Our top rated computer programmers worked hard to obtain the PDF editor we are now pleased to deliver to you. The application makes it possible to quickly prepare missouri registration application form pdf and saves valuable time. You only need to follow this procedure.

Step 1: You should press the orange "Get Form Now" button at the top of the page.

Step 2: So you should be on your document edit page. You can add, adjust, highlight, check, cross, add or erase fields or text.

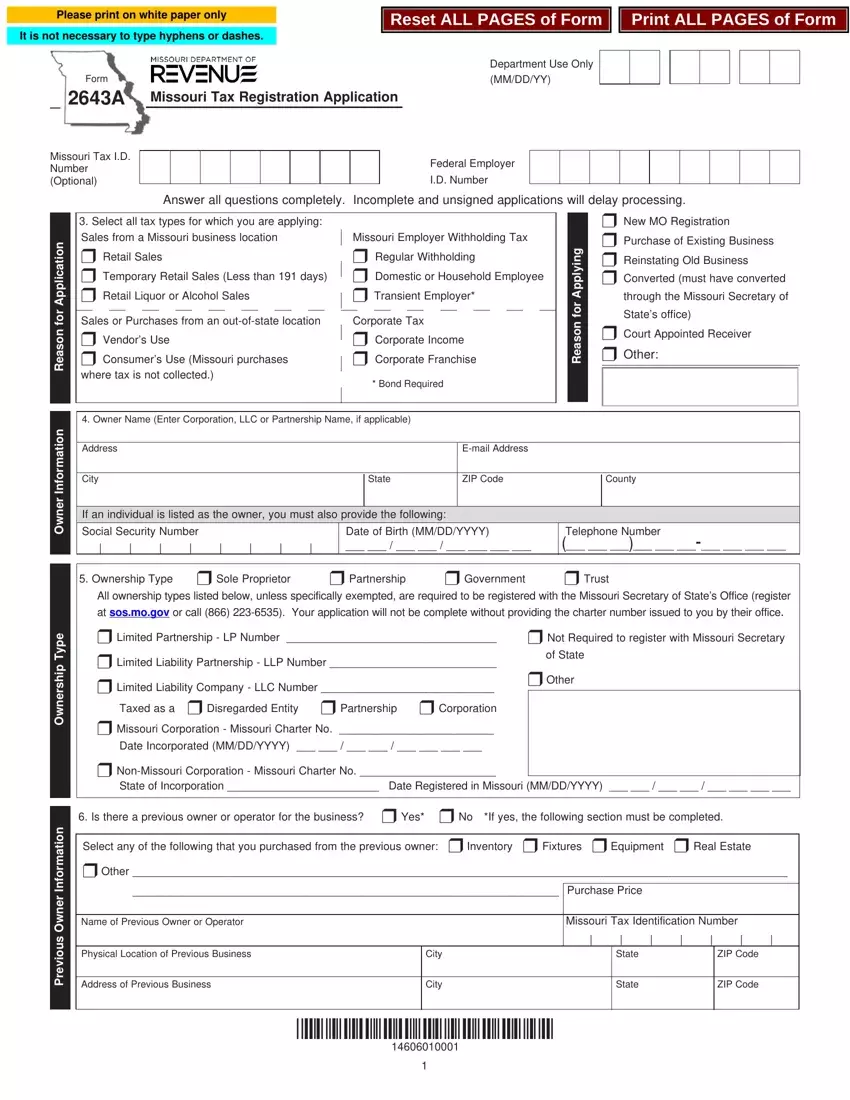

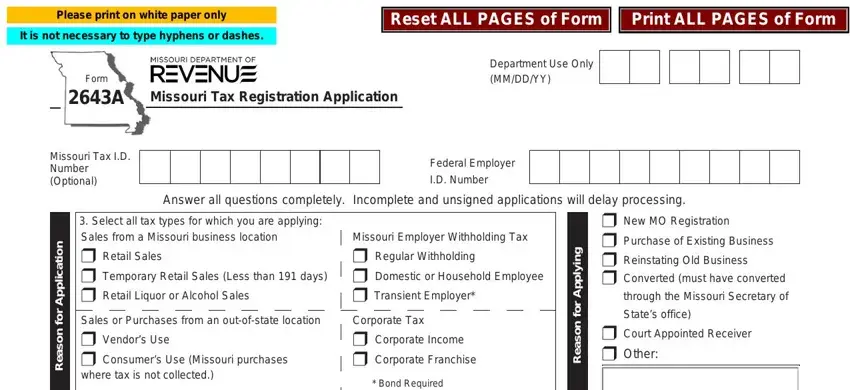

Prepare the missouri registration application form pdf PDF and provide the content for every section:

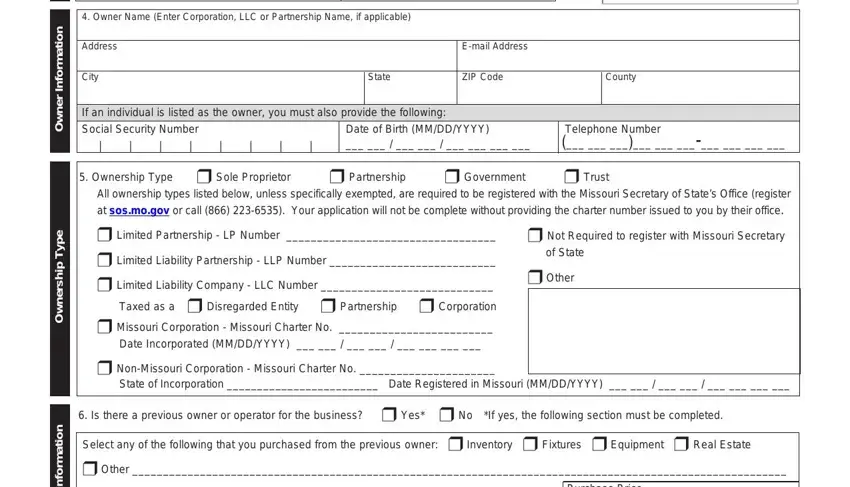

Enter the appropriate details in the area Owner Name Enter Corporation LLC, Address, City, Email Address, State, ZIP Code, County, If an individual is listed as the, Social Security Number, Date of Birth MMDDYYYY, Telephone Number, Ownership Type r Sole Proprietor, All ownership types listed below, r Limited Partnership LP Number, and r Not Required to register with.

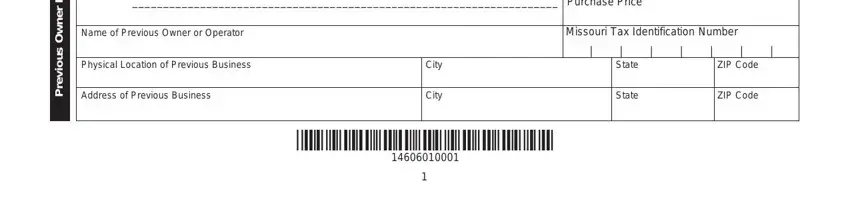

The program will require you to give specific fundamental data to easily fill in the segment Purchase Price, Name of Previous Owner or Operator, Physical Location of Previous, Address of Previous Business, City, City, Missouri Tax Identification Number, State, State, ZIP Code, ZIP Code, n o i t a m r o f n, and r e n w O s u o i v e r P.

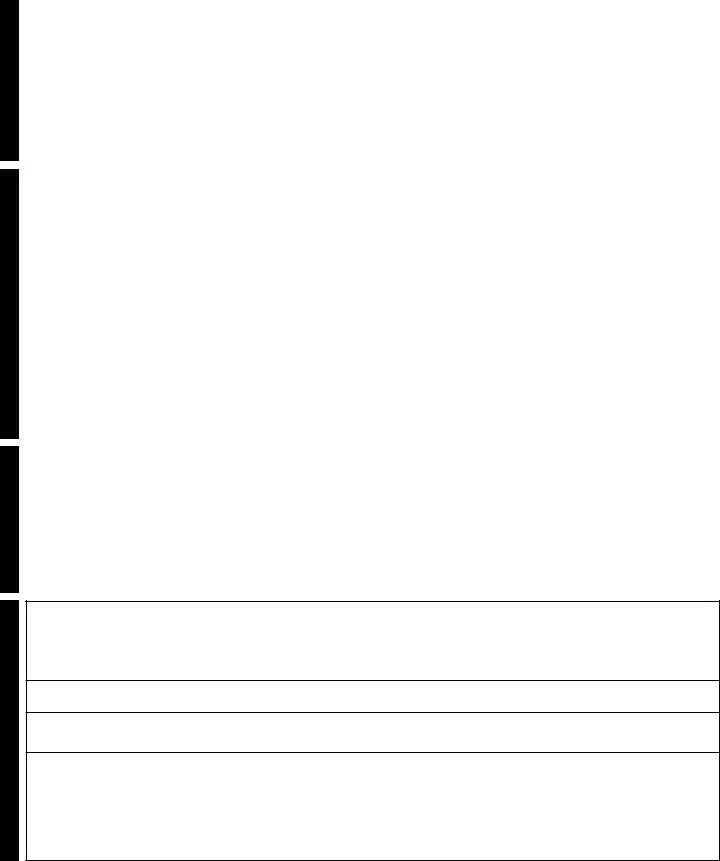

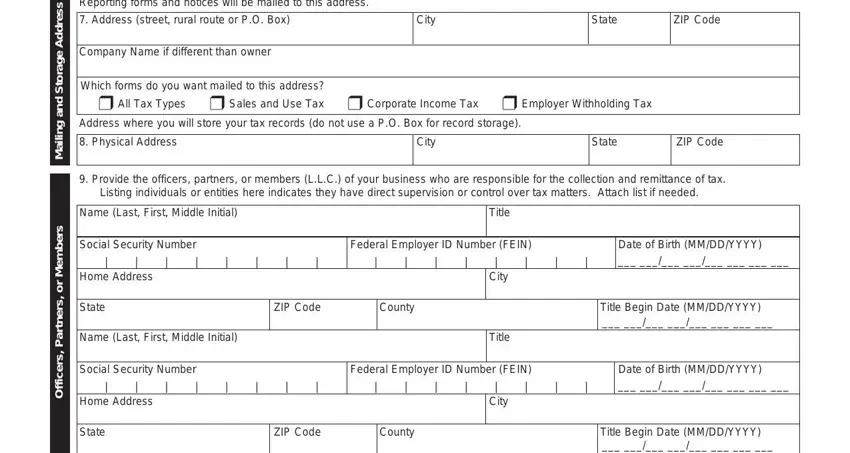

The space s s e r d d A e g a r o t S d n a, i l i a M, s r e b m e M, r o, s r e n t r a P, s r e c i f f, Reporting forms and notices will, Address street rural route or PO, City, State, ZIP Code, Company Name if different than, Which forms do you want mailed to, Address where you will store your, and Physical Address should be for you to indicate each side's rights and obligations.

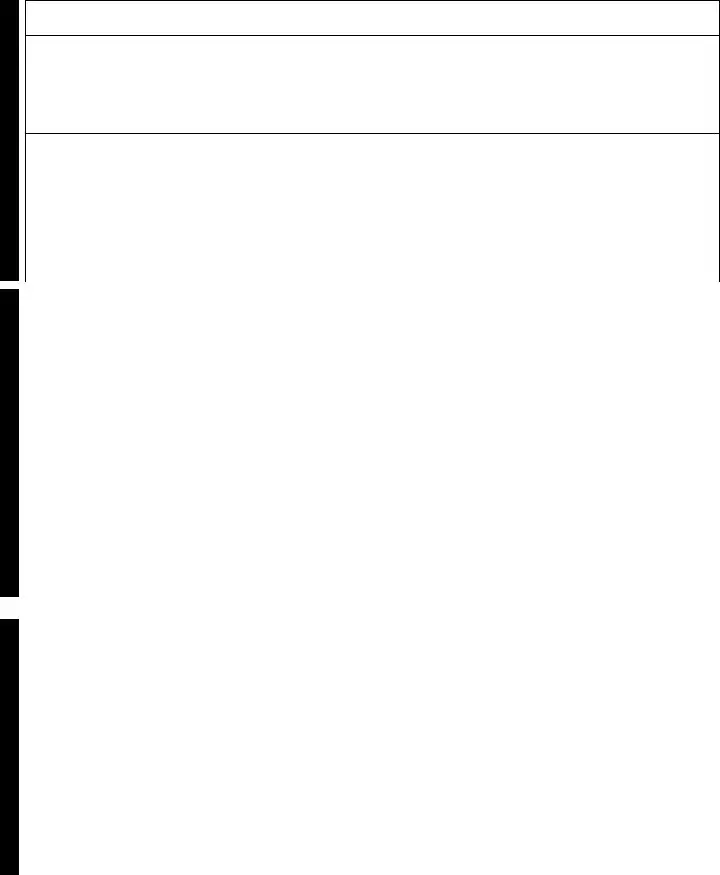

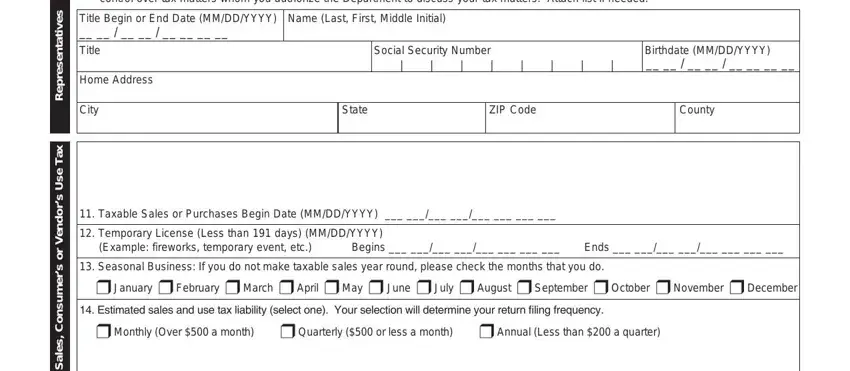

Terminate by analyzing all these sections and filling them out accordingly: s e v i t a t n e s e r p e R, x a T, e s U s r o d n e V r o, s r e m u s n o C, s e l a S, control over tax matters whom you, Title Begin or End Date MMDDYYYY, Title, Home Address, City, Social Security Number, Birthdate MMDDYYYY, State, ZIP Code, and County.

Step 3: Hit "Done". You can now export the PDF file.

Step 4: Be sure to make as many copies of the document as possible to keep away from future complications.