missouri partnership return instructions 2019 can be filled in very easily. Simply try FormsPal PDF editing tool to do the job in a timely fashion. To keep our editor on the forefront of convenience, we work to put into operation user-driven features and improvements regularly. We are routinely looking for feedback - play a pivotal part in remolding how you work with PDF documents. It just takes several basic steps:

Step 1: First of all, access the tool by clicking the "Get Form Button" at the top of this page.

Step 2: When you start the PDF editor, you will find the form ready to be filled in. Other than filling in various blanks, you could also do other actions with the form, including writing any text, editing the original textual content, inserting illustrations or photos, signing the document, and more.

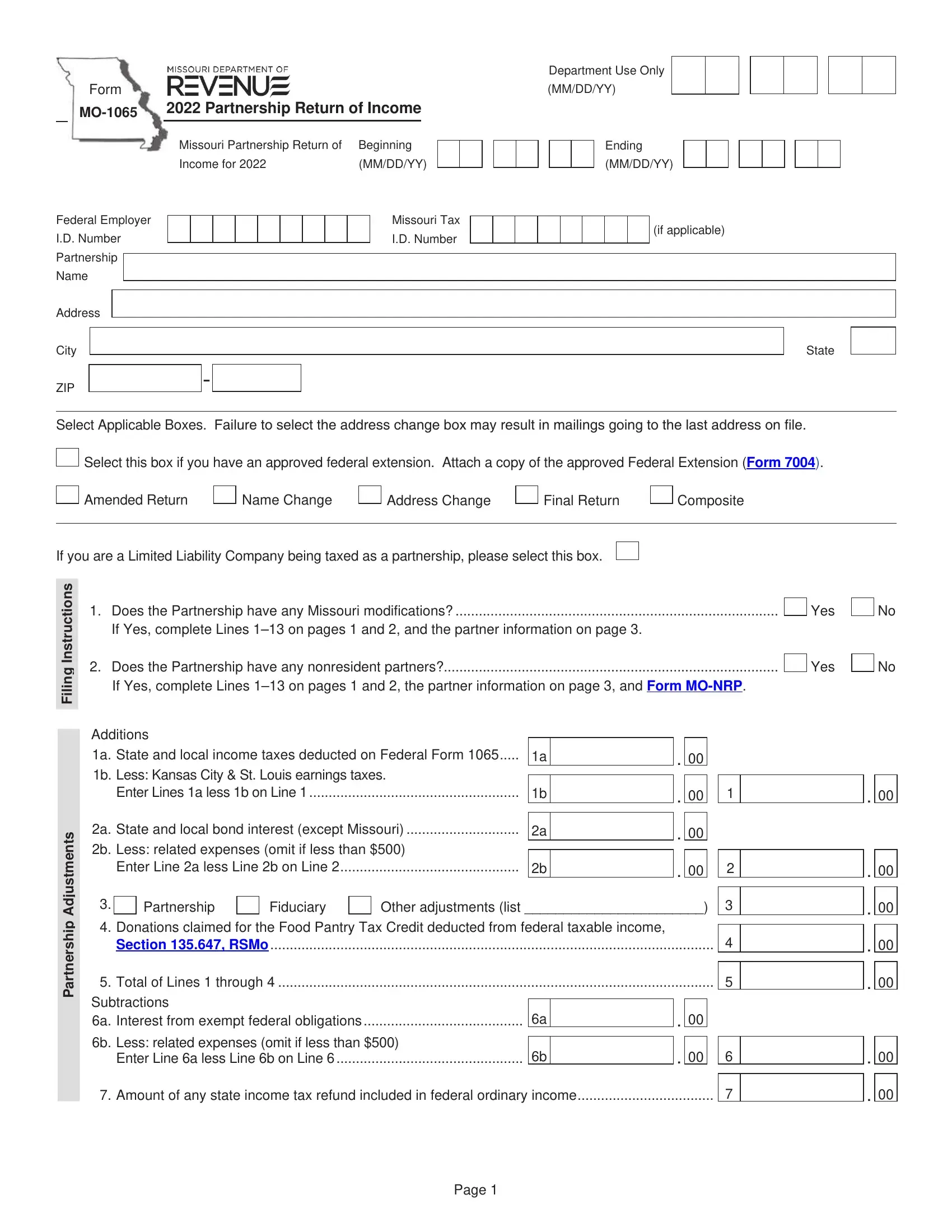

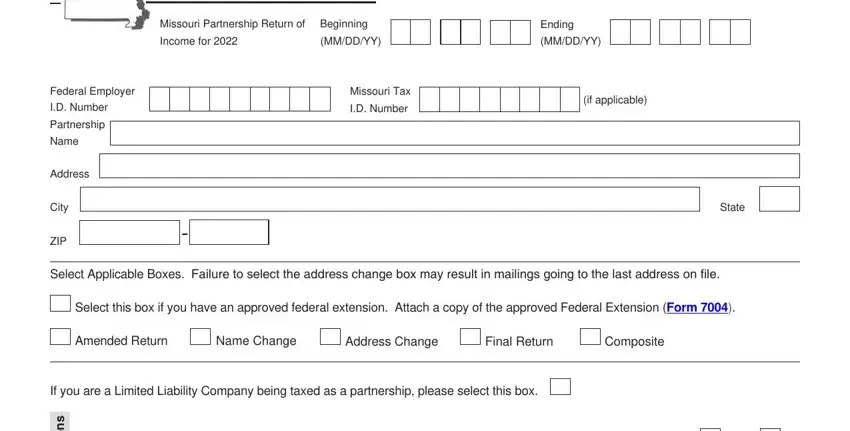

This PDF requires particular details to be typed in, thus ensure you take the time to fill in what's expected:

1. The missouri partnership return instructions 2019 requires specific details to be inserted. Ensure that the subsequent fields are completed:

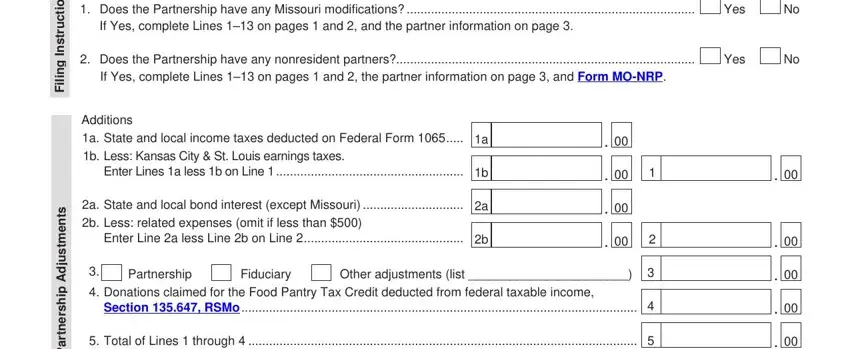

2. After the last array of fields is finished, you need to include the essential particulars in s n o i t c u r t s n, g n, i l i, Does the Partnership have any, If Yes complete Lines on pages, Does the Partnership have any, If Yes complete Lines on pages, Yes No, Yes No, s t n e m t s u d A p h s r e n t, Additions a State and local income, Enter Lines a less b on Line b, a State and local bond interest, Enter Line a less Line b on Line, and Partnership Fiduciary Other in order to progress to the 3rd stage.

It's easy to make an error when completing your Enter Line a less Line b on Line, therefore be sure to look again before you finalize the form.

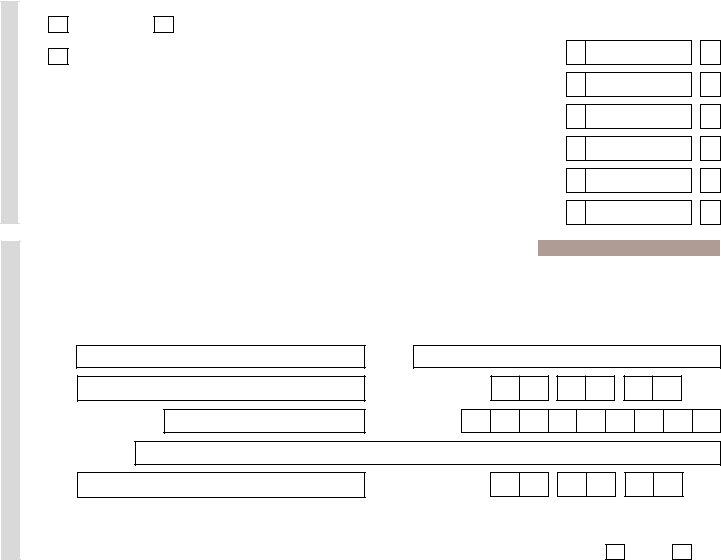

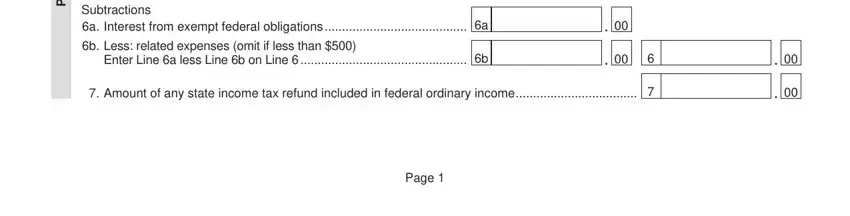

3. Within this step, have a look at s t n e m t s u d A p h s r e n t, Total of Lines through, b Less related expenses omit if, Enter Line a less Line b on Line, Amount of any state income tax, and Page. Each of these must be taken care of with utmost accuracy.

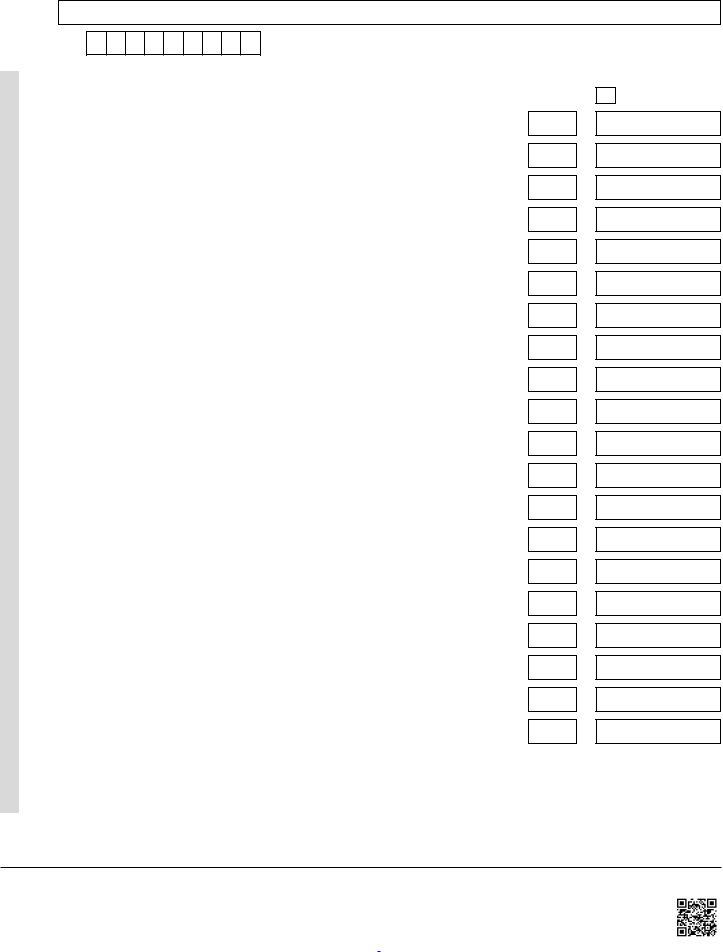

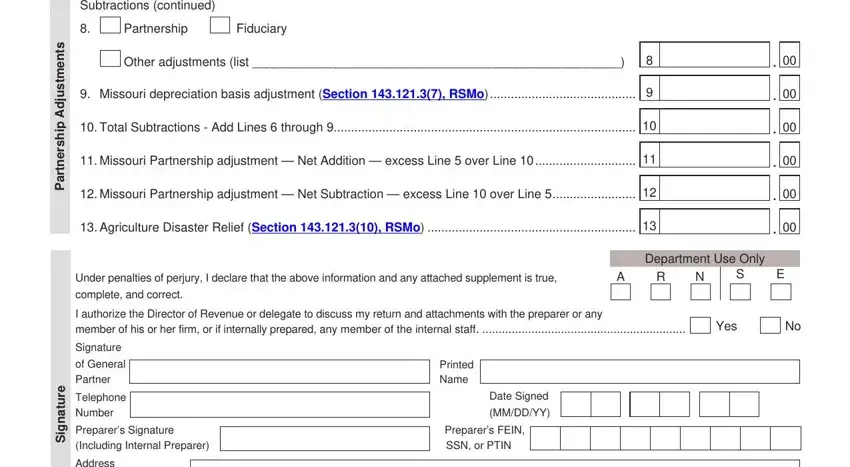

4. To go forward, this part will require filling in several blanks. These comprise of s t n e m t s u d A p h s r e n t, Subtractions continued, Partnership Fiduciary, Other adjustments list, Missouri depreciation basis, Total Subtractions Add Lines, Missouri Partnership adjustment, Missouri Partnership adjustment, Agriculture Disaster Relief, Under penalties of perjury I, complete and correct, Department Use Only, I authorize the Director of, Yes, and e r u t a n g S, which you'll find essential to going forward with this particular PDF.

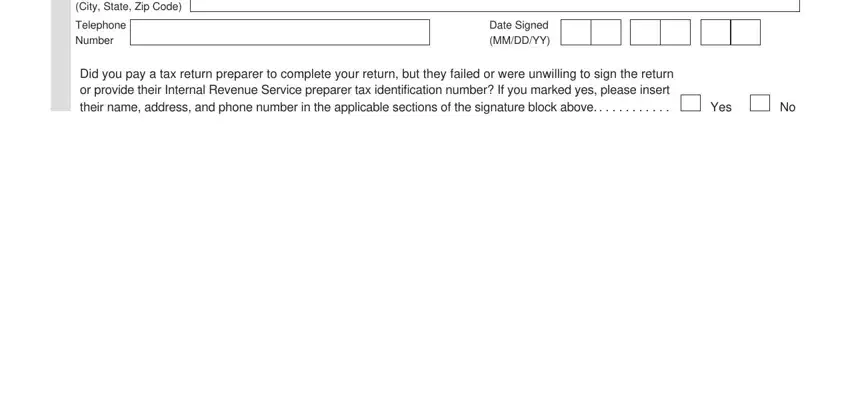

5. This final stage to submit this document is essential. Make sure you fill out the appropriate blank fields, for instance Address City State Zip Code, Telephone Number, Date Signed MMDDYY, Did you pay a tax return preparer, and Yes, before finalizing. If not, it might result in an unfinished and probably unacceptable document!

Step 3: Right after proofreading your fields, press "Done" and you are done and dusted! Get hold of the missouri partnership return instructions 2019 the instant you subscribe to a free trial. Quickly gain access to the form inside your FormsPal account page, along with any modifications and changes conveniently saved! FormsPal is committed to the confidentiality of our users; we always make sure that all personal information handled by our system continues to be confidential.