Form 13615

(October 2021)

Department of the Treasury - Internal Revenue Service

Volunteer Standards of Conduct Agreement – VITA/TCE Programs

The mission of the VITA/TCE return preparation programs is to assist eligible taxpayers in satisfying their tax responsibilities by providing free tax return preparation. To establish the greatest degree of public trust, volunteers are required to maintain the highest standards of ethical conduct and provide quality service.

Use of Form 13615: This form provides information on a volunteer's certification. All VITA/TCE volunteers (whether paid or unpaid workers) must pass the Volunteer Standards of Conduct certification, and sign and date Form 13615, Volunteer Standards of Conduct Agreement, prior to working at a VITA/TCE site. In addition, return preparers, quality reviewers, site coordinators, and VITA/TCE tax law instructors must certify in the Intake/Interview & Quality Review and tax law prior to signing this form. This form is not valid until the site coordinator, sponsoring partner, instructor, or IRS contact confirms the volunteer’s identity, with a government-issued photo ID, and signs and dates the form.

Standards of Conduct: As a volunteer in the VITA/TCE Programs, you must:

VSC #1 - Follow the Quality Site Requirements (QSR).

VSC #2 - Not accept payment, solicit donations, or accept refund payments for federal or state tax return preparation from customers.

VSC #3 - Not solicit business from taxpayers you assist or use the information you gained about them for any direct or indirect personal benefit for you or any other specific individual.

VSC #4 - Not knowingly prepare false returns.

VSC #5 - Not engage in criminal, infamous, dishonest, notoriously disgraceful conduct, or any other conduct deemed to have a negative effect on the VITA/TCE Programs.

VSC #6 - Treat all taxpayers in a professional, courteous, and respectful manner.

Failure to comply with these standards could result in, but is not limited to, the following:

•Your removal from all VITA/TCE Programs;

•Inclusion in the IRS Volunteer Registry to bar future VITA/TCE activity indefinitely;

•Deactivation of your sponsoring partner’s site VITA/TCE EFIN (electronic filing ID number);

•Removal of all IRS products, supplies, loaned equipment, and taxpayer information from your site;

•Termination of your sponsoring organization’s partnership with the IRS;

•Termination of grant funds from the IRS to your sponsoring partner; and

•Referral of your conduct for potential TIGTA and criminal investigations.

Taxpayer Impact: Taxpayer trust in the IRS and the local sponsoring partner organization is jeopardized when ethical standards are not followed. Fraudulent returns that report incorrect income, credits, or deductions can result in many years of interaction with the IRS as the taxpayer tries to pay the additional tax plus interest and penalties. This can result in an extreme burden for the taxpayer as the taxpayer tries to resolve the errors made on his or her return.

Volunteer Protection: The Volunteer Protection Act generally protects unpaid volunteers from liability for acts or omissions that occur while acting within the scope of their responsibilities at the time of the act or omission. It provides no protection for harm caused by willful or criminal misconduct, gross negligence, reckless misconduct, or a conscious, flagrant indifference to the rights or safety of the individual harmed by the volunteer.

For additional information on the volunteer standards of conduct, please refer to Publication 4961, Volunteer Standards of Conduct - Ethics Training.

Privacy Act Notice – The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether your response is voluntary, required to obtain a benefit, or mandatory.

Our legal right to ask for information is 5 U.S.C. 301. We are asking for this information to assist us in contacting you relative to your interest and/or participation in the IRS volunteer income tax preparation and outreach programs. The information you provide may be furnished to others who coordinate activities and staffing at volunteer return preparation sites or outreach activities. The information may also be used to establish effective controls, send correspondence and recognize volunteers. Your response is voluntary. However, if you do not provide the requested information, the IRS may not be able to use your assistance in these programs. Please note: Sponsoring organizations may perform background checks on their volunteers.

IRC 7216(a) - Imposes criminal penalties on tax return preparers who knowingly or recklessly make unauthorized disclosures or uses of information furnished in connection with the preparation of an income tax return. A violation of IRC 7216 is a misdemeanor, with a maximum penalty of up to one year imprisonment or a fine of not more than $1,000, or both, together with the cost of prosecution.

Catalog Number 38847H |

www.irs.gov |

Form 13615 (Rev. 10-2021) |

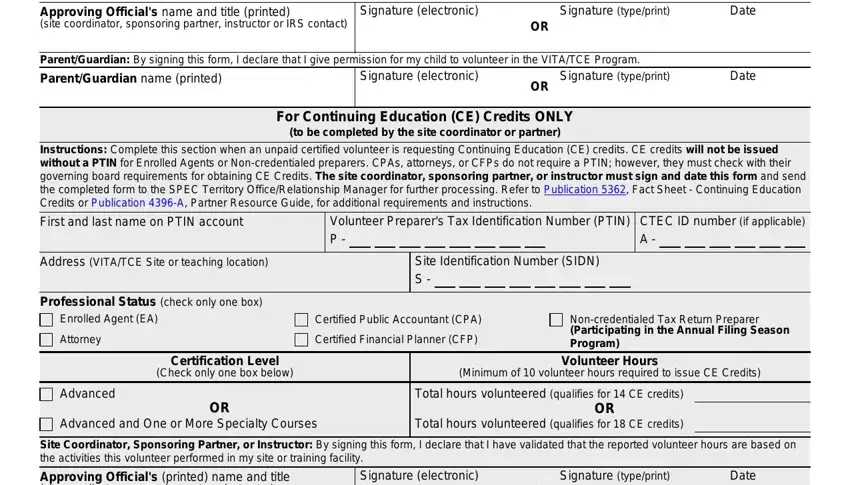

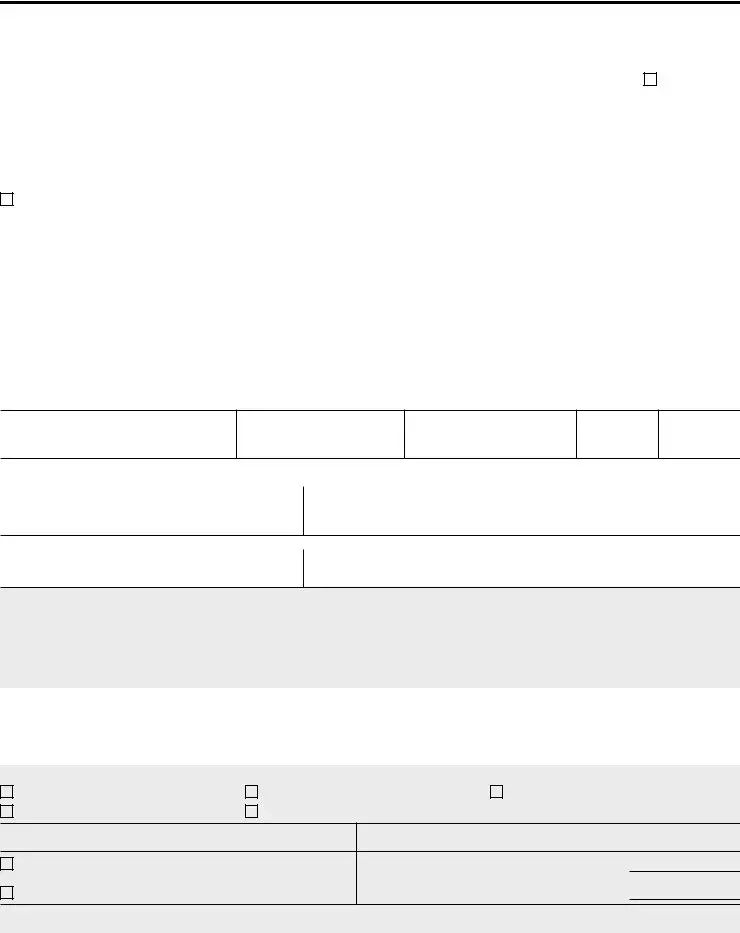

Certification Level

(Check only one box below)

Advanced

OR

Advanced and One or More Specialty Courses

Attorney

(check only one box)

Professional Status

Enrolled Agent (EA)

Volunteer:

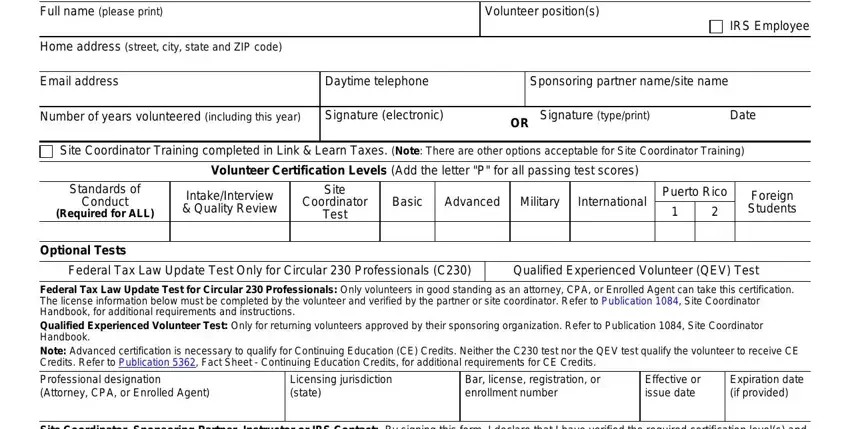

By signing this form, I declare that I have completed Volunteer Standards of Conduct certification and have read, understand, and will comply with the standards of conduct. I also certify that I am a U.S. citizen, a legal resident, or otherwise reside in the U.S. legally.

Full name (please print) |

|

|

|

|

|

|

|

|

Volunteer position(s) |

|

|

IRS Employee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street, city, state and ZIP code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

|

Daytime telephone |

|

|

|

|

Sponsoring partner name/site name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of years volunteered (including this year) |

|

Signature (electronic) |

|

|

|

OR Signature (type/print) |

|

|

Date |

Site Coordinator Training completed in Link & |

Learn Taxes. (Note: There are other options acceptable for Site Coordinator Training) |

|

Volunteer Certification Levels (Add the letter "P" for all passing test scores) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Standards of |

Intake/Interview |

|

|

Site |

|

|

|

|

|

|

|

|

Puerto Rico |

|

Foreign |

Conduct |

& Quality Review |

|

Coordinator |

Basic |

|

Advanced |

Military |

International |

|

|

|

Students |

(Required for ALL) |

|

|

Test |

|

|

|

|

|

|

|

|

1 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Optional Tests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Tax Law Update Test Only for Circular 230 Professionals (C230) |

|

|

Qualified Experienced Volunteer (QEV) Test |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Tax Law Update Test for Circular 230 Professionals: Only volunteers in good standing as an attorney, CPA, or Enrolled Agent can take this certification. The license information below must be completed by the volunteer and verified by the partner or site coordinator. Refer to Publication 1084, Site Coordinator Handbook, for additional requirements and instructions.

Qualified Experienced Volunteer Test: Only for returning volunteers approved by their sponsoring organization. Refer to Publication 1084, Site Coordinator Handbook.

Note: Advanced certification is necessary to qualify for Continuing Education (CE) Credits. Neither the C230 test nor the QEV test qualify the volunteer to receive CE Credits. Refer to Publication 5362, Fact Sheet - Continuing Education Credits, for additional requirements for CE Credits.

Professional designation (Attorney, CPA, or Enrolled Agent)

Licensing jurisdiction (state)

Bar, license, registration, or

enrollment number

Expiration date

(if provided)

Site Coordinator, Sponsoring Partner, Instructor or IRS Contact: By signing this form, I declare that I have verified the required certification level(s) and government-issued photo ID for this volunteer prior to allowing the volunteer to work at the VITA/TCE site.

Approving Official's name and title (printed) |

Signature (electronic) |

Signature (type/print) |

Date |

(site coordinator, sponsoring partner, instructor or IRS contact) |

|

OR |

|

Parent/Guardian: By signing this form, I declare that I give permission for my child to volunteer in the VITA/TCE Program.

Parent/Guardian name (printed) |

Signature (electronic) |

OR |

Signature (type/print) |

Date |

|

|

|

|

For Continuing Education (CE) Credits ONLY

(to be completed by the site coordinator or partner)

Instructions: Complete this section when an unpaid certified volunteer is requesting Continuing Education (CE) credits. CE credits will not be issued without a PTIN for Enrolled Agents or Non-credentialed preparers. CPAs, attorneys, or CFPs do not require a PTIN; however, they must check with their governing board requirements for obtaining CE Credits. The site coordinator, sponsoring partner, or instructor must sign and date this form and send the completed form to the SPEC Territory Office/Relationship Manager for further processing. Refer to Publication 5362, Fact Sheet - Continuing Education Credits or Publication 4396-A, Partner Resource Guide, for additional requirements and instructions.

First and last name on PTIN account |

Volunteer Preparer's Tax Identification Number (PTIN) |

CTEC ID number (if applicable) |

|

P - |

A - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (VITA/TCE Site or teaching location) |

|

|

|

|

|

|

Site Identification Number (SIDN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified Public Accountant (CPA)

Certified Financial Planner (CFP)

Non-credentialed Tax Return Preparer

(Participating in the Annual Filing Season Program)

Volunteer Hours

(Minimum of 10 volunteer hours required to issue CE Credits)

Total hours volunteered (qualifies for 14 CE credits)

OR

Total hours volunteered (qualifies for 18 CE credits)

Site Coordinator, Sponsoring Partner, or Instructor: By signing this form, I declare that I have validated that the reported volunteer hours are based on the activities this volunteer performed in my site or training facility.

Approving Official's (printed) name and title |

Signature (electronic) |

Signature (type/print) |

Date |

(site coordinator, sponsoring partner, instructor) |

|

OR |

|

|

|

|

Catalog Number 38847H |

www.irs.gov |

Form 13615 (Rev. 10-2021) |