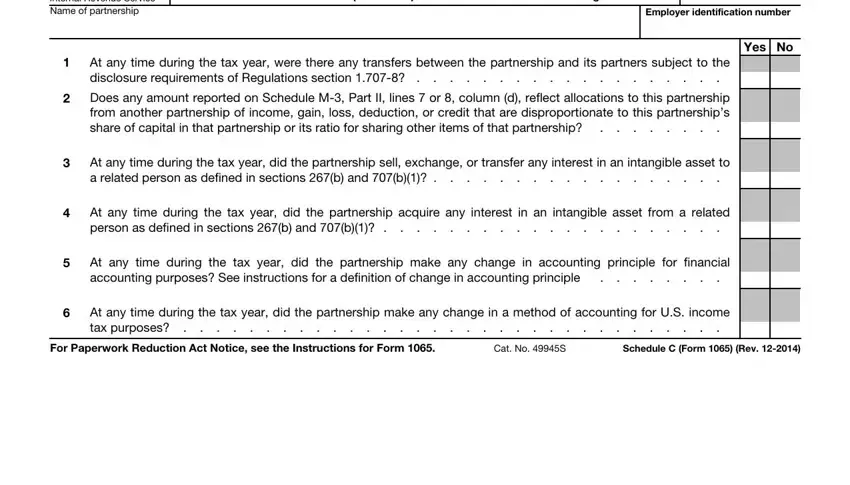

As a way to fill out this PDF document, make certain you type in the right information in each blank field:

1. To begin with, once filling in the irs form 1065 schedule c, begin with the section that contains the subsequent blanks:

Step 3: Confirm that the details are correct and click on "Done" to continue further. Obtain your irs form 1065 schedule c the instant you register online for a free trial. Instantly view the document within your personal account page, along with any edits and adjustments being conveniently saved! With FormsPal, you can certainly fill out documents without having to worry about personal data breaches or data entries being shared. Our protected system ensures that your private information is stored safe.