aver can be filled in easily. Simply make use of FormsPal PDF tool to get the job done right away. Our team is always endeavoring to enhance the tool and help it become even faster for people with its extensive functions. Enjoy an ever-evolving experience now! If you are seeking to start, here is what it will take:

Step 1: First, open the pdf editor by clicking the "Get Form Button" in the top section of this webpage.

Step 2: With this state-of-the-art PDF tool, you could accomplish more than simply fill out blank form fields. Try all of the features and make your docs look high-quality with customized text incorporated, or optimize the original content to perfection - all that comes along with an ability to incorporate almost any photos and sign it off.

As for the blanks of this particular form, this is what you want to do:

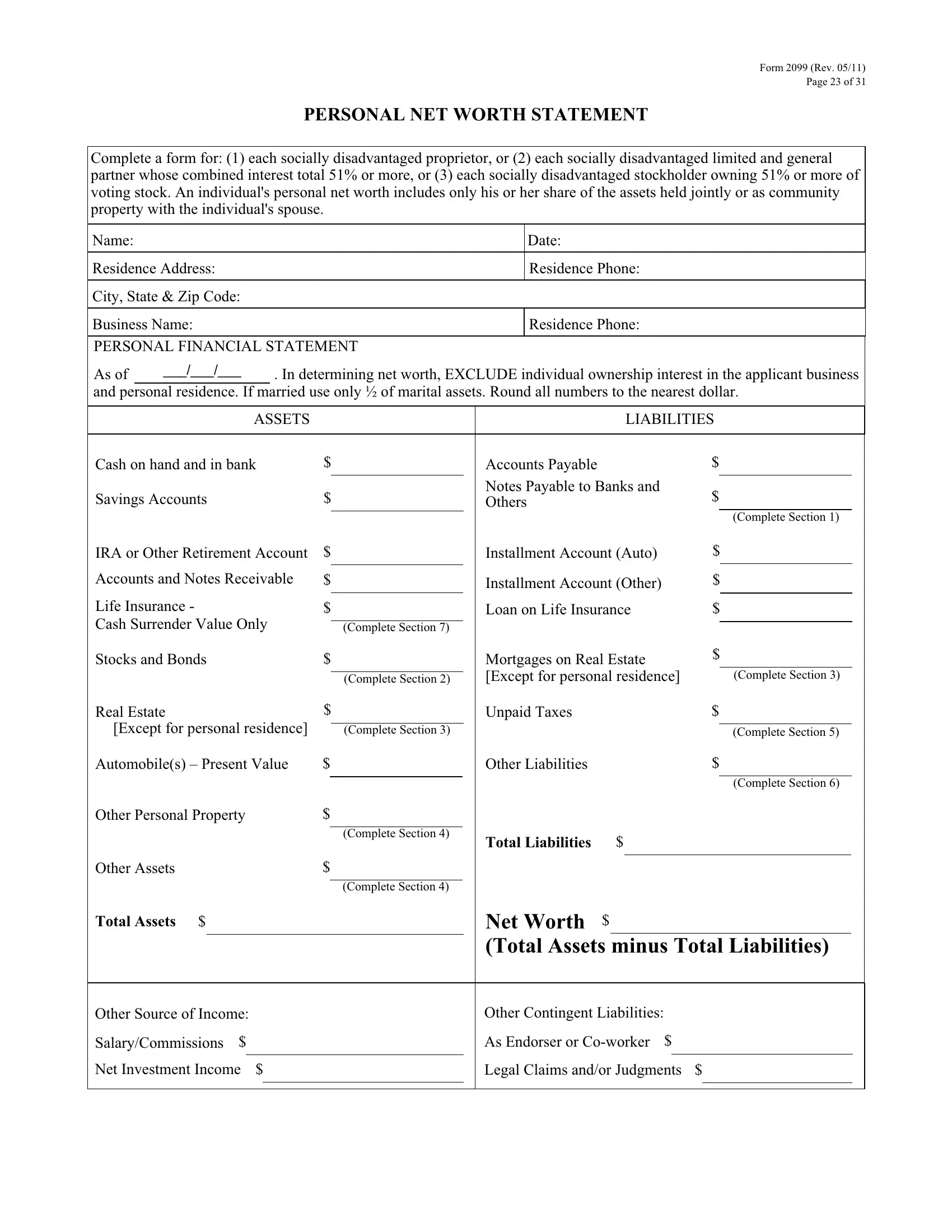

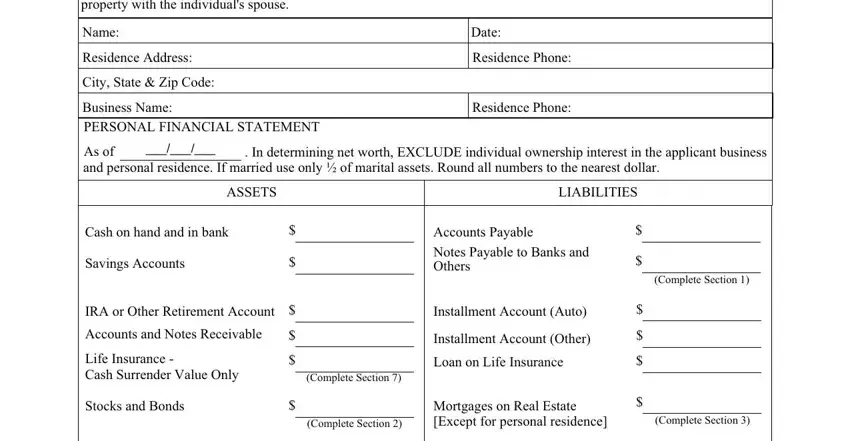

1. You will need to complete the aver accurately, therefore be mindful while working with the parts including all of these blank fields:

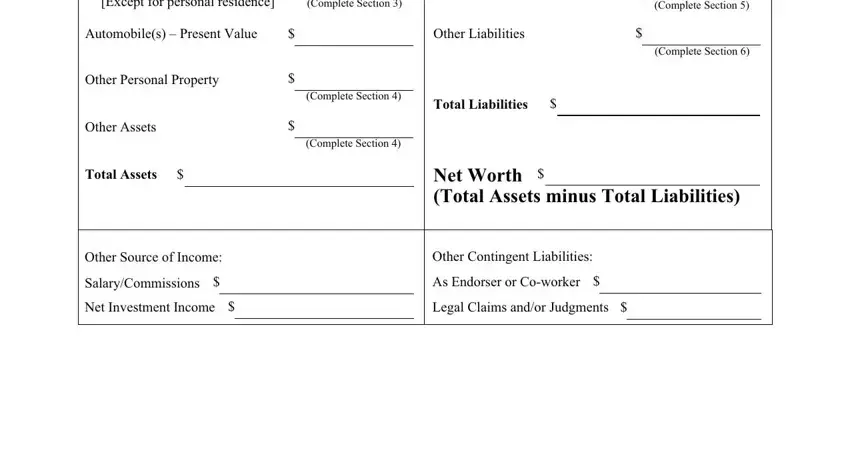

2. Right after filling out this part, head on to the next part and fill in the essential particulars in these blank fields - Except for personal residence, Automobiles Present Value, Other Personal Property, Other Assets, Total Assets, Complete Section, Other Liabilities, Complete Section, Total Liabilities, Complete Section, Complete Section, Complete Section, Net Worth Total Assets minus Total, Other Source of Income, and SalaryCommissions.

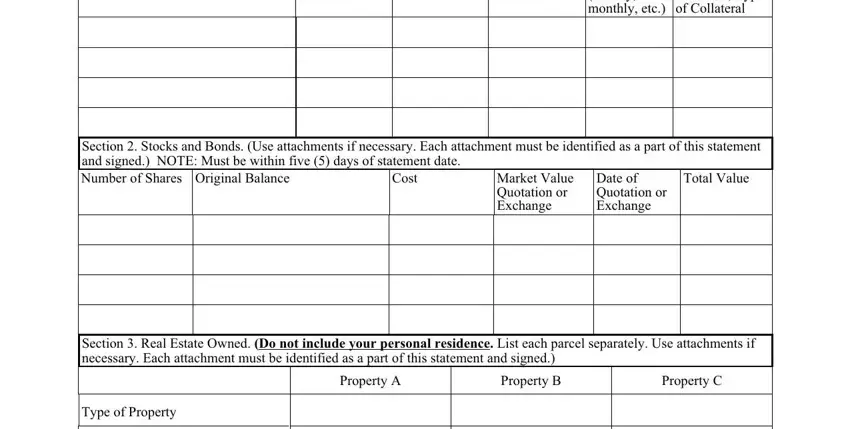

3. This stage is normally straightforward - fill in all the blanks in Original Balance, Payment Amount, Frequency weekly monthly etc, How Secured or Endorsed Type of, Section Stocks and Bonds Use, Original Balance, Total Value, Cost, Market Value Quotation or Exchange, Date of Quotation or Exchange, Section Real Estate Owned Do not, Property A, Property B, Property C, and Type of Property to conclude this process.

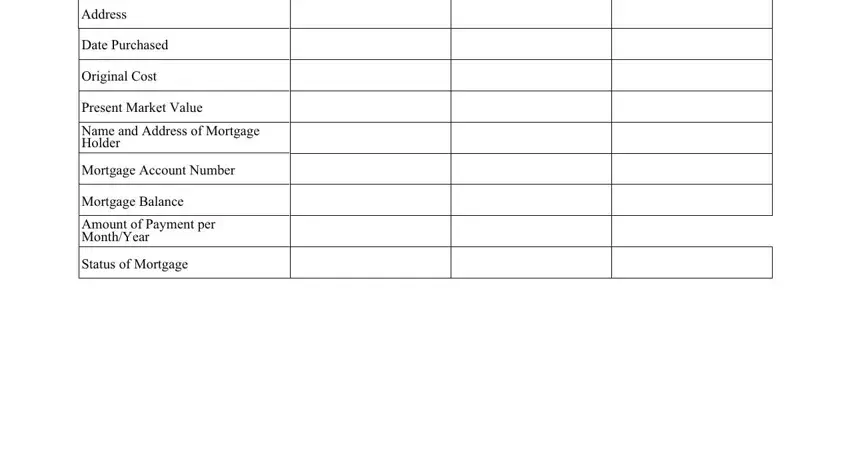

4. Filling out Address, Date Purchased, Original Cost, Present Market Value, Name and Address of Mortgage Holder, Mortgage Account Number, Mortgage Balance, Amount of Payment per MonthYear, and Status of Mortgage is key in the next step - make sure you take the time and be attentive with each empty field!

People often make mistakes when completing Original Cost in this section. You should definitely double-check what you enter here.

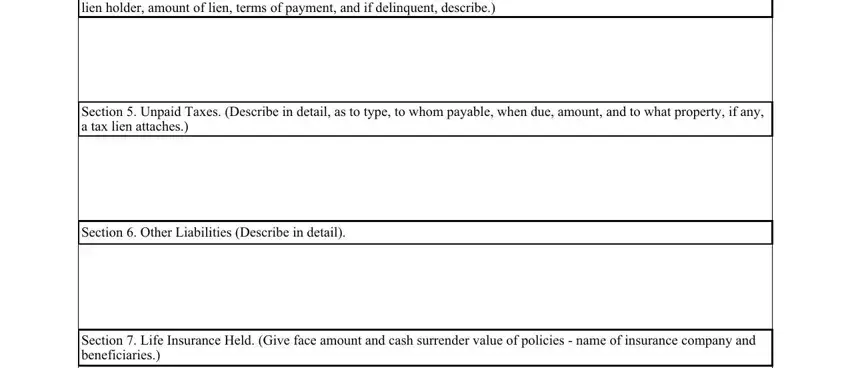

5. Lastly, the following final portion is what you will need to complete prior to submitting the form. The blank fields at issue include the following: Section Other Personal Property, Section Unpaid Taxes Describe in, Section Other Liabilities, and Section Life Insurance Held Give.

Step 3: Go through everything you have entered into the form fields and hit the "Done" button. Right after getting afree trial account here, you'll be able to download aver or email it without delay. The document will also be easily accessible through your personal account menu with your every single change. FormsPal is focused on the confidentiality of all our users; we make certain that all information used in our tool remains secure.