Handling PDF files online is certainly simple using our PDF editor. You can fill out form 13711 here painlessly. To have our tool on the leading edge of practicality, we work to adopt user-oriented capabilities and enhancements regularly. We are at all times looking for suggestions - play a vital part in revolutionizing PDF editing. For anyone who is looking to get going, this is what it will require:

Step 1: Simply hit the "Get Form Button" in the top section of this page to get into our pdf editing tool. This way, you'll find everything that is needed to fill out your document.

Step 2: This tool gives you the capability to modify your PDF form in a variety of ways. Improve it by writing customized text, correct original content, and place in a signature - all within a few clicks!

It really is easy to finish the document with our detailed tutorial! Here is what you need to do:

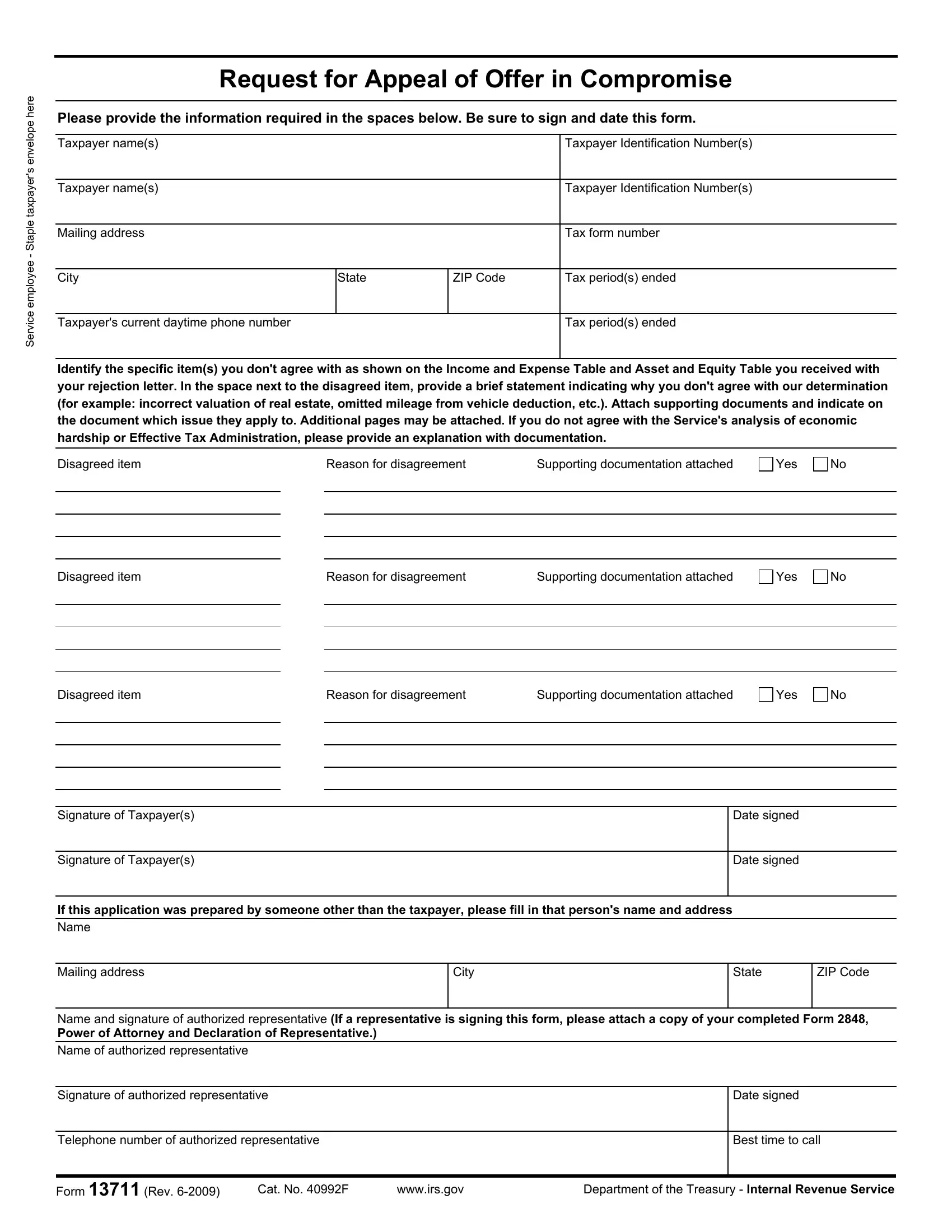

1. Start completing the form 13711 with a group of essential blank fields. Gather all of the necessary information and be sure not a single thing left out!

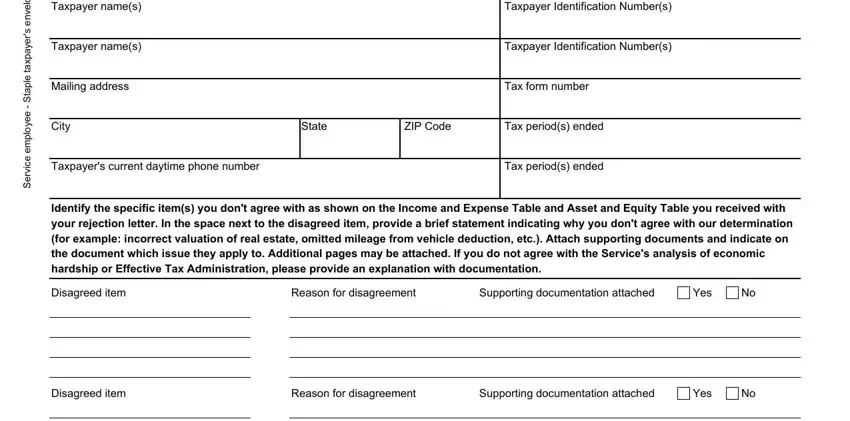

2. After the last section is complete, it's time to put in the necessary details in Disagreed item, Reason for disagreement, Supporting documentation attached, Yes, Signature of Taxpayers, Signature of Taxpayers, Date signed, Date signed, If this application was prepared, Mailing address, City, State, ZIP Code, and Name and signature of authorized in order to go further.

It's easy to make a mistake when filling out the Signature of Taxpayers, and so make sure that you reread it prior to deciding to submit it.

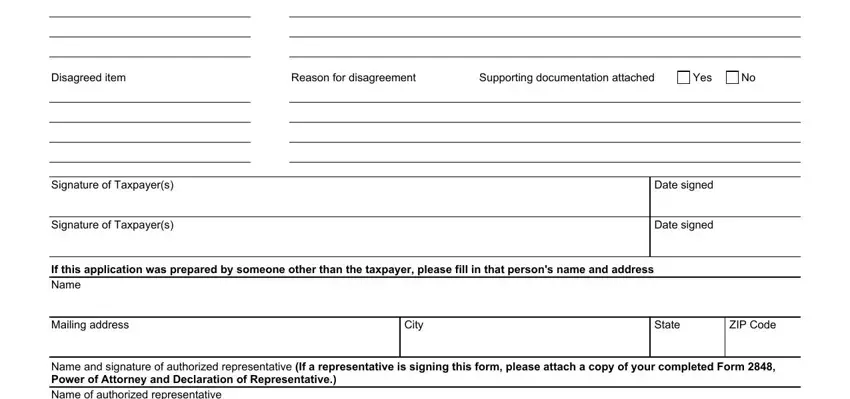

3. Within this step, have a look at Name and signature of authorized, Signature of authorized, Telephone number of authorized, Date signed, Best time to call, Form Rev, Cat No F, wwwirsgov, and Department of the Treasury. These are required to be filled out with highest attention to detail.

Step 3: As soon as you've looked over the details in the file's blanks, click on "Done" to conclude your FormsPal process. Join FormsPal now and immediately get form 13711, ready for download. All alterations made by you are preserved , helping you to change the pdf at a later point when necessary. We don't sell or share the details that you use whenever filling out forms at our site.