Dealing with PDF forms online can be surprisingly easy with our PDF editor. Anyone can fill out Form 1120X here in a matter of minutes. The tool is continually improved by our team, getting new awesome functions and becoming greater. Starting is effortless! All you should do is follow the following basic steps down below:

Step 1: Press the "Get Form" button above. It's going to open our pdf editor so that you can begin filling out your form.

Step 2: The editor offers you the capability to change nearly all PDF forms in a range of ways. Enhance it by including any text, correct original content, and add a signature - all at your fingertips!

It's easy to complete the form with our detailed tutorial! Here is what you want to do:

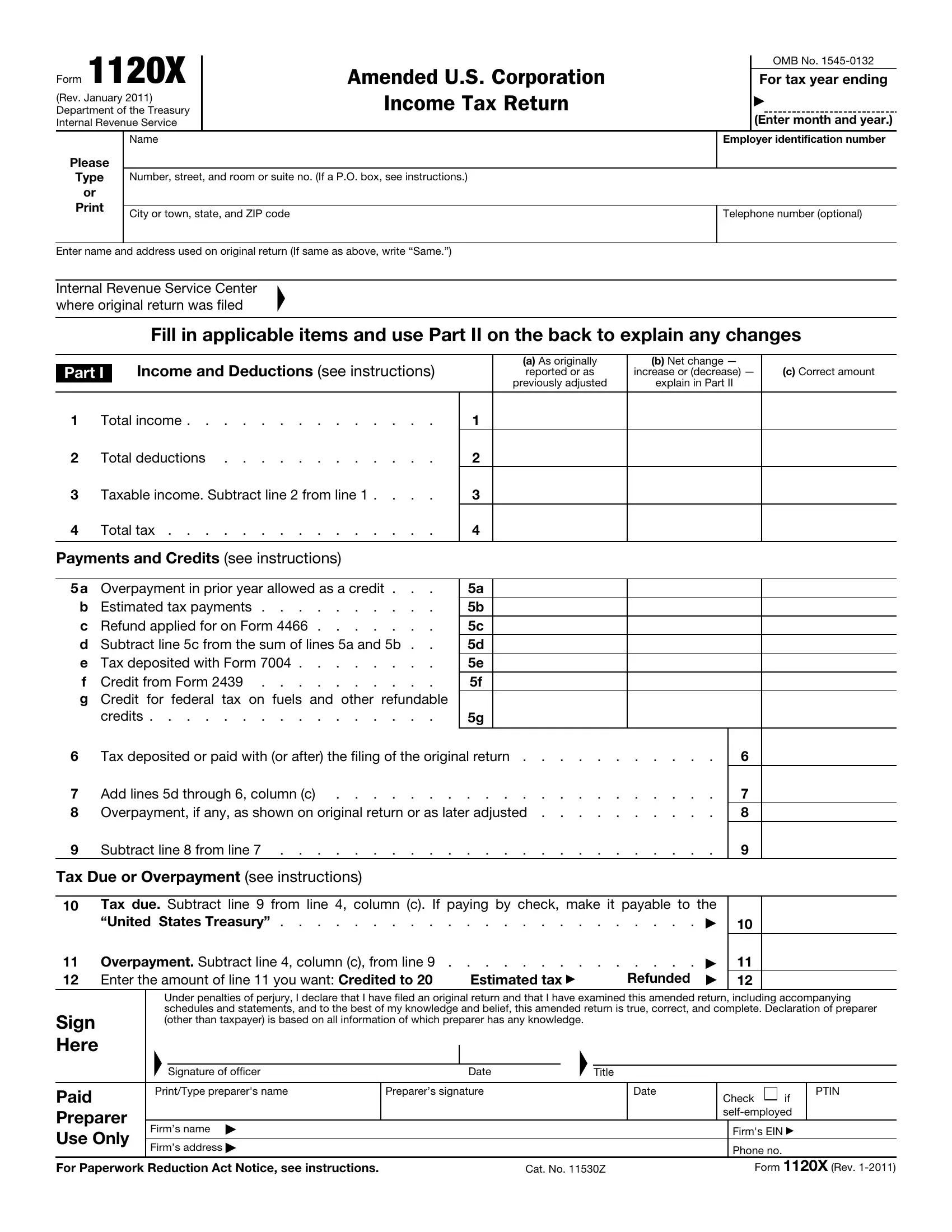

1. First, while completing the Form 1120X, begin with the page with the next blank fields:

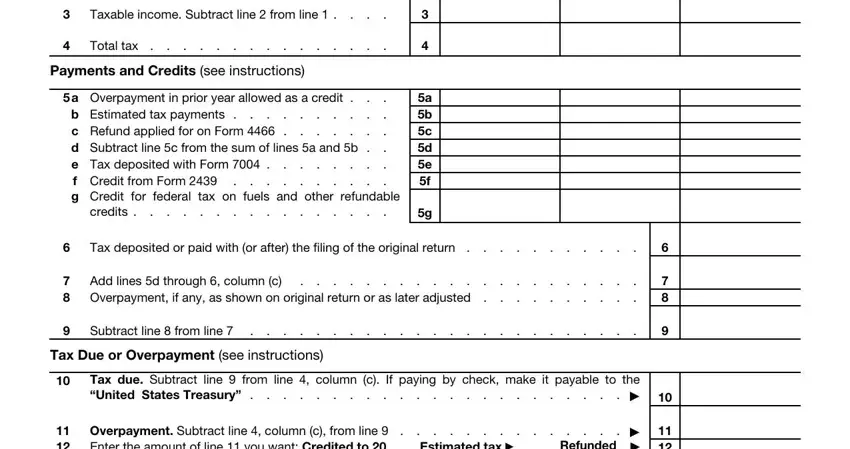

2. Once your current task is complete, take the next step – fill out all of these fields - Taxable income Subtract line from, Total tax, Payments and Credits see, a Overpayment in prior year, b Estimated tax payments c, credits, a b c d e f, Tax deposited or paid with or, Add lines d through column c, Overpayment if any as shown on, Subtract line from line, Tax Due or Overpayment see, Tax due Subtract line from line, Overpayment Subtract line column, and Estimated tax with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

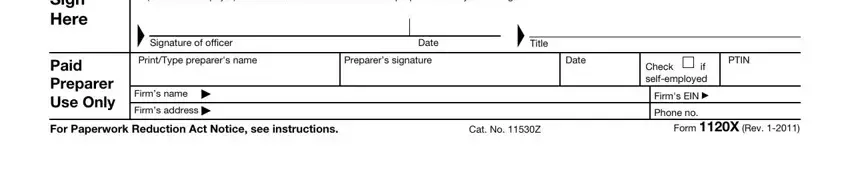

3. This third step is normally easy - fill in every one of the empty fields in Sign Here, Paid Preparer Use Only, Under penalties of perjury I, Signature of officer, Date, Title, PrintType preparers name, Preparers signature, Date, Firms name, Firms address, PTIN, Check if selfemployed, Firms EIN, and Phone no in order to complete the current step.

It's easy to make a mistake while filling in the Date, for that reason be sure to take a second look prior to when you submit it.

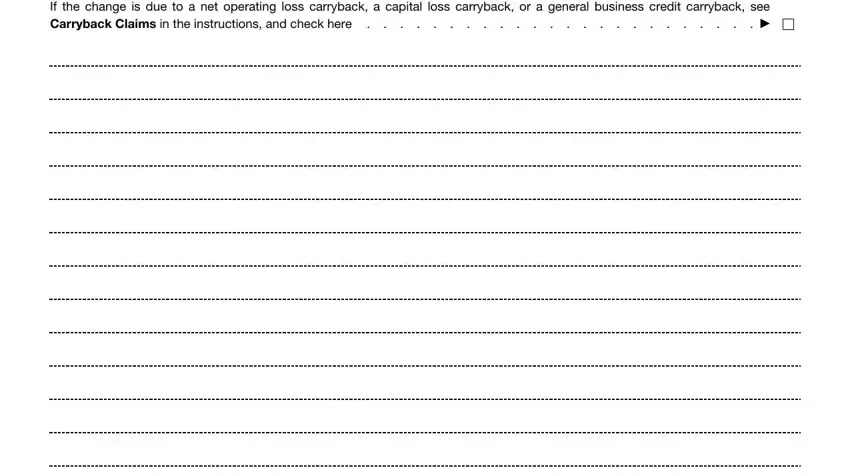

4. This next section requires some additional information. Ensure you complete all the necessary fields - If the change is due to a net - to proceed further in your process!

5. The final stage to submit this form is essential. Be sure to fill in the mandatory blank fields, such as Form X Rev, before using the file. Otherwise, it can generate an unfinished and possibly invalid document!

Step 3: After rereading your completed blanks, press "Done" and you're done and dusted! Right after registering a7-day free trial account with us, you will be able to download Form 1120X or send it through email without delay. The PDF will also be readily available from your personal account page with your every single modification. FormsPal guarantees protected form editing with no personal data record-keeping or sharing. Rest assured that your data is in good hands with us!