You are able to fill out 1099 q qualified expenses effectively with the help of our online PDF editor. Our team is focused on providing you with the perfect experience with our tool by consistently presenting new functions and enhancements. Our tool has become much more user-friendly with the latest updates! At this point, filling out PDF documents is a lot easier and faster than ever before. Here is what you will need to do to get going:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" at the top of this site.

Step 2: When you start the tool, you will notice the document all set to be filled in. Apart from filling in various blanks, you might also perform other actions with the PDF, including adding custom text, modifying the original textual content, inserting illustrations or photos, placing your signature to the form, and a lot more.

This PDF doc needs specific information; in order to ensure accuracy and reliability, don't hesitate to take into account the subsequent recommendations:

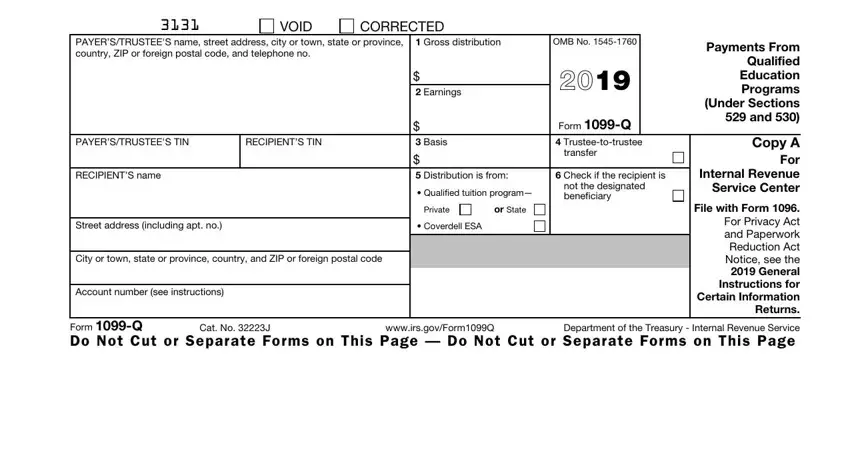

1. Whenever filling in the 1099 q qualified expenses, ensure to include all needed blanks in their corresponding form section. This will help to expedite the process, allowing for your details to be handled fast and properly.

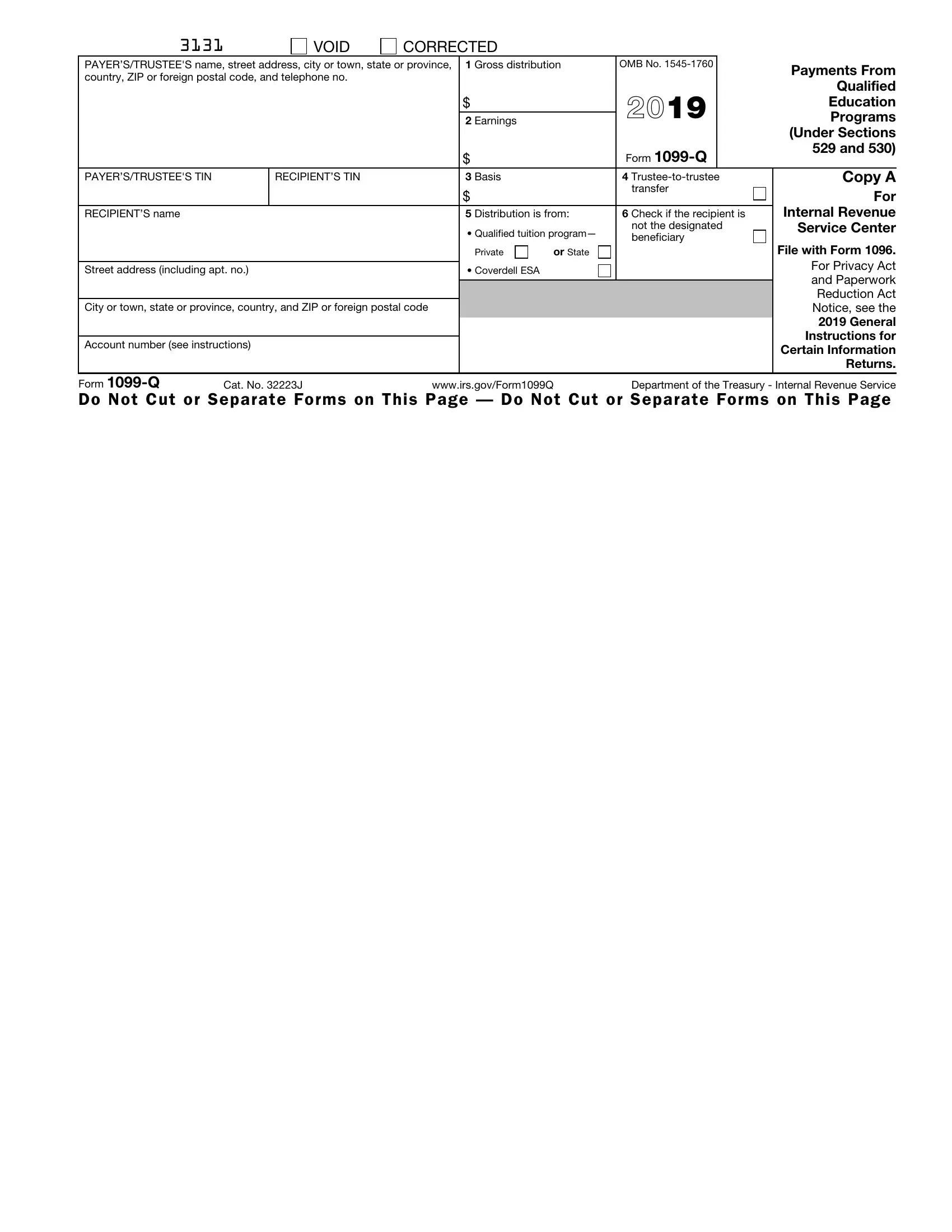

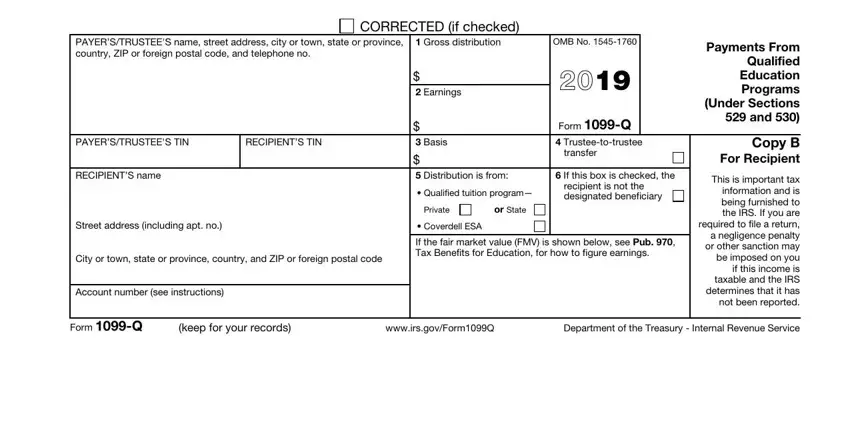

2. Just after filling out the last part, head on to the next part and enter the necessary particulars in all these fields - CORRECTED if checked, PAYERSTRUSTEES name street address, Gross distribution, OMB No, PAYERSTRUSTEES TIN, RECIPIENTS TIN, RECIPIENTS name, Street address including apt no, City or town state or province, Account number see instructions, Earnings, Basis, Distribution is from, Qualified tuition program, and Private.

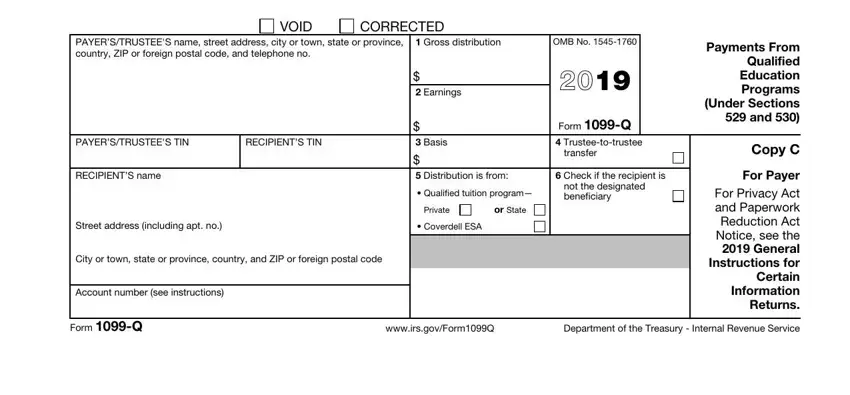

3. Through this step, look at VOID, CORRECTED, PAYERSTRUSTEES name street address, Gross distribution, OMB No, Earnings, Basis, Distribution is from, Qualified tuition program, Private, or State, Coverdell ESA, Form Q Trusteetotrustee, transfer, and Check if the recipient is. Each of these must be completed with highest precision.

Those who use this PDF often make errors while completing transfer in this section. Ensure that you re-examine whatever you type in here.

Step 3: Go through the details you've inserted in the blanks and then press the "Done" button. Right after setting up a7-day free trial account at FormsPal, you will be able to download 1099 q qualified expenses or email it at once. The PDF form will also be readily accessible in your personal account with all of your edits. FormsPal guarantees secure document tools without personal data record-keeping or any sort of sharing. Feel comfortable knowing that your data is safe here!