You'll be able to fill in 17b easily by using our online editor for PDFs. We at FormsPal are devoted to providing you with the absolute best experience with our tool by constantly releasing new capabilities and enhancements. Our editor is now much more useful with the newest updates! So now, working with PDF files is simpler and faster than ever. To get the process started, consider these easy steps:

Step 1: Access the PDF in our editor by clicking the "Get Form Button" in the top part of this page.

Step 2: After you launch the PDF editor, you'll notice the document prepared to be filled in. Besides filling in various blanks, you could also perform other things with the PDF, specifically adding custom text, editing the initial text, inserting illustrations or photos, putting your signature on the form, and a lot more.

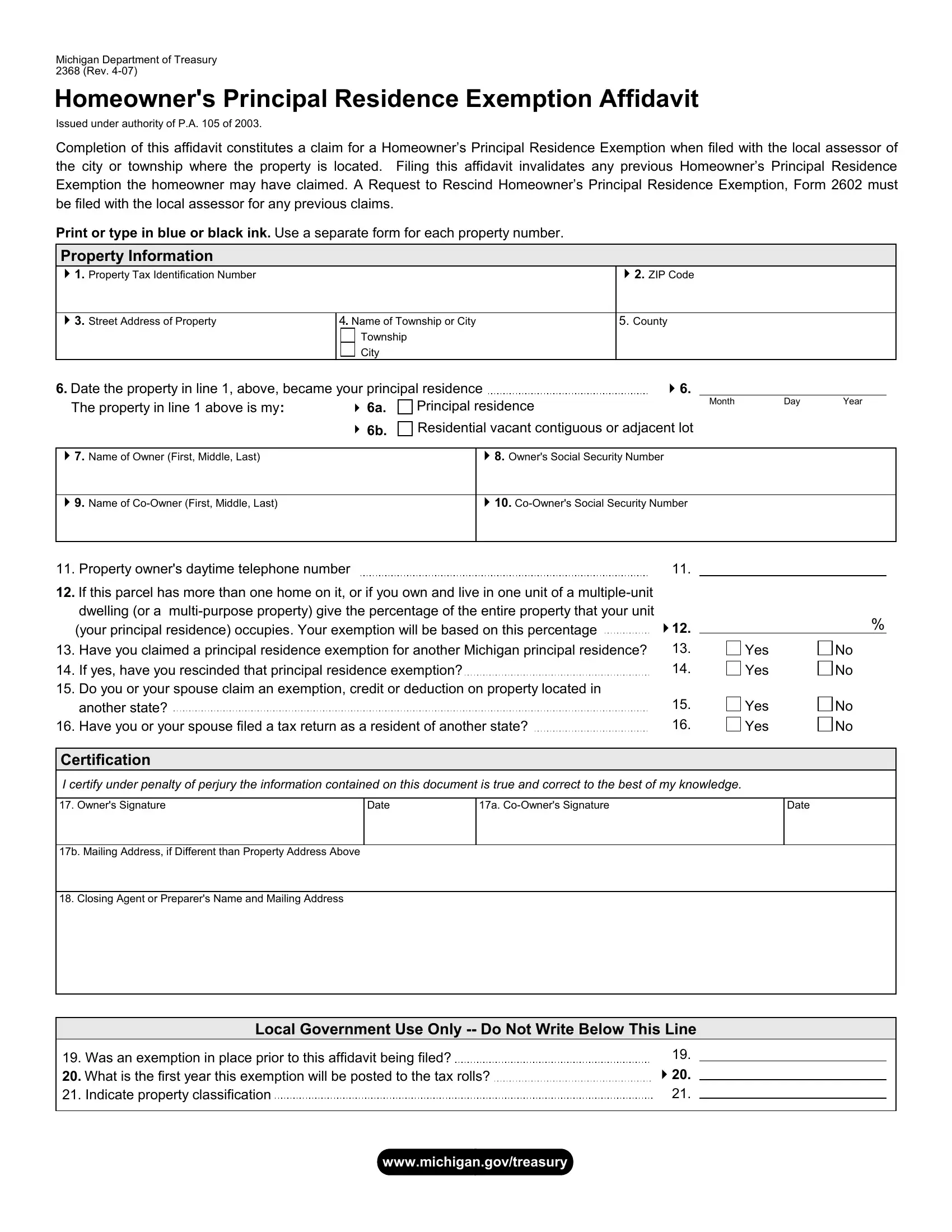

This document will require particular data to be filled out, so you must take whatever time to enter what is required:

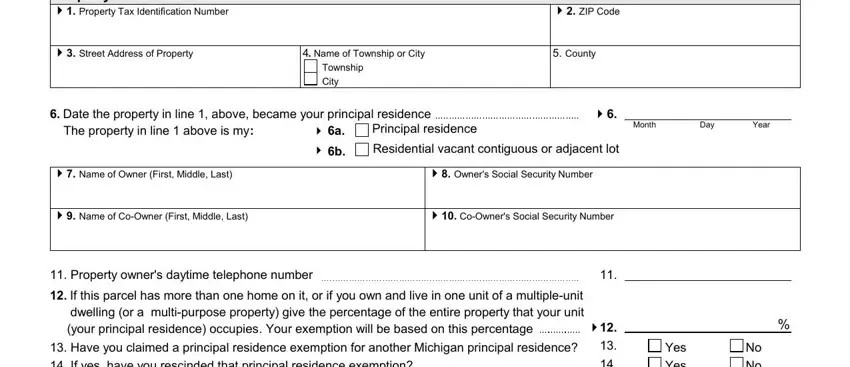

1. The 17b requires particular details to be inserted. Make sure the following fields are finalized:

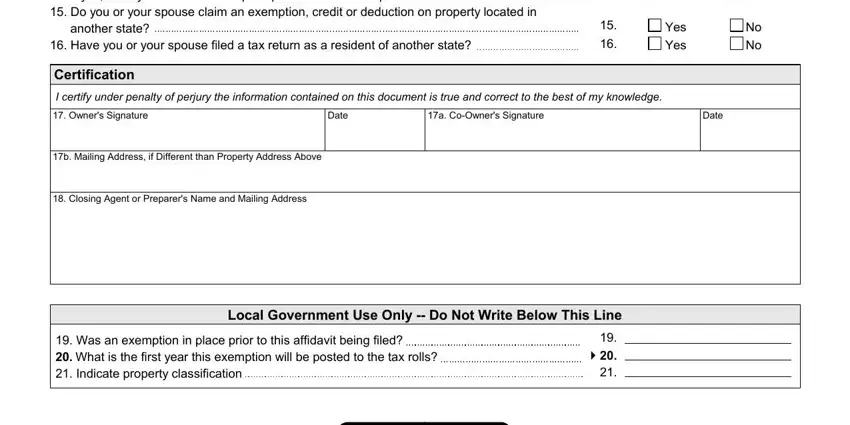

2. Just after completing the last step, go on to the next stage and fill out the essential details in these blanks - If yes have you rescinded that, Yes, Yes, Yes, Certification, I certify under penalty of perjury, Owners Signature, Date, a CoOwners Signature, Date, b Mailing Address if Different, Closing Agent or Preparers Name, Local Government Use Only Do Not, Was an exemption in place prior, and cid.

Be very attentive when filling out If yes have you rescinded that and Yes, as this is where a lot of people make a few mistakes.

Step 3: Before finalizing this file, it's a good idea to ensure that all form fields have been filled in the right way. As soon as you think it's all fine, click on “Done." Sign up with FormsPal right now and immediately use 17b, prepared for download. All adjustments you make are kept , helping you to customize the pdf at a later point as needed. We do not share any information you type in while dealing with documents at FormsPal.