When you would like to fill out irs form 13909, there's no need to install any software - just make use of our PDF editor. FormsPal expert team is constantly working to develop the editor and insure that it is even easier for people with its handy features. Enjoy an ever-evolving experience today! Here's what you will want to do to begin:

Step 1: Click the "Get Form" button in the top area of this webpage to open our tool.

Step 2: As you access the tool, you will see the document prepared to be filled in. In addition to filling out different fields, you may as well perform other things with the Document, such as putting on any textual content, modifying the original text, inserting graphics, placing your signature to the document, and a lot more.

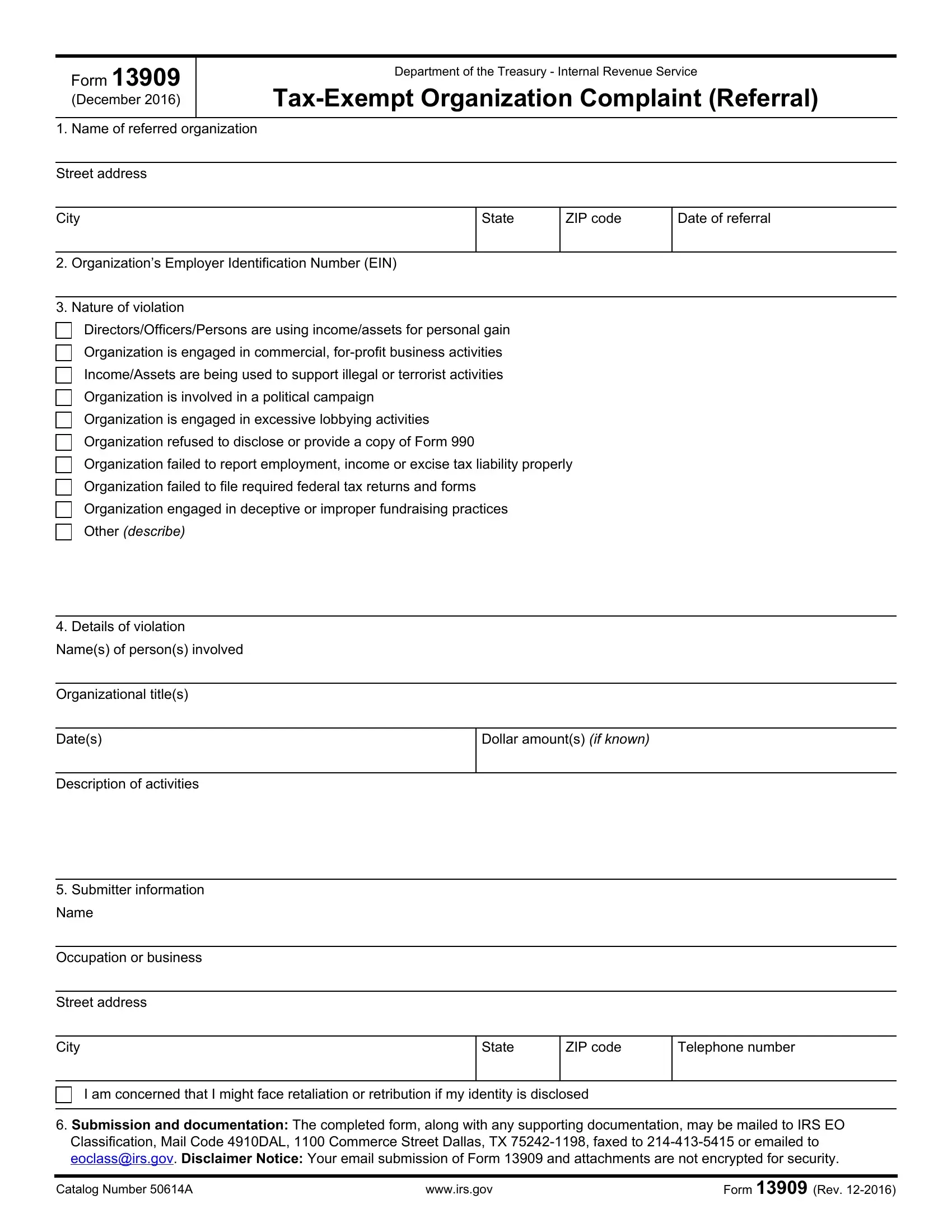

This PDF form will require specific information to be entered, therefore be sure you take the time to fill in what's expected:

1. The irs form 13909 usually requires certain details to be typed in. Ensure the next fields are finalized:

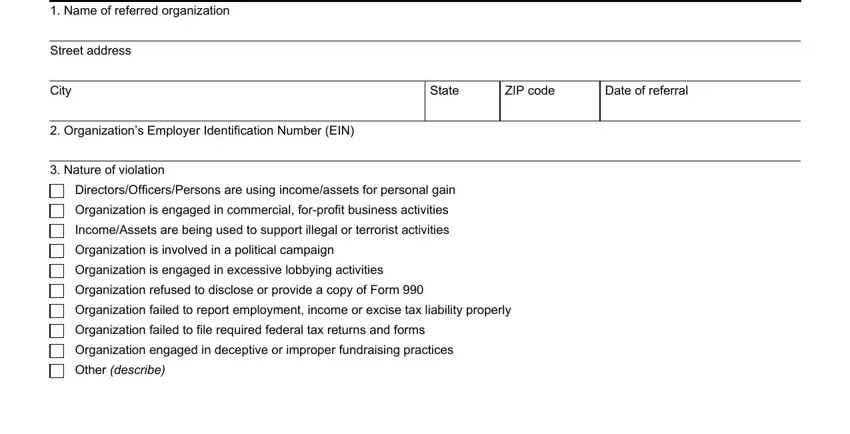

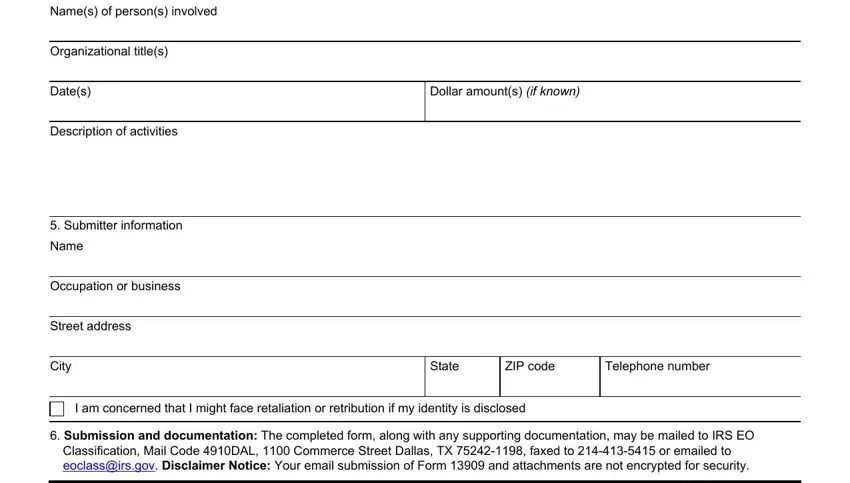

2. The subsequent part is to complete the next few blanks: Names of persons involved, Organizational titles, Dates, Dollar amounts if known, Description of activities, Submitter information, Name, Occupation or business, Street address, City, State, ZIP code, Telephone number, I am concerned that I might face, and Submission and documentation The.

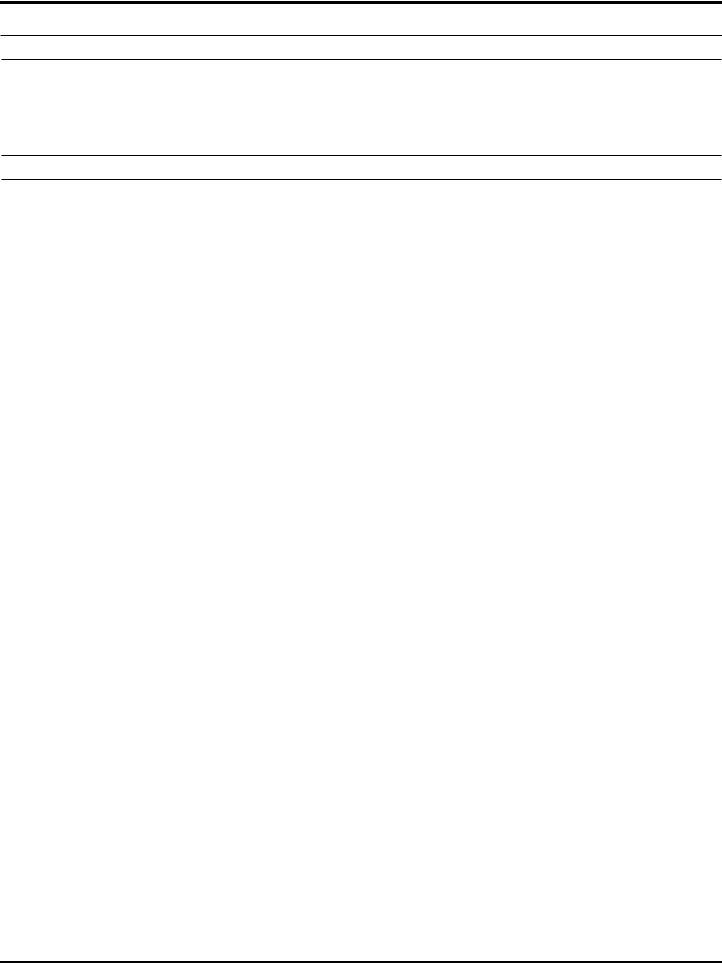

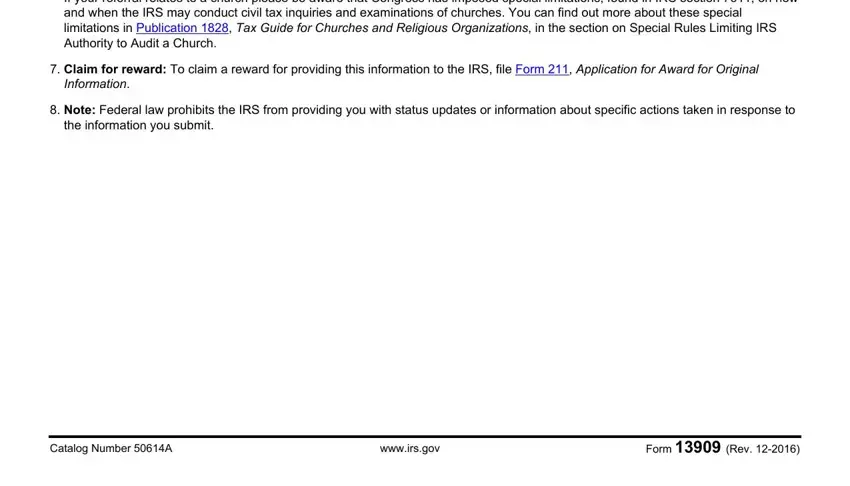

3. The following portion is focused on If your referral relates to a, Claim for reward To claim a, Information, Note Federal law prohibits the, the information you submit, Catalog Number A, wwwirsgov, and Form Rev - fill out each of these empty form fields.

A lot of people generally get some things wrong while completing Catalog Number A in this part. Make sure you review whatever you type in right here.

Step 3: As soon as you've looked again at the information entered, simply click "Done" to complete your form at FormsPal. Go for a 7-day free trial option with us and gain instant access to irs form 13909 - readily available in your personal cabinet. FormsPal is committed to the privacy of our users; we make sure that all personal information processed by our tool is protected.