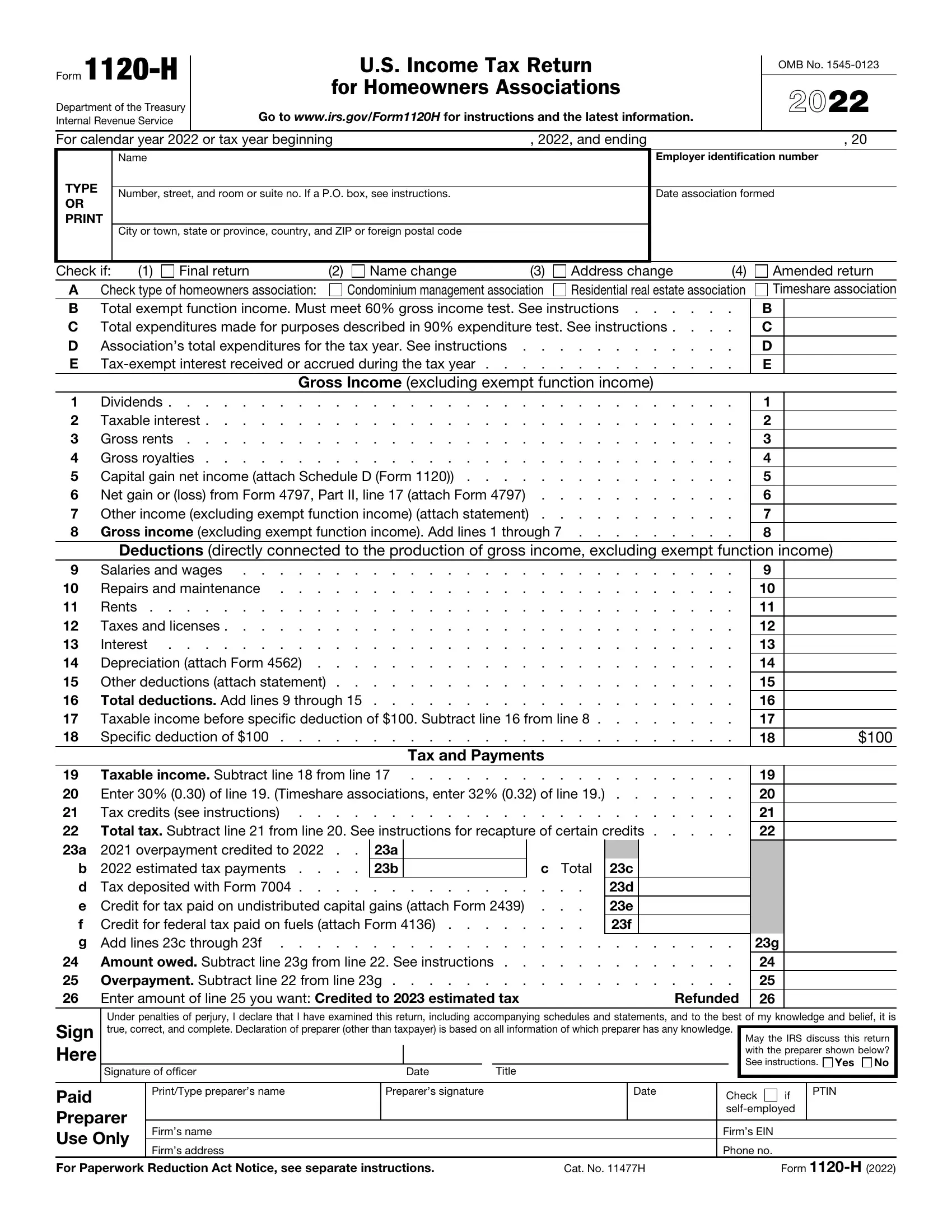

Filling out 2002 is simple. We designed our PDF editor to really make it easy to use and enable you to fill out any form online. Below are some steps that you need to follow:

Step 1: Choose the button "Get Form Here" on the website and press it.

Step 2: As soon as you've accessed the editing page 2002, you should be able to find every one of the functions intended for your file at the top menu.

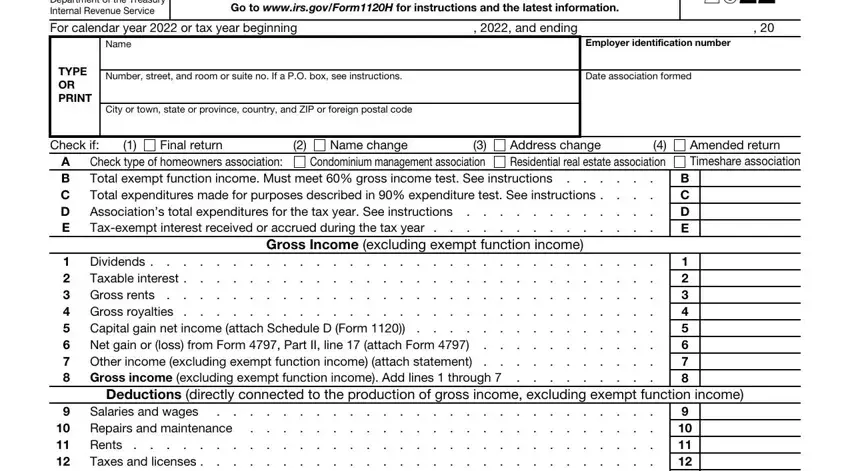

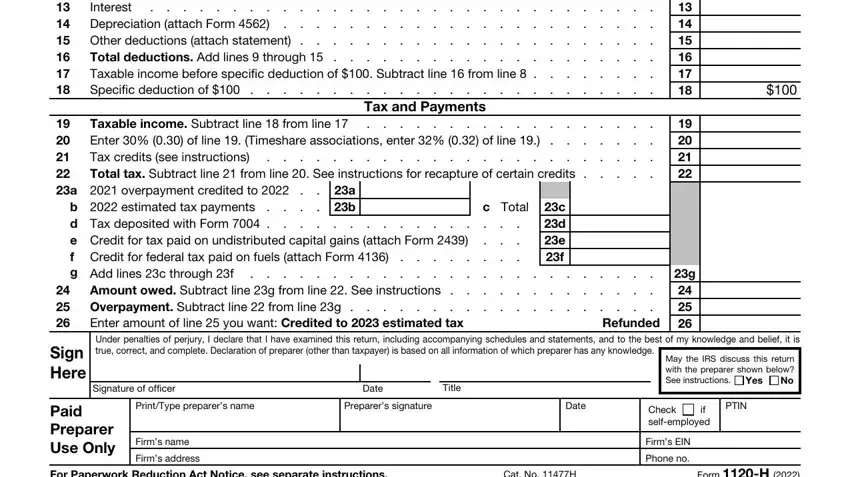

For every single segment, complete the details requested by the application.

The software will need you to fill in the Salaries and wages, Tax and Payments, Taxable income Subtract line, a overpayment credited to, a b, b estimated tax payments d Tax, c Total, Refunded, c d e f, Signature of officer, Date, Title, Paid Preparer Use Only, PrintType preparers name, and Preparers signature box.

Step 3: As you choose the Done button, your prepared form can be easily transferred to any of your gadgets or to electronic mail provided by you.

Step 4: You can create duplicates of the document toavoid any kind of potential future troubles. Don't be concerned, we cannot reveal or monitor your data.