|

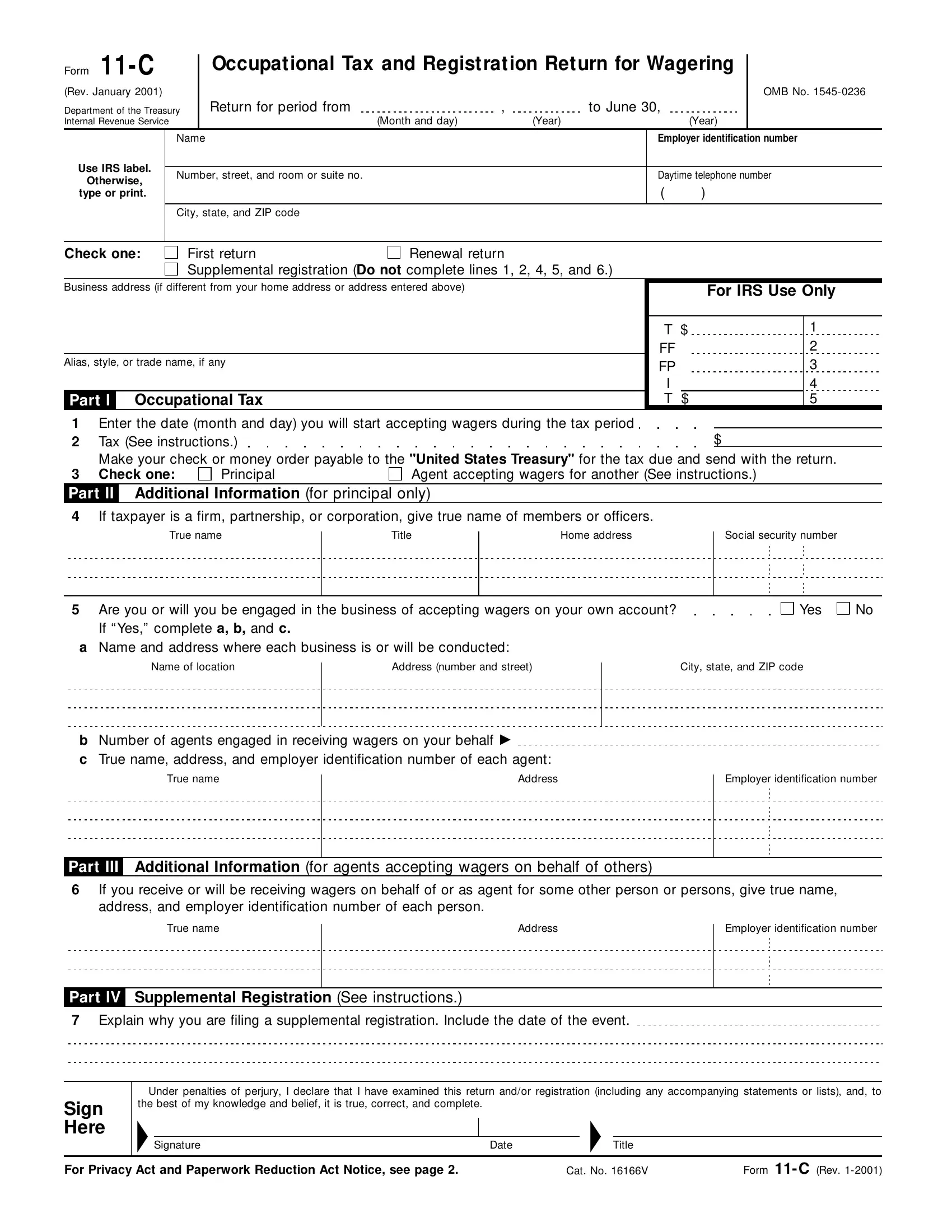

Where to file. Mail the return to |

|

executor, administrator, or other legal |

|

Internal Revenue Service Center |

|

representative, the business of a deceased |

|

|

person who paid the occupational tax. |

|

Cincinnati, OH 45999- 0101 |

|

|

|

|

|

Mail the return using the U.S. Postal Service |

3. You continue for the remainder of the |

|

period the business as a receiver or trustee in |

|

or other designated private delivery service. See |

|

bankruptcy. |

|

the instructions for your income tax return for |

|

|

|

more information. |

|

|

4. You continue for the remainder of the |

|

Penalties. There are penalties for not filing on |

period the business as an assignee for creditors. |

|

|

|

time, for accepting wagers before paying the tax, |

5. One or more members withdraws from a |

|

and for willfully failing to file the return. There are |

firm or partnership. |

|

also penalties for making or helping to make |

6. The corporate name is changed. |

|

false returns, documents, or statements. |

|

7. You engage a new agent to receive wagers. |

|

|

|

|

|

Confidentiality of information. No Treasury |

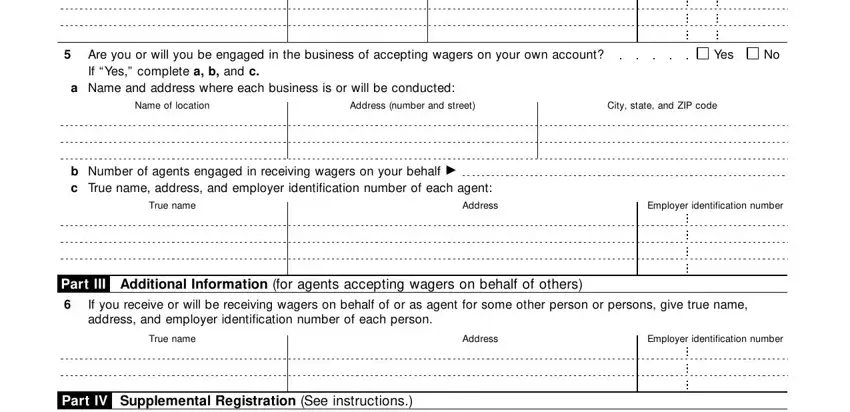

You must file a supplemental registration to |

|

Department employee may disclose information |

report the name, address, and EIN of each new |

|

you supply in relation to wagering tax except |

agent within 10 days after you engage the agent. |

|

when needed to administer or enforce the tax |

Agents must complete line 7 if you have |

|

law. See section 4424 for more information. |

|

previously filed Form 11-C and are engaged to |

|

|

|

|

|

Specific Instructions |

|

receive wagers for another. You must register |

|

|

the name, address, and EIN of each new person |

|

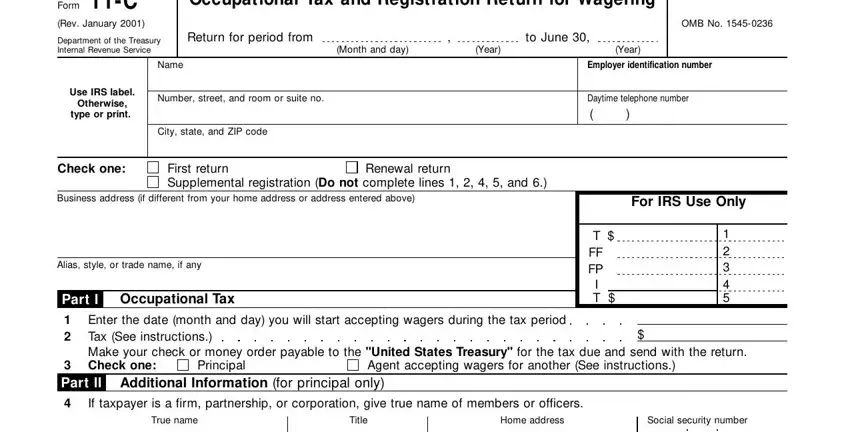

Return period. Enter the month, day, and year |

who engaged you within 10 days after being |

|

engaged. |

|

that begins the return period. Also, enter the |

|

How to file a supplemental registration. |

|

ending year. Write the year as a 4-digit number, |

|

Complete the name, address, EIN, business |

|

i.e., 2000, 2001, etc. |

|

|

|

address, and alias lines. Also, be sure to check |

|

Line 1. Enter the day and month that you will |

|

the “ supplemental registration” box. Then check |

|

start accepting wagers. A full month’s tax is due |

|

the applicable box on line 3 and enter the |

|

regardless of which day you start accepting |

|

information that has changed on line 7, including |

|

wagers during a month. |

|

|

|

the date of the event of change. Do not |

|

Line 2. There are two amounts of tax, $500 and |

|

complete lines 1, 2, 4, 5, or 6 for a supplemental |

|

$50, payable for the year that begins July 1. The |

|

registration. |

|

$50 tax applies only if all wagers (including those |

|

|

|

accepted by an agent for another) are authorized |

|

|

|

|

under the laws of the state in which accepted. If |

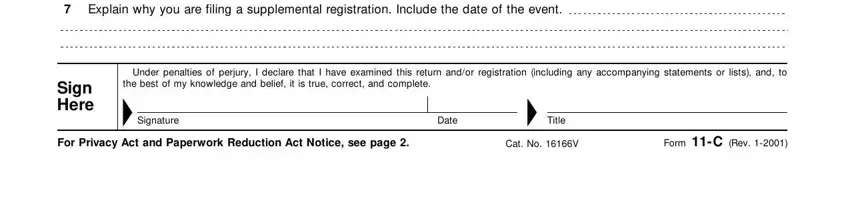

Privacy Act and Paperwork Reduction Act |

|

you start accepting wagers after July 31, the tax |

|

Notice. We ask for the information on this form |

|

is prorated for the first year. Use the table below |

|

to carry out the Internal Revenue laws of the |

|

to determine the tax. |

|

|

|

United States. We need it to figure and collect |

|

Note: This tax is paid once for each taxable |

|

the right amount of tax. Subtitle D, |

|

period. If you are required to file a supplemental |

|

Miscellaneous Excise Taxes, Chapter 35, Section |

|

registration, do not pay the tax a second time. |

|

4411 imposes a special tax on each person who |

|

|

|

|

|

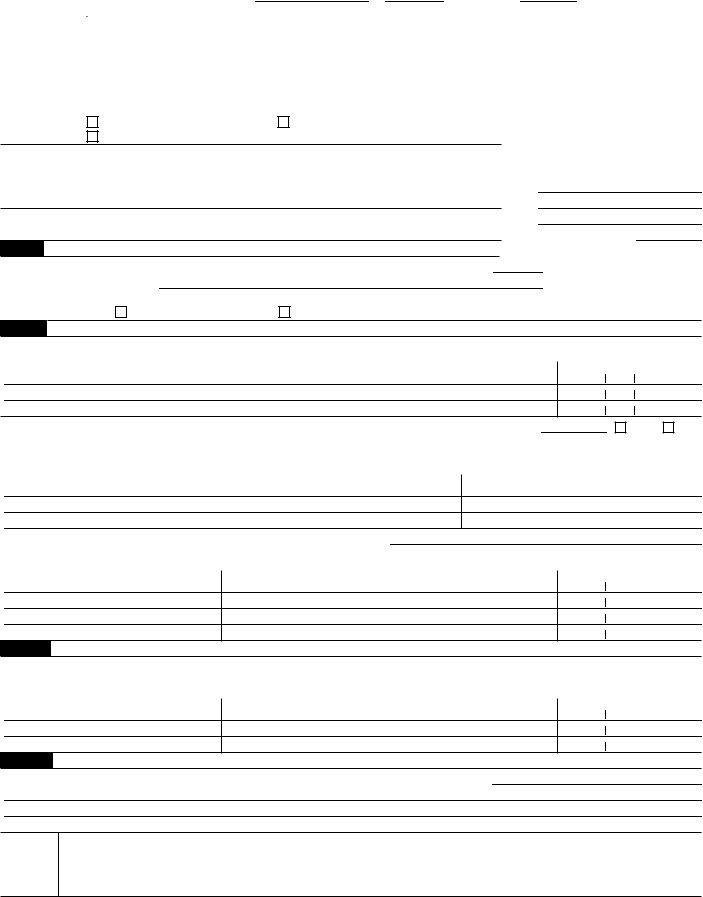

If you start |

|

|

is engaged in receiving wagers for or on behalf |

|

accepting |

$500 |

$50 |

of any person liable for the tax on wagers. |

|

wagers in |

tax |

tax |

Section 4412 requires that person to register |

|

July |

$500.00 |

$50.00 |

with the IRS. This form is used to determine the |

|

August |

458.33 |

45.83 |

amount of the tax that you owe and to register |

|

September |

416.66 |

41.66 |

certain information with the IRS. Section 6011 |

|

October |

375.00 |

37.50 |

requires you to provide the requested |

|

November |

333.33 |

33.33 |

information if this tax is applicable to you. |

|

December |

291.66 |

29.16 |

Section 6109 requires you to provide your |

|

January |

250.00 |

25.00 |

|

taxpayer identification number. Routine uses of |

|

February |

208.33 |

20.83 |

|

this information include giving it to the |

|

March |

166.66 |

16.66 |

|

Department of Justice for civil and criminal |

|

April |

125.00 |

12.50 |

|

litigation, and to cities, states, and the District of |

|

May |

83.33 |

8.33 |

|

Columbia for use in administering their tax laws. |

|

June |

41.66 |

4.16 |

|

If you fail to provide this information in a timely |

|

|

|

|

|

Line 3. You must check one of the boxes. See |

manner, you may be subject to penalties and |

|

Who must file for the definition of principal and |

interest. |

|

agent. Principals are liable for the excise tax on |

You are not required to provide the |

|

wagers, which is reported and filed monthly on |

|

information requested on a form that is subject |

|

Form 730, Tax on Wagering. |

|

|

|

to the Paperwork Reduction Act unless the form |

|

|

|

|

|

Lines 4 and 5. These lines are to be completed |

displays a valid OMB control number. Books or |

|

by principals only. Enter applicable information |

records relating to a form or its instructions must |

|

for officers and/or partners of the company on |

be retained as long as their contents may |

|

line 4. Enter on line 5a the name and address of |

become material in the administration of any |

|

each location where business will be conducted. |

Internal Revenue law. Generally, tax returns and |

|

Enter the number of agents who accept wagers |

return information are confidential, as required |

|

for you on line 5b and their names, addresses, |

by section 6103. |

|

and EINs on line 5c. |

|

|

The time needed to complete and file this |

|

|

|

|

|

Line 6. This line is to be completed by agents |

form will vary depending on individual |

|

accepting wagers on behalf of another. Enter the |

circumstances. The estimated average time is: |

|

name, address, and EIN of each person or |

|

Recordkeeping, 7 hr. 24 min.; Learning about |

|

company on whose behalf you accept wagers. |

the law or the form, 57 min.; Preparing the |

|

Supplemental Registration |

form, 2 hr., 3 min.; and Copying, assembling, |

|

and sending the form to the IRS, 16 min. |