Form 165 Schedule K 1 Nr can be filled out without difficulty. Simply open FormsPal PDF editing tool to complete the job right away. The tool is consistently maintained by our team, getting additional features and growing to be greater. To get the ball rolling, consider these easy steps:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: This editor offers the capability to change your PDF form in many different ways. Enhance it by writing any text, adjust what is already in the file, and add a signature - all doable within minutes!

Filling out this form calls for care for details. Make certain all required blanks are done properly.

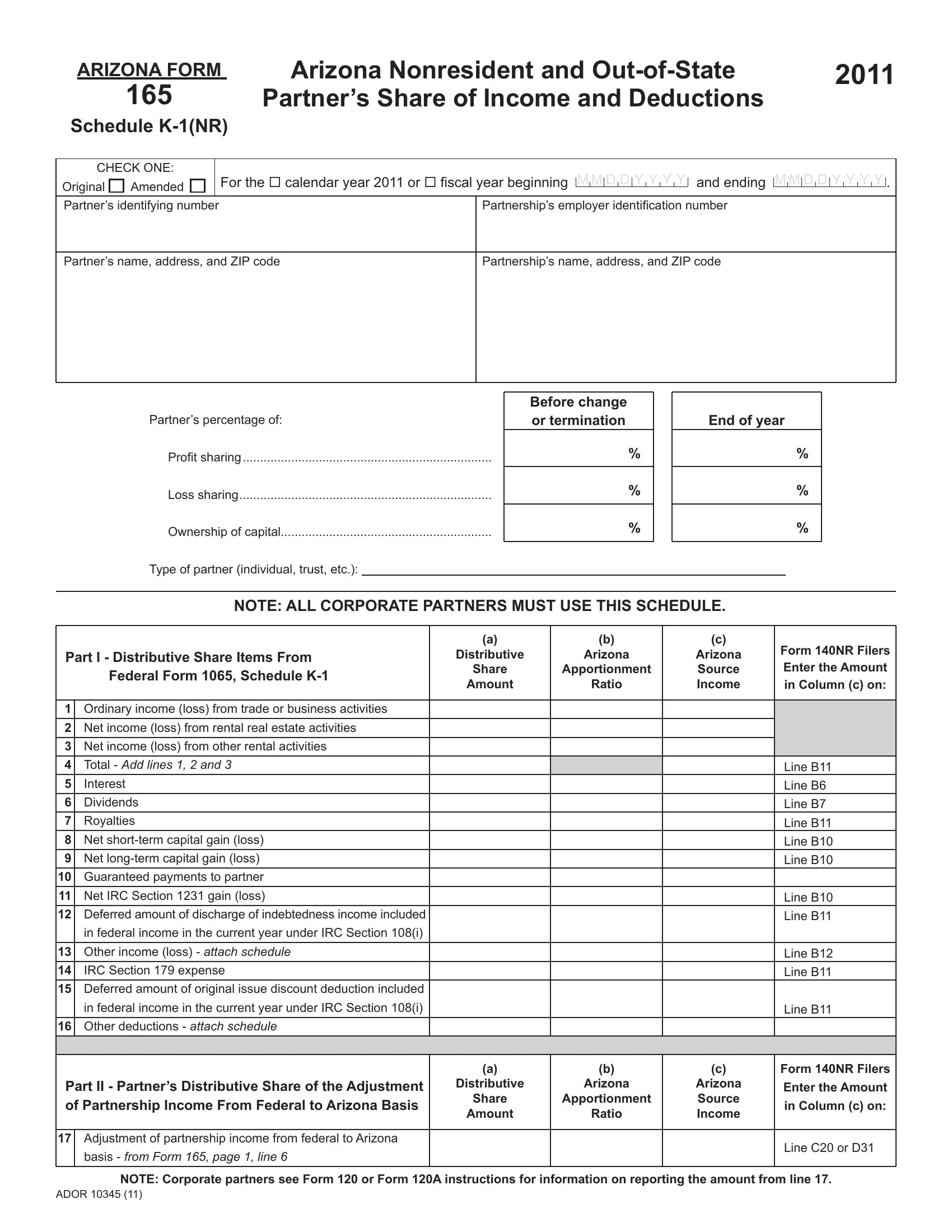

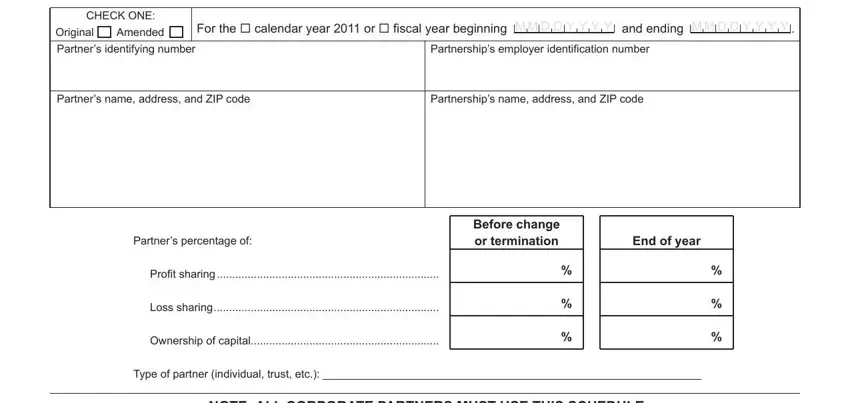

1. The Form 165 Schedule K 1 Nr requires particular information to be inserted. Ensure the subsequent blank fields are finalized:

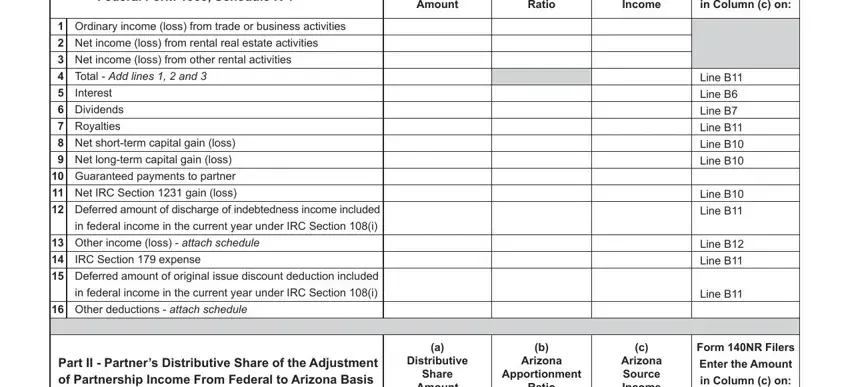

2. Soon after filling out the previous part, head on to the subsequent part and fill out the necessary particulars in all these blanks - Part I Distributive Share Items, Federal Form Schedule K, Ordinary income loss from trade, Net income loss from rental real, Net income loss from other rental, Total Add lines and, Interest, Dividends, Royalties, Net shortterm capital gain loss, Net longterm capital gain loss, Guaranteed payments to partner, Net IRC Section gain loss, Deferred amount of discharge of, and in federal income in the current.

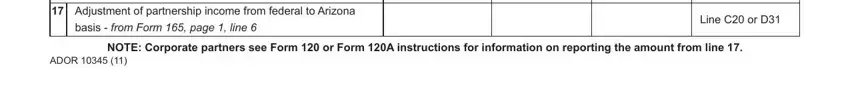

3. This third step is fairly uncomplicated, Adjustment of partnership income, basis from Form page line, Line C or D, NOTE Corporate partners see Form, and ADOR - every one of these fields will need to be filled out here.

Be very attentive while filling out ADOR and basis from Form page line, because this is where many people make some mistakes.

Step 3: Glance through everything you have typed into the form fields and click on the "Done" button. Join FormsPal right now and instantly access Form 165 Schedule K 1 Nr, set for downloading. All changes you make are kept , allowing you to edit the file later on anytime. We don't share or sell the information that you enter whenever filling out forms at our website.