You are able to prepare form 109 b md effectively using our online PDF tool. FormsPal is dedicated to making sure you have the best possible experience with our tool by consistently releasing new features and enhancements. With all of these updates, working with our tool gets easier than ever before! With just a couple of easy steps, you'll be able to begin your PDF editing:

Step 1: Click on the orange "Get Form" button above. It will open up our pdf editor so that you can start completing your form.

Step 2: Using this state-of-the-art PDF editing tool, it's possible to do more than merely fill out blank form fields. Express yourself and make your forms appear perfect with custom textual content incorporated, or fine-tune the original content to excellence - all backed up by the capability to add almost any pictures and sign the PDF off.

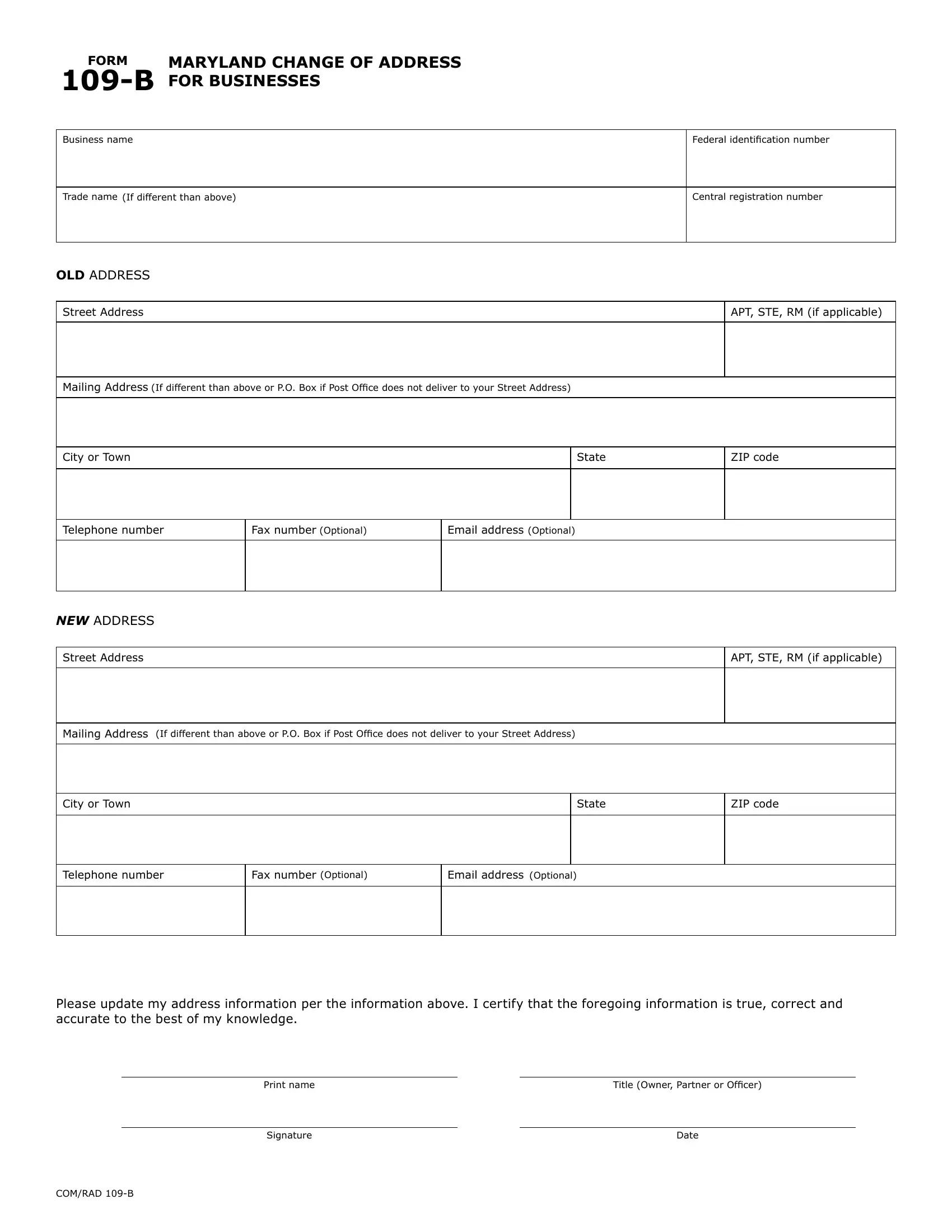

This PDF will need specific info to be filled in, so make sure you take some time to fill in what's asked:

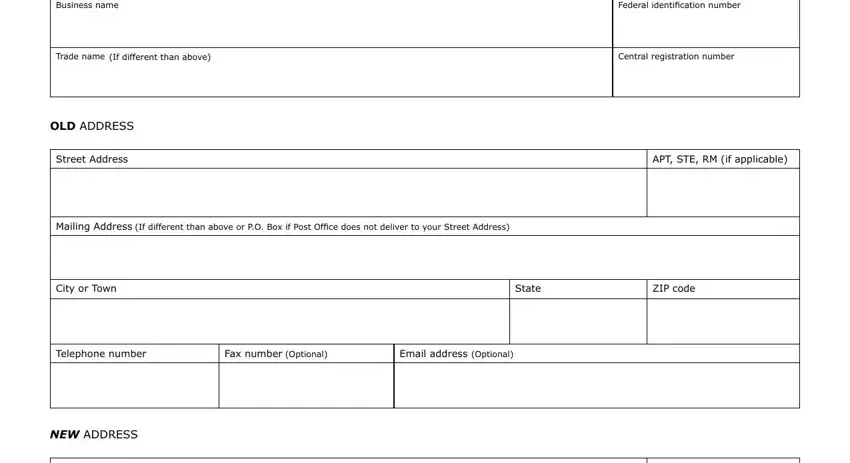

1. Begin completing the form 109 b md with a number of major blanks. Gather all of the required information and ensure absolutely nothing is left out!

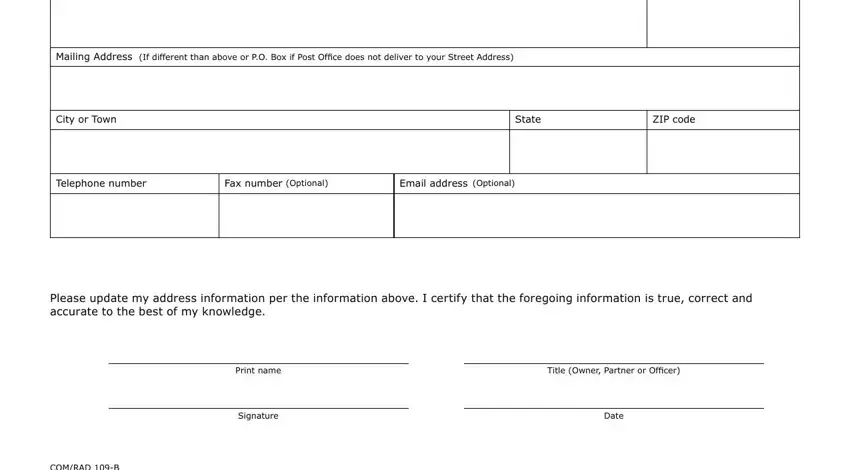

2. After completing the last section, head on to the subsequent stage and complete all required details in all these fields - Mailing Address, If different than above or PO Box, City or Town, State, ZIP code, Telephone number, Fax number, Optional, Email address, Optional, Please update my address, COMRAD B, Print name, Signature, and Title Owner Partner or Oficer.

Be really careful when filling in Title Owner Partner or Oficer and City or Town, because this is the part in which many people make some mistakes.

Step 3: Before finishing your file, make sure that all form fields are filled in the right way. When you believe it is all good, click on “Done." Find the form 109 b md after you sign up for a free trial. Easily get access to the pdf document in your FormsPal account, along with any modifications and changes conveniently preserved! Here at FormsPal, we endeavor to be certain that your details are kept private.