In an environment where the stakes of regulatory compliance and executive decision-making are high, the Chubb Group of Insurance Companies' 17 03 0085 form emerges as a critical document for financial institutions and their subsidiaries seeking renewal of their executive liability insurance underwritten in Vigilant Insurance Company. This Renewal Application Form is a comprehensive document designed to capture the complete profile of a company, including basic information like company name and address, as well as detailed inquiries into the type of company, stock ownership, anticipated changes in ownership, and plans for mergers, acquisitions, or public offerings. It specifically caters to the intricate needs of financial institutions by probing into regulatory interactions, past claims, and the structure and meetings of the board of directors, alongside summarizing their operational, financial, and management dynamics over recent periods. The requirement for each company desiring coverage to fill a separate form, coupled with meticulous questions related to subsidiaries, loans to directors and officers, regulatory actions, and insurance coverages previously held, underlines the form’s emphasis on tailored risk assessment and due diligence. Essential for gauging the executive liability landscape of applying entities, this form serves as a foundation for insurance agreements that align with specific institutional risks and operational realities.

| Question | Answer |

|---|---|

| Form Name | Form 17 03 0085 |

| Form Length | 9 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 15 sec |

| Other names | Colorado, Rico, divestment, coverages |

Chubb Group of Insurance Companies

15 Mountain View Road, Warren, New Jersey 07059

RENEWAL APPLICATION FORM FOR EXECUTIVE LIABILITY INSURANCE FINANCIAL INSTITUTIONS

AND SUBSIDIARIES

UNDERWRITTEN IN VIGILANT INSURANCE COMPANY

(If coverage is desired for more than one Company, a separate Application must be completed for each.)

Company Name

Street Address

City |

State |

Zip Code |

Telephone |

1.Officer designated, as agent of the Company and of all insured Directors and Officers, to receive any and all notices from the Insurer or their authorized representative(s) concerning this insurance:

Name of Officer |

Title of Officer |

2.Type of Company:

Commercial Bank

Savings & Loan

Other (specify)

3. |

Deposits of Subsidiaries are insured since |

|

by: |

F.D.I.C.

F.S.L.I.C.

Other (specify)

4.Common Stock:

a. |

|

Total number of shareholders |

b. |

|

Total number of shares outstanding |

c. |

|

Total number of shares owned directly or beneficially by Directors and Officers |

d.Give names and percent owned of any shareholders holding directly or beneficially 10% or more of the common stock (if none, so indicate).

e.Has there been a change in controlling ownership (10% or more) in the last policy period?

If yes, provide details.

YES

NO

f.Are there any negotiations now pending for the sale of stock in this Company

Form |

Page 1 of 9 |

in excess of 10% of the total stock outstanding?

If yes, provide details

g.Are there any other securities which are convertible to common stock?

If yes, provide details.

5.a. Have any plans for merger, acquisition, consolidation or

divestiture been currently approved by the Board of Directors?

b.If yes, have such plans been submitted to the shareholders for approval? Kindly provide details of current status of such plans (attach sheet if necessary).

c.Does the Company or any Subsidiary anticipate any new public offering of securities or registration of securities under the Securities act of 1933 or any other similar Federal, State or Municipal Statute or qualification of securities under Regulation A or any other similar Federal, State, or Municipal Regulation

within the next year?

If yes, provide details and submit prospectus.

6.Has any regulatory agency denied or indicated that they would deny any contemplated merger, acquisition or divestment in the last 5 years?

If yes, provide details.

YES

YES

YES

YES

YES

YES

NO

NO

NO

NO

NO

NO

7.Provide the following information on Page 8 for all Subsidiaries (including Subsidiaries of Subsidiaries): If none, please indicate:

a. |

Name |

f. |

Domestic or foreign |

most |

b. |

Date created or acquired |

g. |

Name of parent institution |

recent |

c. |

State of Incorporation |

h. |

Total revenues |

year end |

d. |

Percent of ownership |

i. |

Total assets |

figures |

e. |

Nature of business |

j. |

Net income |

|

It is agreed that coverage is not provided for Subsidiaries unless listed above or by an attachment hereto providing similar information.

k.Is coverage to include all listed Subsidiaries?

If no, specify which Subsidiaries are not to be included.

8.Provide the following information for the Company and Subsidiaries:

YES

NO

a. |

|

Number of Directors |

|

b. |

|

|

Number of Officers |

Form |

Page 2 of 9 |

9.Is the Company or any of its Subsidiaries currently offering or planning to offer any of the following services?

a.Actuarial Services

b.Appraisal Services

c.Data Processing Services

d.Discount Brokerage Services

e.Insurance Agent/Agency

f.Investment Advisor/Counselor

g.Real Estate Agent/Agency

h.Real Estate Investment Trust Advisory Services

i.Security Broker/Dealer

j.Travel Agent/Agency

k.Underwriting of Securities

YES YES YES YES YES YES YES YES YES YES YES

NO NO NO NO NO NO NO NO NO NO NO

10.Attach a list of names and principal business affiliations, including directorships of financial institutions, for all Directors and Senior Officers proposed for this insurance.

It is agreed that coverage is not provided under this Policy for outside positions listed in conjunction with the above question.

11.a. Have there been any changes in senior management during the last policy period

If yes, provide details.

b.In the last five years, has the Company changed the Certified Public Accounting firm that prepares its independent audited financial statements?

If yes, provide the time of the change and the reasons for making the change.

YES

YES

NO

NO

12.Have there been during the last policy period, or are there now pending, any suits, claims or proceedings against this Company or Subsidiaries?

If yes, provide details.

13.a. Are there any outstanding loans to any Director or Officer

of the Company or of any Subsidiary?

b.Are there any outstanding loans to any corporations or partnerships in which a Director or Officer of the Company or its Subsidiaries owns

or controls more than 10% interest?

YES

YES

YES

NO

NO

NO

If Question 13(a) or 13(b) is answered yes, please provide separate schedule of such loans with the following information:

i.name of borrower

ii.type of loan

iii.whether secured or unsecured

iv.outstanding balance

v.final due date

vi.amount past due.

Form |

Page 3 of 9 |

14.During the last policy period, have any Directors or Officers been alerted to any of the following conditions relating to the Company or any Subsidiary?

a.Concentration of credits which warrant reduction or correction?

b.Extensions of credit which exceed the legal lending limit?

c.Assets subject to criticism by any regulatory authority as substandard, doubtful, loss, or as other assets especially mentioned, the total

of which exceeds 25% of capital?

d.Problems involving extensions of credit to Directors, Officers or Corporations controlled by Directors or Officers?

e.Significant violations of laws and regulations?

f.Conflict of interest transactions?

YES

YES

YES

YES

YES

YES

NO

NO

NO

NO

NO

NO

If any of the above are answered yes, provide details by attachment with current status.

15.Provide the dates of the last 3 regulatory examinations along with the name of the examining agency for the Company and each Subsidiary.

Have all recommendations or criticisms of the last examination |

|

|

been complied with as respects the Company and Subsidiaries? |

YES |

NO |

If no, please attach a separate sheet and explain. |

|

|

16.Since the last policy period, has the Company or any Subsidiary ever received a cease and desist order from any regulatory agency or entered into any other type

of written agreement with a regulatory agency concerning the operation of the |

|

|

Company |

|

|

or Subsidiaries? |

YES |

NO |

If yes, provide details. |

|

|

17.Provide the following information: a. Blanket Bond

Limit: |

|

Deductible: |

|

||

Expiration Date: |

|

|

Insurer: |

|

|

b.Trust Department E&O (Surcharge Liability)

Limit: |

|

Retention: |

|

|

||

Expiration Date: |

|

|

Insurer: |

|

|

|

c.General Liability Insurance

Limit: |

|

Deductible: |

|

|

||

Expiration Date: |

|

|

Insurer: |

|

|

|

It is represented and agreed that above coverages in current amounts will be maintained by the Company and its Subsidiaries during the policy period of the proposed insurance and that the Insurer is relying upon such representations when issuing a Policy.

Form |

Page 4 of 9 |

18.During the last policy period, has this Company or any Subsidiary, made any claim in excess of $25,000 under its Blanket Bond?

If yes, provide details.

19.How often are Board of Directors meetings held?

YES

NO

20. List the Board of Directors committees which are in existence and indicate the frequency of the meetings.

a.c.

b.d.

21.Indicate the areas in which formal written policies and/or procedures have been implemented by the Board of Directors to address the following:

Audit Policy

Conflicts of Interest Policy

Duties of Directors and Officers

Investment Policy

Loan Policy

Merger and Tender Offers Operation Procedures Personnel Policy

Risk Management Policy

Selection process for New Directors

22.How often does the Board of Directors review the following?

Financial Statements of the Institution Investment Activities

(Purchase, Sales, Gains & Losses) Insurance Coverages

Changes in Lending Policy Loan Delinquencies Charged Off Loans Significant Overdrafts Threatened or Actual Litigation

23.Trust Department:

a.Approximate trust assets: Market Value Number of Accounts

b.Approximate assets of plans subject to ERISA Market Value

Number of Accounts

c.Number of Trust Officers

24.One copy of each of the following documents is to be attached and made a part of this Application:

a.latest two Annual Audited Financial Statements;

b.latest two C.P.A. Management Letters and Responses;

c.latest two Annual Reports to Stockholders;

d.all subsequent Quarterly Reports to Stockholders;

e.notice to Stockholders and Proxy Statement for both the last and next scheduled meetings;

f.most recent S.E.C. Form

g.all subsequent

h.all Registration Statements of securities made in the last year.

Form |

Page 5 of 9 |

25.In addition to the documents referred to in 24 above, one copy of each of the following documents is also to be attached and made a part of this Application:

COMMERCIAL BANKS AND SAVINGS BANKS:

a.most recent Uniform Bank Performance Report (UBPR) and

b.most recent Quarterly Call Report including Statement of Condition and Income for each Bank Subsidiary.

SAVINGS & LOAN ASSOCIATIONS:

a.two latest Annual FHLBB Reports for each Savings & Loan Association;

b.all subsequent Quarterly FHLBB Reports for each Savings & Loan Association; and

c.latest Monthly FHLBB Report for each Savings & Loan Association.

The undersigned persons declare that to the best of their knowledge, the statements set forth herein are true and correct and that reasonable efforts have been made to obtain sufficient information from each and every Director or Officer proposed for this insurance to facilitate the proper and accurate completion of this Application. The undersigned further agree that, if between the date of this Application and the effective date of the Policy, (1) any material change in the condition of the Applicant is discovered or, (2) there is any material change in the answers to the questions contained herein, either of which would render this Application inaccurate or incomplete, notice of such change will be reported in writing to the Insurer immediately and if necessary, any outstanding quotation may be modified or withdrawn.

The signing of this Application Form does not bind the undersigned to purchase this insurance, but it is agreed by the Company and all persons proposed for this insurance that the particulars and statements contained in this Renewal Application Form and attachments and materials submitted with this Renewal Application Form (which shall be retained on file by the Insurer and shall be deemed attached to the Policy, if insurance is provided, as if physically attached thereto) are 1) supplemental to Application Form(s) for all Policies of which this Insurance would be a renewal and 2) true and correct and will be the basis of the Policy, and 3) considered as incorporated in and constituting a part of the Policy. It is further agreed by the Company and all persons proposed for this insurance that such particulars and statements are material to the decision to provide this insurance and that any Policy will be issued in reliance upon the truth of such particulars and statements. All such particulars and statements shall be deemed to be made by each and every one of the persons proposed for this insurance, provided that, except for any misstatements or omissions of which the signers of this Renewal Application Form are aware, any misstatement or omission in this Renewal Application Form or the attachments and materials submitted with it, concerning any matter which any person proposed for this insurance has reason to suppose might afford grounds for a future claim against him shall not be imputed, for purposes of any rescission of the Policy, to any other persons proposed for this insurance who are not aware of the omission or the falsity of the statement.

False Information:

Any person who, knowingly and with intent to defraud any insurance company or other person, files an Application for insurance containing any false information, or conceals for the purpose of misleading, information concerning any material fact thereto, commits a fraudulent insurance act, which is a crime.

Notice to Arkansas, Minnesota, New Mexico and Ohio Applicants: Any person who, with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false, fraudulent or deceptive statement is, or may be found to be, guilty of insurance fraud, which is a crime, and may be subject to civil fines and criminal penalties.

Notice to Colorado Applicants: It is unlawful to knowingly provide false, incomplete or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policy holder or claimant for the purpose of defrauding or attempting to defraud the policy holder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory agencies.

Form |

Page 6 of 9 |

Notice to District of Columbia Applicants: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

Notice to Florida Applicants: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Notice to Kentucky Applicants: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Notice to Louisiana and Rhode Island Applicants: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Notice to Maine, Tennessee, Virginia and Washington Applicants: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Notice to Alabama and Maryland Applicants: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Notice to New Jersey Applicants: Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Notice to Oklahoma Applicants: Any person who, knowingly and with intent to injure, defraud or deceive any employer or employee, insurance company, or

Notice to Oregon and Texas Applicants: Any person who makes an intentional misstatement that is material to the risk may be found guilty of insurance fraud by a court of law.

Notice to Pennsylvania Applicants: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Notice to Puerto Rico Applicants: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation with the penalty of a fine of not less than five thousand (5,000) dollars and not more than ten thousand (10,000) dollars, or a fixed term of imprisonment for three

(3)years, or both penalties. Should aggravating circumstances are present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

Notice to New York Applicants: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime and shall also be subject to: a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Form |

Page 7 of 9 |

Signature of Chief Executive Officer

(or other Senior Officer if the Chief Executive Officer is also the Chairman, Board of Directors)

Company

Signature of Chairman, Board of Directors

Date

A Policy cannot be issued unless the Application is properly signed and dated by the Chief Executive Officer (or other Senior Officer if the Chief Executive Officer is also the Chairman, board of Directors) and the Chairman, Board of Directors.

NOTE: The Application and all exhibits shall be treated in strictest confidence.

Form |

Page 8 of 9 |

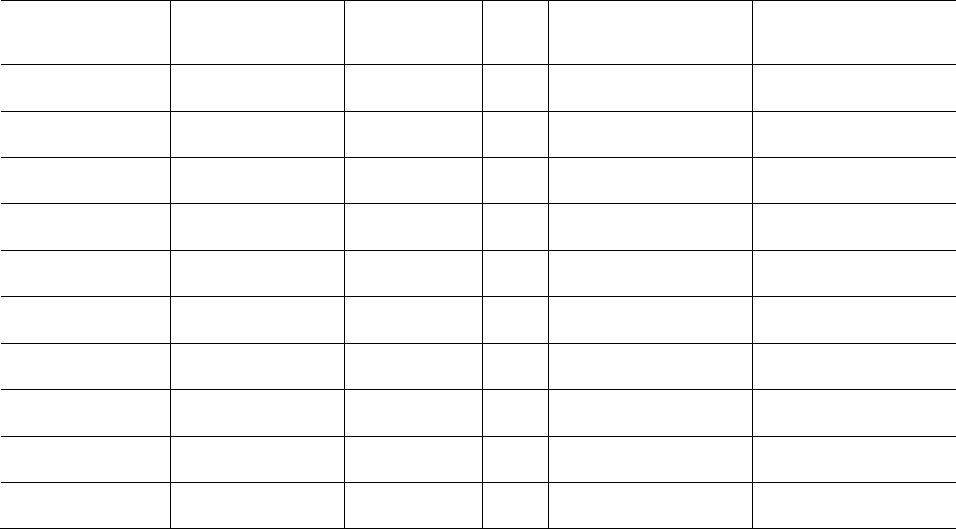

SUBSIDIARY INFORMATION FORM

Name of Subsidiary

Date |

|

|

Created |

State |

Percent |

or |

of |

of |

Acquired |

Incorp. |

Ownership |

|

|

|

Nature of Business

Domestic

or

Foreign

Name of Parent Institution

Financial Information for

Most Recent Year End

|

Total |

|

Total |

Assets |

Net |

Revenues |

(in Millions) |

Income |

|

|

|

This information is attached to and forms a part of the Application Form for Executive Liability.

Form |

Page 9 of 9 |