Should you intend to fill out form ndfl statement, you won't have to install any sort of applications - just try using our PDF tool. To have our tool on the cutting edge of practicality, we work to put into operation user-driven features and enhancements regularly. We are routinely happy to receive suggestions - play a vital part in remolding how we work with PDF docs. With some simple steps, you can start your PDF journey:

Step 1: Press the "Get Form" button above on this webpage to access our PDF tool.

Step 2: As soon as you access the tool, there'll be the document ready to be filled in. In addition to filling in various fields, you might also do some other things with the file, such as writing any words, editing the original textual content, inserting illustrations or photos, signing the form, and a lot more.

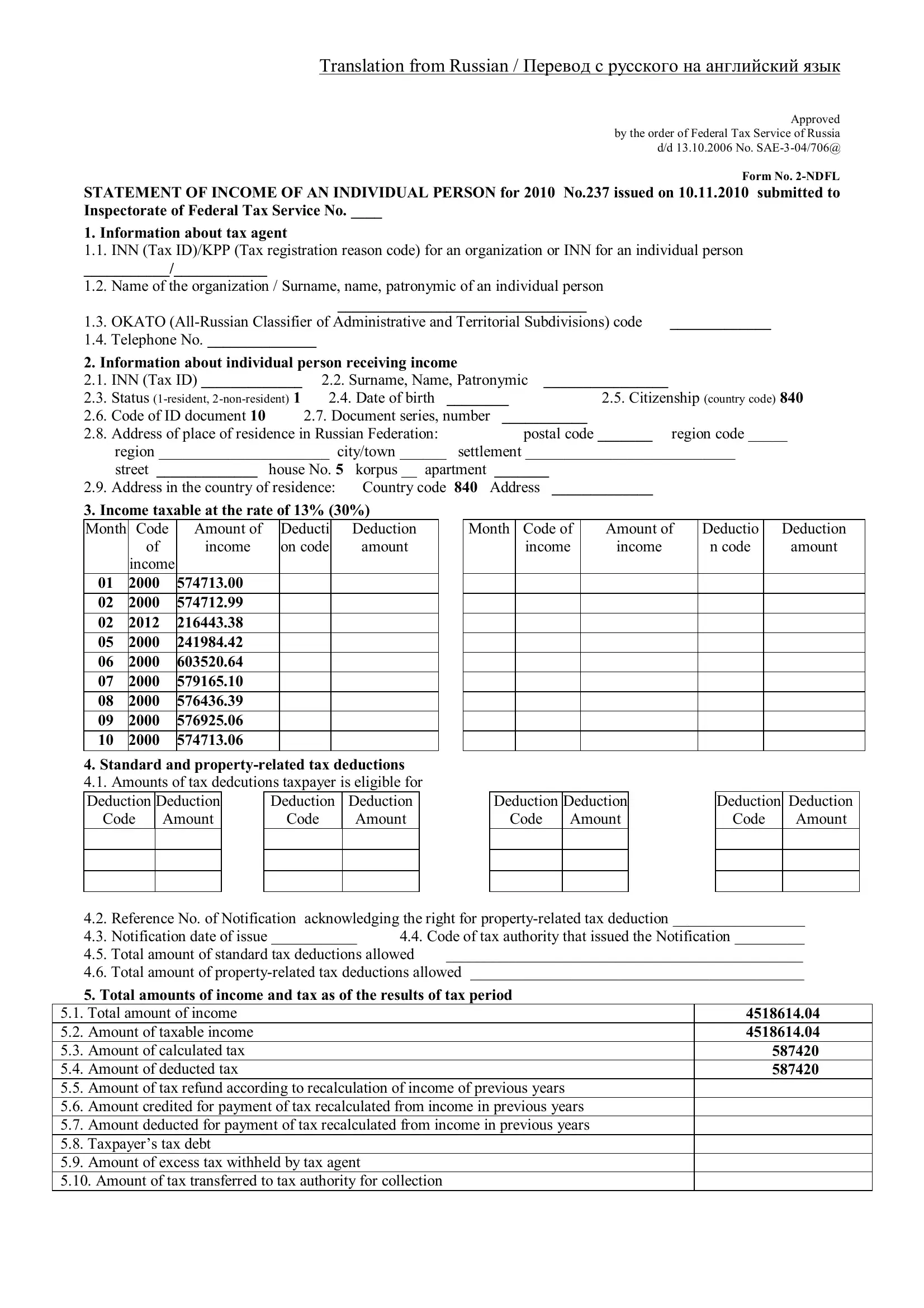

This document will require particular data to be entered, so ensure that you take your time to fill in exactly what is requested:

1. While filling in the form ndfl statement, be sure to complete all needed fields within its associated section. This will help to expedite the work, enabling your information to be handled swiftly and correctly.

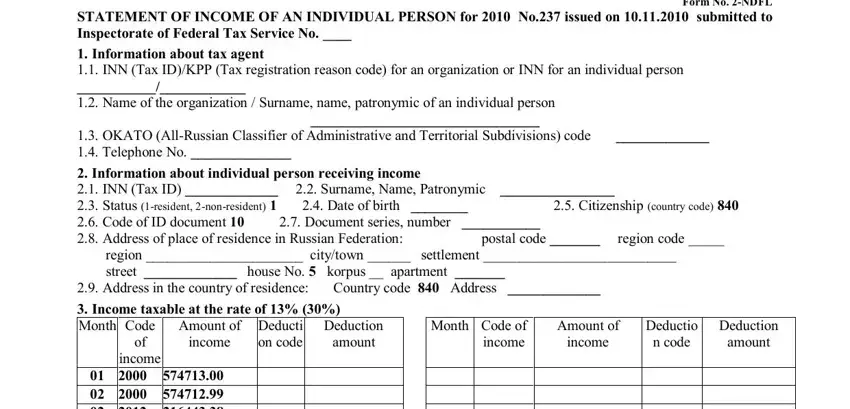

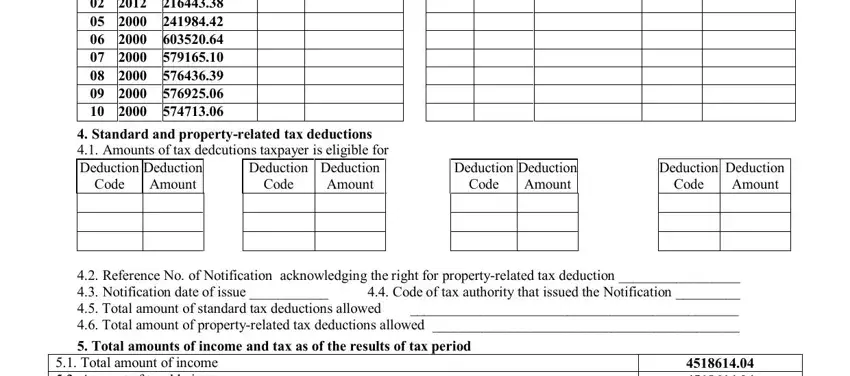

2. After performing the previous part, head on to the next step and enter all required details in these blank fields - Code, Standard and propertyrelated tax, Deduction Amount, Deduction Amount, Deduction, Code, Deduction, Code, Deduction Amount, Deduction, Code, Deduction Amount, Reference No of Notification, and Total amount of income Amount of.

It's easy to make an error while completing the Total amount of income Amount of, consequently you'll want to take another look before you decide to send it in.

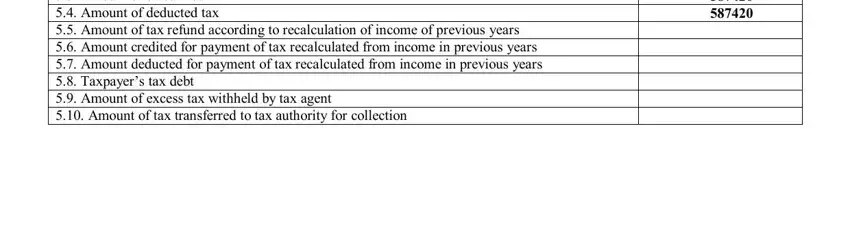

3. Within this stage, take a look at Total amount of income Amount of. Each of these are required to be filled in with utmost focus on detail.

4. This next section requires some additional information. Ensure you complete all the necessary fields - Translation from Russian, Tax agent, Acting Chief Accountant signature, position, Round Stamp, and Surname name patronymic - to proceed further in your process!

Step 3: Check all the details you've typed into the blank fields and then press the "Done" button. Obtain the form ndfl statement when you join for a 7-day free trial. Easily use the pdf file inside your FormsPal account page, together with any edits and changes conveniently synced! FormsPal is committed to the privacy of our users; we ensure that all information used in our system is protected.