You can work with irs 13206 instantly by using our online tool for PDF editing. To keep our tool on the leading edge of practicality, we work to integrate user-driven features and enhancements regularly. We're always looking for feedback - help us with revampimg PDF editing. To get the ball rolling, go through these simple steps:

Step 1: Just click on the "Get Form Button" at the top of this webpage to access our form editing tool. Here you'll find all that is needed to work with your file.

Step 2: With our online PDF editor, you are able to accomplish more than merely fill out forms. Express yourself and make your forms look faultless with customized textual content incorporated, or optimize the file's original input to perfection - all comes with an ability to insert any pictures and sign the document off.

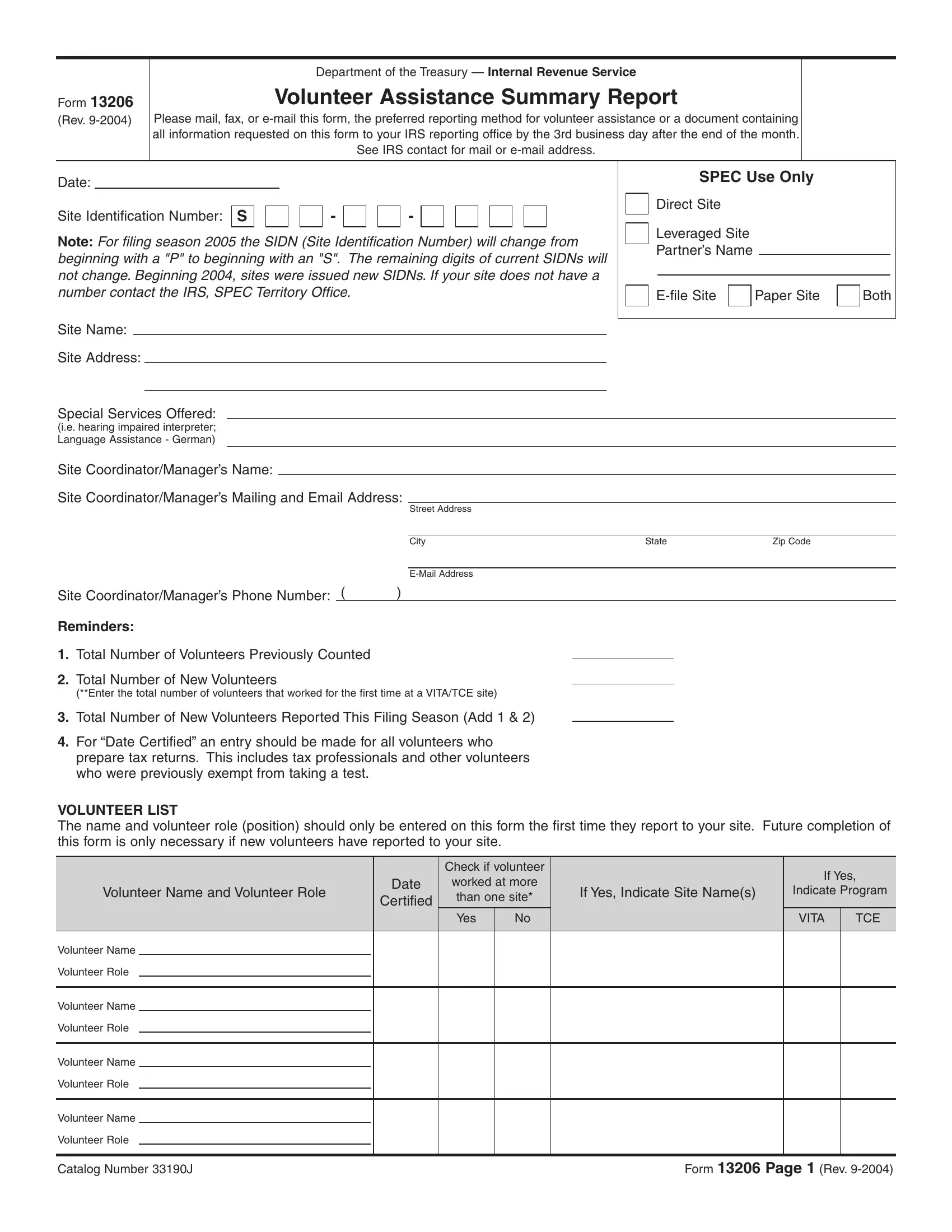

This form requires specific details; to guarantee correctness, remember to take into account the following guidelines:

1. The irs 13206 usually requires particular details to be typed in. Be sure the next blanks are completed:

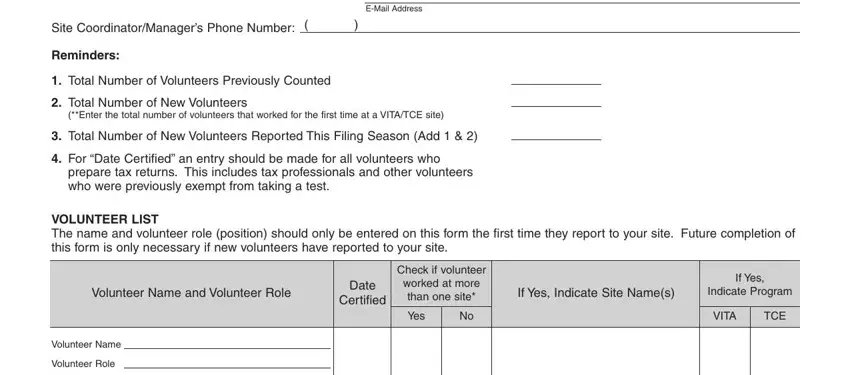

2. Soon after this array of blanks is completed, go to enter the applicable information in all these: Site CoordinatorManagers Phone, EMail Address, Reminders, Total Number of Volunteers, Total Number of New Volunteers, Enter the total number of, Total Number of New Volunteers, For Date Certified an entry, prepare tax returns This includes, VOLUNTEER LIST The name and, Volunteer Name and Volunteer Role, Date, Certified, Check if volunteer, and worked at more than one site.

People frequently make errors when filling out Reminders in this part. You need to revise whatever you enter right here.

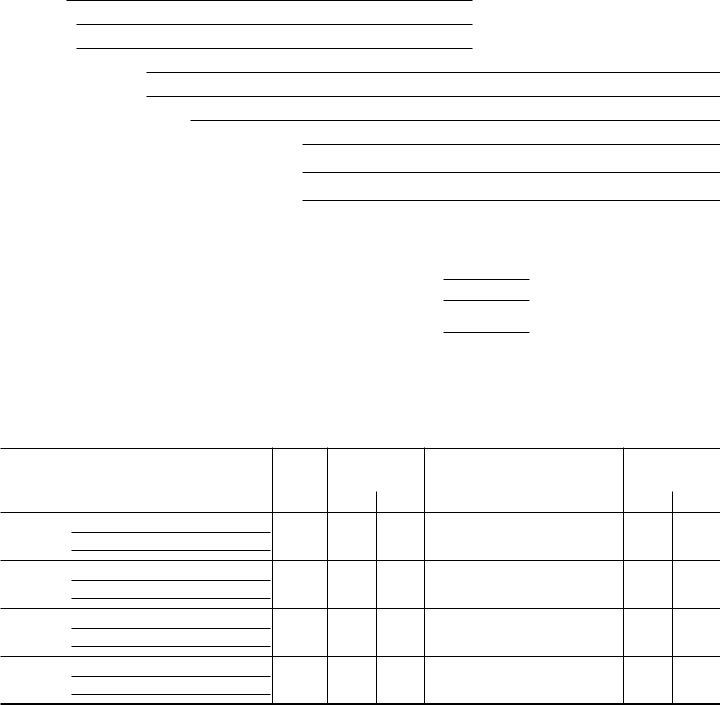

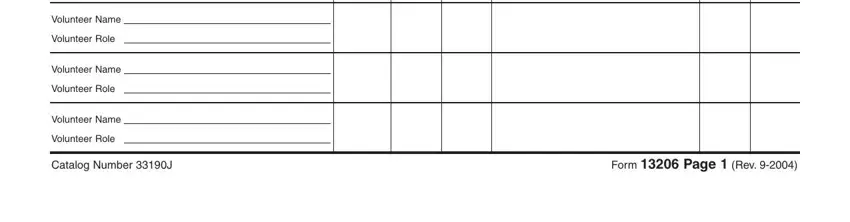

3. Completing Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Catalog Number J, and Form Page Rev is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

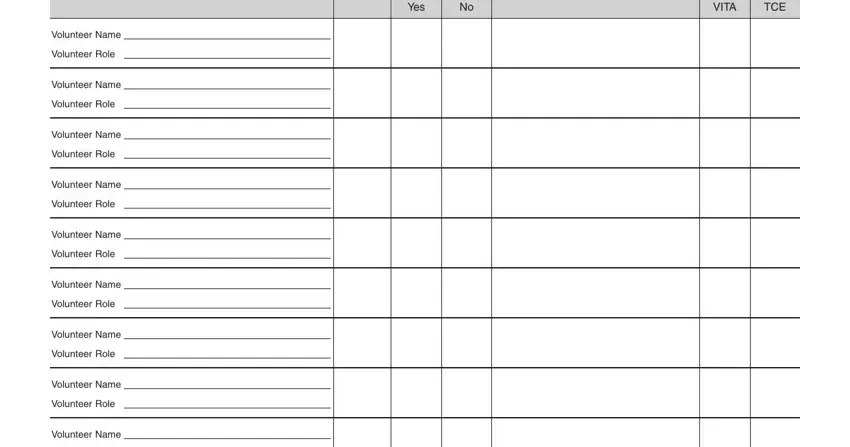

4. To move ahead, this fourth part will require filling out a few fields. Included in these are Yes, VITA, TCE, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, and Volunteer Role, which are crucial to carrying on with this form.

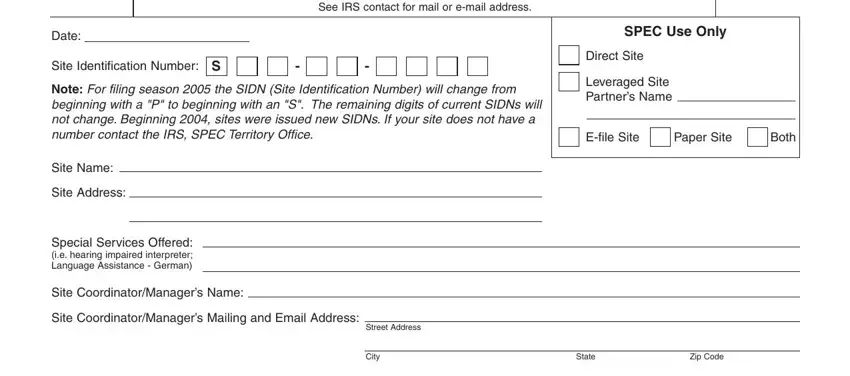

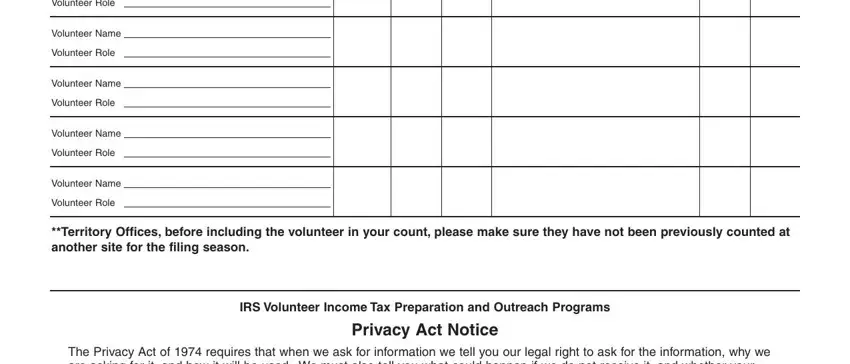

5. As you come near to the last sections of the document, you'll notice just a few more points to complete. Notably, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Volunteer Name, Volunteer Role, Territory Offices before including, IRS Volunteer Income Tax, Privacy Act Notice, and The Privacy Act of requires that should be filled in.

Step 3: Immediately after taking one more look at the filled out blanks, click "Done" and you're all set! Sign up with FormsPal right now and instantly obtain irs 13206, all set for downloading. Every single modification you make is conveniently saved , which enables you to edit the form at a later point if needed. FormsPal provides risk-free document editor without personal data record-keeping or sharing. Be assured that your information is secure here!