Should you want to fill out Form 1120 L, it's not necessary to install any programs - just give a try to our online tool. To keep our tool on the forefront of practicality, we strive to put into practice user-driven capabilities and enhancements on a regular basis. We are always grateful for any suggestions - assist us with remolding PDF editing. If you're looking to get going, here is what it requires:

Step 1: Click the "Get Form" button at the top of this webpage to access our PDF editor.

Step 2: This tool offers you the ability to customize nearly all PDF files in a variety of ways. Transform it by including personalized text, adjust what's originally in the document, and put in a signature - all when you need it!

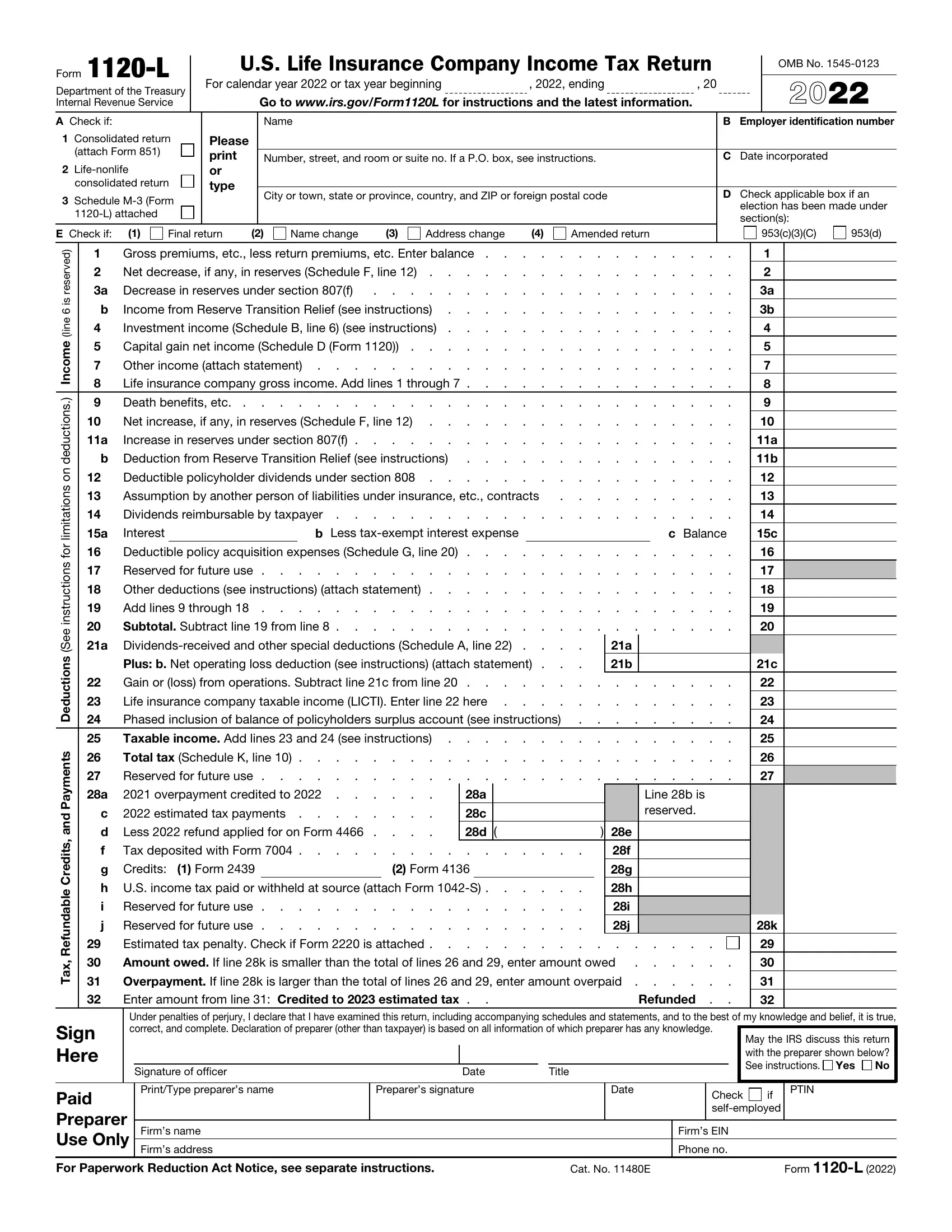

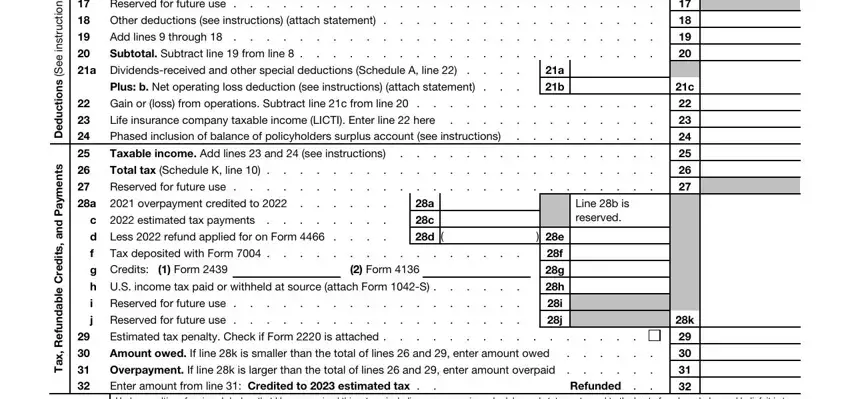

So as to finalize this document, ensure that you enter the information you need in every blank field:

1. The Form 1120 L involves specific information to be typed in. Make certain the subsequent blank fields are finalized:

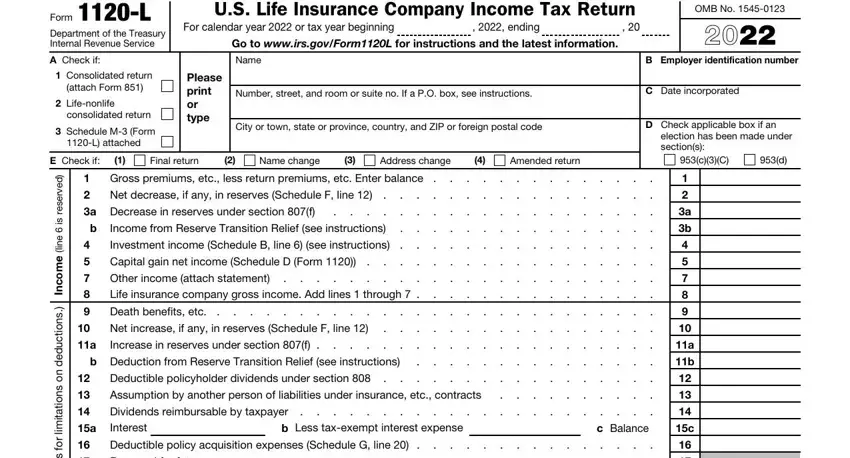

2. Right after filling in the last part, head on to the next stage and enter the necessary details in all these blank fields - Deductible policy acquisition, Plus b Net operating, a Dividendsreceived and other, Taxable income Add lines and see, c Balance, Line b is reserved, i l r o f s n o i t c u r t s n, i e e S, s n o i t c u d e D, s t n e m y a P d n a, s t i d e r C e b a d n u f e R, x a T, estimated tax payments, d Less refund applied for on, and Tax deposited with Form.

Be extremely careful when filling out Deductible policy acquisition and Plus b Net operating, since this is the section where a lot of people make mistakes.

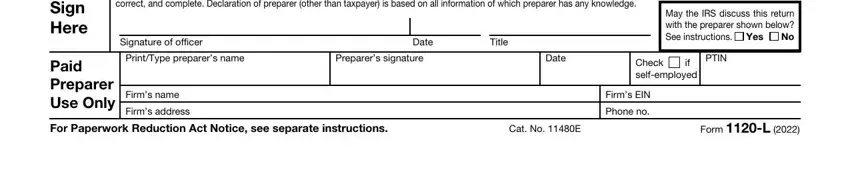

3. The third stage is normally easy - complete all of the form fields in Sign Here, Reserved for future use Reserved, Paid Preparer Use Only, Signature of officer, Date, Title, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, May the IRS discuss this return, Yes, Check if selfemployed, and PTIN in order to finish the current step.

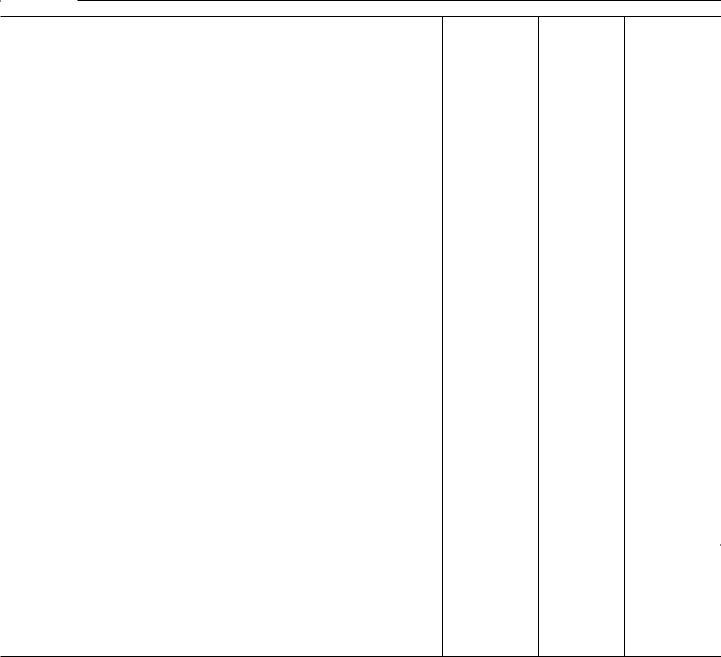

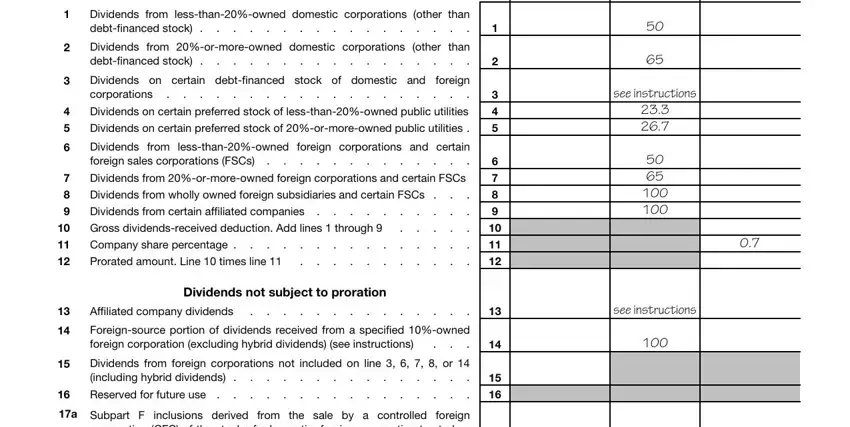

4. Completing Dividends from lessthanowned, Dividends from ormoreowned, Dividends on certain debtfinanced, foreign, Dividends on certain preferred, Dividends from lessthanowned, Dividends from ormoreowned foreign, see instructions, Dividends not subject to proration, Affiliated company dividends, see instructions, Foreignsource portion of dividends, Dividends from foreign, Reserved for future use, and a Subpart F inclusions derived is crucial in this fourth form section - make certain that you don't rush and be attentive with every empty field!

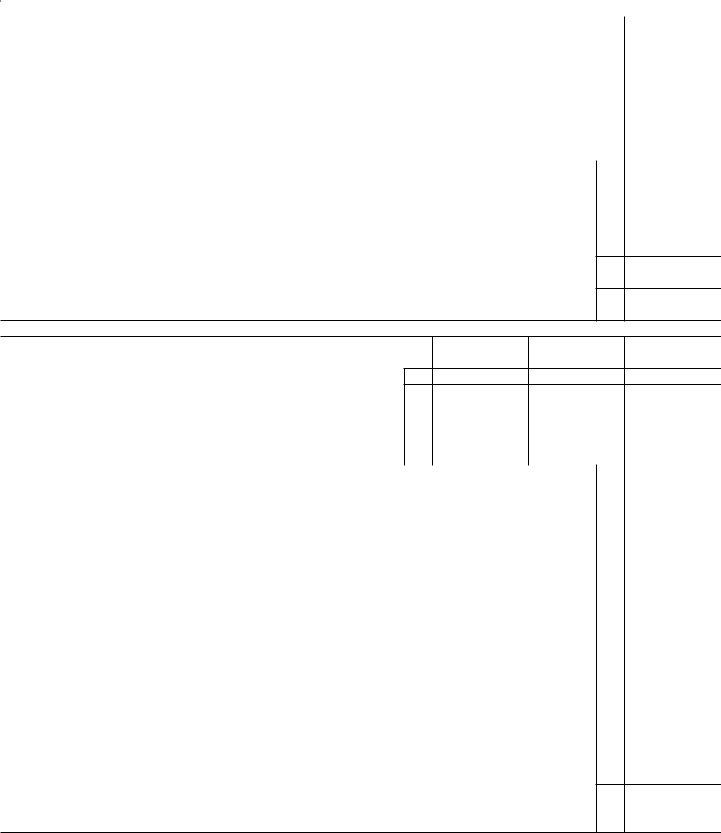

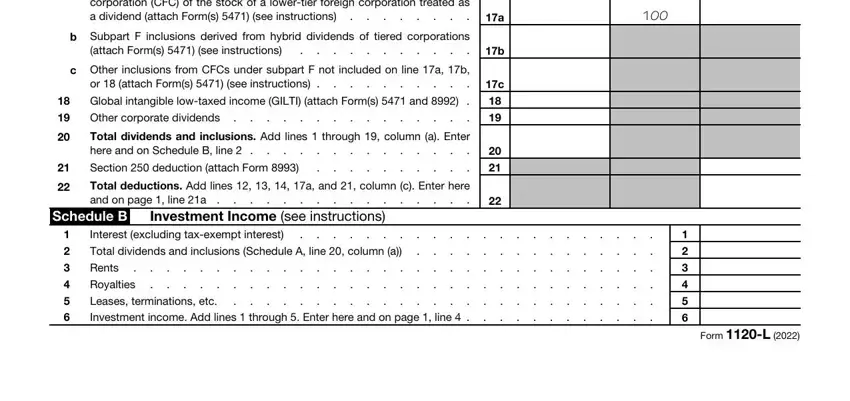

5. Now, the following last part is precisely what you will have to wrap up before closing the form. The blanks at this point include the next: a Subpart F inclusions derived, b Subpart F inclusions derived, attach Forms see instructions, c Other inclusions from CFCs under, or attach Forms see instructions, Form L, Global intangible lowtaxed income, Total dividends and inclusions Add, Section deduction attach Form, Total deductions Add lines a, Investment Income see, Interest excluding taxexempt, and Schedule B.

Step 3: Spell-check all the information you've entered into the blanks and then click on the "Done" button. Try a free trial plan at FormsPal and acquire instant access to Form 1120 L - downloadable, emailable, and editable from your personal account. With FormsPal, you can certainly fill out documents without being concerned about database incidents or records being shared. Our protected software makes sure that your private data is kept safely.