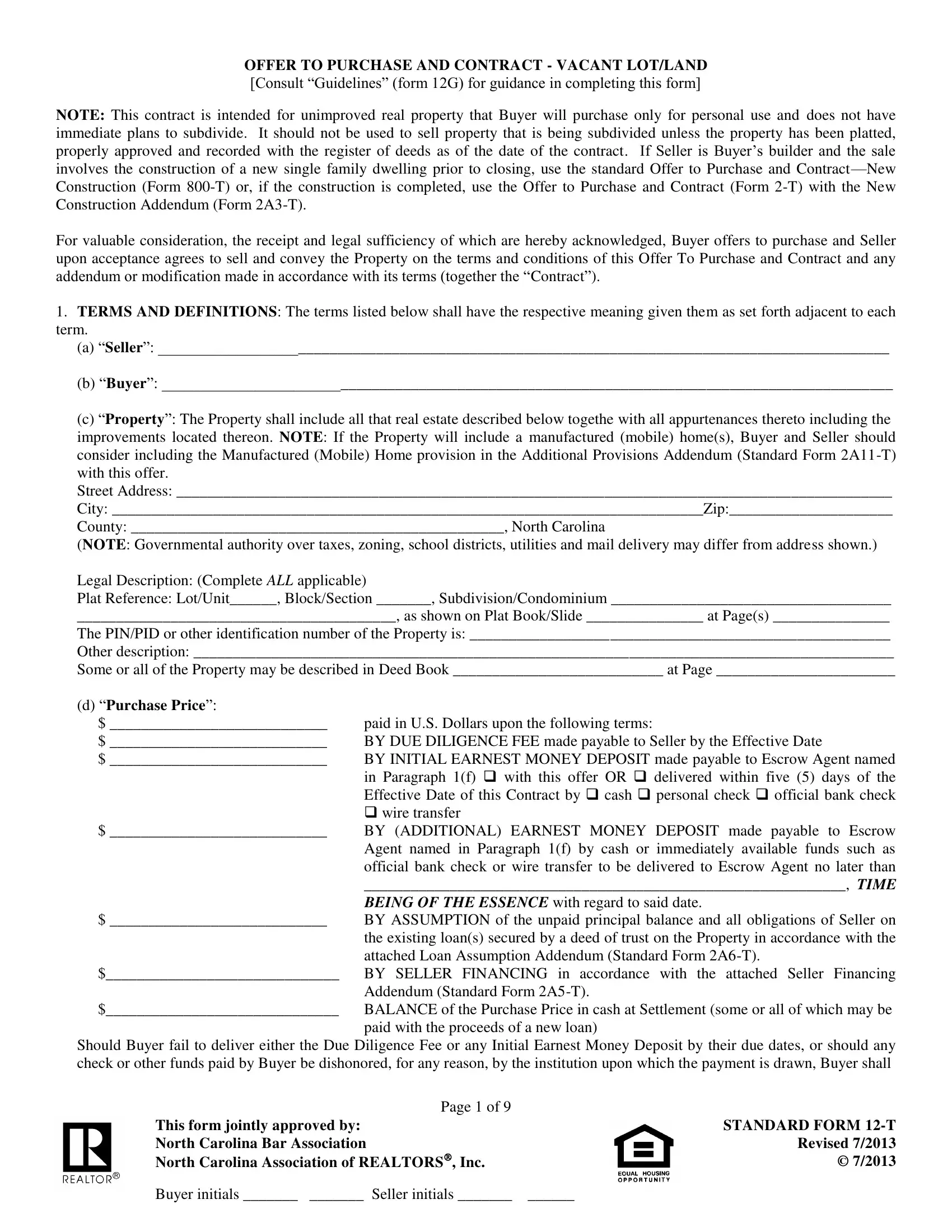

OFFER TO PURCHASE AND CONTRACT - VACANT LOT/LAND

[Consult “Guidelines” (form 12G) for guidance in completing this form]

NOTE: This contract is intended for unimproved real property that Buyer will purchase only for personal use and does not have

immediate plans to subdivide. It should not be used to sell property that is being subdivided unless the property has been platted, properly approved and recorded with the register of deeds as of the date of the contract. If Seller is Buyer’s builder and the sale

involves the construction of a new single family dwelling prior to closing, use the standard Offer to Purchase and Contract —New Construction (Form 800-T) or, if the construction is completed, use the Offer to Purchase and Contract (Form 2-T) with the New Construction Addendum (Form 2A3-T).

For valuable consideration, the receipt and legal sufficiency of which are hereby acknowledged, Buyer offers to purchase and Seller

upon acceptance agrees to sell and convey the Property on the terms and conditions of this Offer To Purchase and Contract and any addendum or modification made in accordance with its terms (together the “Contract”).

1.TERMS AND DEFINITIONS: The terms listed below shall have the respective meaning given them as set forth adjacent to each term.

(a)“Seller”: ______________________________________________________________________________________________

(b)“Buyer”: ______________________________________________________________________________________________

(c)“Property”: The Property shall include all that real estate described below togethe with all appurtenances thereto including the improvements located thereon. NOTE: If the Property will include a manufactured (mobile) home(s), Buyer and Seller should consider including the Manufactured (Mobile) Home provision in the Additional Provisions Addendum (Standard Form 2A11-T) with this offer.

Street Address: ____________________________________________________________________________________________

City: ____________________________________________________________________________Zip:_____________________

County: ________________________________________________, North Carolina

(NOTE: Governmental authority over taxes, zoning, school districts, utilities and mail delivery may differ from address shown.)

Legal Description: (Complete ALL applicable)

Plat Reference: Lot/Unit______, Block/Section _______, Subdivision/Condominium ____________________________________

_________________________________________, as shown on Plat Book/Slide _______________ at Page(s) _______________

The PIN/PID or other identification number of the Property is: ______________________________________________________

Other description: __________________________________________________________________________________________

Some or all of the Property may be described in Deed Book ___________________________ at Page _______________________

(d) “Purchase Price”: |

|

$ ____________________________ |

paid in U.S. Dollars upon the following terms: |

$ ____________________________ |

BY DUE DILIGENCE FEE made payable to Seller by the Effective Date |

$ ____________________________ |

BY INITIAL EARNEST MONEY DEPOSIT made payable to Escrow Agent named |

|

in Paragraph 1(f) with this offer OR delivered within five (5) days of the |

|

Effective Date of this Contract by cash personal check official bank check |

|

wire transfer |

$ ____________________________ |

BY (ADDITIONAL) EARNEST MONEY DEPOSIT made payable to Escrow |

|

Agent named in Paragraph 1(f) by cash or immediately available funds such as |

|

official bank check or wire transfer to be delivered to Escrow Agent no later than |

|

______________________________________________________________, TIME |

|

BEING OF THE ESSENCE with regard to said date. |

$ ____________________________ |

BY ASSUMPTION of the unpaid principal balance and all obligations of Seller on |

|

the existing loan(s) secured by a deed of trust on the Property in accordance with the |

|

attached Loan Assumption Addendum (Standard Form 2A6-T). |

$______________________________ |

BY SELLER FINANCING in accordance with the attached Seller Financing |

|

Addendum (Standard Form 2A5-T). |

$______________________________ |

BALANCE of the Purchase Price in cash at Settlement (some or all of which may be |

|

paid with the proceeds of a new loan) |

Should Buyer fail to deliver either the Due Diligence Fee or any Initial Earnest Money Deposit by their due dates, or should any check or other funds paid by Buyer be dishonored, for any reason, by the institution upon which the payment is drawn, Buyer shall

Page 1 of 9 |

|

This form jointly approved by: |

STANDARD FORM 12-T |

North Carolina Bar Association |

Revised 7/2013 |

North Carolina Association of REALTORS®, Inc. |

© 7/2013 |

Buyer initials _______ _______ Seller initials _______ |

______ |

have one (1) banking day after written notice to deliver cash or immediately available funds to the payee. In the event Buyer does not timely deliver cash or immediately available funds, Seller shall have the right to terminate this Contract upon written notice to Buyer.

(e)“Earnest Money Deposit”: The Initial Earnest Money Deposit, the Additional Earnest Money Deposit and any other earnest monies paid in connection with this transaction, hereinafter collectively referred to as “Earnest Money Deposit”, shall be deposited and held in escrow by Escrow Agent until Closing, at which time it will be credited to Buyer, or until this Contract is otherwise terminated. In the event: (1) this offer is not accepted; or (2) a condition of any resulting contract is not satisfied, then the Earnest

Money Deposit shall be refunded to Buyer. In the event of breach of this Contract by Seller, the Earnest Money Deposit shall be refunded to Buyer upon Buyer’s request, but such return shall not affect any other remedies available to Buyer for such breach. In the event of breach of this Contract by Buyer, the Earnest Money Deposit shall be paid to Seller upon Seller’s request as liquidated damages and as Seller’s sole and exclusive remedy for such breach, but without limiting Seller’s rights under Paragraphs 2(c) and 2(d) for damage to the Property or Seller’s right to retain the Due Diligence Fee. It is acknowledged by the parties that payment of

the Earnest Money Deposit to Seller in the event of a breach of this Contract by Buyer is compensatory and not punitive, such amount being a reasonable estimation of the actual loss that Seller would incur as a result of such breach. The payment of the

Earnest Money Deposit to Seller shall not constitute a penalty or forfeiture but actual compensation for Seller's anticipated loss, both parties acknowledging the difficulty determining Seller’s actual damages for such breach. If legal proceedings are brought by

Buyer or Seller against the other to recover the Earnest Money Deposit, the prevailing party in the proceeding shall be entitled to recover from the non-prevailing party reasonable attorney fees and court costs incurred in connection with the proceeding.

(f) “Escrow Agent” (insert name): ____________________________________________________________________________

NOTE: In the event of a dispute between Seller and Buyer over the disposition of the Earnest Money Deposit held in escrow, a licensed real estate broker (“Broker”) is required by state law (and Escrow Agent, if not a Broker, hereby agrees) to retain the Earnest Money Deposit in the Escrow Agent’s trust or escrow account until Escrow Agent has obtained a written release from the

parties consenting to its disposition or until disbursement is ordered by a court of competent jurisdiction. Alternatively, if a Broker or an attorney licensed to practice law in North Carolina ("Attorney") is holding the Earnest Money Deposit, the Broker or Attorney may deposit the disputed monies with the appropriate clerk of court in accordance with the provisions of N.C.G.S. §93A- 12.

THE PARTIES AGREE THAT A REAL ESTATE BROKERAGE FIRM ACTING AS ESCROW AGENT MAY PLACE THE EARNEST MONEY DEPOSIT IN AN INTEREST BEARING TRUST ACCOUNT AND THAT ANY INTEREST EARNED THEREON SHALL BE DISBURSED TO THE ESCROW AGENT MONTHLY IN CONSIDERATION OF THE EXPENSES INCURRED BY MAINTAINING SUCH ACCOUNT AND RECORDS ASSOCIATED THEREWITH.

(g) “Effective Date”: The date that: (1) the last one of Buyer and Seller has signed or initialed this offer or the final counteroffer, if any, and (2) such signing or initialing is communicated to the party making the offer or counteroffer, as the case may be.

(h) “Due Diligence”: Buyer’s opportunity during the Due Diligence Period to investigate the Property and the transaction

contemplated by this Contract, including but not necessarily limited to the matters described in Paragraph 2 below, to decide whether Buyer, in Buyer’s sole discretion, will proceed with or terminate the transaction.

(i)“Due Diligence Fee”: A negotiated amount, if any, paid by Buyer to Seller with this Contract for Buyer’s right to conduct Due Diligence during the Due Diligence Period. It shall be the property of Seller upon the Effective Date and shall be a credit to Buyer at Closing. The Due Diligence Fee shall be non-refundable except in the event of a material breach of this Contract by Seller, or if this Contract is terminated under Paragraph 6(l) or Paragraph 9, or as otherwise provided in any addendum hereto. Buyer and Seller each expressly waive any right that they may have to deny the right to conduct Due Diligence or to assert any defense as to the enforceability of this Contract based on the absence or alleged insufficiency of any Due Diligence Fee, it being the intent of the parties to create a legally binding contract for the purchase and sale of the Property without regard to the existence or amount of any Due Diligence Fee.

(j) “Due Diligence Period”: The period beginning on the Effective Date and extending through 5:00 p.m. on ________________

_______________________________________________________TIME BEING OF THE ESSENCE with regard to said date.

(k) “Settlement”: The proper execution and delivery to the closing attorney of all documents necessary to complete the transaction contemplated by this Contract, including the deed, settlement statement, deed of trust and other loan or conveyance documents, and the closing attorney’s receipt of all funds necessary to complete such transaction.

Page 2 of 9 |

|

|

STANDARD FORM 12-T |

|

Revised 7/2013 |

Buyer initials _______ _______ Seller initials _______ ______ |

© 7/2013 |

|

(l)“Settlement Date”: The parties agree that Settlement will take place on __________________________________________

_______________________(the “Settlement Date”), unless otherwise agreed in writing, at a time and place designated by Buyer.

(m)“Closing”: The completion of the legal process which results in the transfer of title to the Property from Seller to Buyer, which

includes the following steps: (1) the Settlement (defined above); (2) the completion of a satisfactory title update to the Property following the Settlement; (3) the closing attorney’s receipt of authorization to disburse all necessary funds; and (4) recordation in the appropriate county registry of the deed(s) and deed(s) of trust, if any, which shall take place as soon as reasonably possible for the closing attorney after Settlement. Upon Closing, the proceeds of sale shall be disbursed by the closing attorney in accordance with the settlement statement and the provisions of Chapter 45A of the North Carolina General Statutes. If the title update should reveal unexpected liens, encumbrances or other title defects, or if the closing attorney is not authorized to disburse all necessary funds, then the Closing shall be suspended and the Settlement deemed delayed under Paragraph 13 (Delay in Settlement/Closing).

WARNING: The North Carolina State Bar has determined that the performance of most acts and services required for a closing constitutes the practice of law and must be performed only by an attorney licensed to practice law in North Carolina. State law prohibits unlicensed individuals or firms from rendering legal services or advice. Although non-attorney settlement agents may perform limited services in connection with a closing, they may not perform all the acts and services required to complete a closing. A closing involves significant legal issues that should be handled by an attorney. Accordingly it is the position of the North Carolina Bar Association and the North Carolina Association of REALTORS® that all buyers should hire an attorney licensed in North Carolina to perform a closing.

(n)“Special Assessments”: A charge against the Property by a governmental authority in addition to ad valorem taxes and recurring governmental service fees levied with such taxes, or by an owners’ association in addition to any regular assessment

(dues), either of which may be a lien against the Property. A Special Assessment may be either proposed or confirmed.

“Proposed Special Assessment”: A Special Assessment that is under formal consideration but which has not been approved prior to Settlement.

“Confirmed Special Assessment”: A Special Assessment that has been approved prior to Settlement whether or not it is fully payable at time of Settlement.

2.BUYER’S DUE DILIGENCE PROCESS:

(a)Loan: During the Due Diligence Period, Buyer, at Buyer’s expense, shall be entitled to pursue qualification for and approval of the Loan if any.

(NOTE: Buyer is advised to consult with Buyer’s lender prior to signing this offer to assure that the Due Diligence Period allows sufficient time for the appraisal to be completed and for Buyer’s lender to provide Buyer sufficient information to decide whether

to proceed with or terminate the transaction since the Loan is not a condition of the Contract.)

(b)Property Investigation: During the Due Diligence Period, Buyer or Buyer’s agents or representatives, at Buyer’s expense, shall be entitled to conduct all desired tests, surveys, appraisals, investigations, examinations and inspections of the Property as

Buyer deems appropriate, including but NOT limited to the following:

(i)Soil And Environmental: Reports to determine whether the soil is suitable for Buyer’s intended use and whether there is any environmental contamination, law, rule or regulation that may prohibit, restrict or limit Buyer’s intended use.

(ii)Septic/Sewer System: Any applicable investigation(s) to determine: (1) the condition of an existing sewage system, (2) the costs and expenses to install a sewage system approved by an existing Improvement Permit, (3) the availability and expense to connect to a public or community sewer system, and/or (4) whether an Improvement Permit or written evaluation may be obtained from the County Health Department for a suitable ground absorption sewage system.

(iii)Water: Any applicable investigation(s) to determine: (1) the condition of an existing private drinking water well, (2) the costs and expenses to install a private drinking water well approved by an existing Construction Permit, (3) the availability, costs and expenses to connect to a public or community water system, or a shared private well, and/or (4) whether a Construction Permit may be obtained from the County Health Department for a private drinking water well.

(iv)Review of Documents: Review of Documents: Review of the Declaration of Restrictive Covenants, Bylaws, Articles of Incorporation, Rules and Regulations, and other governing documents of any applicable owners’ association and/or subdivision. If the Property is subject to regulation by an owners’ association, it is recommended that Buyer review the completed Owners' Association And Addendum (Standard Form 2A12-T) provided by Seller prior to signing this offer.

(v)Appraisals: An appraisal of the Property.

(vi)Survey: A survey to determine whether the property is suitable for Buyer’s intended use and the location of easements, setbacks, property boundaries and other issues which may or may not constitute title defects.

|

Page 3 of 9 |

|

|

|

STANDARD FORM 12-T |

|

Buyer initials _______ _______ Seller initials _______ ______ |

Revised 7/2013 |

|

© 7/2013 |

|

|

(vii)Zoning and Governmental Regulation: Investigation of current or proposed zoning or other governmental regulation that may affect Buyer’s intended use of the Property, adjacent land uses, planned or proposed road construction, and school attendance zones.

(viii)Flood Hazard: Investigation of potential flood hazards on the Property, and/or any requirement to purchase flood insurance in order to obtain the Loan.

(ix)Utilities and Access: Availability, quality, and obligations for maintenance of roads and utilities including electric, gas, communication services, stormwater management, and means of access to the Property and amenities.

(c)Buyer’s Obligation to Repair Damage: Buyer shall, at Buyer’s expense, promptly repair any damage to the Property resulting from any activities of Buyer and Buyer’s agents and contractors, but Buyer shall not be responsible for any damage caused by accepted practices applicable to any N.C. licensed professional performing reasonable appraisals, tests, surveys, examinations and inspections of the Property. This repair obligation shall survive any termination of this Contract.

(d)Indemnity: Buyer will indemnify and hold Seller harmless from all loss, damage, claims, suits or costs, which shall arise out of

any contract, agreement, or injury to any person or property as a result of any activities of Buyer and Buyer’s agents and

contractors relating to the Property except for any loss, damage, claim, suit or cost arising out of pre-existing conditions of the Property and/or out of Seller’s negligence or willful acts or omissions. This indemnity shall survive this Contract and any

termination hereof.

(e)Buyer’s Right to Terminate: Buyer shall have the right to terminate this Contract for any reason or no reason, by delivering to

Seller written notice of termination (the “Termination Notice”) during the Due Diligence Period (or any agreed-upon written extension of the Due Diligence Period), TIME BEING OF THE ESSENCE. If Buyer timely delivers the Termination Notice, this Contract shall be terminated and the Earnest Money Deposit shall be refunded to Buyer.

WARNING: If Buyer is not satisfied with the results or progress of Buyer’s Due Diligence, Buyer should terminate this Contract, prior to the expiration of the Due Diligence Period, unless Buyer can obtain a written extension from Seller. SELLER IS NOT

OBLIGATED TO GRANT AN EXTENSION. Although Buyer may continue to investigate the Property following the expiration of the Due Diligence Period, Buyer’s failure to deliver a Termination Notice to Seller prior to the expiration of the Due Diligence Period shall constitute a waiver by Buyer of any right to terminate this Contract based on any matter relating to Buyer’s Due

Diligence. Provided however, following the Due Diligence Period, Buyer may still exercise a right to terminate if Seller fails to materially comply with any of Seller’s obligations under paragraph 6 of this Contract or for any other reason permitted under the

terms of this Contract or North Carolina law.

(f)CLOSING SHALL CONSTITUTE ACCEPTANCE OF THE PROPERTY IN ITS THEN EXISTING CONDITION UNLESS PROVISION IS OTHERWISE MADE IN WRITING.

3.BUYER REPRESENTATIONS:

(a)Loan: Buyer does does not have to obtain a new loan in order to purchase the Property. If Buyer is obtaining a new loan, Buyer intends to obtain a loan as follows: Conventional Other: __________________________________________ loan at a

Fixed Rate Adjustable Rate in the principal amount of _______________________ for a term of _____________ year(s), at an initial interest rate not to exceed ____________ % per annum (the “Loan”).

(NOTE: Buyer’s obligations under this Contract are not conditioned upon obtaining or closing any loan. If Buyer represents that Buyer does not have to obtain a new loan in order to purchase the Property, Seller is advised, prior to signing this offer, to obtain documentation from Buyer which demonstrates that Buyer will be able to close on the Property without the necessity of obtaining a new loan.)

(b)Other Property: Buyer does does not have to sell or lease other real property in order to qualify for a new loan or to complete purchase. (NOTE: If Buyer does have to sell, Buyer and Seller should consider including a Contingent Sale Addendum (Standard Form 2A2-T) with this offer.)

(c)Performance of Buyer’s Financial Obligations: To the best of Buyer’s knowledge, there are no other circumstances or conditions existing as of the date of this offer that would prohibit Buyer from performing Buyer’s financial obligations in accordance with this Contract, except as may be specifically set forth herein.

|

Page 4 of 9 |

|

|

|

STANDARD FORM 12-T |

|

Buyer initials _______ _______ Seller initials _______ ______ |

Revised 7/2013 |

|

© 7/2013 |

|

|

4.BUYER OBLIGATIONS:

(a)Owners’ Association Fees/Charges: Buyer shall pay any fees required for confirming account payment information on owners’ association dues or assessments for payment or proration and any charge made by the owners’ association in connection with the disposition of the Property to Buyer, including any transfer and/or document fee imposed by the owners’ association.

Buyer shall not be responsible for fees incurred by Seller in completing the Owners’ Association Disclosure and Addendum For Properties Exempt from Residential Property Disclosure Statement (Standard Form 2A12-T).

(b)Responsibility for Proposed Special Assessments: Buyer shall take title subject to all Proposed Special Assessments.

(c)Responsibility for Certain Costs: Buyer shall be responsible for all costs with respect to any loan obtained by Buyer, appraisal, title search, title insurance, recording the deed and for preparation and recording of all instruments required to secure the balance of the Purchase Price unpaid at Settlement.

5. SELLER REPRESENTATIONS:

(a)Ownership: Seller represents that Seller:

has owned the Property for at least one year.

has owned the Property for less than one year.

does not yet own the Property.

(b)Assessments: To the best of Seller’s knowledge there are no Proposed Special Assessments except as follows (Insert “None” or the identification of such assessments, if any):_________________________________________________________________.

Seller warrants that there are no Confirmed Special Assessments except as follows (Insert “None” or the identification of such assessments, if any):________________________________________________________________________________________.

(c)Owners’ Association(s) and Dues: To best of Seller’s knowledge, ownership of the Property subjects does not subject Buyer to regulation by one or more owners’ association(s) and governing documents, which impose various mandatory covenants, conditions and restrictions upon the Property and Buyer’s enjoyment thereof, including but not limited to obligations to pay regular assessments (dues) and Special Assessments. If there is an owners’ association, then an Owners’ Association Disclosure and

Addendum For Properties Exempt from Residential Property Disclosure Statement (Standard Form 2A12-T) shall be completed by

Seller, at Seller’s expense, and must be attached as an addendum to this Contract

(d)Sewage System Permit: ( Applicable Not Applicable) Seller warrants that the sewage system described in the Improvement Permit attached hereto has been installed, which representation survives Closing, but makes no further representations as to the system.

(e)Private Drinking Water Well Permit: ( Applicable Not Applicable) Seller warrants that a private drinking water well has been installed, which representation survives Closing, but makes no further representations as to the well. (If well installed after July 1, 2008, attach Improvement Permit hereto.

6.SELLER OBLIGATIONS:

(a)Evidence of Title: Seller agrees to use best efforts to deliver to Buyer as soon as reasonably possible after the Effective Date, copies of all title information in possession of or available to Seller, including but not limited to: title insurance policies, attorney’s opinions on title, surveys, covenants, deeds, notes and deeds of trust, leases, and easements relating to the Property. Seller

authorizes: (1) any attorney presently or previously representing Seller to release and disclose any title insurance policy in such attorney's file to Buyer and both Buyer's and Seller's agents and attorneys; and (2) the Property’s title insurer or its agent to release

and disclose all materials in the Property's title insurer's (or title insurer's agent's) file to Buyer and both Buyer's and Seller's agents and attorneys.

(b)Access to Property/Walk-Through Inspection: Seller shall provide reasonable access to the Property (including working, existing utilities) through the earlier of Closing or possession by Buyer, including, but not limited to, allowing the Buyer an opportunity to conduct a final walk-through inspection of the Property. To the extent applicable, Seller shall also be responsible for timely clearing that portion of the Property required by the County to perform tests, inspections and/or evaluations to deter mine the suitability of the Property for a sewage system and/or private drinking water well.

(c)Removal of Seller’s Property: Seller shall remove, by the date possession is made available to Buyer, all personal property which is not a part of the purchase and all garbage and debris from the Property.

|

Page 5 of 9 |

|

|

|

STANDARD FORM 12-T |

|

Buyer initials _______ _______ Seller initials _______ ______ |

Revised 7/2013 |

|

© 7/2013 |

|

|

(d)Affidavit And Indemnification Agreement: Seller shall furnish at Settlement an affidavit(s) and indemnification agreement(s) in form satisfactory to Buyer and Buyer’s title insurer, if any, executed by Seller and any person or entity who has performed or furnished labor, services, materials or rental equipment to the Property within 120 days prior to the date of Settlement and who

may be entitled to claim a lien against the Property as described in N.C.G.S. §44A-8 verifying that each such person or entity has been paid in full and agreeing to indemnify Buyer, Buyer’s lender(s) and Buyer’s title insurer against all loss from any cause or

claim arising therefrom.

(e)Designation of Lien Agent, Payment and Satisfaction of Liens: If required by N.C.G.S. §44A-11.1, Seller shall have designated a Lien Agent, and Seller shall deliver to Buyer as soon as reasonably possible a copy of the appointment of Lien Agent. All deeds of trust, deferred ad valorem taxes, liens and other charges against the Property, not assumed by Buyer, must be paid and satisfied by Seller prior to or at Settlement such that cancellation may be promptly obtained following Closing. Seller shall remain obligated to obtain any such cancellations following Closing.

(f)Good Title, Legal Access: Seller shall execute and deliver a GENERAL WARRANTY DEED for the Property in recordable form no later than Settlement, which shall convey fee simple marketable and insurable title, without exception for mechanics’ liens, and free of any other liens, encumbrances or defects, including those which would be revealed by a current and accurate survey of the Property, except: ad valorem taxes for the current year (prorated through the date of Settlement); utility ease ments and unviolated covenants, conditions or restrictions that do not materially affect the value of the Property; and such other liens, encumbrances or defects as may be assumed or specifically approved by Buyer in writing. The Property must have legal access to a public right of way.

(NOTE: Buyer’s failure to terminate this Contract prior to the expiration of the Due Diligence Period as a result of any encumbrance or defect that is or would have been revealed by a title examination of the Property or a current and accurate survey shall not relieve Seller of any obligation under this subparagraph)

(NOTE: If any sale of the Property may be a “short sale,” consideration should be given to attaching a Short Sale Addendum (Standard Form 2A14-T) as an addendum to this Contract.)

(g)Deed, Excise Taxes: Seller shall pay for preparation of a deed and all other documents necessary to perform Seller’s obligations under this Contract, and for state and county excise taxes required by law. The deed is to be made to: ______________

________________________________________________________________________________________________________.

(h)Agreement to Pay Buyer Expenses: Seller shall pay at Settlement $________________________ toward any of Buyer’s expenses associated with the purchase of the Property, less any portion disapproved by Buyer’s lender.

NOTE: Examples of Buyer’s expenses associated with the purchase of the Property include, but are not limited to, discount points, loan origination fees, appraisal fees, attorney’s fees, inspection fees, and “pre-paids” (taxes, insurance, owners’ association dues,

etc).

(i)Payment of Confirmed Special Assessments: Seller shall pay all Confirmed Special Assessments, if any, provided that the amount thereof can be reasonably determined or estimated.

(j)Late Listing Penalties: All property tax late listing penalties, if any, shall be paid by Seller.

(k)Owners’ Association Disclosure and Addendum For Properties Exempt from Residential Property Disclosure Statement

(Standard Form 2A12-T): If applicable, Seller shall provide the completed Owners’ Association Disclosure and Addendum For Properties Exempt from Residential Property Disclosure Statement to Buyer on or before the Effective Date.

(l)Seller’s Failure to Comply or Breach: If Seller fails to materially comply with any of Seller’s obligations under this Paragraph

6 or Seller materially breaches this Contract, and Buyer elects to terminate this Contract as a result of such failure or breach, then

the Earnest Money Deposit and the Due Diligence Fee shall be refunded to Buyer and Seller shall reimburse to Buyer the reasonable costs actually incurred by Buyer in connection with Buyer’s Due Diligence without affecting any other remedies. If

legal proceedings are brought by Buyer against the Seller to recover the Earnest Money Deposit, the Due Diligence Fee and/or the reasonable costs actually incurred by Buyer in connection with Buyer’s Due Diligence, the prevailing party in the proceeding shall

be entitled to recover from the non-prevailing party reasonable attorney fees and court costs incurred in connection with the proceeding.

|

Page 6 of 9 |

|

|

|

STANDARD FORM 12-T |

|

Buyer initials _______ _______ Seller initials _______ ______ |

Revised 7/2013 |

|

© 7/2013 |

|

|

7.PRORATIONS AND ADJUSTMENTS: Unless otherwise provided, the following items shall be prorated through the date of Settlement and either adjusted between the parties or paid at Settlement:

(a)Taxes on Real Property: Ad valorem taxes and recurring governmental service fees levied with such taxes on real property shall be prorated on a calendar year basis;

(b)Rents: Rents, if any, for the Property;

(c)Dues: Owners’ association regular assessments (dues) and other like charges.

8. CONDITION OF PROPERTY AT CLOSING: Buyer’s obligation to complete the transaction contemplated by this Contract shall be contingent upon the Property being in substantially the same or better condition at Closing as on the date of this offer, reasonable wear and tear excepted.

9. RISK OF LOSS: The risk of loss or damage by fire or other casualty prior to Closing shall be upon Seller. If the improvements on

the Property are destroyed or materially damaged prior to Closing, Buyer may terminate this Contract by written notice delivered to Seller or Seller’s agent and the Earnest Money Deposit and any Due Diligence Fee shall be refunded to Buyer. In the event Buyer does NOT elect to terminate this Contract, Buyer shall be entitled to receive, in addition to the Property, any of Seller’s insurance proceeds

payable on account of the damage or destruction applicable to the Property being purchased. Seller is advised not to cancel existing insurance on the Property until after confirming recordation of the deed.

10.DELAY IN SETTLEMENT/CLOSING: Absent agreement to the contrary in this Contract or any subsequent modification

thereto, if a party is unable to complete Settlement by the Settlement Date but intends to complete the transaction and is acting in good faith and with reasonable diligence to proceed to Settlement (“Delaying Party”), and if the other party is ready, willing and able to complete Settlement on the Settlement Date (“Non-Delaying Party”) then the Delaying Party shall give as much notice as possible to

the Non-Delaying Party and closing attorney and shall be entitled to a delay in Settlement. If the parties fail to complete Settlement and Closing within fourteen (14) days of the Settlement Date (including any amended Settlement Date agreed to in writing by the parties) or to otherwise extend the Settlement Date by written agreement, then the Delaying Party shall be in breach and the Non- Delaying Party may terminate this Contract and shall be entitled to enforce any remedies available to such party under this Contract for the breach.

11.POSSESSION: Unless otherwise provided herein, possession shall be delivered at Closing as defined in Paragraph 1(m). No alterations, excavations, tree or vegetation removal or other such activities may be done before possession is delivered.

12.OTHER PROVISIONS AND CONDITIONS: CHECK ALL STANDARD ADDENDA THAT MAY BE A PART OF THIS CONTRACT, IF ANY, AND ATTACH HERETO. ITEMIZE ALL OTHER ADDENDA TO THIS CONTRACT, IF ANY, AND ATTACH HERETO.

(NOTE: UNDER NORTH CAROLINA LAW, REAL ESTATE BROKERS ARE NOT PERMITTED TO DRAFT CONDITIONS OR CONTINGENCIES TO THIS CONTRACT.)

Additional Provisions Addendum (Form 2A11-T) |

Loan Assumption Addendum (Form 2A6-T) |

Back-Up Contract Addendum (Form 2A1-T) |

Owners' Association Disclosure And Addendum For Properties |

Contingent Sale Addendum (Form 2A2-T) |

Exempt from Residential Property Disclosure Statement (Form |

|

2A12-T) |

Seller Financing Addendum (Form 2A5-T)

Short Sale Addendum (Form 2A14-T)

OTHER: _________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

13.ASSIGNMENTS: This Contract may not be assigned without the written consent of all parties except in connection with a tax- deferred exchange, but if assigned by agreement, then this Contract shall be binding on the assignee and assignee’s heirs and successors.

14.TAX-DEFERRED EXCHANGE: In the event Buyer or Seller desires to effect a tax-deferred exchange in connection with the conveyance of the Property, Buyer and Seller agree to cooperate in effecting such exchange; provided, however, that the exchanging party shall be responsible for all additional costs associated with such exchange, and provided further, that a non -exchanging party shall not assume any additional liability with respect to such tax-deferred exchange. Buyer and Seller shall execute such additional

|

Page 7 of 9 |

|

|

|

STANDARD FORM 12-T |

|

Buyer initials _______ _______ Seller initials _______ ______ |

Revised 7/2013 |

|

© 7/2013 |

|

|

documents, including assignment of this Contract in connection therewith, at no cost to the non-exchanging party, as shall be required to give effect to this provision.

15.PARTIES: This Contract shall be binding upon and shall inure to the benefit of Buyer and Seller and their respective heirs, successors and assigns. As used herein, words in the singular include the plural and the masculine includes the feminine and neuter genders, as appropriate.

16.SURVIVAL: If any provision herein contained which by its nature and effect is required to be observed, kept or performed after the Closing, it shall survive the Closing and remain binding upon and for the benefit of the parties hereto until fully observed, kept or performed.

17.ENTIRE AGREEMENT: This Contract contains the entire agreement of the parties and there are no representations,

inducements or other provisions other than those expressed herein. All changes, additions or deletions hereto must be in writing and signed by all parties. Nothing contained herein shall alter any agreement between a REALTOR® or broker and Seller or Buyer as contained in any listing agreement, buyer agency agreement, or any other agency agreement between them.

18.NOTICE: Any notice or communication to be given to a party herein may be given to the party or to such party’s agent. Any written notice or communication in connection with the transaction contemplated by this Contract may be given to a party or a party’s agent by sending or transmitting it to any mailing address, e-mail address or fax number set forth in the “Notice Information” section below. Seller and Buyer agree that the “Notice Information” and “Escrow Acknowledgment” sections below shall not constitute a material part of this Contract, and that the addition or modification of any information therein shall not constitute a rejection of an offer or the creation of a counteroffer.

19.EXECUTION: This Contract may be signed in multiple originals or counterparts, all of which together constitute one and the same instrument, and the parties adopt as their seals the word “SEAL” beside their signatures below.

20.COMPUTATION OF DAYS: Unless otherwise provided, for purposes of this Contract, the term “days” shall mean consecutive

calendar days, including Saturdays, Sundays, and holidays, whether federal, state, local or religious. For the purposes of calculating days, the count of “days” shall begin on the day following the day upon which any act or notice as provided in this Contract was

required to be performed or made.

THE NORTH CAROLINA ASSOCIATION OF REALTORS®, INC. AND THE NORTH CAROLINA BAR ASSOCIATION MAKE NO REPRESENTATION AS TO THE LEGAL VALIDITY OR ADEQUACY OF ANY PROVISION OF THIS FORM IN ANY SPECIFIC TRANSACTION. IF YOU DO NOT UNDERSTAND THIS FORM OR FEEL THAT IT DOES NOT PROVIDE FOR YOUR LEGAL NEEDS, YOU SHOULD CONSULT A NORTH CAROLINA REAL ESTATE ATTORNEY BEFORE YOU SIGN IT.

This offer shall become a binding contract on the Effective Date. |

|

Date: ______________________________________ |

Date: ____________________________________ |

Buyer _____________________________________ (SEAL) |

Seller ____________________________________ (SEAL) |

Date:_______________________________________ |

Date: ___________________________________ |

Buyer _____________________________________ (SEAL) |

Seller ____________________________________ (SEAL) |

Date:_______________________________________ |

Date: ___________________________________ |

Buyer _____________________________________ (SEAL) |

Seller ____________________________________ (SEAL) |

Page 8 of 9

STANDARD FORM 12-T Revised 7/2013 © 7/2013

NOTICE INFORMATION

(NOTE: INSERT THE ADDRESS AND/OR ELECTRONIC DELIVERY ADDRESS EACH PARTY AND AGENT APPROVES FOR THE RECEIPT OF ANY NOTICE CONTEMPLATED BY THIS CONTRACT. INSERT “N/A” FOR ANY WHICH ARE

NOT APPROVED.)

BUYER NOTICE ADDRESS: |

SELLER NOTICE ADDRESS: |

Mailing Address: ______________________________________ |

Mailing Address: ______________________________________ |

____________________________________________________ |

_____________________________________________________ |

Buyer Fax#: __________________________________________ |

Seller Fax#:___________________________________________ |

Buyer E-mail:_________________________________________ |

Seller E-mail:_________________________________________ |

SELLING AGENT NOTICE ADDRESS: |

LISTING AGENT NOTICE ADDRESS: |

Firm Name:___________________________________________ |

Firm Name:___________________________________________ |

Acting as Buyer’s Agent Seller’s (sub)Agent Dual Agent |

Acting as Seller’s Agent Dual Agent |

Mailing Address: ______________________________________ |

Mailing Address: ______________________________________ |

____________________________________________________ |

_____________________________________________________ |

Individual Selling Agent: ________________________________ |

Individual Listing Agent: ________________________________ |

Acting as a Designated Dual Agent (check only if applicable) |

Acting as a Designated Dual Agent (check only if applicable) |

License #:____________________________________________ |

License #:____________________________________________ |

Selling Agent Phone#: __________________________________ |

Listing Agent Phone#:__________________________________ |

Selling Agent Fax#:____________________________________ |

Listing Agent Fax#:____________________________________ |

Selling Agent E-mail:___________________________________ |

Listing Agent E-mail:___________________________________ |

|

|

|

ESCROW ACKNOWLEDGMENT OF INITIAL EARNEST MONEY DEPOSIT

Property: _________________________________________________________________________________________________

Seller: ____________________________________________________________________________________________________

Buyer: ____________________________________________________________________________________________________

Escrow Agent acknowledges receipt of the Initial Earnest Money Deposit and agrees to hold and disburse the same in accordance with the terms hereof.

Date_______________________________________Firm:____________________________________________________

By:______________________________________________________

(Signature)

________________________________________________________

(Print name)

Page 9 of 9

STANDARD FORM 12-T Revised 7/2013 © 7/2013